Exhibit 99.2

Third Quarter 2020 Earnings Supplemental Three and Nine Months Ended September 30, 2020 www.globalmedicalreit.com NYSE: GMRE

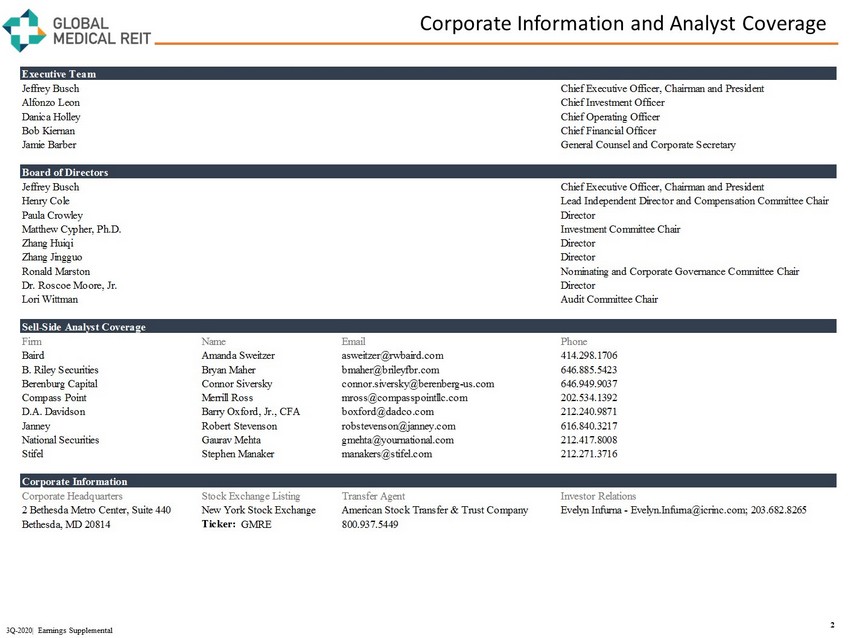

Corporate Information and Analyst Coverage 2 3Q - 2020| Earnings Supplemental Jeffrey Busch Chief Executive Officer, Chairman and President Alfonzo Leon Chief Investment Officer Danica Holley Chief Operating Officer Bob Kiernan Chief Financial Officer Jamie Barber General Counsel and Corporate Secretary Jeffrey Busch Chief Executive Officer, Chairman and President Henry Cole Lead Independent Director and Compensation Committee Chair Paula Crowley Director Matthew Cypher, Ph.D. Investment Committee Chair Zhang Huiqi Director Zhang Jingguo Director Ronald Marston Nominating and Corporate Governance Committee Chair Dr. Roscoe Moore, Jr. Director Lori Wittman Audit Committee Chair Firm Name Email Phone Baird Amanda Sweitzer asweitzer@rwbaird.com 414.298.1706 B. Riley Securities Bryan Maher bmaher@brileyfbr.com 646.885.5423 Berenburg Capital Connor Siversky connor.siversky@berenberg-us.com 646.949.9037 Compass Point Merrill Ross mross@compasspointllc.com 202.534.1392 D.A. Davidson Barry Oxford, Jr., CFA boxford@dadco.com 212.240.9871 Janney Robert Stevenson robstevenson@janney.com 616.840.3217 National Securities Gaurav Mehta gmehta@yournational.com 212.417.8008 Stifel Stephen Manaker manakers@stifel.com 212.271.3716 Corporate Headquarters Stock Exchange Listing Transfer Agent Investor Relations 2 Bethesda Metro Center, Suite 440 New York Stock Exchange American Stock Transfer & Trust Company Evelyn Infurna - Evelyn.Infurna@icrinc.com; 203.682.8265 Bethesda, MD 20814 Ticker: GMRE 800.937.5449 Executive Team Board of Directors Sell-Side Analyst Coverage Corporate Information

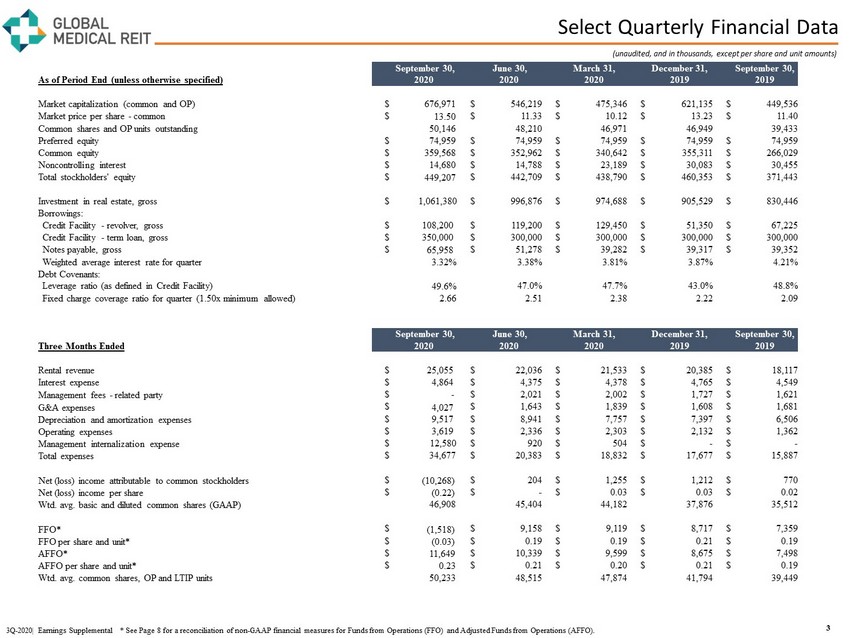

Select Quarterly Financial Data (unaudited, and in thousands, except per share and unit amounts) 3 3Q - 2020| Earnings Supplemental * See Page 8 for a reconciliation of non - GAAP financial measures for Funds from Operations (FFO ) and Adjusted Funds from Operations (AFFO). September 30, June 30, March 31, December 31, September 30, As of Period End (unless otherwise specified) 2020 2020 2020 2019 2019 Market capitalization (common and OP) $ 676,971 $ 546,219 $ 475,346 $ 621,135 $ 449,536 Market price per share - common $ 13.50 $ 11.33 $ 10.12 $ 13.23 $ 11.40 Common shares and OP units outstanding 50,146 48,210 46,971 46,949 39,433 Preferred equity $ 74,959 $ 74,959 $ 74,959 $ 74,959 $ 74,959 Common equity $ 359,568 $ 352,962 $ 340,642 $ 355,311 $ 266,029 Noncontrolling interest $ 14,680 $ 14,788 $ 23,189 $ 30,083 $ 30,455 Total stockholders' equity $ 449,207 $ 442,709 $ 438,790 $ 460,353 $ 371,443 Investment in real estate, gross $ 1,061,380 $ 996,876 $ 974,688 $ 905,529 $ 830,446 Borrowings: Credit Facility - revolver, gross $ 108,200 $ 119,200 $ 129,450 $ 51,350 $ 67,225 Credit Facility - term loan, gross $ 350,000 $ 300,000 $ 300,000 $ 300,000 $ 300,000 Notes payable, gross $ 65,958 $ 51,278 $ 39,282 $ 39,317 $ 39,352 Weighted average interest rate for quarter 3.32% 3.38% 3.81% 3.87% 4.21% Debt Covenants: Leverage ratio (as defined in Credit Facility) 49.6% 47.0% 47.7% 43.0% 48.8% Fixed charge coverage ratio for quarter (1.50x minimum allowed) 2.66 2.51 2.38 2.22 2.09 September 30, June 30, March 31, December 31, September 30, Three Months Ended 2020 2020 2020 2019 2019 Rental revenue $ 25,055 $ 22,036 $ 21,533 $ 20,385 $ 18,117 Interest expense $ 4,864 $ 4,375 $ 4,378 $ 4,765 $ 4,549 Management fees - related party $ - $ 2,021 $ 2,002 $ 1,727 $ 1,621 G&A expenses $ 4,027 $ 1,643 $ 1,839 $ 1,608 $ 1,681 Depreciation and amortization expenses $ 9,517 $ 8,941 $ 7,757 $ 7,397 $ 6,506 Operating expenses $ 3,619 $ 2,336 $ 2,303 $ 2,132 $ 1,362 Management internalization expense $ 12,580 $ 920 $ 504 $ - $ - Total expenses $ 34,677 $ 20,383 $ 18,832 $ 17,677 $ 15,887 Net (loss) income attributable to common stockholders $ (10,268) $ 204 $ 1,255 $ 1,212 $ 770 Net (loss) income per share $ (0.22) $ - $ 0.03 $ 0.03 $ 0.02 Wtd. avg. basic and diluted common shares (GAAP) 46,908 45,404 44,182 37,876 35,512 FFO* $ (1,518) $ 9,158 $ 9,119 $ 8,717 $ 7,359 FFO per share and unit* $ (0.03) $ 0.19 $ 0.19 $ 0.21 $ 0.19 AFFO* $ 11,649 $ 10,339 $ 9,599 $ 8,675 $ 7,498 AFFO per share and unit* $ 0.23 $ 0.21 $ 0.20 $ 0.21 $ 0.19 Wtd. avg. common shares, OP and LTIP units 50,233 48,515 47,874 41,794 39,449

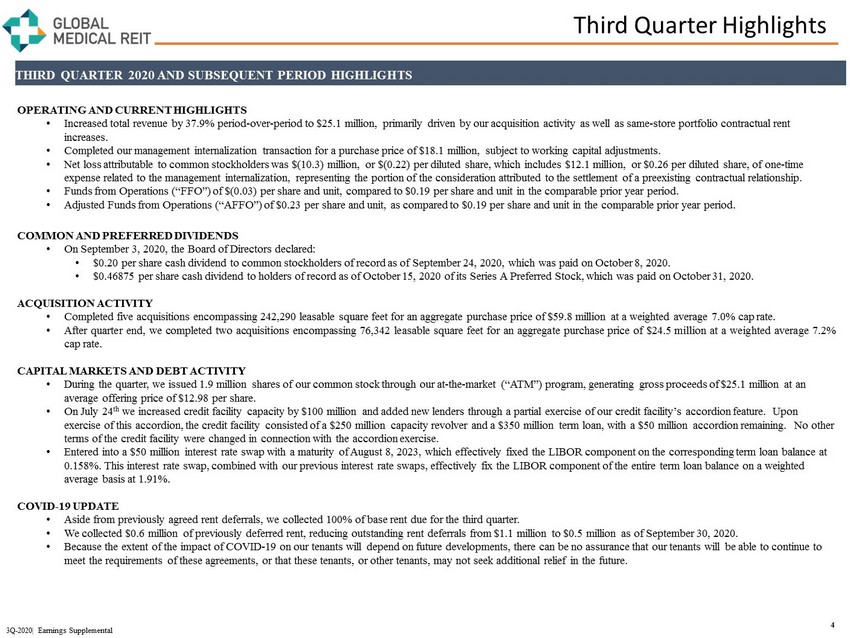

Third Quarter Highlights 4 3Q - 2020| Earnings Supplemental OPERATING AND CURRENT HIGHLIGHTS • Increased total revenue by 37.9% period - over - period to $25.1 million, primarily driven by our acquisition activity as well as sa me - store portfolio contractual rent increases. • Completed our management internalization transaction for a purchase price of $18.1 million, subject to working capital adjust men ts. • Net loss attributable to common stockholders was $(10.3) million, or $(0.22) per diluted share, which includes $12.1 million, or $0.26 per diluted share, of one - time expense related to the management internalization, representing the portion of the consideration attributed to the settlement of a preexisting contractual relationship. • Funds from Operations (“FFO”) of $(0.03) per share and unit, compared to $0.19 per share and unit in the comparable prior yea r p eriod. • Adjusted Funds from Operations (“AFFO”) of $0.23 per share and unit, as compared to $0.19 per share and unit in the comparabl e p rior year period. COMMON AND PREFERRED DIVIDENDS • On September 3, 2020, the Board of Directors declared: • $0.20 per share cash dividend to common stockholders of record as of September 24, 2020, which was paid on October 8, 2020. • $0.46875 per share cash dividend to holders of record as of October 15, 2020 of its Series A Preferred Stock, which was paid on October 31, 2020. ACQUISITION ACTIVITY • Completed five acquisitions encompassing 242,290 leasable square feet for an aggregate purchase price of $59.8 million at a w eig hted average 7.0% cap rate. • After quarter end, we completed two acquisitions encompassing 76 , 342 leasable square feet for an aggregate purchase price of $ 24 . 5 million at a weighted average 7 . 2 % cap rate . CAPITAL MARKETS AND DEBT ACTIVITY • During the quarter, we issued 1.9 million shares of our common stock through our at - the - market (“ATM”) program, generating gross proceeds of $25.1 million at an average offering price of $12.98 per share. • On July 24 th we increased credit facility capacity by $100 million and added new lenders through a partial exercise of our credit facility ’s accordion feature. Upon exercise of this accordion, the credit facility consisted of a $250 million capacity revolver and a $350 million term loan, w ith a $50 million accordion remaining. No other terms of the credit facility were changed in connection with the accordion exercise. • Entered into a $50 million interest rate swap with a maturity of August 8, 2023, which effectively fixed the LIBOR component on the corresponding term loan balance at 0.158%. This interest rate swap, combined with our previous interest rate swaps, effectively fix the LIBOR component of the e nti re term loan balance on a weighted average basis at 1.91%. COVID - 19 UPDATE • Aside from previously agreed rent deferrals, we collected 100% of base rent due for the third quarter. • We collected $0.6 million of previously deferred rent, reducing outstanding rent deferrals from $1.1 million to $0.5 million as of September 30, 2020. • Because the extent of the impact of COVID - 19 on our tenants will depend on future developments, there can be no assurance that o ur tenants will be able to continue to meet the requirements of these agreements, or that these tenants, or other tenants, may not seek additional relief in the fut ure . THIRD QUARTER 2020 AND SUBSEQUENT PERIOD HIGHLIGHTS

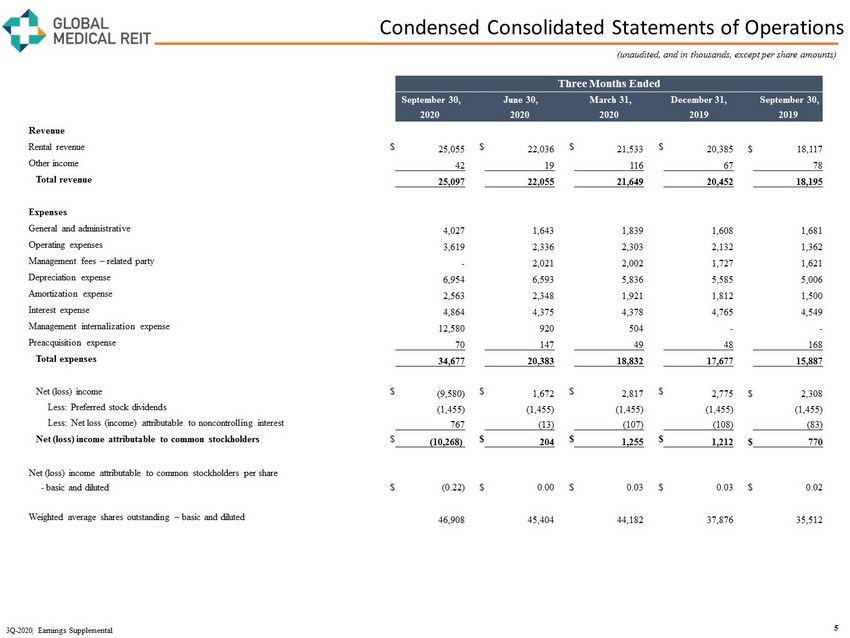

Condensed Consolidated Statements of Operations 5 3Q - 2020| Earnings Supplemental (unaudited, and in thousands, except per share amounts) Three Months Ended September 30, June 30, March 31, December 31, September 30, 2020 2020 2020 2019 2019 Revenue Rental revenue $ 25,055 $ 22,036 $ 21,533 $ 20,385 $ 18,117 Other income 42 19 116 67 78 Total revenue 25,097 22,055 21,649 20,452 18,195 Expenses General and administrative 4,027 1,643 1,839 1,608 1,681 Operating expenses 3,619 2,336 2,303 2,132 1,362 Management fees – related party - 2,021 2,002 1,727 1,621 Depreciation expense 6,954 6,593 5,836 5,585 5,006 Amortization expense 2,563 2,348 1,921 1,812 1,500 Interest expense 4,864 4,375 4,378 4,765 4,549 Management internalization expense 12,580 920 504 - - Preacquisition expense 70 147 49 48 168 Total expenses 34,677 20,383 18,832 17,677 15,887 Net (loss) income $ (9,580) $ 1,672 $ 2,817 $ 2,775 $ 2,308 Less: Preferred stock dividends (1,455) (1,455) (1,455) (1,455) (1,455) Less: Net loss (income) attributable to noncontrolling interest 767 (13) (107) (108) (83) Net (loss) income attributable to common stockholders $ (10,268) $ 204 $ 1,255 $ 1,212 $ 770 Net (loss) income attributable to common stockholders per share - basic and diluted $ (0.22) $ 0.00 $ 0.03 $ 0.03 $ 0.02 Weighted average shares outstanding – basic and diluted 46,908 45,404 44,182 37,876 35,512

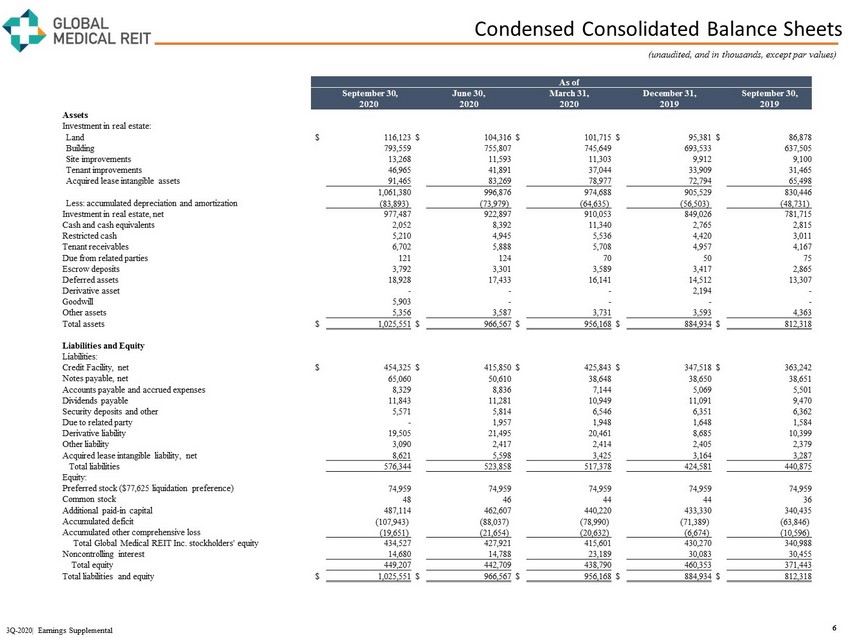

Condensed Consolidated Balance Sheets 6 3Q - 2020| Earnings Supplemental (unaudited, and in thousands, except par values) As of September 30, June 30, March 31, December 31, September 30, 2020 2020 2020 2019 2019 Assets Investment in real estate: Land $ 116,123 $ 104,316 $ 101,715 $ 95,381 $ 86,878 Building 793,559 755,807 745,649 693,533 637,505 Site improvements 13,268 11,593 11,303 9,912 9,100 Tenant improvements 46,965 41,891 37,044 33,909 31,465 Acquired lease intangible assets 91,465 83,269 78,977 72,794 65,498 1,061,380 996,876 974,688 905,529 830,446 Less: accumulated depreciation and amortization (83,893) (73,979) (64,635) (56,503) (48,731) Investment in real estate, net 977,487 922,897 910,053 849,026 781,715 Cash and cash equivalents 2,052 8,392 11,340 2,765 2,815 Restricted cash 5,210 4,945 5,536 4,420 3,011 Tenant receivables 6,702 5,888 5,708 4,957 4,167 Due from related parties 121 124 70 50 75 Escrow deposits 3,792 3,301 3,589 3,417 2,865 Deferred assets 18,928 17,433 16,141 14,512 13,307 Derivative asset - - - 2,194 - Goodwill 5,903 - - - - Other assets 5,356 3,587 3,731 3,593 4,363 Total assets $ 1,025,551 $ 966,567 $ 956,168 $ 884,934 $ 812,318 Liabilities and Equity Liabilities: Credit Facility, net $ 454,325 $ 415,850 $ 425,843 $ 347,518 $ 363,242 Notes payable, net 65,060 50,610 38,648 38,650 38,651 Accounts payable and accrued expenses 8,329 8,836 7,144 5,069 5,501 Dividends payable 11,843 11,281 10,949 11,091 9,470 Security deposits and other 5,571 5,814 6,546 6,351 6,362 Due to related party - 1,957 1,948 1,648 1,584 Derivative liability 19,505 21,495 20,461 8,685 10,399 Other liability 3,090 2,417 2,414 2,405 2,379 Acquired lease intangible liability, net 8,621 5,598 3,425 3,164 3,287 Total liabilities 576,344 523,858 517,378 424,581 440,875 Equity: Preferred stock ($77,625 liquidation preference) 74,959 74,959 74,959 74,959 74,959 Common stock 48 46 44 44 36 Additional paid - in capital 487,114 462,607 440,220 433,330 340,435 Accumulated deficit (107,943) (88,037) (78,990) (71,389) (63,846) Accumulated other comprehensive loss (19,651) (21,654) (20,632) (6,674) (10,596) Total Global Medical REIT Inc. stockholders' equity 434,527 427,921 415,601 430,270 340,988 Noncontrolling interest 14,680 14,788 23,189 30,083 30,455 Total equity 449,207 442,709 438,790 460,353 371,443 Total liabilities and equity $ 1,025,551 $ 966,567 $ 956,168 $ 884,934 $ 812,318

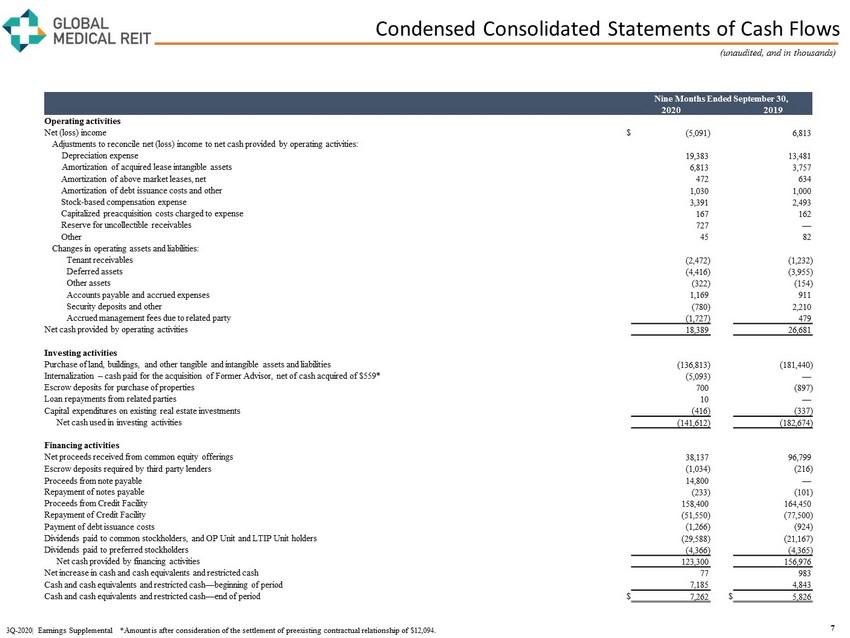

Condensed Consolidated Statements of Cash Flows 7 (unaudited, and in thousands) Nine Months Ended September 30, 2020 2019 Operating activities Net (loss) income $ (5,091) 6,813 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation expense 19,383 13,481 Amortization of acquired lease intangible assets 6,813 3,757 Amortization of above market leases, net 472 634 Amortization of debt issuance costs and other 1,030 1,000 Stock - based compensation expense 3,391 2,493 Capitalized preacquisition costs charged to expense 167 162 Reserve for uncollectible receivables 727 — Other 45 82 Changes in operating assets and liabilities: Tenant receivables (2,472) (1,232) Deferred assets (4,416) (3,955) Other assets (322) (154) Accounts payable and accrued expenses 1,169 911 Security deposits and other (780) 2,210 Accrued management fees due to related party (1,727) 479 Net cash provided by operating activities 18,389 26,681 Investing activities Purchase of land, buildings, and other tangible and intangible assets and liabilities (136,813) (181,440) Internalization – cash paid for the acquisition of Former Advisor, net of cash acquired of $559* (5,093) — Escrow deposits for purchase of properties 700 (897) Loan repayments from related parties 10 — Capital expenditures on existing real estate investments (416) (337) Net cash used in investing activities (141,612) (182,674) Financing activities Net proceeds received from common equity offerings 38,137 96,799 Escrow deposits required by third party lenders (1,034) (216) Proceeds from note payable 14,800 — Repayment of notes payable (233) (101) Proceeds from Credit Facility 158,400 164,450 Repayment of Credit Facility (51,550) (77,500) Payment of debt issuance costs (1,266) (924) Dividends paid to common stockholders, and OP Unit and LTIP Unit holders (29,588) (21,167) Dividends paid to preferred stockholders (4,366) (4,365) Net cash provided by financing activities 123,300 156,976 Net increase in cash and cash equivalents and restricted cash 77 983 Cash and cash equivalents and restricted cash — beginning of period 7,185 4,843 Cash and cash equivalents and restricted cash — end of period $ 7,262 $ 5,826 3Q - 2020| Earnings Supplemental *Amount is after consideration of the settlement of preexisting contractual relationship of $12 ,094.

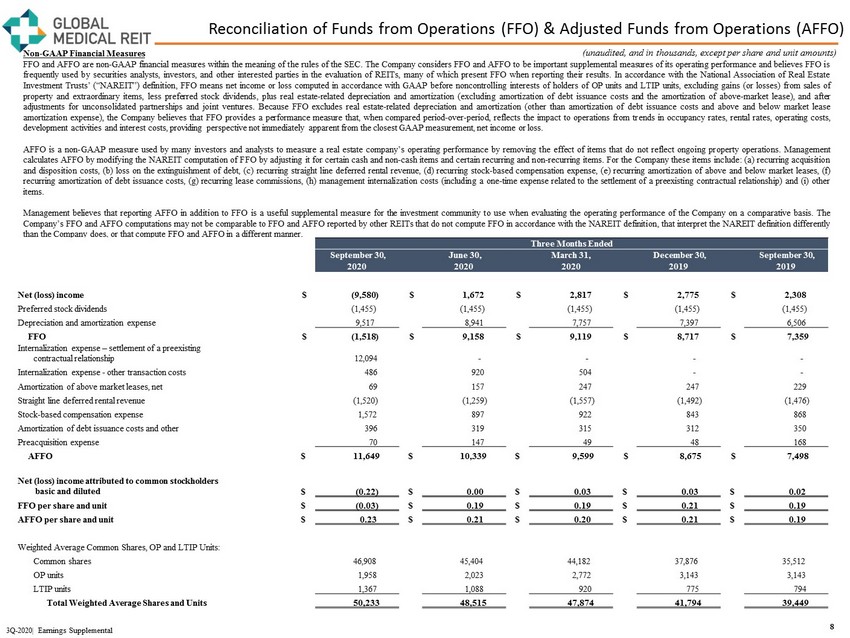

Reconciliation of Funds from Operations (FFO) & Adjusted Funds from Operations (AFFO) Non - GAAP Financial Measures FFO and AFFO are non - GAAP financial measures within the meaning of the rules of the SEC . The Company considers FFO and AFFO to be important supplemental measures of its operating performance and believes FFO is frequently used by securities analysts, investors, and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results . In accordance with the National Association of Real Estate Investment Trusts’ (“NAREIT”) definition, FFO means net income or loss computed in accordance with GAAP before noncontrolling interests of holders of OP units and LTIP units, excluding gains (or losses) from sales of property and extraordinary items, less preferred stock dividends, plus real estate - related depreciation and amortization (excluding amortization of debt issuance costs and the amortization of above - market lease), and after adjustments for unconsolidated partnerships and joint ventures . Because FFO excludes real estate - related depreciation and amortization (other than amortization of debt issuance costs and above and below market lease amortization expense), the Company believes that FFO provides a performance measure that, when compared period - over - period, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from the closest GAAP measurement, net income or loss . AFFO is a non - GAAP measure used by many investors and analysts to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations . Management calculates AFFO by modifying the NAREIT computation of FFO by adjusting it for certain cash and non - cash items and certain recurring and non - recurring items . For the Company these items include : (a) recurring acquisition and disposition costs, (b) loss on the extinguishment of debt, (c) recurring straight line deferred rental revenue, (d) recurring stock - based compensation expense, (e) recurring amortization of above and below market leases, (f) recurring amortization of debt issuance costs, (g) recurring lease commissions, (h) management internalization costs (including a one - time expense related to the settlement of a preexisting contractual relationship) and (i) other items . Management believes that reporting AFFO in addition to FFO is a useful supplemental measure for the investment community to use when evaluating the operating performance of the Company on a comparative basis . The Company’s FFO and AFFO computations may not be comparable to FFO and AFFO reported by other REITs that do not compute FFO in accordance with the NAREIT definition, that interpret the NAREIT definition differently than the Company does, or that compute FFO and AFFO in a different manner . 8 3Q - 2020| Earnings Supplemental (unaudited, and in thousands, except per share and unit amounts) Three Months Ended September 30, June 30, March 31, December 30, September 30, 2020 2020 2020 2019 2019 Net (loss) income $ (9,580) $ 1,672 $ 2,817 $ 2,775 $ 2,308 Preferred stock dividends (1,455) (1,455) (1,455) (1,455) (1,455) Depreciation and amortization expense 9,517 8,941 7,757 7,397 6,506 FFO $ (1,518) $ 9,158 $ 9,119 $ 8,717 $ 7,359 Internalization expense – settlement of a preexisting contractual relationship 12,094 - - - - Internalization expense - other transaction costs 486 920 504 - - Amortization of above market leases, net 69 157 247 247 229 Straight line deferred rental revenue (1,520) (1,259) (1,557) (1,492) (1,476) Stock - based compensation expense 1,572 897 922 843 868 Amortization of debt issuance costs and other 396 319 315 312 350 Preacquisition expense 70 147 49 48 168 AFFO $ 11,649 $ 10,339 $ 9,599 $ 8,675 $ 7,498 Net (loss) income attributed to common stockholders basic and diluted $ (0.22) $ 0.00 $ 0.03 $ 0.03 $ 0.02 FFO per share and unit $ (0.03) $ 0.19 $ 0.19 $ 0.21 $ 0.19 AFFO per share and unit $ 0.23 $ 0.21 $ 0.20 $ 0.21 $ 0.19 Weighted Average Common Shares, OP and LTIP Units: Common shares 46,908 45,404 44,182 37,876 35,512 OP units 1,958 2,023 2,772 3,143 3,143 LTIP units 1,367 1,088 920 775 794 Total Weighted Average Shares and Units 50,233 48,515 47,874 41,794 39,449

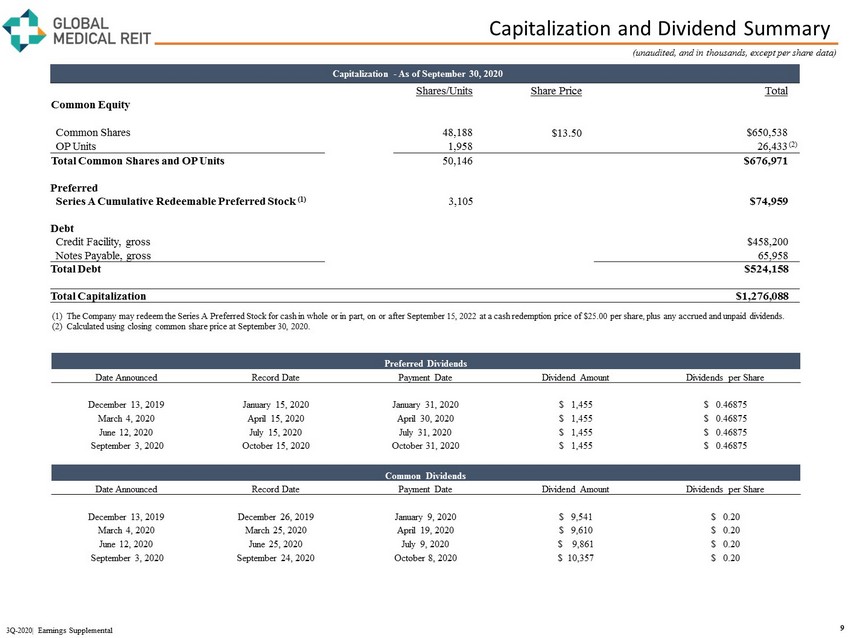

Capitalization and Dividend Summary 9 3Q - 2020| Earnings Supplemental Capitalization - As of September 30, 2020 Shares/Units Share Price Total Common Equity Common Shares 48,188 $13.50 $650,538 OP Units 1,958 26,433 (2) Total Common Shares and OP Units 50,146 $676,971 Preferred Series A Cumulative Redeemable Preferred Stock (1) 3,105 $74,959 Debt Credit Facility, gross $458,200 Notes Payable, gross 65,958 Total Debt $524,158 Total Capitalization $1,276,088 (1) The Company may redeem the Series A Preferred Stock for cash in whole or in part, on or after September 15, 2022 at a cash re dem ption price of $25.00 per share, plus any accrued and unpaid dividends. (2) Calculated using closing common share price at September 30, 2020. (unaudited, and in thousands, except per share data) Preferred Dividends Date Announced Record Date Payment Date Dividend Amount Dividends per Share December 13, 2019 January 15, 2020 January 31, 2020 $ 1,455 $ 0.46875 March 4, 2020 April 15, 2020 April 30, 2020 $ 1,455 $ 0.46875 June 12, 2020 July 15, 2020 July 31, 2020 $ 1,455 $ 0.46875 September 3, 2020 October 15 , 2020 October 31, 2020 $ 1,455 $ 0.46875 Common Dividends Date Announced Record Date Payment Date Dividend Amount Dividends per Share December 13, 2019 December 26, 2019 January 9, 2020 $ 9,541 $ 0.20 March 4, 2020 March 25, 2020 April 19, 2020 $ 9,610 $ 0.20 June 12, 2020 June 25, 2020 July 9, 2020 $ 9,861 $ 0.20 September 3, 2020 September 24, 2020 October 8, 2020 $ 10,357 $ 0.20

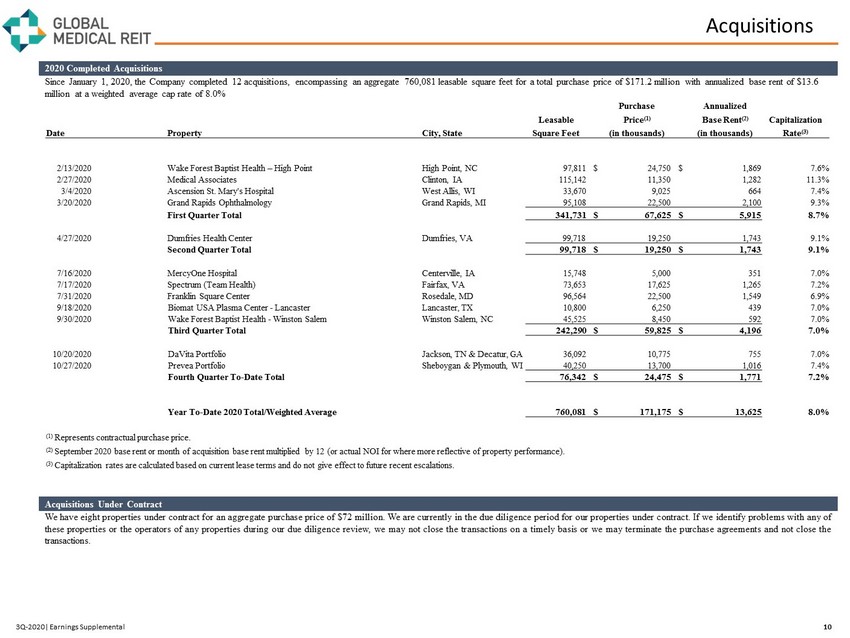

Acquisitions 2020 Completed Acquisitions Since January 1, 2020 , the Company completed 12 acquisitions, encompassing an aggregate 760,081 leasable square feet for a total purchase price of $1 71.2 million with annualized base rent of $13.6 million at a weighted average cap rate of 8.0% 10 3Q - 2020| Earnings Supplemental Acquisitions Under Contract We have eight properties under contract for an aggregate purchase price of $ 72 million . We are currently in the due diligence period for our properties under contract . If we identify problems with any of these properties or the operators of any properties during our due diligence review, we may not close the transactions on a timely basis or we may terminate the purchase agreements and not close the transactions . Purchase Annualized Leasable Price (1) Base Rent (2) Capitalization Date Property City, State Square Feet (in thousands) (in thousands) Rate (3) 2/13/2020 Wake Forest Baptist Health – High Point High Point, NC 97,811 $ 24,750 $ 1,869 7.6% 2/27/2020 Medical Associates Clinton, IA 115,142 11,350 1,282 11.3% 3/4/2020 Ascension St. Mary's Hospital West Allis, WI 33,670 9,025 664 7.4% 3/20/2020 Grand Rapids Ophthalmology Grand Rapids, MI 95,108 22,500 2,100 9.3% First Quarter Total 341,731 $ 67,625 $ 5,915 8.7% 4/27/2020 Dumfries Health Center Dumfries, VA 99,718 19,250 1,743 9.1% Second Quarter Total 99,718 $ 19,250 $ 1,743 9.1% 7/16/2020 MercyOne Hospital Centerville, IA 15,748 5,000 351 7.0% 7/17/2020 Spectrum (Team Health) Fairfax, VA 73,653 17,625 1,265 7.2% 7/31/2020 Franklin Square Center Rosedale, MD 96,564 22,500 1,549 6.9% 9/18/2020 Biomat USA Plasma Center - Lancaster Lancaster, TX 10,800 6,250 439 7.0% 9/30/2020 Wake Forest Baptist Health - Winston Salem Winston Salem, NC 45,525 8,450 592 7.0% Third Quarter Total 242,290 $ 59,825 $ 4,196 7.0% 10/20/2020 DaVita Portfolio Jackson, TN & Decatur, GA 36,092 10,775 755 7.0% 10/27/2020 Prevea Portfolio Sheboygan & Plymouth, WI 40,250 13,700 1,016 7.4% Fourth Quarter To - Date Total 76,342 $ 24,475 $ 1,771 7.2% Year To - Date 2020 Total/Weighted Average 760,081 $ 171,175 $ 13,625 8.0% (1) Represents contractual purchase price. (2) September 2020 base rent or month of acquisition base rent multiplied by 12 (or actual NOI for where more reflective of property performance ). (3) Capitalization rates are calculated based on current lease terms and do not give effect to future recent escalations.

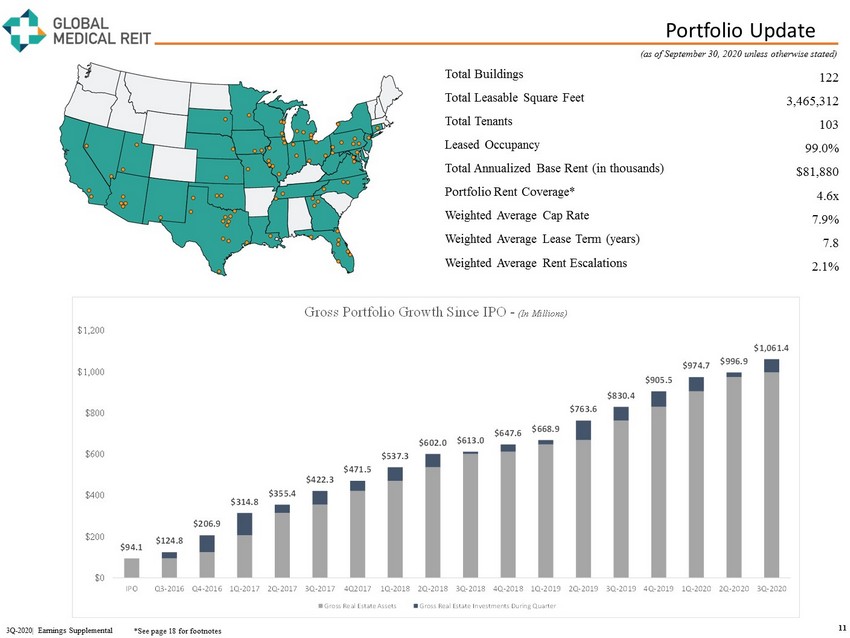

Portfolio Update 11 Total Buildings 122 Total Leasable Square Feet 3,465,312 Total Tenants 103 Leased Occupancy 99.0% Total Annualized Base Rent (in thousands) $81,880 Portfolio Rent Coverage* 4.6x Weighted Average Cap Rate 7.9% Weighted Average Lease Term (years) 7.8 Weighted Average Rent Escalations 2.1% (as of September 30, 2020 unless otherwise stated) 3Q - 2020| Earnings Supplemental *See page 18 for footnotes $94.1 $124.8 $206.9 $314.8 $355.4 $422.3 $471.5 $537.3 $602.0 $613.0 $647.6 $668.9 $763.6 $830.4 $905.5 $974.7 $996.9 $1,061.4 $0 $200 $400 $600 $800 $1,000 $1,200 IPO Q3-2016 Q4-2016 1Q-2017 2Q-2017 3Q-2017 4Q2017 1Q-2018 2Q-2018 3Q-2018 4Q-2018 1Q-2019 2Q-2019 3Q-2019 4Q-2019 1Q-2020 2Q-2020 3Q-2020 Gross Portfolio Growth Since IPO - (In Millions) Gross Real Estate Assets Gross Real Estate Investments During Quarter

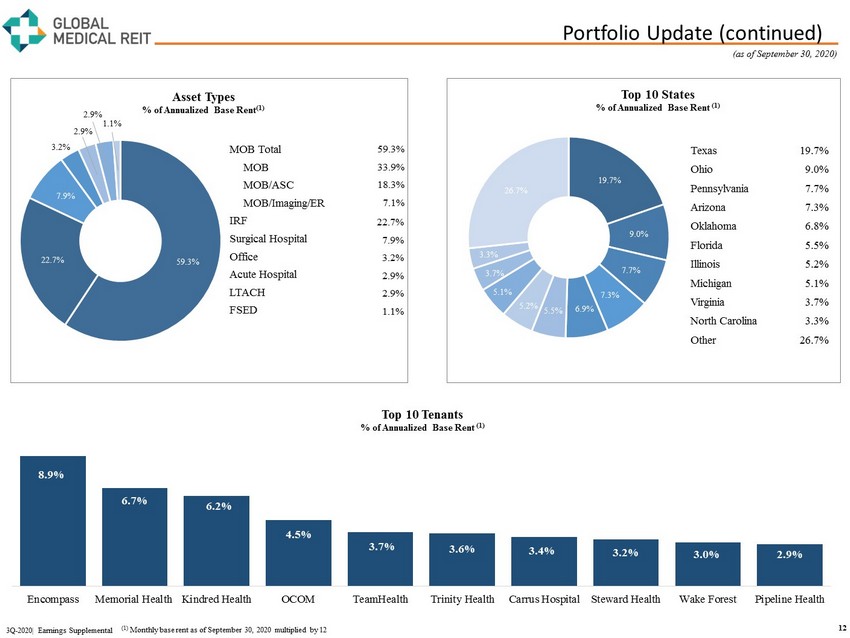

Portfolio Update (continued) 12 3Q - 2020| Earnings Supplemental Top 10 Tenants % of Annualized Base Rent (1) (1) Monthly base rent as of September 30, 2020 multiplied by 12 8.9% 6.7% 6.2% 4.5% 3.7% 3.6% 3.4% 3.2% 3.0% 2.9% Encompass Memorial Health Kindred Health OCOM TeamHealth Trinity Health Carrus Hospital Steward Health Wake Forest Pipeline Health 59.3% 22.7% 7.9% 3.2% 2.9% 2.9% 1.1% MOB Total 59.3% MOB 33.9% MOB/ASC 18.3% MOB/Imaging/ER 7.1% IRF 22.7% Surgical Hospital 7.9% Office 3.2% Acute Hospital 2.9% LTACH 2.9% FSED 1.1% Texas 19.7% Ohio 9.0% Pennsylvania 7.7% Arizona 7.3% Oklahoma 6.8% Florida 5.5% Illinois 5.2% Michigan 5.1% Virginia 3.7% North Carolina 3.3% Other 26.7% 19.7% 9.0% 7.7% 7.3% 6.9% 5.5% 5.2% 5.1% 3.7% 3.3% 26.7% Top 10 States % of Annualized Base Rent (1) Asset Types % of Annualized Base Rent (1) (as of September 30, 2020)

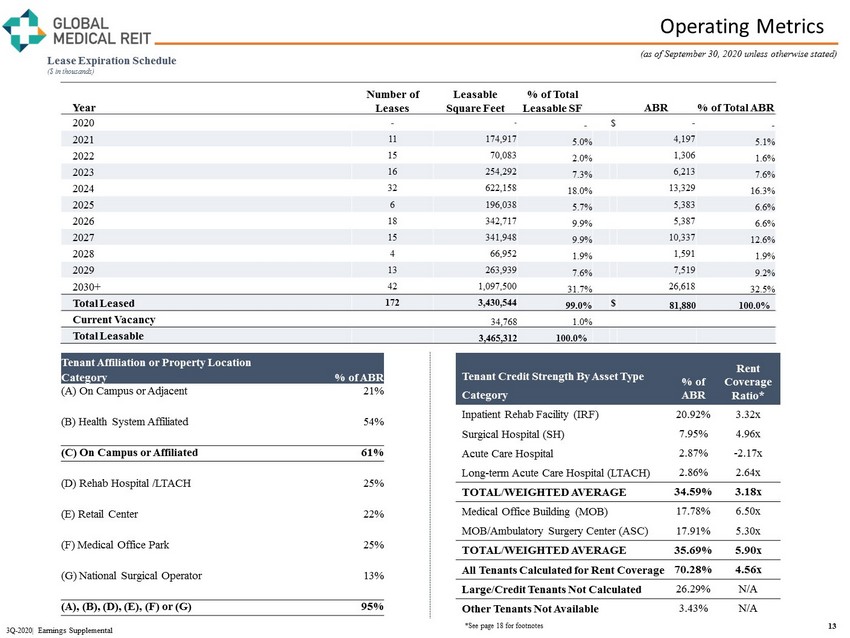

Operating Metrics Year Number of Leases Leasable Square Feet % of Total Leasable SF ABR % of Total ABR 2020 - - - $ - - 2021 11 174,917 5.0% 4,197 5.1% 2022 15 70,083 2.0% 1,306 1.6% 2023 16 254,292 7.3% 6,213 7.6% 2024 32 622,158 18.0% 13,329 16.3% 2025 6 196,038 5.7% 5,383 6.6% 2026 18 342,717 9.9% 5,387 6.6% 2027 15 341,948 9.9% 10,337 12.6% 2028 4 66,952 1.9% 1,591 1.9% 2029 13 263,939 7.6% 7,519 9.2% 2030+ 42 1,097,500 31.7% 26,618 32.5% Total Leased 172 3,430,544 99.0% $ 81,880 100.0% Current Vacancy 34,768 1.0% Total Leasable 3,465,312 100.0% 13 Lease Expiration Schedule ($ in thousands) 3Q - 2020| Earnings Supplemental (as of September 30, 2020 unless otherwise stated) *See page 18 for footnotes Tenant Credit Strength By Asset Type Category % of ABR Rent Coverage Ratio* Inpatient Rehab Facility (IRF) 20.92% 3.32x Surgical Hospital (SH) 7.95% 4.96x Acute Care Hospital 2.87% - 2.17x Long - term Acute Care Hospital (LTACH) 2.86% 2.64x TOTAL/WEIGHTED AVERAGE 34.59% 3.18x Medical Office Building (MOB) 17.78% 6.50x MOB/Ambulatory Surgery Center (ASC) 17.91% 5.30x TOTAL/WEIGHTED AVERAGE 35.69% 5.90x All Tenants Calculated for Rent Coverage 70.28% 4.56x Large/Credit Tenants Not Calculated 26.29% N/A Other Tenants Not Available 3.43% N/A Tenant Affiliation or Property Location Category % of ABR (A) On Campus or Adjacent 21% (B) Health System Affiliated 54% (C) On Campus or Affiliated 61% (D) Rehab Hospital /LTACH 25% (E) Retail Center 22% (F) Medical Office Park 25% (G) National Surgical Operator 13% (A), (B), (D), (E), (F) or (G) 95%

Top 10 Tenant Profiles 14 3Q - 2020| Earnings Supplemental Encompass Health (Ba 3 ) (NYSE : EHC), headquartered in Birmingham, AL is a national leader in integrated healthcare services offering both facility - based and home - based patient care through its network of inpatient rehabilitation hospitals, home health agencies and hospice agencies . With a national footprint that spans 136 hospitals and 328 home health & hospice locations in 39 states and Puerto Rico, Encompass Health is committed to delivering high - quality, cost - effective care across the healthcare continuum . Encompass Health is ranked as one of Fortune's 100 Best Companies to Work For, as well as Modern Healthcare's Best Places to Work . Marietta Memorial Health System (MMH), (BB - ) is headquartered in Marietta, OH, and is the largest health system in the Parkersburg - Marietta - Vienna MSA . The largest employer in Washington County, MMH comprises (i) two hospitals, Marietta Memorial Hospital ( 205 - bed) and Selby General Hospital ( 35 - bed) critical access hospital ; (ii) the Belpre Campus ; (iii) ten clinic outpatient service sites ; and (iv) five imaging locations and has over 2 , 500 employees and 211 accredited physicians . In August 2020 , a critical access hospital, Sistersville General Hospital, joined Memorial Health System . Kindred Healthcare, LLC is a healthcare services company based in Louisville, KY with annual revenues of approximately $ 3 . 1 billion . At June 30 , 2020 , Kindred through its subsidiaries had approximately 32 , 000 employees providing healthcare services in 1 , 731 locations in 46 states, including 64 long - term acute care hospitals, 22 inpatient rehabilitation hospitals, 10 sub - acute units, 94 inpatient rehabilitation units (hospital - based), contract rehabilitation service businesses which served 1 , 541 non - affiliated sites of service, and behavioral health services . Kindred is ranked as one of Fortune magazine’s Most Admired Healthcare Companies for nine years . Oklahoma Center for Orthopedic & Multi - Specialty Surgery, LLC (OCOM) is based Oklahoma City, OK and affiliated with USPI and INTEGRIS, and is a leading hospital for orthopedic specialists . OCOM operates a surgical hospital with six operating rooms, nine treatment rooms and a physical therapy department, an ancillary surgery center, and multiple imaging centers in throughout Oklahoma City . TeamHealth Holdings is one of the largest providers of physician outsourcing in the United States, with a network of affiliated physicians and advanced practice clinicians across more than 3 , 100 civilian and military hospitals, clinics and physician groups in 47 states . Blackstone acquired TeamHealth for $ 6 . 1 billion in 2017 . Spectrum Healthcare Resources is a division of TeamHealth dedicated to providing permanent, civilian - contracted medical professionals exclusively to U . S . military treatment facilities (MTFs), VA clinics and other Federal agencies through program development and healthcare services delivery . Trinity Health is one of the largest multi - institutional Catholic health care delivery systems in the nation, rated Aa 3 by Moody’s, serving diverse communities that include more than 30 million people across 22 states . Trinity Health includes 92 hospitals, as well as 106 continuing care locations that include PACE programs, senior living facilities, and home care and hospice services . Based in Livonia, Michigan, Trinity Health employs about 125 , 000 colleagues, including 7 , 500 employed physicians and clinicians . Carrus Hospital is located in Sherman, TX and provides acute rehabilitative care and long term acute care . Accredited with The Joint Commission’s Gold Seal of Approval, Carrus Hospital serves Sherman, Durant, Denison, Gainesville, Denton, McKinney, Plano, Bonham, Lewisville, Carrollton, Fort Worth, Dallas, Oklahoma City and beyond . Steward Health Care is the largest physician - owned, private, for - profit health care network in the U . S . – attending to 2 . 2 million people during more than 12 million physician and hospital visits annually . Headquartered in Dallas, Steward's integrated health care model employs 42 , 000 people at 35 hospitals and hundreds of urgent care, skilled nursing, and primary and specialty care medical practice locations across 11 states and the country of Malta, serving over 800 communities . Wake Forest Baptist Health (A 2 ) is a regional health system that includes five community hospitals and 300 + primary and specialty clinics serving residents of 24 counties in North Carolina and Virginia . In early October 2020 , Wake Forest Baptist Health, including Wake Forest School of Medicine, officially completed its combination with the Charlotte - based Atrium Health (Aa 3 ) . The new Atrium Health enterprise, an academic health system, services more than 7 million people at 42 hospitals and more than 1 , 500 care locations across the region with over 70 , 000 teammates and educates over 3 , 500 students in more than 100 specialized programs . The immediate direct and indirect annual economic and employment impact from the combined enterprise exceeds $ 32 billion and 180 , 000 jobs . Pipeline Health is a privately - held, community - based hospital ownership and management company based in Los Angeles . The principals of Pipeline Health have more than 250 years of collective experience in clinical medicine, finance, hospital operations and acquisitions . Pipeline’s growing business, through its affiliates, includes : Emergent Medical Associates, a leading provider of ER serving 20 + hospital sites and 900 , 000 patients annually ; Integrated Anesthesia Medical Group, with 100 providers performing 15 , 000 procedures annually ; Avanti Hospitals, a Los Angeles health system with four hospitals, 400 + beds and 55 , 000 ER visits annually ; Cloudbreak, a telemedicine company with 75 , 000 monthly encounters in 700 hospitals ; Pacific Healthworks, a physician practice management company ; and Benchmark Hospitalists ; four community hospitals in Chicago and Dallas .

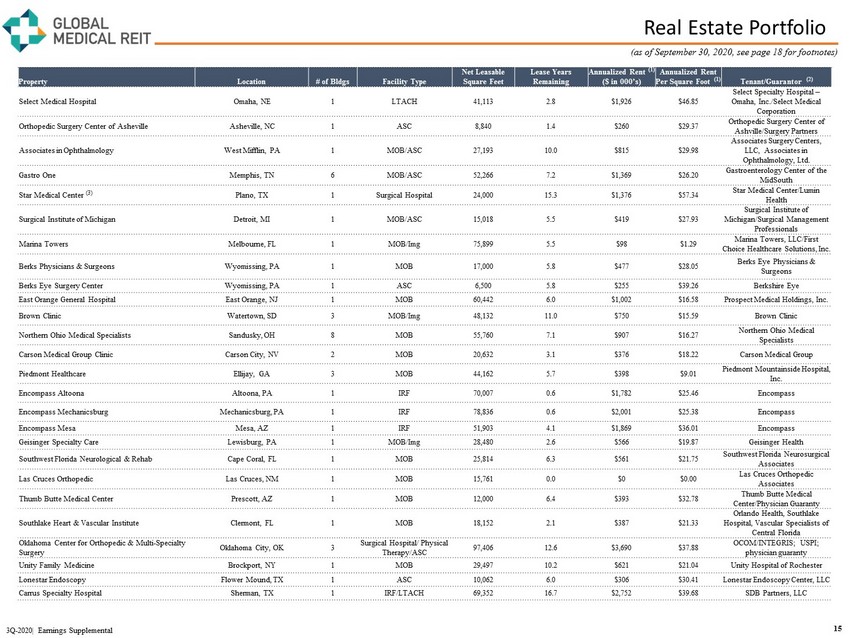

Real Estate Portfolio 15 Property Location # of Bldgs Facility Type Net Leasable Square Feet Lease Years Remaining Annualized Rent (1) ($ in 000’s) Annualized Rent Per Square Foot (1) Tenant/Guarantor (2) Select Medical Hospital Omaha, NE 1 LTACH 41,113 2.8 $1,926 $46.85 Select Specialty Hospital – Omaha, Inc./Select Medical Corporation Orthopedic Surgery Center of Asheville Asheville, NC 1 ASC 8,840 1.4 $260 $29.37 Orthopedic Surgery Center of Ashville/Surgery Partners Associates in Ophthalmology West Mifflin, PA 1 MOB/ASC 27,193 10.0 $815 $29.98 Associates Surgery Centers, LLC, Associates in Ophthalmology, Ltd. Gastro One Memphis, TN 6 MOB/ASC 52,266 7.2 $1,369 $26.20 Gastroenterology Center of the MidSouth Star Medical Center (3) Plano, TX 1 Surgical Hospital 24,000 15.3 $1,376 $57.34 Star Medical Center/Lumin Health Surgical Institute of Michigan Detroit, MI 1 MOB/ASC 15,018 5.5 $419 $27.93 Surgical Institute of Michigan/Surgical Management Professionals Marina Towers Melbourne, FL 1 MOB/Img 75,899 5.5 $98 $1.29 Marina Towers, LLC/First Choice Healthcare Solutions, Inc. Berks Physicians & Surgeons Wyomissing, PA 1 MOB 17,000 5.8 $477 $28.05 Berks Eye Physicians & Surgeons Berks Eye Surgery Center Wyomissing, PA 1 ASC 6,500 5.8 $255 $39.26 Berkshire Eye East Orange General Hospital East Orange, NJ 1 MOB 60,442 6.0 $1,002 $16.58 Prospect Medical Holdings, Inc. Brown Clinic Watertown, SD 3 MOB/Img 48,132 11.0 $750 $15.59 Brown Clinic Northern Ohio Medical Specialists Sandusky, OH 8 MOB 55,760 7.1 $907 $16.27 Northern Ohio Medical Specialists Carson Medical Group Clinic Carson City, NV 2 MOB 20,632 3.1 $376 $18.22 Carson Medical Group Piedmont Healthcare Ellijay, GA 3 MOB 44,162 5.7 $398 $9.01 Piedmont Mountainside Hospital, Inc. Encompass Altoona Altoona, PA 1 IRF 70,007 0.6 $1,782 $25.46 Encompass Encompass Mechanicsburg Mechanicsburg, PA 1 IRF 78,836 0.6 $2,001 $25.38 Encompass Encompass Mesa Mesa, AZ 1 IRF 51,903 4.1 $1,869 $36.01 Encompass Geisinger Specialty Care Lewisburg, PA 1 MOB/Img 28,480 2.6 $566 $19.87 Geisinger Health Southwest Florida Neurological & Rehab Cape Coral, FL 1 MOB 25,814 6.3 $561 $21.75 Southwest Florida Neurosurgical Associates Las Cruces Orthopedic Las Cruces, NM 1 MOB 15,761 0.0 $0 $0.00 Las Cruces Orthopedic Associates Thumb Butte Medical Center Prescott, AZ 1 MOB 12,000 6.4 $393 $32.78 Thumb Butte Medical Center/Physician Guaranty Southlake Heart & Vascular Institute Clermont, FL 1 MOB 18,152 2.1 $387 $21.33 Orlando Health, Southlake Hospital, Vascular Specialists of Central Florida Oklahoma Center for Orthopedic & Multi - Specialty Surgery Oklahoma City, OK 3 Surgical Hospital/ Physical Therapy/ASC 97,406 12.6 $3,690 $37.88 OCOM/INTEGRIS; USPI; physician guaranty Unity Family Medicine Brockport, NY 1 MOB 29,497 10.2 $621 $21.04 Unity Hospital of Rochester Lonestar Endoscopy Flower Mound, TX 1 ASC 10,062 6.0 $306 $30.41 Lonestar Endoscopy Center, LLC Carrus Specialty Hospital Sherman, TX 1 IRF/LTACH 69,352 16.7 $2,752 $39.68 SDB Partners, LLC 3Q - 2020| Earnings Supplemental (as of September 30, 2020, see page 18 for footnotes)

Real Estate Portfolio 16 Property Location # of Bldgs Facility Type Net Leasable Square Feet Lease Years Remaining Annualized Rent (1) ($ in 000’s) Annualized Rent Per Square Foot (1) Tenant/Guarantor (2) Cardiologists of Lubbock Lubbock, TX 1 MOB 27,280 8.9 $637 $23.35 Lubbock Heart Hospital/Surgery Partners, Inc. Conrad Pearson Clinic Germantown, TN 1 MOB/ASC 33,777 3.7 $1,548 $45.84 Urology Center of the South/Physician guarantees Central Texas Rehabilitation Clinic Austin, TX 1 IRF 59,258 6.6 $3,152 $53.19 CTRH, LLC / Kindred Health GI Alliance Fort Worth, TX 1 MOB 18,084 7.7 $464 $25.69 Texas Digestive Disease Consultants Albertville Medical Building Albertville, MN 1 MOB 21,486 8.2 $498 $23.18 Stellis Health Heartland Clinic Moline, IL 1 MOB/ASC 34,020 12.7 $948 $27.86 Heartland Clinic Kansas City Cardiology Lee’s Summit, MO 1 MOB 12,180 4.2 $286 $23.48 Kansas City Cardiology Amarillo Bone & Joint Clinic Amarillo, TX 1 MOB 23,298 9.2 $618 $26.53 Amarillo Bone & Joint Clinic Respiratory Specialists Wyomissing, PA 1 MOB 17,598 7.2 $421 $23.93 Berks Respiratory Zion Eye Institute St. George, UT 1 MOB/ASC 16,000 9.2 $416 $26.01 Zion Eye Institute Fresenius Kidney Care Moline, IL 2 MOB 27,173 10.6 $548 $20.17 Quad City Nephrology/Fresenius Medical Care Holdings Northern Ohio Medical Specialists Fremont, OH 1 MOB 25,893 9.4 $639 $24.69 Northern Ohio Medical Specialists Gainesville Eye Gainesville, GA 1 MOB/ASC 34,020 9.4 $808 $23.74 SCP Eyecare Services City Hospital at White Rock Dallas, TX 1 Acute Hospital 236,314 17.4 $2,349 $9.94 Pipeline East Dallas Orlando Health Orlando, FL 5 MOB 59,644 3.5 $1,280 $21.47 Orlando Health Memorial Health System Belpre, OH 4 MOB/Img/ER/ASC 155,600 10.4 $5,482 $35.23 Marietta Memorial Valley ENT McAllen, TX 1 MOB 30,811 8.9 $457 $14.83 Valley ENT Rock Surgery Center Derby, KS 1 ASC 16,704 6.7 $260 $15.55 Rock Surgery Center/Rock Medical Assets Foot and Ankle Specialists Bountiful, UT 1 MOB 22,335 13.1 $387 $17.34 Foot and Ankle Specialists of Utah / physician guaranty TriHealth Cincinnati, OH 1 MOB 18,820 4.5 $313 $16.64 TriHealth Cancer Center of Brevard Melbourne, FL 1 MOB 19,074 2.7 $648 $33.99 Brevard Radiation Oncology / Vantage Oncology Heartland Women's Healthcare Southern IL 6 MOB 64,966 9.00 $1,191 $18.33 Heartland Women's Healthcare / USA OBGYN Management Prospect Medical Vernon, CT 2 MOB/Dialysis/Office 58,550 10.95 $791 $13.52 Prospect ECHN / Prospect Medical Holdings, Inc. Citrus Valley Medical Associates Corona, CA 1 MOB 41,803 10.2 $1,228 $29.38 Citrus Valley Medical Associates AMG Specialty Hospital Zachary, LA 1 LTACH 12,424 15.7 $415 $33.41 AMG Specialty Hospital East Valley Gastroenterology & Hepatology Associates Chandler, AZ 3 MOB/ASC 39,305 9.3 $1,254 $31.89 East Valley Gastroenterology & Hepatology Associates/ USPI 3Q - 2020| Earnings Supplemental (as of September 30, 2020, see page 18 for footnotes)

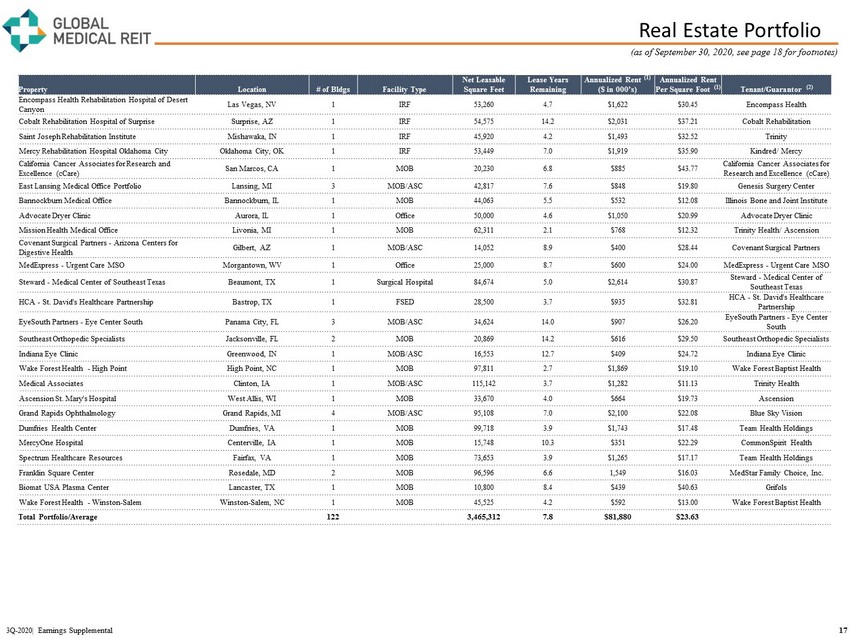

Real Estate Portfolio 17 Property Location # of Bldgs Facility Type Net Leasable Square Feet Lease Years Remaining Annualized Rent (1) ($ in 000’s) Annualized Rent Per Square Foot (1) Tenant/Guarantor (2) Encompass Health Rehabilitation Hospital of Desert Canyon Las Vegas, NV 1 IRF 53,260 4.7 $1,622 $30.45 Encompass Health Cobalt Rehabilitation Hospital of Surprise Surprise, AZ 1 IRF 54,575 14.2 $2,031 $37.21 Cobalt Rehabilitation Saint Joseph Rehabilitation Institute Mishawaka, IN 1 IRF 45,920 4.2 $1,493 $32.52 Trinity Mercy Rehabilitation Hospital Oklahoma City Oklahoma City, OK 1 IRF 53,449 7.0 $1,919 $35.90 Kindred/ Mercy California Cancer Associates for Research and Excellence (cCare) San Marcos, CA 1 MOB 20,230 6.8 $885 $43.77 California Cancer Associates for Research and Excellence (cCare) East Lansing Medical Office Portfolio Lansing, MI 3 MOB/ASC 42,817 7.6 $848 $19.80 Genesis Surgery Center Bannockburn Medical Office Bannockburn, IL 1 MOB 44,063 5.5 $532 $12.08 Illinois Bone and Joint Institute Advocate Dryer Clinic Aurora, IL 1 Office 50,000 4.6 $1,050 $20.99 Advocate Dryer Clinic Mission Health Medical Office Livonia, MI 1 MOB 62,311 2.1 $768 $12.32 Trinity Health/ Ascension Covenant Surgical Partners - Arizona Centers for Digestive Health Gilbert, AZ 1 MOB/ASC 14,052 8.9 $400 $28.44 Covenant Surgical Partners MedExpress - Urgent Care MSO Morgantown, WV 1 Office 25,000 8.7 $600 $24.00 MedExpress - Urgent Care MSO Steward - Medical Center of Southeast Texas Beaumont, TX 1 Surgical Hospital 84,674 5.0 $2,614 $30.87 Steward - Medical Center of Southeast Texas HCA - St. David's Healthcare Partnership Bastrop, TX 1 FSED 28,500 3.7 $935 $32.81 HCA - St. David's Healthcare Partnership EyeSouth Partners - Eye Center South Panama City, FL 3 MOB/ASC 34,624 14.0 $907 $26.20 EyeSouth Partners - Eye Center South Southeast Orthopedic Specialists Jacksonville, FL 2 MOB 20,869 14.2 $616 $29.50 Southeast Orthopedic Specialists Indiana Eye Clinic Greenwood, IN 1 MOB/ASC 16,553 12.7 $409 $24.72 Indiana Eye Clinic Wake Forest Health - High Point High Point, NC 1 MOB 97,811 2.7 $1,869 $19.10 Wake Forest Baptist Health Medical Associates Clinton, IA 1 MOB/ASC 115,142 3.7 $1,282 $11.13 Trinity Health Ascension St. Mary's Hospital West Allis, WI 1 MOB 33,670 4.0 $664 $19.73 Ascension Grand Rapids Ophthalmology Grand Rapids, MI 4 MOB/ASC 95,108 7.0 $2,100 $22.08 Blue Sky Vision Dumfries Health Center Dumfries, VA 1 MOB 99,718 3.9 $1,743 $17.48 Team Health Holdings MercyOne Hospital Centerville, IA 1 MOB 15,748 10.3 $351 $22.29 CommonSpirit Health Spectrum Healthcare Resources Fairfax, VA 1 MOB 73,653 3.9 $1,265 $17.17 Team Health Holdings Franklin Square Center Rosedale, MD 2 MOB 96,596 6.6 1,549 $16.03 MedStar Family Choice, Inc. Biomat USA Plasma Center Lancaster, TX 1 MOB 10,800 8.4 $439 $40.63 Grifols Wake Forest Health - Winston - Salem Winston - Salem, NC 1 MOB 45,525 4.2 $592 $13.00 Wake Forest Baptist Health Total Portfolio/Average 122 3,465,312 7.8 $81,880 $23.63 3Q - 2020| Earnings Supplemental (as of September 30, 2020, see page 18 for footnotes)

Disclosures Rent Coverage Ratio (see pages 11 and 13 ) For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded credit - rated tenants or their subsidiaries for which financial statements were either not available or not sufficiently detailed . These ratios are based on latest available information only . Most tenant financial statements are unaudited and we have not independently verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information is accurate or complete . Certain other tenants (approximately 3 % of our portfolio) are excluded from the calculation due to lack of available financial information . Additionally, our Rent Coverage Ratio adds back physician distributions and compensation . Management believes all adjustments are reasonable and necessary . Real Estate Portfolio (see pages 15 , 16 and 17 ) Data as of September 30, 2020. (1) Monthly base rent at September 30, 2020 multiplied by 12 (or actual NOI where more reflective of property performance). In a ddition, Marina Towers is presented on a cash - collected basis. Accordingly, this methodology produces an annualized amount as of a point in time but does not take into account future contr act ual rental rate increases . (2) Certain lease guarantees are for less than 100% of the contractual rental payments. Additional Information The information in this document should be read in conjunction with the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K, and other information filed with, or furnished to, the SEC . You can access the Company’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13 (a) or 15 (d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www . globalmedicalreit . com) under “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC . The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into, this Earnings Supplemental . You also can review these SEC filings and other information by accessing the SEC’s website at http : //www . sec . gov . Certain information contained in this package, including, but not limited to, information contained in our Top 10 tenant profiles is derived from publicly - available third - party sources . The Company has not independently verified this information and there can be no assurance that such information is accurate or complete . 18 (as of September 30, 2020) 3Q - 2020| Earnings Supplemental

Evelyn Infurna Evelyn.Infurna@icrinc.com 203.682.8265 www.globalmedicalreit.com NYSE: GMRE INVESTOR RELATIONS