Exhibit 99.2

Investor Presentation June 2020 I Internalization Presentation July 9, 2020

Forward - Looking Statements 1 This presentation is for informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to purchase, Global Medical REIT Inc . ’s (the “Company ”, or “GMRE”) securities . The information contained in this presentation does not purport to be complete and should not be relied upon as a basis for making an investment decision in the Company’s securities . This presentation also contains statements that, to the extent they are not recitations of historical fact, constitute “forward - looking statements . ” Forward - looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology . The forward - looking statements included herein are based upon the Company’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control . Although the Company believes that the expectations reflected in such forward - looking statements are based on reasonable assumptions, the Company’s actual results and performance could differ materially from those set forth in the forward - looking statements due to the impact of many factors including, but not limited to, those discussed under “Risk Factors” in the Company’s Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q and any prospectus or prospectus supplement filed with the Securities and Exchange Commission . The Company undertakes no obligation to update or revise any such information for any reason after the date of this presentation, unless required by law . This presentation includes information regarding certain other companies . The information related to such companies contained in this report was derived from publicly available information . We have not independently investigated or verified this information . We have no reason to believe that this information is inaccurate in any material respect, but we cannot provide any assurance of its accuracy . We are providing this data for informational purposes only .

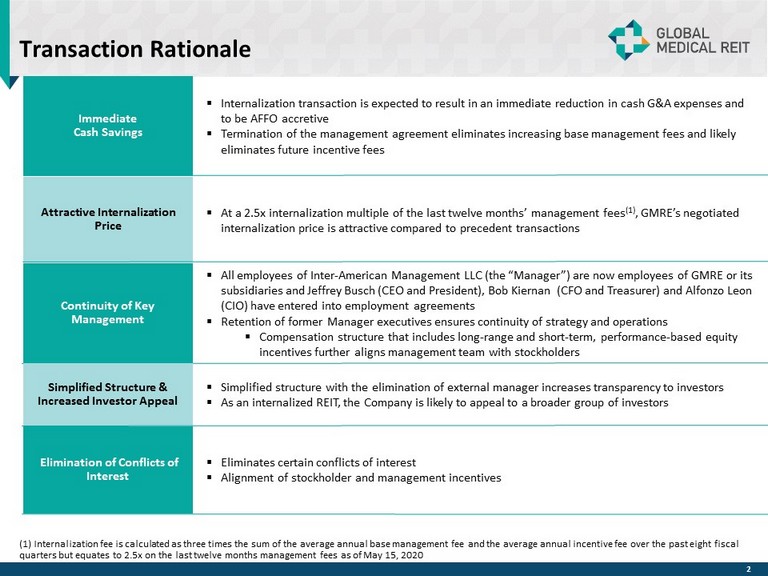

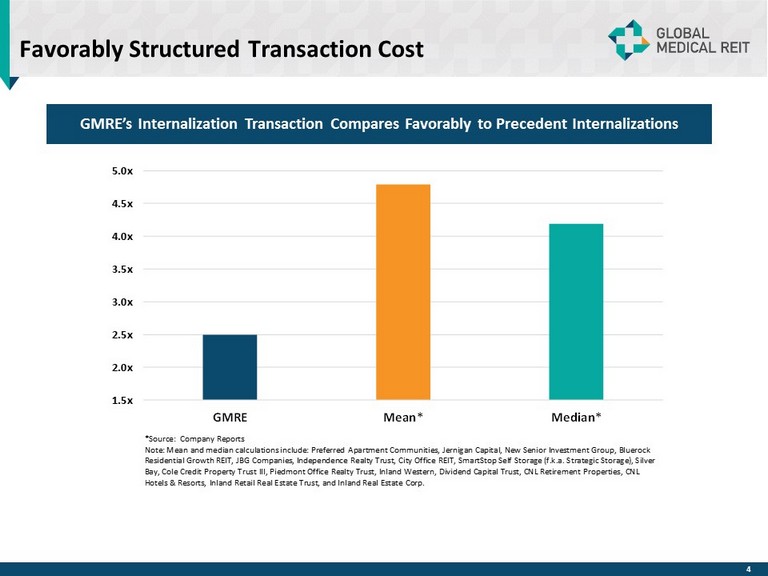

Transaction Rationale 2 ▪ Eliminates certain conflicts of interest ▪ Alignment of stockholder and management incentives Elimination of Conflicts of Interest Immediate Cash Savings ▪ Internalization transaction is expected to result in an immediate reduction in cash G&A expenses and to be AFFO accretive ▪ Termination of the management agreement eliminates increasing base management fees and likely eliminates future incentive fees Attractive Internalization Price ▪ At a 2.5x internalization multiple of the last twelve months’ management fees (1) , GMRE’s negotiated internalization price is attractive compared to precedent transactions Continuity of Key Management ▪ All employees of Inter - American Management LLC (the “Manager ”) are now employees of GMRE or its subsidiaries and Jeffrey Busch ( CEO and President), Bob Kiernan ( CFO and Treasurer) and Alfonzo Leon (CIO) have entered into employment agreements ▪ Retention of former Manager executives ensures continuity of strategy and operations ▪ Compensation structure that includes long - range and short - term, performance - based equity incentives further aligns management team with stockholders Simplified Structure & Increased Investor Appeal ▪ Simplified structure with the elimination of external manager increases transparency to investors ▪ As an internalized REIT, the Company is likely to appeal to a broader group of investors (1) Internalization fee is calculated as three times the sum of the average annual base management fee and the average annual incentive fee over the past eight fiscal quarters but equates to 2.5x on the last twelve months management fees as of May 15, 2020 2

Transaction Overview 3 ▪ Purchase price of $18.095 million, subject to customary adjustments ▪ All - cash, taxable transaction ▪ Zensun Enterprises Limited (“ Zensun ”) and Jeffrey Busch received aggregate cash consideration of $18.095 million ▪ 85% of the $18.095 million Purchase Price was paid to Zensun , 15% of the Purchase Price was paid to Jeffrey Busch Consideration Transaction ▪ Global Medical REIT Inc. and Inter - American Management LLC have completed an internalization ▪ GMRE purchased all of the stock of Inter - American Group Holdings Inc., the parent of the Manager, and GMRE or its subsidiaries n ow employ the Manager’s executive team and other employees ▪ The Special Committee has received a fairness opinion from Stifel, a diversified financial services holding company Timing ▪ The Board approved the transaction on Thursday, July 9, 2020 and closed the transaction the same day

Favorably Structured Transaction Cost 4 GMRE’s Internalization Transaction Compares Favorably to Precedent Internalizations 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 5.0x GMRE Mean* Median* *Source: Company Reports Note: Mean and median calculations include: Preferred Apartment Communities, Jernigan Capital, New Senior Investment Group, B lue rock Residential Growth REIT, JBG Companies, Independence Realty Trust, City Office REIT, SmartStop Self Storage (f.k.a. Strategic St orage), Silver Bay, Cole Credit Property Trust III, Piedmont Office Realty Trust, Inland Western, Dividend Capital Trust, CNL Retirement Pro per ties, CNL Hotels & Resorts, Inland Retail Real Estate Trust, and Inland Real Estate Corp.

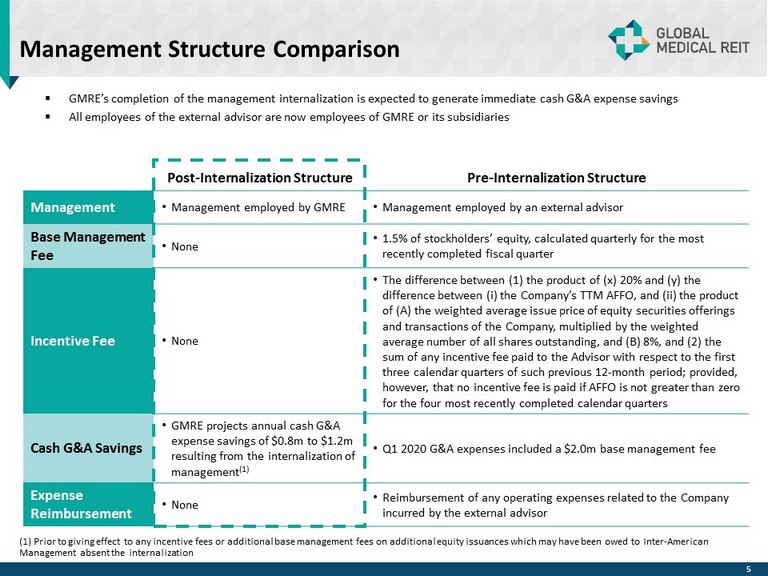

Management Structure Comparison 5 Post - Internalization Structure Pre - Internalization Structure Management • Management employed by GMRE • Management employed by an external advisor Base Management Fee • None • 1.5% of stockholders’ equity, calculated quarterly for the most recently completed fiscal quarter Incentive Fee • None • The difference between (1) the product of (x) 20% and (y) the difference between (i) the Company’s TTM AFFO, and (ii) the product of (A) the weighted average issue price of equity securities offerings and transactions of the Company, multiplied by the weighted average number of all shares outstanding, and (B) 8%, and (2) the sum of any incentive fee paid to the Advisor with respect to the first three calendar quarters of such previous 12 - month period; provided, however, that no incentive fee is paid if AFFO is not greater than zero for the four most recently completed calendar quarters Cash G&A Savings • GMRE projects annual cash G&A expense savings of $0.8m to $1.2m resulting from the internalization of management (1) • Q1 2020 G&A expenses included a $2.0m base management fee Expense Reimbursement • None • Reimbursement of any operating expenses related to the Company incurred by the external advisor ▪ GMRE’s completion of the management internalization is expected to generate immediate cash G&A expense savings ▪ All employees of the external advisor are now employees of GMRE or its subsidiaries (1) Prior to giving effect to any incentive fees or additional base management fees on additional equity issuances which may hav e been owed to Inter - American Management absent the internalization

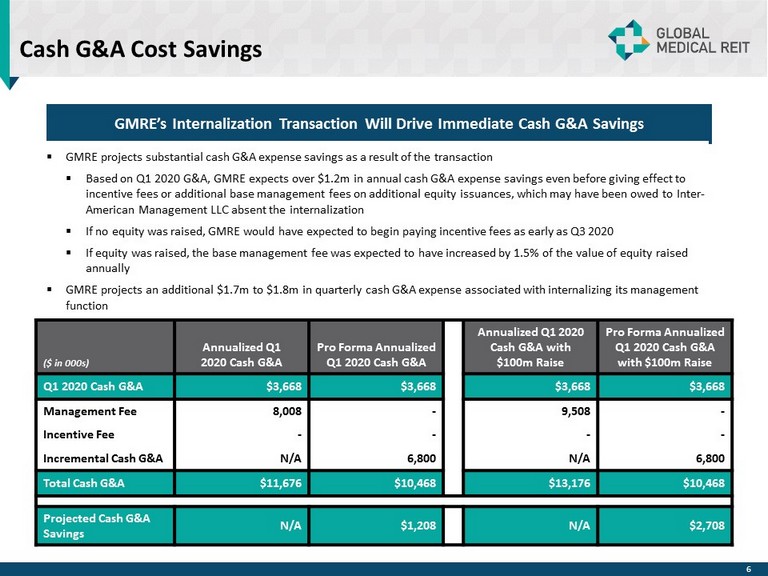

Cash G&A Cost Savings 6 GMRE’s Internalization Transaction Will Drive Immediate Cash G&A Savings ▪ GMRE projects substantial cash G&A expense savings as a result of the transaction ▪ Based on Q1 2020 G&A, GMRE expects over $1.2m in annual cash G&A expense savings even before giving effect to incentive fees or additional base management fees on additional equity issuances, which may have been owed to Inter - American Management LLC absent the internalization ▪ If no equity was raised , GMRE would have expected to begin paying incentive fees as early as Q3 2020 ▪ If equity was raised , the base management fee was expected to have increased by 1.5% of the value of equity raised annually ▪ GMRE projects an additional $1.7m to $1.8m in quarterly cash G&A expense associated with internalizing its management function ($ in 000s) Annualized Q1 2020 Cash G&A Pro Forma Annualized Q1 2020 Cash G&A Annualized Q1 2020 Cash G&A with $100m Raise Pro Forma Annualized Q1 2020 Cash G&A with $100m Raise Q1 2020 Cash G&A $3,668 $3,668 $3,668 $3,668 Management Fee 8,008 - 9,508 - Incentive Fee - - - - Incremental Cash G&A N/A 6,800 N/A 6,800 Total Cash G&A $11,676 $10,468 $13,176 $10,468 Projected Cash G&A Savings N/A $1,208 N/A $2,708

INVESTOR RELATIONS Evelyn Infurna Evelyn.Infurna@icrinc.com 203.682.8265