UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

GLOBAL MEDICAL REIT INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

CHAIRMAN’S LETTER

April 16, 2021

Dear Stockholder:

On behalf of the Board of Directors of Global Medical REIT Inc., a Maryland corporation, I cordially invite you to attend our annual meeting of stockholders on May 26, 2021 at 10:00 a.m. (ET), to be held virtually, by remote communication. To attend the meeting, you must register at https://viewproxy.com/gmre/2021/htype.asp by 11:59 p.m. (ET) on May 23, 2021.

We are using a virtual format due to the ongoing COVID-19 pandemic. A virtual Annual Meeting makes it possible for stockholders to attend the Annual Meeting without risking transmission of COVID-19 or violating local rules regarding in-person gatherings. We believe that the online tools we have selected will facilitate stockholder communication, allowing stockholders to communicate with us in advance of, and during, the Annual Meeting. During the live Q&A session of the Annual Meeting, we may answer questions as they come in and address those asked in advance, to the extent relevant to the business of the Annual Meeting, as time permits.

Both stockholders of record and street name stockholders will be able to attend the Annual Meeting via live audio webcast, submit their questions during the meeting and vote their shares electronically at the Annual Meeting.

If you are a registered holder, your virtual control number will be on your Notice of Internet Availability of Proxy Materials or proxy card.

If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration, and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at https://viewproxy.com/gmre/2021/htype.asp. On the day of the Annual Meeting, you may only vote during the meeting by e-mailing a copy of your legal proxy to virtualmeeting@viewproxy.com in advance of the meeting.

We look forward to seeing you at the Annual Meeting.

| Sincerely, | |

| /s/ Jeffrey Busch | |

| Jeffrey Busch | |

| Chairman of the Board, Chief Executive Officer and President |

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held Virtually on May 26, 2021

The Proxy Statement and 2020 Annual Report are available online at https://www.viewproxy.com/GMRE/2021 and in the “Investors” section of our website at http://www.globalmedicalreit.com.

The 2021 Annual Stockholder Meeting of Global Medical REIT Inc., a Maryland corporation (the “Company”), will be held virtually via live webcast on May 26, 2021 at 10:00 a.m. (ET). To attend the meeting, you must register at https://viewproxy.com/gmre/2021/htype.asp by 11:59 p.m. (ET) on May 23, 2021.

Items of Business

As a stockholder, you will be asked to:

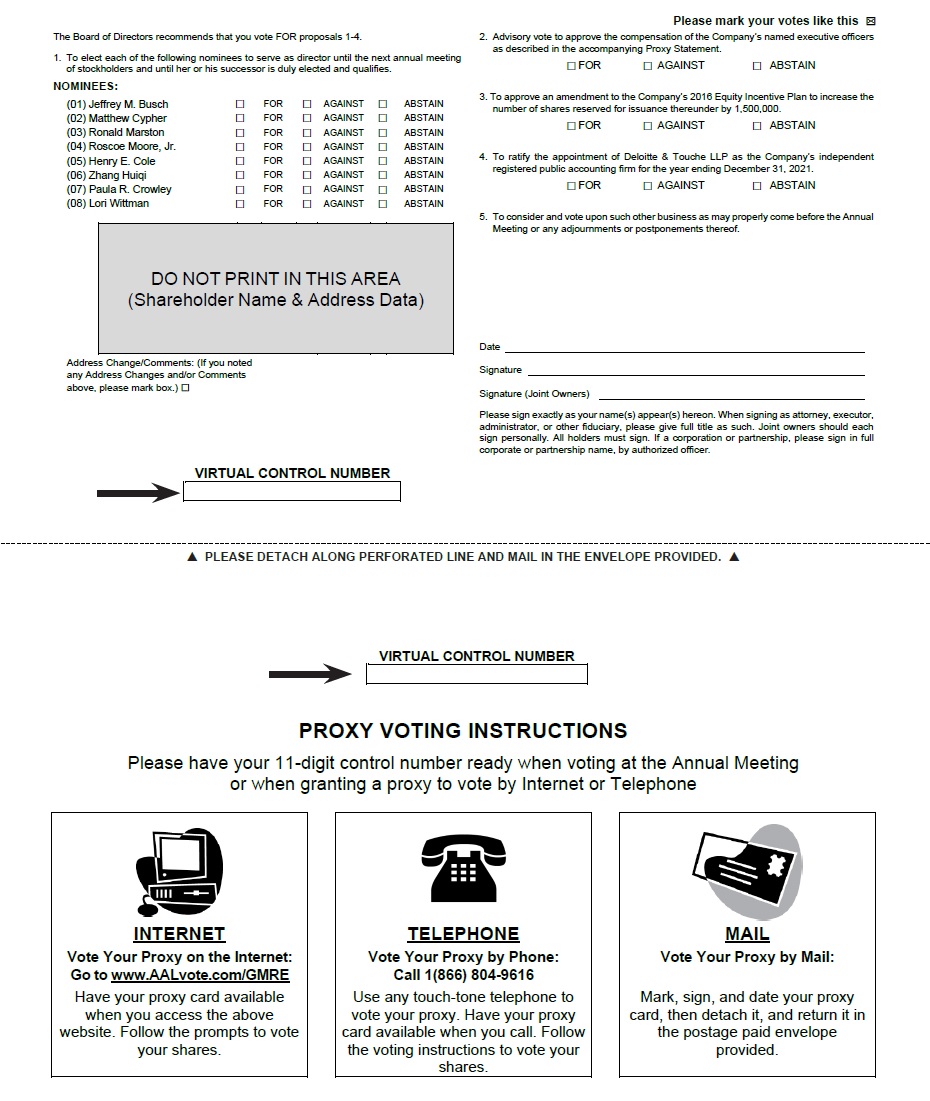

| 1. | elect eight nominees to serve as directors on our Board of Directors (our “Board of Directors” or our “Board”), each to serve until the next annual meeting of stockholders and until her or his successor is duly elected and qualifies; |

| 2. | consider and vote on an advisory resolution to approve named executive officer (“NEO”) compensation; |

| 3. | consider and vote on an amendment to our 2016 Equity Incentive Plan to increase the number of shares reserved for issuance thereunder by 1,500,000 shares; |

| 4. | consider and vote on the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the year ending December 31, 2021; and |

| 5. | transact such other business as may properly be brought before the Annual Meeting and at any adjournment or postponement thereof. |

Record Date

The Board of Directors has fixed the close of business on April 1, 2021 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

Proxy Voting

You may authorize your proxy on the Internet or by phone. For a beneficial holder to vote at the meeting, you must submit a copy of your legal proxy to virtualmeeting@viewproxy.com in advance of the meeting. We encourage you to instruct us on the Internet as to the authorization of your proxy. Instructions for authorizing your vote are contained on the Notice of Internet Availability. If for any reason you should decide to revoke your proxy, you may do so at any time prior to its exercise at the Annual Meeting.

Virtual Meeting

To attend the meeting, you must register at https://viewproxy.com/gmre/2021/htype.asp by 11:59 p.m. (ET) on May 23, 2021. A unique join link to the Annual Meeting and a password will be provided to each stockholder who registers to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting virtually, your vote is very important, and we encourage you to authorize your proxy as promptly as possible. If you vote by proxy, but later decide to attend the Annual Meeting virtually, or for any other reason desire to revoke your proxy, you may still do so by following the procedures set forth in the proxy statement.

As permitted by the Securities and Exchange Commission (the “SEC”), the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) to all stockholders of record. All stockholders will have the ability to access the Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 as filed with the SEC on March 8, 2021 (the “Annual Report”) on a website referred to in this Notice of Internet Availability or to request a printed set of these materials at no charge. Instructions on how to access these materials over the Internet or to request a printed copy may be found in this Notice of Internet Availability.

In addition, any stockholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to stockholders and will reduce the impact of annual meetings on the environment. A stockholder’s election to receive proxy materials by email will remain in effect until the stockholder terminates it.

| We look forward to speaking with you at the meeting. | |

| Bethesda, Maryland | On behalf of the Board of Directors, |

| April 16, 2021 | /s/ Jamie Barber |

| Jamie Barber | |

| General Counsel and Secretary |

PROXY STATEMENT

This proxy statement, including the information incorporated by reference herein (collectively, this “Proxy Statement”), provides information about the 2021 Annual Meeting of Stockholders of Global Medical REIT Inc., a Maryland Corporation.

| Meeting Information | |

| Date: | Wednesday, May 26, 2021 |

| Time: | 10:00 a.m. Eastern Time |

| Virtual Meeting: | Register at: https://viewproxy.com/gmre/2021/htype.asp |

| Record Date: | April 1, 2021 |

| How to Vote |

| Your vote is important. You may authorize your proxy in advance of the meeting via the Internet, by telephone or by mail, or by attending and voting online at the 2021 Annual Stockholders Meeting. Please refer to the Notice of Internet Availability, proxy card or voter instruction form for detailed voting instructions. |

The Notice of Internet Availability and this Proxy Statement and form of proxy were first made available to stockholders on the Internet on April 16, 2021.

| Voting Items | Board Vote Recommendation |

| Elect eight nominees to serve as directors on our Board of Directors (our “Board of Directors” or our “Board”), each to serve until the next annual meeting of stockholders and until her or his successor is duly elected and qualifies. See “Proposal 1 – Election of Directors.” | FOR each nominee |

| Consider and vote on an advisory resolution to approve named executive officer (“NEO”) compensation. See “Proposal 2 – Advisory Vote on Named Executive Officer Compensation.” | FOR this proposal |

| Consider and vote on an amendment to our 2016 Equity Incentive Plan to increase the number of shares reserved for issuance thereunder by 1,500,000 shares. See “Proposal 3 – Amendment to 2016 Equity Incentive Plan.” | FOR this proposal |

| Consider and vote on the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the year ending December 31, 2021. See “Proposal 4 – Ratification of Appointment of Independent Registered Public Accounting Firm.” | FOR this proposal |

Contents

CONTACT INFORMATION AND GENERAL INFORMATION

The Board of Directors of Global Medical REIT Inc., a Maryland corporation, has made these materials available to you on the Internet in connection with the Company’s solicitation of proxies for its Annual Meeting to be held on May 26, 2021, virtually, by remote communication, at 10:00 a.m. (ET). These materials were first made available to stockholders on the Internet on April 16, 2021. Unless the context requires otherwise, references in this Proxy Statement to “we,” “our,” “us,” “our Company” and the “Company” refer to Global Medical REIT Inc.

The mailing address of our principal executive office is c/o Global Medical REIT Inc., 2 Bethesda Metro Center, Suite 440, Bethesda, MD 20814, Attention: Chief Operating Officer, and our main telephone number is (202) 524-6851. We maintain an Internet website at http://www.globalmedicalreit.com. Information at or connected to our website is not and should not be considered part of this Proxy Statement.

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials via the Internet, instead of mailing printed copies. Accordingly, we are sending a Notice of Internet Availability on or about April 16, 2021 to our stockholders of record as of the close of business on April 1, 2021, the record date. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability will instruct you as to how you may access and review all the proxy materials on the Internet. The Notice of Internet Availability also instructs you as to how to authorize your proxy to vote online, by phone and how to request a paper copy of the Proxy Statement and 2020 Annual Report if you so desire. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice of Internet Availability.

The SEC rules permit us, with your permission, to deliver a single proxy statement and annual report to any household at which two or more stockholders of record reside at the same address. Each stockholder will continue to receive a separate proxy card. This procedure, known as “householding,” reduces the volume of duplicate information you receive and reduces our expenses. Stockholders of record authorizing their vote by mail can choose this option by marking the appropriate box on the proxy card included with this Proxy Statement. Stockholders of record authorizing their vote via telephone or over the Internet can choose this option by following the instructions provided by telephone or over the Internet, as applicable.

Once given, a stockholder’s consent will remain in effect until he or she revokes it by notifying us. If you revoke your consent, we will begin sending you individual copies of future mailings of these documents within 30 days after we receive your revocation notice. Stockholders of record who elect to participate in householding may also request a separate copy of future proxy statements and annual reports by contacting us at the address and main telephone number above.

Institutions that hold shares in street name for two or more beneficial owners with the same address are permitted to deliver a single proxy statement and annual report to that address. Any such beneficial owner can request a separate copy of this Proxy Statement or the 2020 Annual Report by contacting us as described above. Beneficial owners with the same address who receive more than one Proxy Statement and 2020 Annual Report may request delivery of a single Proxy Statement and 2020 Annual Report by contacting the Corporate Secretary in writing at the address and main telephone number above.

No person is authorized to give any information or to make any representation not contained in this Proxy Statement and, if given or made, you should not rely on that information or representation as having been authorized by us. The delivery of this Proxy Statement does not imply that the information herein has remained unchanged since the date of this Proxy Statement.

1

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Where and when is the Annual Meeting?

The Annual Meeting will be held May 26, 2021, at 10:00 a.m. (ET). The Annual Meeting will be conducted via a virtual format (i.e., no physical meeting will take place). A unique join link to the Annual Meeting and a password will be provided to each stockholder who registers to attend the Annual Meeting, as described below.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will vote upon matters described in the Notice of Annual Meeting and this Proxy Statement. In addition, once the business of the Annual Meeting is concluded, members of management will respond to questions raised by stockholders, as time permits.

How Do I Register for the Annual Meeting?

Please visit https://viewproxy.com/gmre/2021/htype.asp to register to attend the Annual Meeting.

ALL REGISTRATIONS MUST BE RECEIVED BY 11:59 P.M. (ET) ON MAY 23, 2021.

| • | If you hold your shares in your name and have received a Notice of Internet Availability or proxy card, please click “Registration for Registered Holders” and enter your name, phone number, e-mail address and indicate if you plan to vote at the meeting. |

| • | If you hold your shares through a bank or broker, please click “Registration for Beneficial Holders” and enter your name, phone number, e-mail address and indicate if you plan to vote at the meeting. Then please upload or email a copy of your legal proxy that you have obtained from your bank or broker to virtualmeeting@viewproxy.com. |

| • | Beneficial Holders must submit a copy of their legal proxy from their bank or broker if they wish to vote their shares at the Annual Meeting. |

| • | If a beneficial holder wants to attend the meeting and not vote, they will need to provide proof of ownership (see below “How Do I Demonstrate Proof of Stock Ownership?”) during registration. |

How Do I Demonstrate Proof of Stock Ownership?

| • | If you are a registered holder, the proof of your stock ownership is your name and address as it appears on the proxy card or Notice of Internet Availability you have received. Our team will crosscheck this with a list of all registered holders to confirm your ownership. |

| • | If you are a beneficial holder (hold your shares at a bank or broker), your proof will be the copy of your legal proxy that you obtain from your bank or broker, a copy of your voter instruction form, proxy card, Notice of Internet Availability, or current broker statement. Please upload or email proof of stock ownership to virtualmeeting@viewproxy.com |

What is the difference between a stockholder of record and a beneficial owner of our common stock held in street name?

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), you are considered the stockholder of record with respect to those shares, and we sent the Notice of Internet Availability directly to you.

2

Beneficial Owner of Stock Held in Street Name. If your shares are held in an account at a broker, bank or other nominee, then you are the beneficial owner of those shares in “street name,” and the Notice of Internet Availability has been forwarded to you by your broker, bank or other nominee who is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to instruct your broker, bank or other nominee on how to vote the shares held in your account. Those instructions are contained in a “vote instruction form.”

I’ve Submitted My Registration — What Happens Now?

| • | A member of our team will review and confirm your registration. | |

| • | If you are a beneficial holder and want to attend the virtual Annual Meeting and not vote, you will need to provide proof of stock ownership (see “How Do I Demonstrate Proof of Stock Ownership?”). | |

| • | An e-mail will be sent with the link to attend the Annual Meeting. | |

| • | Two days prior to the meeting, you will receive the password that you will need to attend the virtual Annual Meeting. | |

| • | You will need the password to attend the virtual Annual Meeting. | |

| • | If you have indicated that you will be voting at the virtual Annual Meeting, and you are a registered holder, your virtual control number is on your Proxy Card or Notice of Internet Availability. You will need your virtual control number to vote your shares during the virtual Annual Meeting. | |

| • | If you are a beneficial holder and want to vote at the virtual Annual Meeting, you must upload a copy of your legal proxy which you need to obtain from your bank or broker and then a virtual control number will be e-mailed to you. You will need your virtual control number to vote your shares during the virtual Annual Meeting. |

Who can attend the Annual Meeting?

All our common stockholders of record as of the close of business on April 1, 2021, the record date for the Annual Meeting, or their duly appointed proxies, may attend the Annual Meeting.

How Do I Attend the Annual Meeting?

If you have registered for the Annual Meeting at: https://viewproxy.com/gmre/2021/htype.asp, please refer back to your meeting invitation e-mail for your unique join link. Please click that link and use the password that was e-mailed to you two days prior to the meeting. This will give you access to the Global Medical REIT Inc. 2021 Annual Meeting.

Where Can I Find My Virtual Control Number?

| • | You first must register to attend the meeting at: https://viewproxy.com/gmre/2021/htype.asp. | |

| • | If you have indicated that you will be voting at the meeting, and you are a registered holder, your virtual control number is on your proxy card or Notice of Internet Availability. |

| • | If you are a beneficial holder and want to vote at the meeting, you must upload a copy of your legal proxy which is obtained from your bank or broker and then a virtual control number will be e-mailed to you. |

Who may vote?

You may vote if you were the record owner of shares of our common stock at the close of business on April 1, 2021, the record date for the Annual Meeting. Each share of our common stock owned as of the record date has one vote.

3

How do I vote?

There are four ways to vote, either by authorizing a proxy or voting at the Annual Meeting:

| • | During the Meeting. See “How do I Vote During the Meeting?” below. |

| • | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice of Internet Availability. |

| • | By Phone. You may vote by proxy via telephone by following the instructions provided in the Notice of Internet Availability. |

| • | By Mail. If you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. |

How Do I Vote During the Meeting?

During the Annual Meeting, please visit www.AALvote.com/GMRE to vote your shares during the meeting while the polls are open. You will need your Virtual Control Number to vote your shares.

| • | If you have indicated that you will be voting at the meeting, and you are a registered holder, your virtual control number is on your proxy card or Notice of Internet Availability. |

| • | If you are a beneficial holder and want to vote at the meeting, you must upload a copy of your legal proxy which is obtained from your bank or broker and then a virtual control number will be e-mailed to you. |

I Am Trying to Access the Meeting, But I Cannot Get In, Why?

Please be sure that you have already registered to attend the Annual Meeting. If your registration has been accepted and you still cannot access the meeting, be sure that you have downloaded the required software. If you are still having a problem, please e-mail virtualmeeting@viewproxy.com

What If I Hold Multiple Positions and Have Multiple Virtual Control Numbers?

You will only need the password to access the meeting, however you will need to use each virtual control number to vote each position.

What am I voting on?

Our Board of Directors is soliciting your vote for:

| (1) | the election of eight directors (each to serve until the next annual meeting of stockholders and until her or his successor is duly elected and qualifies); | |

| (2) | an advisory resolution to approve NEO compensation; |

| (3) | the approval of an amendment to our 2016 Equity Incentive Plan to increase the number of shares reserved for issuance thereunder by 1,500,000 shares; | |

| (4) | the ratification of the appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2021; and | |

| (5) | any other business that properly comes before the Annual Meeting and any adjournment or postponement thereof. |

4

What are the Board of Directors’ recommendations?

Our Board of Directors recommends you vote:

| (1) | “FOR” the election of each nominee named in this Proxy Statement (see Proposal No. 1); | |

| (2) | “FOR” the advisory resolution approving NEO compensation (see Proposal No. 2); |

| (3) | “FOR” the approval of the amendment to the 2016 Equity Incentive Plan (see Proposal No. 3); and | |

| (4) | “FOR” ratification of the appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2021 (see Proposal No. 4). |

How many votes do I have?

You are entitled to one vote for each whole share of our common stock you held as of the close of business on April 1, 2021. Our stockholders do not have the right to cumulate their votes for directors.

How are proxies voted?

All shares represented by valid proxies received prior to the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. If no instructions are given in a duly authorized proxy, shares will be voted in accordance with the Board’s recommendations.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the vote at the Annual Meeting. You may authorize your proxy to vote again on a later date prior to the Annual Meeting via the Internet or phone (in which case only your latest Internet proxy or phone proxy submitted prior to the Annual Meeting will be counted) by signing and returning a new proxy card or vote instruction form with a later date, or by attending the Annual Meeting and voting virtually. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation to the Company’s Secretary prior to the Annual Meeting.

Will my shares be voted if I do not provide my proxy?

It depends on whether you hold your shares in your own name or in the name of a bank or brokerage firm. If you hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote virtually at the Annual Meeting.

Brokerage firms generally have the authority to vote customers’ non-voted shares on certain “routine” matters. If your shares are held in the name of the brokerage firm, the brokerage firm can vote your shares for the ratification of Deloitte as our registered independent public accounting firm for the year ending December 31, 2021 (Proposal No. 4) if you do not timely provide your voting instructions, because this matter is considered “routine” under the applicable rules. The other items (Proposals Nos. 1, 2 and 3) are not considered “routine” and therefore may not be voted upon by your broker without instructions.

What constitutes a quorum for the Annual Meeting?

As of the close of business on the record date for the Annual Meeting, there were 60,794,166 shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting. In order to conduct the Annual Meeting, a majority of the votes entitled to be cast must be present in person, including virtually, or by proxy. This is referred to as a “quorum.” If you submit a properly executed proxy card or vote on the Internet or by phone, you will be considered part of the quorum. Abstentions and broker “non-votes” will be counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under the applicable rules, does not have discretionary authority to vote on a matter. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. No business may be conducted at the Annual Meeting if a quorum is not present.

5

What vote is required to approve an item of business at the Annual Meeting?

Election of Directors (Proposal No. 1). The affirmative vote of a majority of the votes cast at the Annual Meeting is required to elect a director. For purposes of this vote, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote for this proposal, although they will be considered present for the purpose of determining the presence of a quorum.

Advisory Vote on NEO Compensation (Proposal No. 2). The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve this proposal. For purposes of this vote, abstentions and broker-non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum.

Approval of the Amendment to the 2016 Equity Incentive Plan (Proposal No. 3). The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve this proposal. For purposes of this vote, abstentions will have the same effect as a vote against the proposal and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although broker non-votes will be considered present for the purpose of determining the presence of a quorum.

Ratification of the Appointment of Deloitte (Proposal No. 4). The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve this proposal. For purposes of this vote, abstentions will not be counted as votes cast and will have no effect on the result of the vote for this proposal, although abstentions will be considered present for the purpose of determining the presence of a quorum. Because brokers are entitled to vote on Proposal 4 without specific instructions from beneficial owners, there will be no broker non-votes on this matter.

Where can I find the voting results of the Annual Meeting?

The Company intends to announce preliminary voting results at the Annual Meeting and disclose final results in a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting. If final results are not yet known within that four-business day period, the Company will disclose preliminary voting results in a Form 8-K and file an amendment to the Form 8-K to disclose the final results within four business days after such final results are known.

How can a stockholder propose business to be brought before next year’s annual meeting?

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, we must receive any stockholder proposals intended to be presented at our 2022 annual meeting of stockholders on or before December 17, 2021 for a proposal to be eligible to be included in the Proxy Statement and form of proxy to be distributed by the Board of Directors for that meeting. In addition, if you desire to otherwise present a stockholder proposal or director nomination before our 2022 annual meeting, you must comply with our bylaws, which require that you provide written notice of such proposal or nomination, as well as additional information set forth therein, no earlier than November 17, 2021 and no later than 5:00 p.m., Eastern Time, on December 17, 2021; provided, however, that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from May 26, 2022, in order for notice by the stockholder to be timely, such notice must be so delivered not earlier than the 150th day prior to the date of such annual meeting and not later than 5:00 p.m., Eastern Time, on the later of the 120th day prior to the date of such annual meeting, as originally convened, or the tenth day following the day on which public announcement of the date of such meeting is first made.

6

How are proxies solicited?

The costs and expenses of soliciting proxies from stockholders will be paid by the Company. Employees, officers and directors of the Company may solicit proxies. In addition, we will, upon request, reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to the beneficial owners of common stock.

7

| Portfolio Growth of 26% to Over $1 Billion in Assets |

The Company continued its high acquisition growth rate during 2020 despite the economic turmoil caused by the COVID-19 pandemic. From January 1, 2020 through December 31, 2020, the Company acquired $237.4 million of gross real estate investments, and ended 2020 with over $1 billion in investments with a portfolio weighted average capitalization rate of 7.8%. The Company’s portfolio has a compound annual growth rate of 75% since its initial public offering in 2016 through December 31, 2020.

8

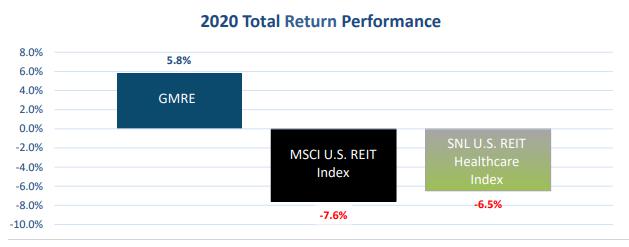

| Total Stockholder Return of 5.8% in 2020 and 101% since 2018 |

During 2020, the Company’s common stockholders earned 5.8% on a total return basis. The chart below compares the Company’s total return performance to the SNL U.S. REIT Healthcare Index and the MSCI U.S. REIT Index:

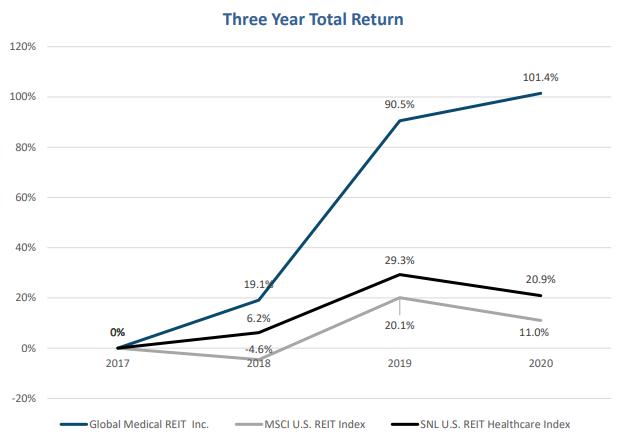

Since December 31, 2017, the Company’s common stock has increased 101.4% on a total return basis. The chart below compares the Company’s total return performance to the SNL U.S. REIT Healthcare Index and the MSCI U.S. REIT Index:

9

| Cost Effective Management Internalization Transaction |

On July 9, 2020, the Company completed its management internalization transaction (the “Internalization”) pursuant to which the Company acquired all the outstanding shares of capital stock of Inter-American Group Holdings Inc. (“IAGH”), the parent company of Inter-American Management LLC, our former external advisor (“IAM” or our “Former Advisor”) for an aggregate purchase price of approximately $18.1 million, subject to a working capital adjustment. Benefits of the internalization include:

| • | Economies of Scale with Growth — Elimination of management fees based on stockholders’ equity provides for significantly lower incremental costs as the Company's stockholders’ equity grows. |

| • | Simplified Structure and Elimination of Conflicts of Interests — The Internalization simplified the Company’s structure by integrating all operating activities under a single corporate structure. Internalizing management also mitigates any perceived or actual conflicts of interest between the Company and the Former Advisor related to the previous external management structure. |

| • | Improved Cost of Capital — Elimination of the base management fee improved the Company’s cost of capital by allowing the Company to retain more of the net proceeds from post-Internalization capital raises, including our March 2021 common stock offering. In addition, we believe that the elimination of the external manager will broaden our potential stockholder base and increase demand for our stock, which should also translate into a lower cost of capital over time. |

| • | Management Continuity — The Company’s pre-Internalization management team and corporate staff continues to lead the Company post-internalization. This continuity of management provides a seamless transition to future senior leadership. |

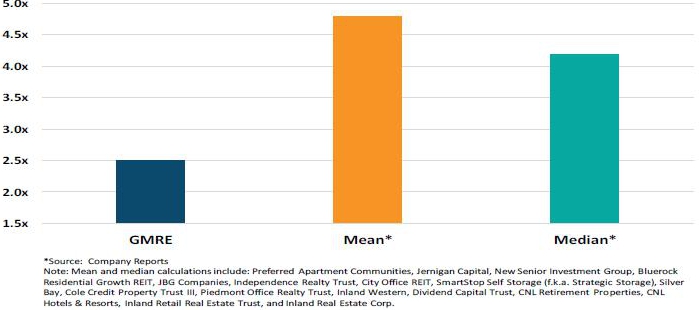

The Internalization consideration was approximately 2.5 times the annual base management fee, which was significantly lower than other REIT internalization transactions, as shown below (shown as a base management fee multiple):

10

PROPOSAL 1 — ELECTION OF DIRECTORS

Directors and Executive Officers

The following table provides information about the individuals nominated for election as directors at the Annual Meeting and our executive officers as of the date of this Proxy Statement.

| Name | Age | Position | ||

| Jeffrey Busch | 63 | Chairman of the Board, Chief Executive Officer and President | ||

| Robert Kiernan | 55 | Chief Financial Officer and Treasurer | ||

| Alfonzo Leon | 45 | Chief Investment Officer | ||

| Jamie Barber | 44 | General Counsel and Secretary | ||

| Danica Holley | 48 | Chief Operating Officer | ||

| Henry Cole† | 76 | Director | ||

| Matthew L. Cypher, Ph.D.† | 44 | Director | ||

| Ronald Marston† | 78 | Director | ||

| Dr. Roscoe Moore† | 76 | Director | ||

| Zhang Huiqi | 31 | Director | ||

| Lori Wittman† | 62 | Director | ||

| Paula Crowley† | 66 | Director |

| † | This individual is independent in accordance with the listing standards of the New York Stock Exchange (“NYSE”). |

Nominees for Election as Directors

The Board is currently comprised of nine directors and the Board has nominated each of the individuals named below for election to the Board until the 2022 annual meeting of stockholders and until a successor is elected and qualifies. This section gives information about the nominees for election as directors: Mr. Jeffrey Busch, Mr. Henry Cole, Mr. Matthew L. Cypher, Ph.D., Mr. Ronald Marston, Dr. Roscoe Moore, Miss Zhang Huiqi, Ms. Lori Wittman and Ms. Paula Crowley. Our Nominating and Corporate Governance Committee has recommended that each of these nominees be elected to the Board until the 2022 annual meeting of stockholders and until a successor is elected and qualifies. Each of the nominees has agreed to serve as a director if elected.

Due to his continuing business obligations that our current director, Mr. Zhang Jingguo, had previously raised to the Board, Mr. Zhang was not nominated for re-election as a member of the Board at the Annual Meeting. There has been no disagreement between Mr. Zhang and the Company. Our bylaws provide that a majority of the entire Board may establish, increase or decrease the number of directors, provided that the number of directors may not be less than the minimum number required by the Maryland General Corporation Law, nor more than 15. The Board has established the current number of directors at nine. Although there will be one vacancy on the Board following the Annual Meeting because Mr. Zhang is not standing for re-election, proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

11

The Board of Directors recommends a vote FOR the nominees.

Biographical Information for Nominees for Director

Jeffrey Busch. Director since September 2014. Mr. Busch has been an active investor in the real estate industry since 1985. Mr. Busch also has served as Chairman and President of our Company from August 2015 to present and has served as Chief Executive Officer of our Company since August 2017. His experience includes developing numerous properties in various asset classes, owning and managing real estate in several states, including rental housing, and a wide variety of commercial real estate. Since 2001, Mr. Busch has also served as President of Safe Blood International Foundation, where he oversees the establishment of medical facilities in 35 developing nations, funded by the CDC and USAID, Exxon Mobil, and the Gates Foundation. Mr. Busch has had presidential appointments in two presidential administrations, one in the Department of Housing and Urban Affairs and the other at the United Nations in Geneva, where he served as a United States delegate. Prior to the Internalization, Mr. Busch served as President of our Former Advisor, as well as a Director since 2013 and was an owner of 15% of the outstanding common stock of IAGH. Since October 2014, Mr. Busch has served as Chairman of the Board of American Housing REIT Inc., which was managed by IAM. Mr. Busch served as a director of American Pacific Bankcorp, Inc. (APB) through February 2020. Mr. Busch also serves as the Chairman of the Board of Directors of Theralink Technologies (OTC: OBMP)(“Theralink”), which was formerly known as OncBioMune Pharmaceuticals, Inc. and changed its name to Theralink after completing the purchase of the assets of Avant Diagnostics, Inc. (“Avant”), a cancer diagnostics company. Prior to the purchase of the assets of Avant by Theralink, Mr. Busch served as Chairman of the Board of Directors of Avant. Mr. Busch holds a B.A. from New York University in the Stern School of Business, a Masters of Public Administration from New York University, and a J.D. from Emory University.

The Nominating and Corporate Governance Committee of our Board has concluded that Mr. Busch should serve as a director because of his significant experience with developing and managing real estate assets.

Henry Cole. Lead Independent Director, director since August 2015, Chair of the Compensation Committee and member of the Audit Committee. In supporting the Company and its stockholders, Mr. Cole draws on over 40 years of successful executive management and implementation of health and medical programs involving innovations in technology, market development and service delivery. Mr. Cole serves as President of Global Development International, LLC, a position he has held since 2007. In this position he has provided development support, management and oversight for companies and varied program initiatives in medical and healthcare programs and products. This has included Instant Labs Medical Diagnostics, Inc. (molecular diagnostics, hospital based infections); MedPharm, Inc. (global and developing country hospital and clinic support); Global MD, Inc. (global physicians network); MPRC Group, LTD, Lebanon and US (medical equipment, medical system planning and support throughout the Middle East); Integrated Health Services LTD, India (health services planning for India); Karishma Health Care LTD, India (hospital medical systems software for India, US, Africa) and various others. Mr. Cole previously served from 2007-2010 as Vice President for Strategy at Camris International, Inc., with focus on technologies and services for infectious disease, for radiation diagnostics, and for pulmonary care. From 1981 to 2005 Mr. Cole served as President and Corporate Officer at Futures Group International and Futures Group Holdings. Under his direction, corporate programs expanded to offices in over 40 countries. At Futures, Mr. Cole oversaw programs that included policy, planning, services and facilities addressing public and private sector infectious disease response in over 35 countries. In addition, he was a founder and served as executive for a subsidiary for national health planning and services (Futures Group UK); for a subsidiary in US rehabilitation services providers (Futures Health Corps); and for a subsidiary in global medical equipment distribution (North Star Health). From 1971-1979 Mr. Cole was Director of Population Programs at the Center for Advanced Studies of General Electric. Earlier he served on the Faculty of Economics, Tulane University (1969 – 1972) and The US President’s Council of Economic Advisors as staff intern (1969 – 1970).

Mr. Cole has served on the boards of numerous organizations. In addition to the Futures Group Holding company and the associated companies, Mr. Cole’s previous board positions have also included: the cancer diagnostics company, Avant to June 2020; The Millennium Project to 2006; the Futures Institute for Sustainable Development to 2009; The Foundation Against HIV and AIDS to 2011; Kids Save International to 2012; Triple Win International to 2013; and others.

Mr. Cole holds a B.A. in Economics from Yale University and an MA as well as completed Ph.D. studies (ABD) in Political Economy, with written comprehensive exams and faculty oral exams completed, from The Johns Hopkins University. Mr. Cole has worked in and supported offices in over 40 countries, with in-depth experience beyond the multiple locations in the United States and Great Britain to include Egypt, Turkey, Ghana, Cameroon, Kenya, Sudan, Sahelian Africa, Haiti, Trinidad, Bahamas, Philippines, China, Indonesia and India.

12

Mr. Cole has a son who was an employee of our Former Advisor, and is now an employee of the Company, who performs operational management services for the Company.

The Nominating and Corporate Governance Committee of our Board has concluded that Mr. Cole should serve as a director in recognition of his abilities to assist our Company in expanding its business and the contributions he can make to our strategic direction.

The Nominating and Corporate Governance also took into account that Mr. Cole is “independent” under SEC Rule 10A-3 and under Sections 303A.02 and 303A.07 of the listing standards of the NYSE and that his financial expertise qualifies him to serve on our Audit Committee.

Matthew L. Cypher, Ph.D. Director since March 2016. In July 2012, Dr. Cypher joined the faculty at Georgetown University’s McDonough School of Business as the director of the Real Estate Finance Initiative (since April 2015, the Steers Center for Global Real Estate). He serves as an Atara Kaufman Professor of Real Estate at both the graduate and undergraduate levels and tailors coursework to teach the Four Quadrants of the real estate capital markets — public, private, debt and equity. From 2005 to 2012, he served as a director at Invesco Real Estate (“Invesco”) where he was responsible for oversight of the underwriting group, which acquired $10.2 billion worth of institutional real estate during his leadership tenure. Dr. Cypher personally underwrote $1.5 billion of acquisitions culminating with the purchase of 230 Park Avenue in New York, which Invesco acquired on behalf of its client capital in June 2011. He also oversaw the valuations group, which marked to market Invesco’s more than $13 billion North American portfolio and served as a member of the firm’s investment committee and investment strategy group. He has held positions as an Adjunct Professor at Southern Methodist University and a Visiting Professor at University of Texas at Arlington.

Dr. Cypher holds a B.S. from Penn State University and a Masters and a Ph.D. from Texas A&M University.

The Nominating and Corporate Governance Committee of our Board has concluded that Dr. Cypher should serve as a director because of his extensive knowledge in real estate.

Ronald Marston. Director since August 2015. Mr. Marston has more than 40 years of experience in international healthcare and is known as an international authority on healthcare systems and trends. In 1973, Mr. Marston joined HCA International (now Health Care Corporation of America), a subsidiary of Hospital Corporation of America and was employed there through 1990. In 1980 he was promoted to CEO & Chairman of HCA United Kingdom. In 1987, he was promoted to President and CEO of HCA International with responsibility for all development and operations internationally. Under Mr. Marston’s leadership, HCA International grew to include 10 hospitals and seven nursing homes in the United Kingdom; 10 hospitals in Australia; five hospitals and 55 clinics in Central and South America; a management contract for the restructuring of the Singapore General Hospital; a commissioning and management contract for the King Fahad National Guard Hospital in Riyadh, Saudi Arabia; and the longest standing recruitment contract in Saudi Arabia. Hospital Corporation of America sold HCA International in 1989 after the company elected to go private. After the sale, Mr. Marston and his management team acquired certain assets and management contracts and he became the founder, Chairman, and CEO of the resulting privately held company, Health Care Corporation of America, doing business as HCCA International, where he was CEO and President, positions he held until 2010. He sold his interest in HCCA International in 2010 and then started two companies of his own, Southern Manor Living Centers LLC and HCCA Management Company. Mr. Marston was the founder and served as CEO of Southern Manor Living Centers LLC, three assisted living facilities in Tennessee (which he sold in November 2019), and HCCA Management Company, where he is Founder and CEO doing business in the international healthcare industry.

13

Mr. Marston’s previous experience was with Vanderbilt University Medical Center (“Vanderbilt”) from 1968 to 1973. Prior to joining Vanderbilt, he was responsible for the training and administration of the 400 bed, Twelfth Evacuation Hospital located in Cu Chi, Republic of Vietnam and a graduate of the airborne school in Fort Benning, GA. Mr. Marston holds a B.A. from Tennessee Technological University; a Certificate in Healthcare Administration from the Academy of Health Service; and a Ph.D. in Management from California Western University.

The Nominating and Corporate Governance Committee of our Board has concluded that Mr. Marston should serve as a director in recognition of his abilities to assist our Company in expanding its business and the contributions he can make to our strategic direction.

Dr. Roscoe Moore. Director since August 2015. Until his retirement in 2003, Dr. Roscoe M. Moore, Jr. served with the United States Department of Health and Human Services (“HHS”) and was responsible for the last twelve years of his career for global development support within the Office of the Secretary, HHS, with primary emphasis on Continental Africa and other less-developed countries. Dr. Moore was a career officer within the Commissioned Corps of the United States Public Health Service entering with the U.S. National Institutes of Health and rising to the rank of Assistant United States Surgeon General within the Immediate Office of the Secretary, HHS. Dr. Moore served as an Epidemic Intelligence Service Officer with the U.S. Centers for Disease Control and Prevention (“CDC”). He was with the Center for Veterinary Medicine, U.S. Food and Drug Administration, before becoming Senior Epidemiologist within the National Institute for Occupational Safety and Health, CDC. Dr. Moore has conducted clinical research on infectious diseases, has evaluated the safety and effectiveness of medical devices, and has conducted relevant epidemiological research on the utilization experience and human health effects of medical devices and radiation.

Dr. Moore served on the Fogarty International Center Advisory Board of Directors, NIH from 2009 to 2013. He served on the Alumni Board of Directors, School of Public Health, University of Michigan from 1987 to 1993. Dr. Moore served on the Dean’s Alumni Council, Bloomberg School of Public Health, at Johns Hopkins University from 1998 to 2002. He has also served as an Affiliate Associate Professor of Environmental Health for the University of Washington, Seattle from 1994 to 2003 and as an Adjunct Professor of Epidemiology, for the Medical University of Southern Africa, Pretoria, South Africa from 1999 to 2002. He served on the Board of Directors for the Africa Center for Health and Human Security, at George Washington University from 2006 to 2009. Dr. Moore served as an Adjunct Professor of Epidemiology, at University of Hanoi, Vietnam from 1999 to 2002. Dr. Moore is the Founder and President of PH RockWood Corporation, which is focused on the prevention, treatment and control of infectious diseases worldwide. Dr. Moore has served on the Board of Directors for Biodefense Gamma LLC since 2009, a company that specializes in purified gamma globulin therapy for a number of infectious diseases. Dr. Moore serves on the Board of Trustees for Friends of the University of Stellenbosch Foundation, a position he has held since 2005, the Board of Directors for the Safe Blood for China Foundation, a position he has held since 2004, and the Board of Directors for Constituency for Africa since 2004 and served as its Interim Chairman. Dr. Moore currently serves on the Board of Directors of Immune Therapeutics (OTC: IMUN), a position he has held since 2018 and on the Board of Directors of OyaGen Inc. Dr. Moore currently serves on the Board of Advisors for the Institute of Human Virology, School of Medicine, University of Maryland, and the Board of Directors for the Global Virus Network since September 2019.

Dr. Moore served as Chairperson for the Washington Suburban Sanitation Commission (2011-2012). Dr. Moore served as Commissioner for the Maryland Health Care Commission, appointed by the Governor of Maryland in 2008. Dr. Moore received his B.S. and Doctor of Veterinary Medicine degrees from Tuskegee Institute; his Masters of Public Health degree in Epidemiology from the University of Michigan; and his Ph.D. in Epidemiology from the Johns Hopkins University.

The Nominating and Corporate Governance Committee of our Board has concluded that Dr. Moore should serve as a director in recognition of his abilities to assist our Company in expanding its business and the contributions he can make to our strategic direction.

14

Zhang Huiqi. Director since March 2016. Miss Zhang is currently a Non-Executive Director of Xingye Wulian Service Group Co. Ltd., whose shares are listed on the Main Board of The Stock Exchange of Hong Kong Limited (Stock Code:9916), and the supervisor for Henan Hongguang Real Estate Limited, a company primarily engaged in property development in China, and Henan Zensun Corporate Development Group Company Limited, a company mainly engaged in investment of city infrastructure and related public facilities, finance, commerce, tourism, culture, hotel and agriculture, as well as providing consulting services in investment management, asset management and business administration. She has held such supervisory position since January 2013 for Henan Hongguang Real Estate Limited and September 2013 for Henan Zensun Corporate Development Company Limited. These companies are controlled by Mr. Zhang Jingguo. Miss Zhang is the daughter of Mr. Zhang Jingguo.

Prior to Heng Hongguang Real Estate Limited and Henan Zensun Corporate Development Company Limited, Miss Zhang was a full-time student. Miss Zhang graduated from the University College London and obtained a Master of Science in Project and Enterprise Management in 2015. She holds a Master of Science in Management from the University of Leicester (2013) and a Bachelor of Management in Business Administration (Information Management and Information Systems) from Beijing Forestry University (2011).

The Nominating and Corporate Governance Committee of our Board has concluded that Miss Zhang should serve as a director because of her knowledge in real estate and property development.

Lori Wittman. Director since May 2018. Ms. Wittman has extensive experience in the real estate development industry and until February 2020 was the Executive Vice President and Chief Financial Officer of Big Rock Partners Acquisition Corp., a “blank check” company (“Big Rock Partners”) and remains an advisor to Big Rock Partners. From August 2015 through August 2017, Ms. Wittman served as the Executive Vice President and Chief Financial Officer of Care Capital Properties, Inc. (“CCP”), a public real estate investment trust (“REIT”) that was spun off in 2015 from Ventas, Inc. (“Ventas”), a publicly-held REIT that owns over 1,600 healthcare properties across the United States and Canada. CCP was a healthcare REIT with a diversified portfolio of triple-net leased properties focused on the post-acute sector. CCP was merged into Sabra Healthcare in August of 2017. Prior to serving at CCP, Ms. Wittman was the Senior Vice President of Capital Markets & Investor Relations for Ventas. During her tenure at Ventas, Ms. Wittman had oversight responsibilities for all capital market, investor relations and marketing activities and oversaw the corporate analyst team responsible for the corporate earnings model. From 2006 through 2011, Ms. Wittman was Chief Financial Officer & Managing Principal for Big Rock Partners, LLC, a real estate private equity firm focused on generating returns through development and redevelopment, where she led all capital markets, accounting and investor activities.

Ms. Wittman has also served in various capacities for General Growth Properties, Heitman Financial and Homart Development Company, all entities involved in the investment and/or development of real estate. Ms. Wittman also served on the Board of Directors and as Head of the Audit Committee of Green Realty Trust, Inc. Until November 2020, Ms. Wittman served as a Director of IMH Financial (“IMH”), a member of IMH’s Audit Committee and as Chairperson of the Compensation Committee of IMH’s Board of Directors. In 2019, Ms. Wittman joined the boards of Freehold Properties and NETSTREIT Corp. (NYSE: NTST), and she chairs the audit committees of both companies. Ms. Wittman received her MBA with a concentration in Finance and Accounting from the University of Chicago, and her Masters in City Planning in Housing and Real Estate Finance from the University of Pennsylvania.

The Nominating and Corporate Governance Committee of our Board has concluded that Ms. Wittman should serve as a director because of her thorough knowledge of finance, accounting, capital markets, taxes, control systems and her experience in the public healthcare REIT sector.

The Nominating and Corporate Governance also took into account that Ms. Wittman is “independent” under SEC Rule 10A-3 and under Sections 303A.02 and 303A.07 of the listing standards of the NYSE, that her financial expertise qualifies her to serve on our Audit Committee, and that she is an “audit committee financial expert.”

15

Paula Crowley. Director since June 2018. Ms. Crowley has over 40 years of real estate experience and has worked with Anchor Health Properties (“Anchor”), which she co-founded in 1987 and served as Chief Executive Officer until October 2015, when Anchor was sold to Brinkman Management and Development. Since October 2015, Ms. Crowley has continued to be involved with Anchor, serving as its Chairman from October 2015 through November 2017 and as its Chair Emeritus since November 2017. Anchor is a national full-service real estate development, management and investment company that focuses on healthcare properties. Prior to Anchor, Ms. Crowley spent eight years as Development Director with The Rouse Company of Columbia, Maryland, where she was responsible for the development of urban retail projects.

Ms. Crowley served as Chair of the Board of the High Companies in Lancaster, Pennsylvania through October 2019, as well as Chair of the Board of Women’s Way, a not-for-profit organization based in Philadelphia, Pennsylvania. As of February 2020, Ms. Crowley was appointed Chair of the Board of the Kaiserman Company in Philadelphia. Ms. Crowley is an adjunct professor at the MBA program at Villanova University in the Finance Department.

Ms. Crowley received a BA from Middlebury College, a Masters in City Planning from the University of Pennsylvania and an MBA from the University of Pennsylvania Wharton School.

The Nominating and Corporate Governance Committee of our Board has concluded that Ms. Crowley should serve as a director because of her thorough knowledge of healthcare real estate and her experience running a healthcare company.

The Nominating and Corporate Governance also took into account that Ms. Crowley is “independent” under SEC Rule 10A-3 and under Sections 303A.02 and 303A.07 of the listing standards of the NYSE, that her financial expertise qualifies her to serve on our Audit Committee.

Biographical Information for Executive Officers

Our executive officers are Jeffrey Busch, our Chief Executive Officer, President and Chairman of our Board of Directors; Robert Kiernan, our Chief Financial Officer and Treasurer; Alfonzo Leon, our Chief Investment Officer; Jamie Barber, our General Counsel and Secretary; and Danica Holley, our Chief Operating Officer. Because Mr. Busch is also a director of the Company, we have provided his biographical information above.

Robert Kiernan. Mr. Kiernan joined the Company as our Chief Financial Officer and Treasurer in August 2017. Mr. Kiernan has more than 30 years of experience in financial accounting, reporting and management. Prior to joining our Company, Mr. Kiernan served as the Senior Vice President, Controller and Chief Accounting Officer of FBR & Co. (“FBR” NASDAQ: FBRC) commencing in October 2007 and in a similar role for Arlington Asset Investment Corp. (“Arlington Asset” NYSE: AAIC) commencing in April 2003. Prior to joining Arlington Asset, Mr. Kiernan was a senior manager in the assurance practice at Ernst & Young.

Mr. Kiernan holds a Bachelor of Science in Accounting, Mount St. Mary’s University, Cum Laude (1987) and is a member of the American Institute of Certified Public Accountants.

Alfonzo Leon. Mr. Leon joined the Company in August 2014 and has served as Chief Investment Officer since July 1, 2015. Mr. Leon is a real estate finance executive with 19 years of acquisition and capital markets experience working on behalf of institutional investors, real estate developers, and healthcare operators. Prior to joining our Company, Mr. Leon was a Senior Vice President with Cain Brothers & Company, a boutique healthcare investment banking firm based out of New York and San Francisco, in their real estate M&A and capital markets group. Mr. Leon joined Cain Brothers in 2005 and completed $2 billion in real estate transactions with leading clients across the healthcare spectrum including health systems, multi-specialty physician groups, senior housing operators, non-traded and NYSE-listed REITs, healthcare developers, and private equity funds. Prior to Cain Brothers, Mr. Leon was an associate with LaSalle Investment Management, an international investment advisor firm, in their North American acquisition group. Mr. Leon joined LaSalle in 2000 and acquired $800 million in multi-family, office, medical office, and industrial property on behalf of institutional investors that include the nation’s largest pension funds and college endowments and a number of sovereign wealth funds. LaSalle Investment Management is a subsidiary of global consultancy firm Jones Lang LaSalle (NYSE: JLL).

16

Mr. Leon’s experience includes managing commercial real estate transactions ranging from $5 million to $500 million, raising capital for real estate developers, structuring joint ventures between developers and investors, completing portfolio investment sales to healthcare REITs, structuring sale-leasebacks for physician groups, acquisitions and dispositions for separate and commingled funds, corporate real estate M&A, structuring credit tenant lease financing for investment grade health systems, and strategic real estate advisory for health systems. Mr. Leon’s property type expertise within the healthcare sector includes medical office, outpatient facilities, surgical facilities, post-acute facilities, senior housing, and hospitals. Mr. Leon received his Masters degree in real estate finance from the Massachusetts Institutes of Technology and his B.S. in Architecture from the University of Virginia.

Jamie Barber. Mr. Barber joined our Company as General Counsel and Secretary in May 2017. Prior to joining our Company, from July 2012 to May 2017, Mr. Barber was Associate General Counsel at FBR, where he assisted with SEC compliance and corporate governance matters and was primary counsel for FBR’s investment banking operations. From August 2004 to June 2012 Mr. Barber served as an Associate and Senior Associate — Real Estate Capital Markets at Hunton Andrews Kurth LLP (formerly Hunton & Williams LLP), where he represented public REITs in conjunction with their SEC compliance requirements, corporate governance matters and offerings of equity and debt and merger and acquisition transactions. From September 2003 to August 2004 Mr. Barber served as an Associate at Sullivan & Cromwell LLP, where he represented issuers and underwriters in public and private offerings of equity and debt securities.

Mr. Barber received his Juris Doctor degree from Hofstra University School of Law in 2003. In 1999, he received his Bachelor of Science, Accounting and Finance, from Indiana University.

Danica Holley. Ms. Holley has served as our Chief Operating Officer since March 30, 2016. Ms. Holley’s business development and management experience spans more than 18 years with an emphasis on working in an international environment. She has extensive experience in international program management, government procurement, and global business roll-outs and start-ups. As Executive Director for Safe Blood International Foundation, from April 15, 2008 to present, she oversaw national health initiatives in Africa and Asia, including an Ebola response project. Ms. Holley has held management positions as the Director of Strategy, Corporate Business Development for WorldSpace, Inc. from 1997 to 2000, Director of Marketing for Corporate and Business at ISI Professional Services from 2000 to 2001, and Director of Administration at Tanzus Development from 1996 to 1997 and SK&I Architectural Design Group, LLC from 2003 to 2007. Ms. Holley has more than a decade of experience managing multinational teams for complex service delivery across disciplines.

Ms. Holley received a B.S.F.S from the Edmund Walsh School of Foreign Service at Georgetown University in International Law, Politics and Organization, an African Studies Certificate and Arabic Proficiency (May 1994). She studied International Organization at the School for International Training, Brattleboro, Vermont and Rabat, Morocco (January − June 1993). She is an ICF certified executive leadership coach and an alumna of Georgetown University’s Graduate Leadership Coaching Program (September 2010).

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The table below describes the beneficial ownership of shares of our common stock as of March 31, 2021 for:

| • | each person or entity known by us to be the beneficial owner of more than 5% of the outstanding shares of our common stock; | |

| • | each director and each NEO; and | |

| • | our directors and NEOs as a group. |

Except as noted in the footnotes, each person named in the following table directly owns our common stock and has sole voting and investment power. Unless otherwise indicated, the address of each named person is c/o Global Medical REIT Inc., 2 Bethesda Metro Center, Suite 440, Bethesda, Maryland 20814. As of March 31, 2021, no shares beneficially owned by any executive officer, director or director nominee have been pledged as security for a loan.

| 5% Beneficial Owners | Number

of Shares Beneficially Owned(1) | Percentage

of Shares(2) | ||||||

| The Vanguard Group(3) | 4,343,493 | 7.1 | % | |||||

| Zensun Enterprises Limited(4) | 3,715,611 | 6.1 | % | |||||

| BlackRock, Inc.(5) | 3,410,573 | 5.6 | % | |||||

| Executive Officers and Directors | Number of Shares Beneficially Owned | Percentage of Shares | ||||||

| Jeffrey Busch(6) | 315,285 | * | ||||||

| Robert Kiernan(7) | 115,331 | * | ||||||

| Alfonzo Leon(8) | 148,146 | * | ||||||

| Jamie Barber(9) | 100,512 | * | ||||||

| Danica Holley(10) | 106,059 | * | ||||||

| Zhang Jingguo(11) | 3,715,611 | 6.1 | % | |||||

| Zhang Huiqi(12) | 3,745,611 | 6.2 | % | |||||

| Henry Cole(13) | 19,575 | * | ||||||

| Ronald Marston(14) | 20,960 | * | ||||||

| Matthew L. Cypher, Ph.D.(15) | 13,130 | * | ||||||

| Dr. Roscoe Moore(16) | 7,185 | * | ||||||

| Lori Wittman(17) | 7,185 | * | ||||||

| Paula Crowley(18) | 7,185 | * | ||||||

| All executive officers and directors as a group (13 people) | 4,606,164 | 7.6 | % | |||||

| * | Represents less than 1% |

| (1) | Includes the total number of shares of common stock issuable upon redemption of operating partnership units (“OP Units”) and long-term incentive plan units (“LTIP Units”) in Global Medical REIT L.P., the Company’s operating partnership. Subject to certain restrictions, LTIP Units are convertible into an equivalent number of OP Units. OP Units are redeemable by the holder for cash or, at the Company’s option, an equivalent number of shares of common stock. | |

| (2) | The total number of shares of common stock outstanding used in calculating the percentage ownership of each person assumes that the vested LTIP Units held by such person, directly or indirectly, are redeemed for shares of common stock and none of the vested LTIP Units held by other persons are redeemed for shares of common stock. | |

| (3) | Based on a Schedule 13G/A filed by The Vanguard Group (“Vanguard”) with the SEC on February 10, 2021. These securities are owned by Vanguard directly or through wholly owned subsidiaries of Vanguard. Vanguard has shared voting power with respect to 38,128 shares of common stock, sole dispositive power with respect to 4,272,505 shares of common stock and shared dispositive power with respect to 70,988 shares of common stock. Vanguard lists its address as 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

18

| (4) | Huang Yanping, spouse of Zhang Jingguo, is the sole settlor, protector and one of the beneficiaries of the Superior Glory Enterprises Trust (Zhang Huiqi is the other beneficiary), which, through a number of wholly owned subsidiaries, is the sole parent of Joy Town, Inc. Joy Town, Inc. is the controlling stockholder of Zensun Enterprises Limited. Huang Yanping and Zhang Huiqi have shared voting and dispositive control over securities held by Zensun Enterprises Limited. The information reported in the table above is based on a Schedule 13D filed with the SEC on January 10, 2019 by Huang Yanping. The principal address of Huang Yanping is East No. 38, Floor 3, East Unit 5, Building 2, East Yard No. 9 Jinshui District, Zhengzhou, Henan Province, China. Zensun Enterprises Limited was, prior to the Internalization, the 85% owner of our Former Advisor. | |

| (5) | Based on a Schedule 13G/A filed by BlackRock, Inc. (“BlackRock”) with the SEC on January 29, 2021. These securities are owned by BlackRock directly or through wholly owned subsidiaries of BlackRock. BlackRock has sole voting power with respect to 3,238,353 shares of common stock and sole dispositive power with respect to 3,410,573 shares of common stock. BlackRock lists its address as 55 East 52nd Street, New York, New York 10055. | |

| (6) | Includes 40,490 shares of common stock and 274,795 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. | |

| (7) | Includes 115,331 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one- for-one basis subject to certain conditions. | |

| (8) | Includes 148,146 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one- for-one basis subject to certain conditions. | |

| (9) | Includes 100,512 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one- for-one basis subject to certain conditions. | |

| (10) | Includes 500 shares of common stock and 105,559 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one- for-one basis subject to certain conditions. | |

| (11) | The amount beneficially owned by Mr. Zhang consists of 3,715,611 shares owned by Zensun Enterprises Limited as of March 31, 2021. Huang Yanping, spouse of Mr. Zhang, is the sole settlor, protector and one of the beneficiaries of the Superior Glory Enterprises Trust (Zhang Huiqi is the other beneficiary), which, through a number of wholly owned subsidiaries, is the sole parent of Joy Town, Inc. Joy Town, Inc. is the controlling stockholder of Zensun Enterprises Limited. Huang Yanping has sole voting and dispositive control over securities held by Zensun Enterprises Limited. The information reported in the table above is based on a Schedule 13D filed with the SEC on January 10, 2019 by Huang Yangping. The principal address of Huang Yanping is East No. 38, Floor 3, East Unit 5, Building 2, East Yard No. 9 Jinshui District, Zhengzhou, Henan Province, China. Zensun Enterprises Limited was, prior to the Internalization, the 85% owner of our Former Advisor. | |

| (12) | The amount beneficially owned by Miss Zhang consists of 3,715,611 shares owned by Zensun Enterprises Limited as of March 31, 2021. Miss Zhang is one of the beneficiaries of the Superior Glory Enterprises Trust, which, through a number of wholly owned subsidiaries, is the sole parent of Joy Town, Inc. Joy Town, Inc. is the controlling stockholder of Zensun Enterprises Limited. Huang Yanping has sole voting and dispositive control over securities held by Zensun Enterprises Limited. The information reported in the table above is based on a Schedule 13D filed with the SEC on January 10, 2019 by Huang Yangping. Also includes 30,000 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. The principal address of Huang Yanping is East No. 38, Floor 3, East Unit 5, Building 2, East Yard No. 9 Jinshui District, Zhengzhou, Henan Province, China. | |

| (13) | Includes 6,445 shares of common stock and 13,130 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. | |

| (14) | Includes 7,830 shares of common stock and 13,130 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. | |

| (15) | Includes 13,130 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. | |

| (16) | Includes 7,185 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. | |

| (17) | Includes 7,185 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. | |

| (18) | Includes 7,185 vested (and that are due to vest within 60 days from March 31, 2021) LTIP Units convertible into shares of common stock on a one-for-one basis subject to certain conditions. |

19

Board and Annual Stockholders’ Meetings

The Board of Directors meets regularly to review significant developments affecting us and to act on matters requiring its approval. The Board held seven meetings in 2020. All the Company’s directors serving at the time of the 2020 annual meeting attended the 2020 annual meeting. Our corporate governance guidelines provide that all Board members are expected to attend our annual meeting of stockholders. In 2020 no director attended fewer than 75% of the aggregate total number of meetings of the Board of Directors and of the committees on which they served during 2020.

Committees of the Board of Directors

The Board of Directors has established an Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee. A current copy of each committee’s charter is available on our website at www.globalmedicalreit.com.

Audit Committee. Our Audit Committee currently consists of three of our independent directors, Ms. Wittman, Ms. Crowley and Mr. Cole. Ms. Wittman has been appointed to serve as the chair of the Audit Committee. Each of these members has been determined to be “independent” within the meaning of the applicable standards of the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934, as amended. In addition, each of these members meets the financial literacy requirements for audit committee membership under applicable standards of the NYSE and the rules and regulations of the SEC. Our Board has determined that Ms. Wittman is an “audit committee financial expert” as such term is defined in Item 407(d)(5)(ii) and (iii) of Regulation S-K. No member of the Audit Committee serves on the audit committee of more than three public companies.

The Audit Committee held five meetings in 2020. The primary purpose of the Audit Committee is to assist the Board in fulfilling its legal and fiduciary obligations with respect to matters involving the accounting, auditing, financial reporting and internal control functions of the Company and its subsidiaries, including, without limitation, assisting the Board’s oversight of (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the independent auditor’s qualifications and independence and (iv) the performance of the Company’s independent auditors and the Company’s internal audit function.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee currently consists of four of our independent directors, Mr. Marston, Dr. Moore, Mr. Cypher and Ms. Wittman. Mr. Marston has been appointed to serve as the chair of the Nominating and Corporate Governance Committee. Our Board has determined that each member of the Nominating and Corporate Governance Committee is “independent” within the meaning of the applicable standards of the NYSE.

The Nominating and Corporate Governance Committee held four meetings in 2020. The primary purpose of the Nominating and Corporate Governance Committee is to identify and recommend to the Board individuals qualified to serve as directors of the Company and on committees of the Board; to advise the Board with respect to the Board composition, procedures and committees; to develop and recommend to the Board a set of corporate governance guidelines applicable to the Company; and to oversee the evaluation of the Board and the Company’s management.

Compensation Committee. Our Compensation Committee currently consists of four of our independent directors, Mr. Cole, Mr. Marston, Ms. Crowley and Dr. Moore. Mr. Cole has been appointed to serve as the chair of the Compensation Committee. Our Board has determined that each member of the Compensation Committee is “independent” within the meaning of the applicable standards of the NYSE. Each member of the Compensation Committee qualifies as an “outside director” as such term is defined under Section 162(m) of the Internal Revenue Code and as a “non-employee director” for purposes of Rule 16b-3 of the Exchange Act.

20