Exhibit 99.1

NIMBLE. TENACIOUS. DISCIPLINED. Investor Presentation June 2023

Our primary mission is to attain earnings growth and dividend stability by maximizing the investment spread in our healthcare real estate assets. Our strategies to achieve this mission are as follows: • Asset Type - primarily invest in off - campus medical office and post - acute, in - patient medical facilities; • Asset Yield - acquire properties with acquisition capitalization rates of between 7.5% to 8.0%; • Tenants – acquire properties that are tenanted by profitable national or regional healthcare systems or physician groups; and • Management – utilize our experienced management team to operate our company and portfolio to maximize returns to investors. 2 MISSION STATEMENT AND STRATEGY

3 A STRATEGY THAT DELIVERS VALUE $1.5B Investments in Real Estate Gross $0.6B Market Cap* 7.8% Weighted Average Cap Rate 9.4% Dividend Yield* *Based on closing price of the Company’s common stock of $8.89 on June 2, 2023. All other data as of March 31, 2023. Atrium Health – Winston - Salem, NC

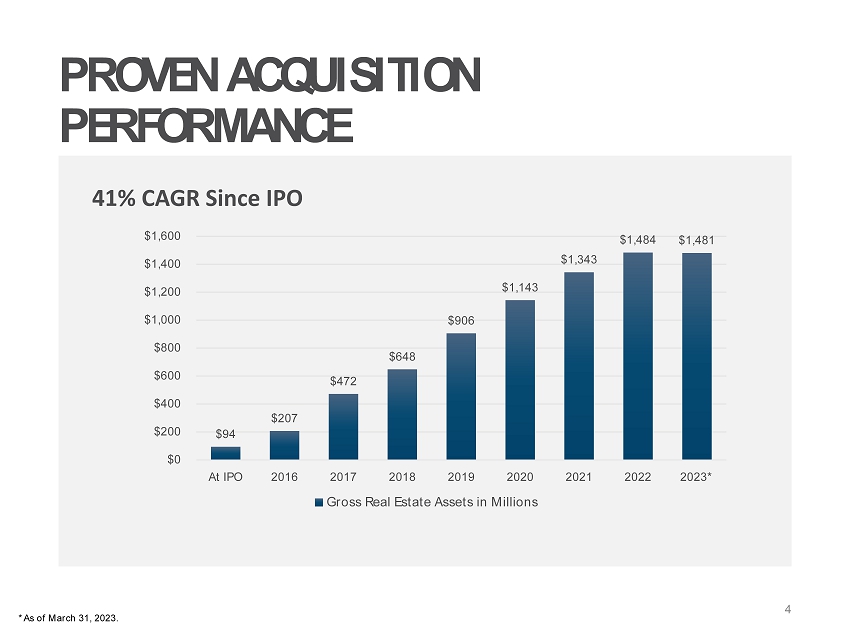

PROVEN ACQUISITION PERFORMANCE $94 $207 $472 $648 $906 $1,143 $1,343 $1,484 $1,481 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 At IPO 2016 2017 2018 2019 2020 2021 2022 2023* 41% CAGR Since IPO Gross Real Estate Assets in Millions 4 *As of March 31, 2023.

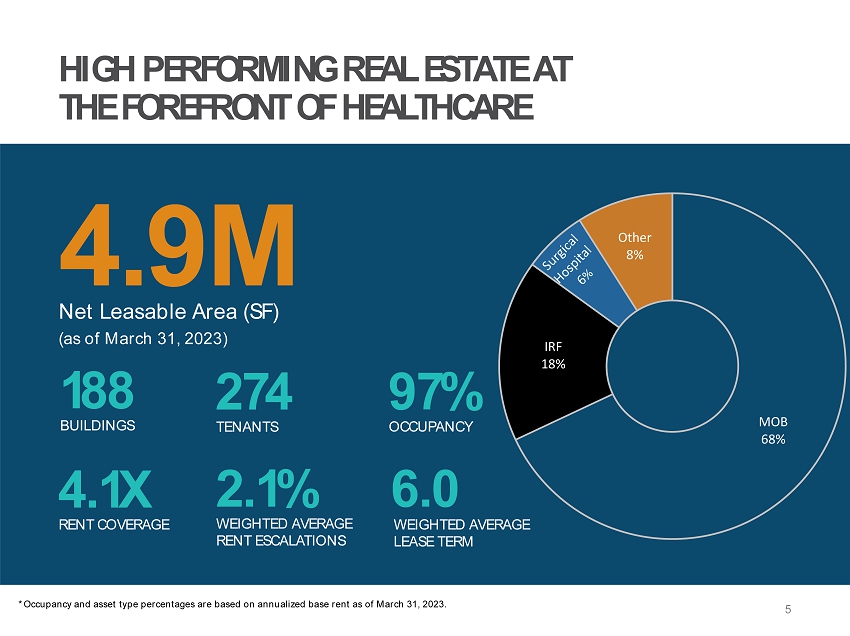

HIGH PERFORMING REAL ESTATE AT THE FOREFRONT OF HEALTHCARE 5 4.1X RENT COVERAGE 2.1% WEIGHTED AVERAGE RENT ESCALATIONS 6.0 WEIGHTED AVERAGE LEASE TERM 188 BUILDINGS 274 TENANTS 97% OCCUPANCY 4.9M Net Leasable Area (SF) (as of March 31, 2023) *Occupancy and asset type percentages are based on annualized base rent as of March 31, 2023. MOB 68% IRF 18% Other 8%

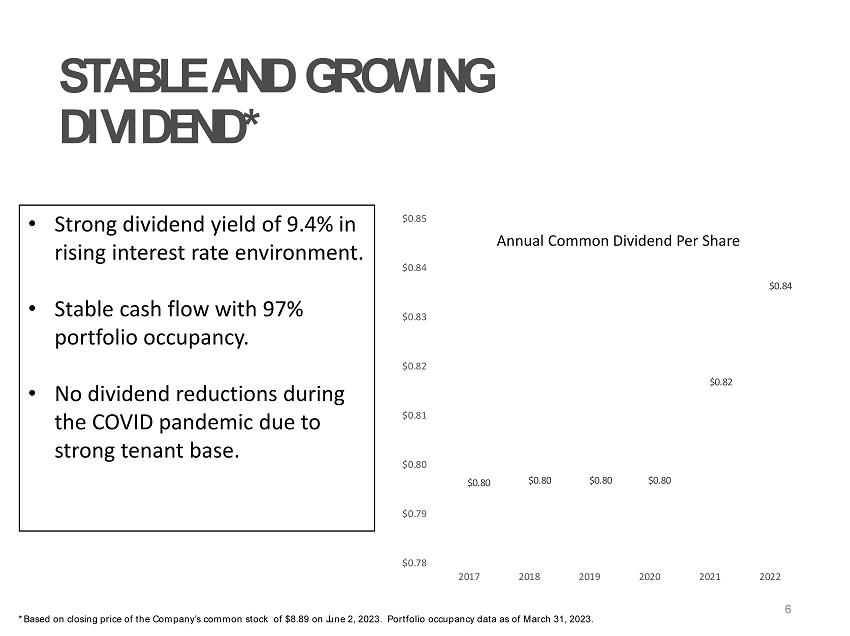

STABLE AND GROWING DIVIDEND* 6 • Strong dividend yield of 9.4% in rising interest rate environment. • Stable cash flow with 97% portfolio occupancy. • No dividend reductions during the COVID pandemic due to strong tenant base. *Based on closing price of the Company’s common stock of $8.89 on June 2, 2023. Portfolio occupancy data as of March 31, 20 23. $0.80 $0.80 $0.80 $0.80 $0.82 $0.84 $0.78 $0.79 $0.80 $0.81 $0.82 $0.83 $0.84 $0.85 2017 2018 2019 2020 2021 2022 Annual Common Dividend Per Share

7 INVESTING IN THE FUTURE OF HEALTHCARE City Hospital at White Rock – Dallas, TX Encompass – Mesa, AZ Southlake Heart & Vascular Institute – Clermont, FL Mission Health – Livonia, MI

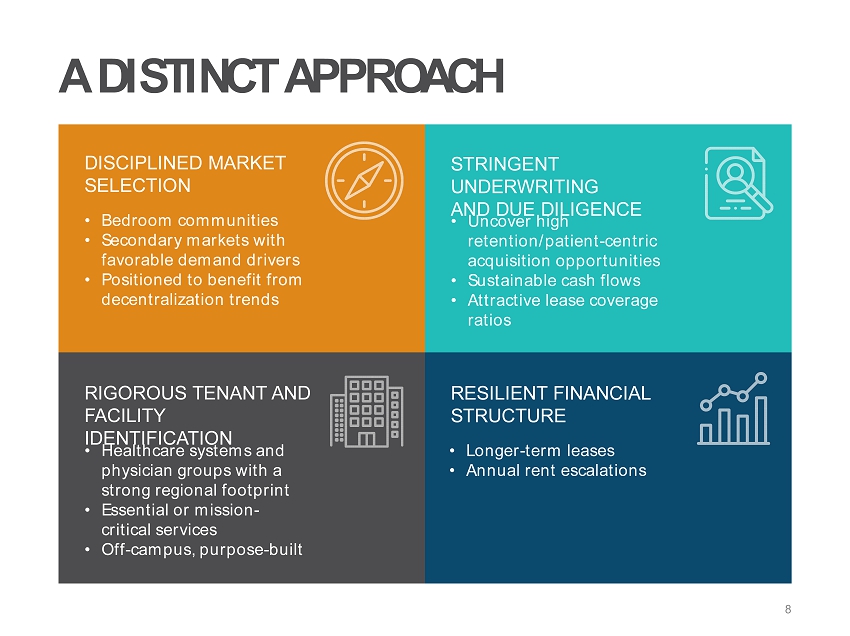

A DISTINCT APPROACH 8 • Longer - term leases • Annual rent escalations • Bedroom communities • Secondary markets with favorable demand drivers • Positioned to benefit from decentralization trends • Uncover high retention/patient - centric acquisition opportunities • Sustainable cash flows • Attractive lease coverage ratios • Healthcare systems and physician groups with a strong regional footprint • Essential or mission - critical services • Off - campus, purpose - built DISCIPLINED MARKET SELECTION STRINGENT UNDERWRITING AND DUE DILIGENCE RIGOROUS TENANT AND FACILITY IDENTIFICATION RESILIENT FINANCIAL STRUCTURE

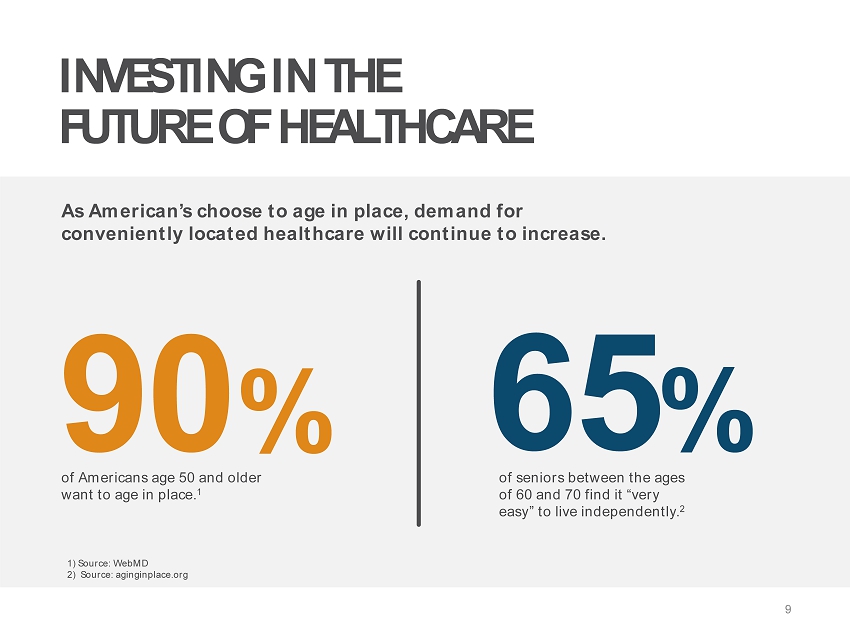

INVESTING IN THE FUTURE OF HEALTHCARE 9 90 % of Americans age 50 and older want to age in place. 1 65 % of seniors between the ages of 60 and 70 find it “very easy” to live independently. 2 As American’s choose to age in place, demand for conveniently located healthcare will continue to increase. 1) Source: WebMD 2) Source: aginginplace.org

10 “We don’t look at investing in real estate as a single activity to be completed but as the first step in building an enduring relationship.” Danica Holley Chief Operating Officer NOMS – Sandusky, OH

11 DOMINANT LOCAL PHYSICIAN GROUPS FOR - PROFIT SYSTEMS AFFILIATIONS AND SURGICAL OPERATOR PARTNERSHIPS STRONG, DIVERSE HEALTHCARE TENANT BASE NOT - FOR - PROFIT HEALTH SYSTEMS AFFILIATIONS

“With an attentive, flexible and creative approach, Global Medical REIT worked with us to structure a transaction that met our goals and helped propel our growth. GMRE has been a helpful partner and resource since our closing.” David Harano former CEO, Gastro One 12

“We continue to strengthen our balance sheet and improve our credit metrics to build a strong foundation for our future growth.” Robert Kiernan Chief Financial Officer and Treasurer 13 Legent Hospital for Special Surgery – Plano, TX

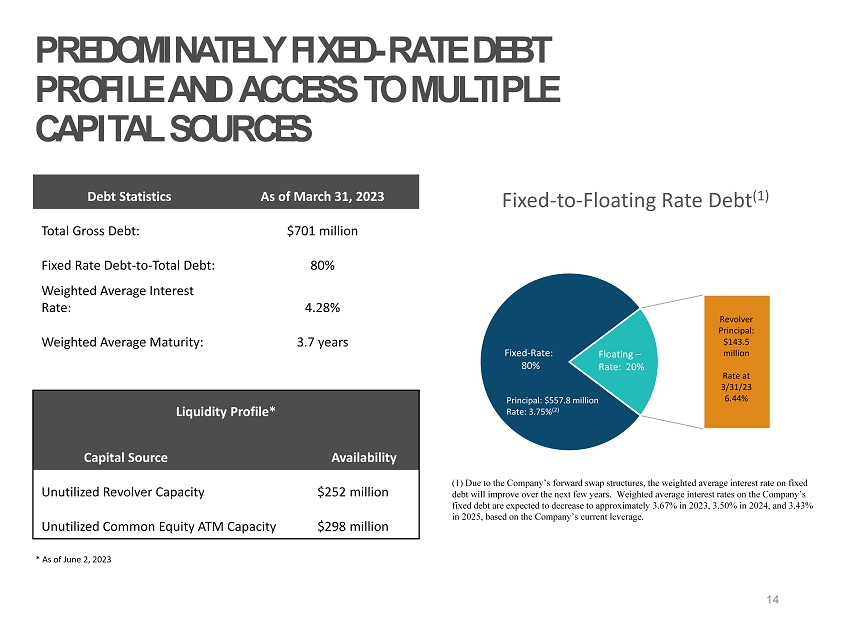

PREDOMINATELY FIXED - RATE DEBT PROFILE AND ACCESS TO MULTIPLE CAPITAL SOURCES 14 Liquidity Profile* Capital Source Availability Unutilized Revolver Capacity $252 million Unutilized Common Equity ATM Capacity $298 million Fixed - to - Floating Rate Debt (1) Fixed - Rate: 80% Floating – Rate: 20% Revolver Principal: $143.5 million Rate at 3/31/23 6.44% Principal: $557.8 million Rate: 3.75% (2) * As of June 2, 2023 Debt Statistics As of March 31, 2023 Total Gross Debt: $701 million Fixed Rate Debt - to - Total Debt: 80% Weighted Average Interest Rate: 4.28% Weighted Average Maturity: 3.7 years (1) Due to the Company’s forward swap structures, the weighted average interest rate on fixed debt will improve over the next few years. Weighted average interest rates on the Company’s fixed debt are expected to decrease to approximately 3.67% in 2023, 3.50% in 2024, and 3.43% in 2025, based on the Company’s current leverage.

INSTITUTIONAL KNOWLEDGE, HANDS - ON APPROACH Jeffrey Busch — Chairman, Chief Executive Officer and President 20+ years of experience in healthcare, real estate development, management and investment Robert Kiernan — Chief Financial Officer and Treasurer 30+ years of experience in financial accounting, reporting and management, with extensive experience in SEC reporting and SOX compliance Alfonzo Leon — Chief Investment Officer 20+ years of experience in real estate finance and has completed $3 billion of transactions Danica Holley — Chief Operating Officer 20+ years of management and business development experience Jamie Barber — General Counsel and Corporate Secretary 15+ years of experience with SEC compliance and reporting matters, corporate governance, investment banking and REIT - related capital markets 15

HIGHLY SKILLED AND DIVERSE BOARD 16 Jeffrey Busch — Chairman, Chief Executive Officer and President 20+ years of experience in healthcare, real estate development, management and investment. Matthew Cypher, PH.D — ESG Committee Chair, Nominating and Governance Committee Member Professor at Georgetown University’s McDonough School of Business where he serves as the director of the Real Estate Finance Initiative. Henry Cole — Lead Independent Director, Compensation Committee Chair, Audit Committee Member 40+ years of successful executive management and implementation of health and medical programs involving innovations in technology, market development and service delivery. Paula Crowley — Audit Committee Member, Compensation Committee Member, ESG Committee Member 40+ years of real estate experience including co - founding Anchor Health Properties in 1987, now Brinkman Management and Development. Ronald Marston — Nominating and Governance Committee Chair, Compensation Committee Member 40+ years of experience in healthcare and is known as an international authority on healthcare systems and trends. Lori Wittman — Audit Committee Chair, Nominating and Governance Committee Member, ESG Committee Member Decades of experience in senior finance and capital market positions at leading REITs and healthcare real estate development companies. Zhang Huiqi — Director Serves as non - Executive Director of Xingye Wulian Service Group Co. Ltd, and the supervisor for Henan Hongguang Real Estate Limited and Henan Zensun Corporate Development Group Company Limited.

• Working with tenants to improve energy consumption, carbon emissions and efficiency • Board of Directors formed an ESG Committee for oversight of corporate sustainability issues • Continue to improve Company’s GRESB score • Completed an Employee Engagement Survey to capture information on employee engagement, demographic data, and work satisfaction • Board of Directors - 43% women and historically underrepresented minorities • Member of National Association of Corporate Directors COMMITTED TO CORPORATE RESPONSIBILITY 17

FORWARD LOOKING STATEMENT Certain statements contained herein may be considered “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and it is the Company’s intent that any such statements be protected by the safe harbor create d thereby. These forward - looking statements are identified by their use of terms and phrases such as "anticipate," "believe," "cou ld," "estimate," "expect," "intend," "may," "should," "plan," "predict," "project," "will," "continue" and other similar terms and ph rases, including references to assumptions and forecasts of future results. Except for historical information, the statements set fo rth herein including, but not limited to, any statements regarding our earnings, our liquidity, our tenants’ ability to pay rent to us, exp ected financial performance (including future cash flows associated with new tenants or the expansion of current properties), futur e dividends or other financial items; any other statements concerning our plans, strategies, objectives and expectations for fu tur e operations and future portfolio occupancy rates, our pipeline of acquisition opportunities and expected acquisition activity, in cluding the timing and/or successful completion of any acquisitions and expected rent receipts on these properties, our expected disp osi tion activity, including the timing and/or successful completion of any dispositions and the expected use of proceeds therefrom, a nd any statements regarding future economic conditions or performance are forward - looking statements. These forward - looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties. Although th e Company believes that the expectations, estimates and assumptions reflected in its forward - looking statements are reasonable, actual results could differ materially from those projected or assumed in any of the Company’s forward - looking statements. Additional information concerning us and our business, including additional factors that could materially and adversely affec t o ur financial results, include, without limitation, the risks described under Part I, Item 1A - Risk Factors, in our Annual Report o n Form 10 - K, our Quarterly Reports on Form 10 - Q, and in our other filings with the SEC. You are cautioned not to place undue reliance on forward - looking statements. The Company does not intend, and undertakes no obligation, to update any forward - looking statement. This presentation includes information regarding certain of our tenants, which are not subject to SEC reporting requirements. Th e information related to our tenants contained in this report was provided to us by such tenants or was derived from publicly a vai lable information. We have not independently investigated or verified this information. We have no reason to believe that this info rma tion is inaccurate in any material respect, but we cannot provide any assurance of its accuracy. We are providing this data for informational purposes only. 18

DISCLOSURES Rent Coverage Ratio and Other Matters For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded credit - rated tenants or their subsidiaries for which financial statements were either not available or not sufficiently detailed. Th ese ratios are based on latest available information only. Most tenant financial statements are unaudited and we have not independently verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information i s accurate or complete. Certain other tenants (approximately 20% of our portfolio) are excluded from the calculation due to ( i ) lack of available financial information or (ii) small tenant size. Additionally, included within 20% of non - reporting tenants is Pipelin e Healthcare, LLC, which filed for Chapter 11 bankruptcy protection in October of 2022. Additionally, our Rent Coverage Ratio a dds back physician distributions and compensation. Management believes all adjustments are reasonable and necessary. Additionally , the recently announced Chapter 11 reorganizations of Envision Healthcare and GenesisCare are not expected to have a material effect on the Company’s business or portfolio. Additional Information The information in this document should be read in conjunction with the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K, and other information filed with, or furnished to, the SEC. You can access the Compan y’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.globalmedicalreit.com) under “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not , and shall not be deemed to be, a part of, or incorporated into, this Earnings Supplemental. You also can review these SEC filings an d other information by accessing the SEC’s website at http://www.sec.gov. Certain information contained in this package, including, but not limited to, information contained in our Top 10 tenant prof ile s is derived from publicly - available third - party sources. The Company has not independently verified this information and there can b e no assurance that such information is accurate or complete. 19