Exhibit 99.2

FOURTH QUARTER 2023 EARNINGS SUPPLEMENTAL www.globalmedicalreit.com NYSE: GMRE Atrium Health – Winston - Salem, NC

Forward - Looking Statements Certain statements contained herein may be considered “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , and it is the Company’s intent that any such statements be protected by the safe harbor created thereby . These forward - looking statements are identified by their use of terms and phrases such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "plan," "predict," "project," "will," "continue" and other similar terms and phrases, including references to assumptions and forecasts of future results . Except for historical information, the statements set forth herein including, but not limited to, any statements regarding our earnings, our liquidity, our tenants’ ability to pay rent to us, expected financial performance (including future cash flows associated with new tenants or the expansion of current properties), future dividends or other financial items ; any other statements concerning our plans, strategies, objectives and expectations for future operations and future portfolio occupancy rates, our pipeline of acquisition opportunities and expected acquisition activity, including the timing and/or successful completion of any acquisitions and expected rent receipts on these properties, our expected disposition activity, including the timing and/or successful completion of any dispositions and the expected use of proceeds therefrom, and any statements regarding future economic conditions or performance are forward - looking statements . These forward - looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties . Although the Company believes that the expectations, estimates and assumptions reflected in its forward - looking statements are reasonable, actual results could differ materially from those projected or assumed in any of the Company’s forward - looking statements . Additional information concerning us and our business, including additional factors that could materially and adversely affect our financial results, include, without limitation, the risks described under Part I, Item 1 A - Risk Factors, in our Annual Report on Form 10 - K, our Quarterly Reports on Form 10 - Q, and in our other filings with the SEC . You are cautioned not to place undue reliance on forward - looking statements . The Company does not intend, and undertakes no obligation, to update any forward - looking statement . TABLE OF CONTENTS Company Overview 3 Select Quarterly Financial Data 6 Business Summary 7 Portfolio Summary 8 Key Tenants/Portfolio Lease Expiration Schedule 11 Debt and Hedging Summary 12 Total Capitalization and Equity Summary 14 ESG Summary 15 Condensed Consolidated Statements of Operations 16 Condensed Consolidated Balance Sheets 17 Condensed Consolidated Statements of Cash Flows 18 Non - GAAP Reconciliations 19 Reporting Definitions and Other Disclosures 20 Legent Hospital for Special Surgery – Plano, TX 4Q - 2023 | Earnings Supplemental 2

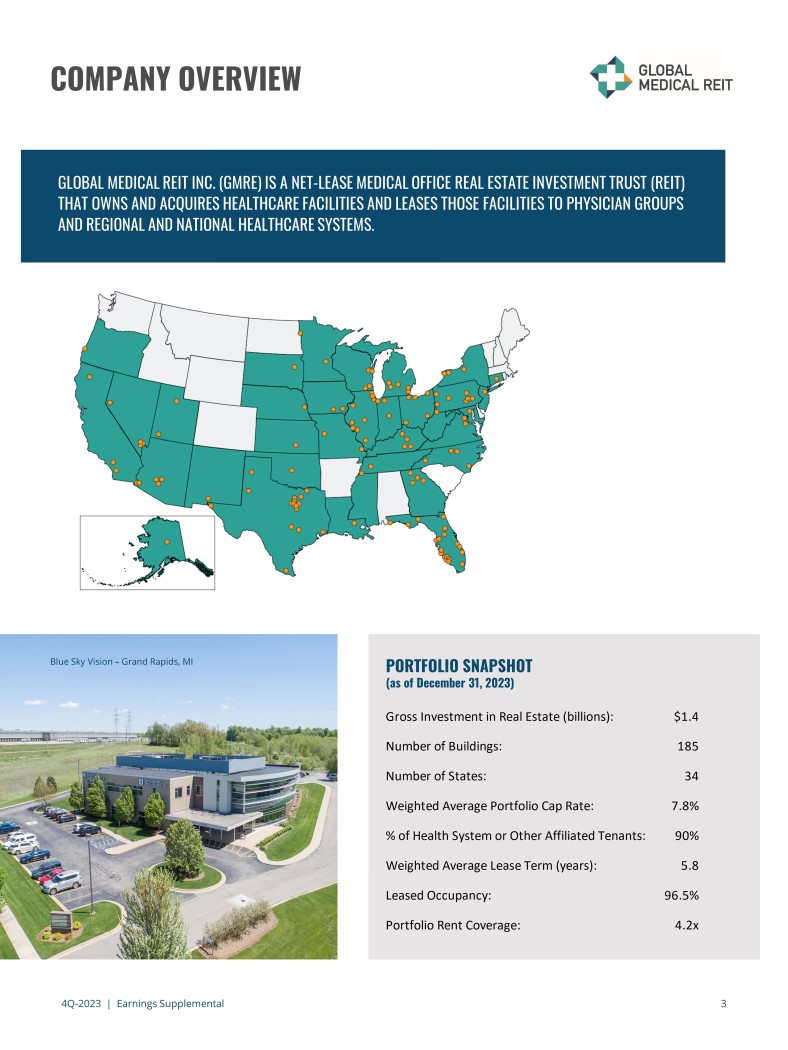

3 4Q - 2023 | Earnings Supplemental COMPANY OVERVIEW GLOBAL MEDICAL REIT INC. (GMRE) IS A NET - LEASE MEDICAL OFFICE REAL ESTATE INVESTMENT TRUST (REIT) THAT OWNS AND ACQUIRES HEALTHCARE FACILITIES AND LEASES THOSE FACILITIES TO PHYSICIAN GROUPS AND REGIONAL AND NATIONAL HEALTHCARE SYSTEMS. PORTFOLIO SNAPSHOT (as of December 31, 2023) Blue Sky Vision – Grand Rapids, MI Gross Investment in Real Estate (billions): $1.4 Number of Buildings: 185 Number of States: 34 Weighted Average Portfolio Cap Rate: 7.8% % of Health System or Other Affiliated Tenants: 90% Weighted Average Lease Term (years): 5.8 Leased Occupancy: 96.5% Portfolio Rent Coverage: 4.2x

4Q - 2023 | Earnings Supplemental 4 Jeffrey Busch Chairman, Chief Executive Officer and President Robert Kiernan Chief Financial Officer and Treasurer Alfonzo Leon Chief Investment Officer Danica Holley Chief Operating Officer Jamie Barber General Counsel and Corporate Secretary Board of Directors Jeffrey Busch Chairman, Chief Executive Officer and President Henry Cole Lead Independent Director, Compensation Committee Chair, Audit Committee Member Paula Crowley Audit Committee Member, ESG Committee Member, Compensation Committee Member Matthew Cypher, Ph.D. ESG Committee Chair, Nominating and Corporate Governance Committee Member Ronald Marston Nominating and Corporate Governance Committee Chair, Compensation Committee Member Lori Wittman Audit Committee Chair, Nominating and Corporate Governance Committee Member, ESG Committee Member Zhang Huiqi Director INDEPENDENT DIRECTORS 71% BOARD % OF WOMEN AND HISTORICALLY UNDERREPRESENTED MINORITIES COMPANY OVERVIEW 43% Executive Officers

4Q - 2023 | Earnings Supplemental 5 COMPANY OVERVIEW Corporate Headquarters Global Medical REIT Inc. 7373 Wisconsin Avenue, Suite 800 Bethesda, MD 20814 Phone: 202.524.6851 www.globalmedicalreit.com Stock Exchange New York Stock Exchange Ticker: GMRE Investor Relations Stephen Swett Phone: 203.682.8377 Email: stephen.swett@icrinc.com Independent Registered Public Accounting Firm Deloitte & Touche LLP McLean, VA Corporate and REIT Tax Counsel Vinson & Elkins LLP Daniel LeBey , Corporate Partner Christopher Mangin , REIT Tax Partner Transfer Agent Equiniti Trust Company (formerly American Stock Transfer & Trust Company) Phone: 800.468.9716 Cobalt Rehabilitation Hospital – Surprise, AZ Firm Name Baird Wes Golladay BMO Juan Sanabria B. Riley Securities Bryan Maher Colliers Securities Barry Oxford Compass Point Merrill Ross JMP Securities Aaron Hecht Janney Robert Stevenson KeyBanc Austin Wurschmidt Stifel Stephen Manaker Sell - Side Analyst Coverage

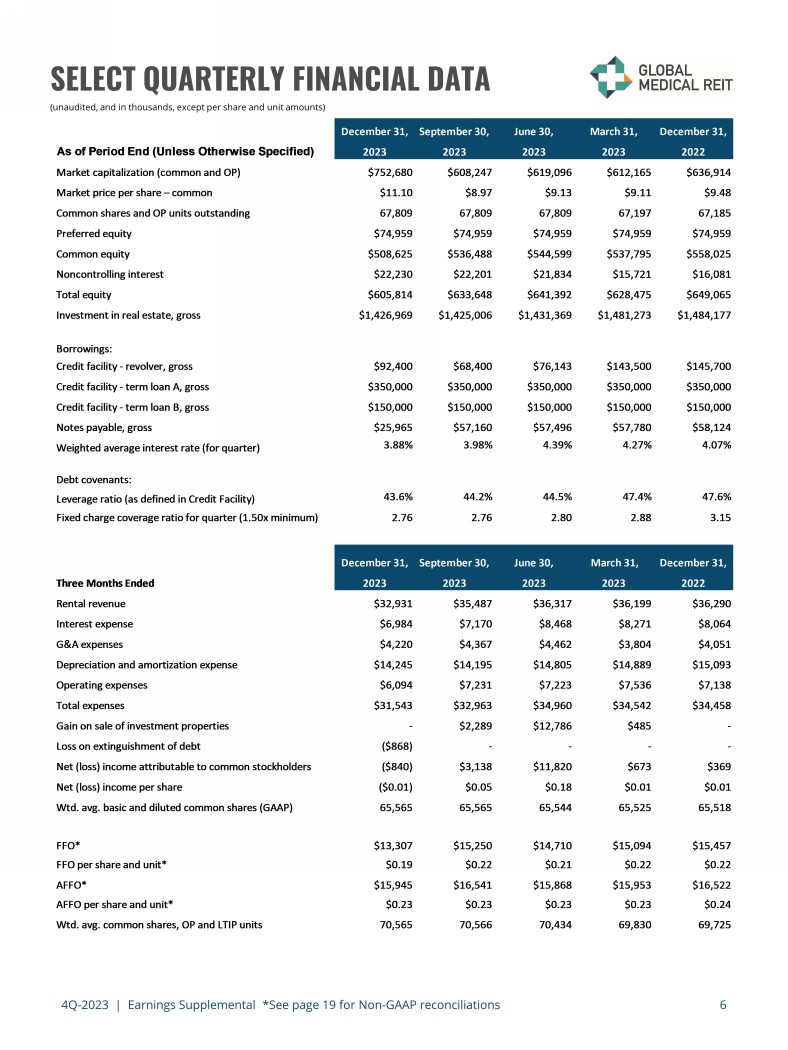

4Q - 2023 | Earnings Supplemental *See page 19 for Non - GAAP reconciliations 6 (unaudited, and in thousands, except per share and unit amounts) SELECT QUARTERLY FINANCIAL DATA December 31, September 30, June 30, March 31, December 31, As of Period End (Unless Otherwise Specified) 2023 2023 2023 2023 2022 Market capitalization (common and OP) $752,680 $608,247 $619,096 $612,165 $636,914 Market price per share – common $11.10 $8.97 $9.13 $9.11 $9.48 Common shares and OP units outstanding 67,809 67,809 67,809 67,197 67,185 Preferred equity $74,959 $74,959 $74,959 $74,959 $74,959 Common equity $508,625 $536,488 $544,599 $537,795 $558,025 Noncontrolling interest $22,230 $22,201 $21,834 $15,721 $16,081 Total equity $605,814 $633,648 $641,392 $628,475 $649,065 Investment in real estate, gross $1,426,969 $1,425,006 $1,431,369 $1,481,273 $1,484,177 Borrowings: Credit facility - revolver, gross $92,400 $68,400 $76,143 $143,500 $145,700 Credit facility - term loan A, gross $350,000 $350,000 $350,000 $350,000 $350,000 Credit facility - term loan B, gross $150,000 $150,000 $150,000 $150,000 $150,000 Notes payable, gross $25,965 $57,160 $57,496 $57,780 $58,124 Weighted average interest rate (for quarter) 3.88% 3.98% 4.39% 4.27% 4.07% Debt covenants: Leverage ratio (as defined in Credit Facility) 43.6% 44.2% 44.5% 47.4% 47.6% Fixed charge coverage ratio for quarter (1.50x minimum) 2.76 2.76 2.80 2.88 3.15 December 31, September 30, June 30, March 31, December 31, Three Months Ended 2023 2023 2023 2023 2022 Rental revenue $32,931 $35,487 $36,317 $36,199 $36,290 Interest expense $6,984 $7,170 $8,468 $8,271 $8,064 G&A expenses $4,220 $4,367 $4,462 $3,804 $4,051 Depreciation and amortization expense $14,245 $14,195 $14,805 $14,889 $15,093 Operating expenses $6,094 $7,231 $7,223 $7,536 $7,138 Total expenses $31,543 $32,963 $34,960 $34,542 $34,458 Gain on sale of investment properties - $2,289 $12,786 $485 - Loss on extinguishment of debt ($868) - - - - Net (loss) income attributable to common stockholders ($840) $3,138 $11,820 $673 $369 Net (loss) income per share ($0.01) $0.05 $0.18 $0.01 $0.01 Wtd. avg. basic and diluted common shares (GAAP) 65,565 65,565 65,544 65,525 65,518 FFO* $13,307 $15,250 $14,710 $15,094 $15,457 FFO per share and unit* $0.19 $0.22 $0.21 $0.22 $0.22 AFFO* $15,945 $16,541 $15,868 $15,953 $16,522 AFFO per share and unit* $0.23 $0.23 $0.23 $0.23 $0.24 Wtd. avg. common shares, OP and LTIP units 70,565 70,566 70,434 69,830 69,725

4Q - 2023 | Earnings Supplemental 7 BUSINESS SUMMARY FOURTH QUARTER 2023 OPERATING SUMMARY • Net loss attributable to common stockholders was $0.8 million, or $0.01 per diluted share, as compared to net income attributable to common stockholders of $0.4 million, or $0.01 per diluted share, in the comparable prior year period. • Funds from Operations (“FFO”) of $13.3 million, or $0.19 per share and unit, as compared to $15.5 million, or $0.22 per share and unit, in the comparable prior year period. • Adjusted Funds from Operations (“AFFO”) of $15.9 million, or $0.23 per share and unit, as compared to $16.5 million, or $0.24 per share and unit, in the comparable prior year period. • Total revenue decreased to $33.0 million as compared to $36.3 million in the comparable prior year period, primarily driven by the Company’s property dispositions completed during the first nine months of 2023, as well as the recognition of reserves for approximately $1.1 million of rent related to one tenant, including approximately $0.2 million of deferred rent. COMMON AND PREFERRED DIVIDENDS • On December 12, 2023, the Board of Directors (the “Board”) declared a: • $0.21 per share cash dividend to common stockholders and unitholders of record as of December 27, 2023, which was paid on January 9, 2024; and • $0.46875 per share cash dividend to holders of record as of January 15, 2024, of the Company’s Series A Preferred Stock, which was paid on January 31, 2024. INVESTMENT AND PORTFOLIO ACTIVITY • The Company did not purchase or sell any properties during the fourth quarter of 2023. • As of December 31, 2023, the Company’s portfolio occupancy was 96.5%. CAPITAL MARKETS AND DEBT ACTIVITY • Leverage was 43.6 % as of December 31, 2023. • In December 2023, we completed the defeasance of a $30.6 million CMBS loan. The defeasance was funded by borrowings on our revolver and resulted in a loss on extinguishment of debt of $0.9 million. In connection with the defeasance, we subsequently received $8.4 million in escrowed funds held by the CMBS servicer and used those funds to reduce total debt. • As of February 26, 2024, we had unutilized borrowing capacity under the Credit Facility of $294 million. • The Company did not issue any shares of common stock under its ATM program during the year ended 2023 or from January 1, 2024 through February 26, 2024.

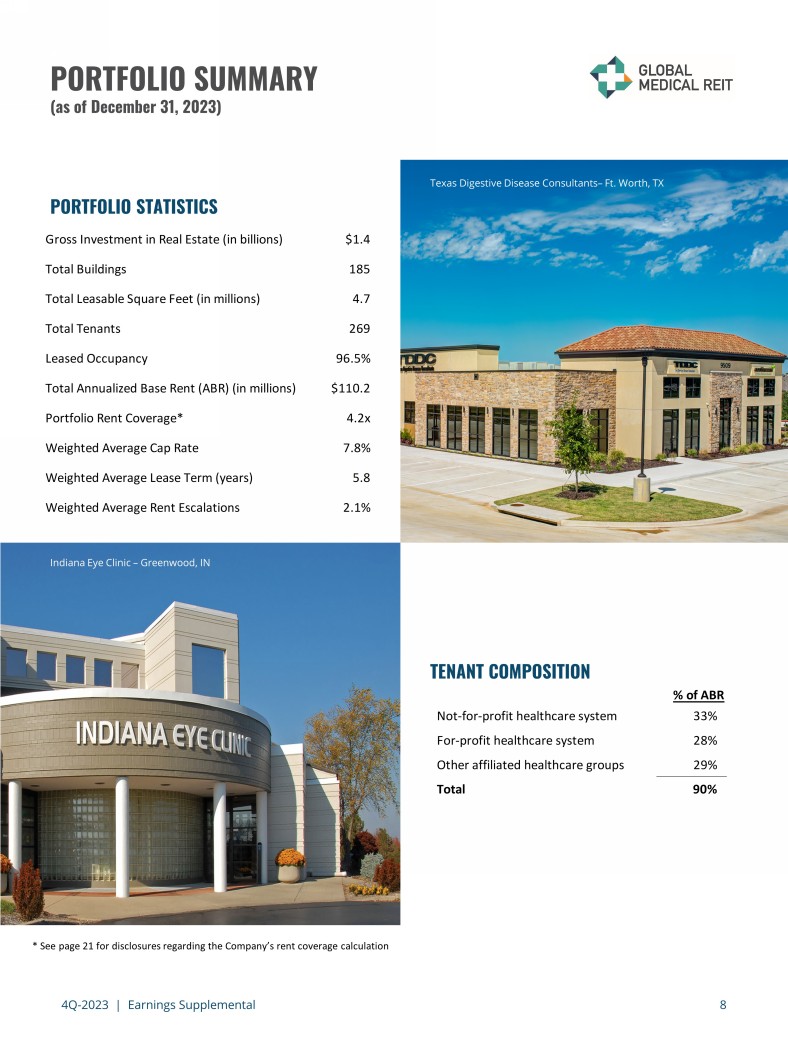

4Q - 2023 | Earnings Supplemental 8 PORTFOLIO SUMMARY (as of December 31, 2023) PORTFOLIO STATISTICS TENANT COMPOSITION * See page 21 for disclosures regarding the Company’s rent coverage calculation Texas Digestive Disease Consultants – Ft. Worth, TX Indiana Eye Clinic – Greenwood, IN Gross Investment in Real Estate (in billions) $1.4 Total Buildings 185 Total Leasable Square Feet (in millions) 4.7 Total Tenants 269 Leased Occupancy 96.5% Total Annualized Base Rent (ABR) (in millions) $110.2 Portfolio Rent Coverage* 4.2x Weighted Average Cap Rate 7.8% Weighted Average Lease Term (years) 5.8 Weighted Average Rent Escalations 2.1% % of ABR Not-for-profit healthcare system 33% For-profit healthcare system 28% Other affiliated healthcare groups 29% Total 90%

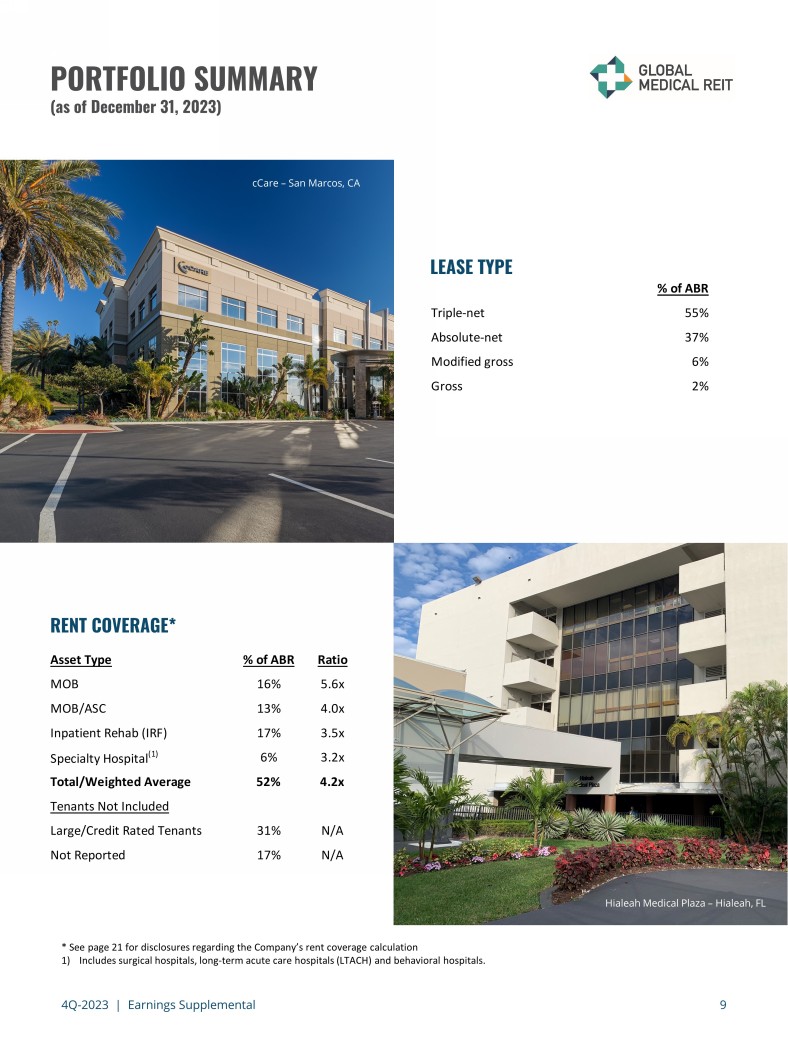

4Q - 2023 | Earnings Supplemental 9 PORTFOLIO SUMMARY (as of December 31, 2023) LEASE TYPE RENT COVERAGE* * See page 21 for disclosures regarding the Company’s rent coverage calculation 1) Includes surgical hospitals, long - term acute care hospitals (LTACH) and behavioral hospitals. cCare – San Marcos, CA Hialeah Medical Plaza – Hialeah, FL % of ABR Triple-net 55% Absolute-net 37% Modified gross 6% Gross 2% Asset Type % of ABR Ratio MOB 16% 5.6x MOB/ASC 13% 4.0x Inpatient Rehab (IRF) 17% 3.5x Specialty Hospital (1) 6% 3.2x Total/Weighted Average 52% 4.2x Tenants Not Included Large/Credit Rated Tenants 31% N/A Not Reported 17% N/A

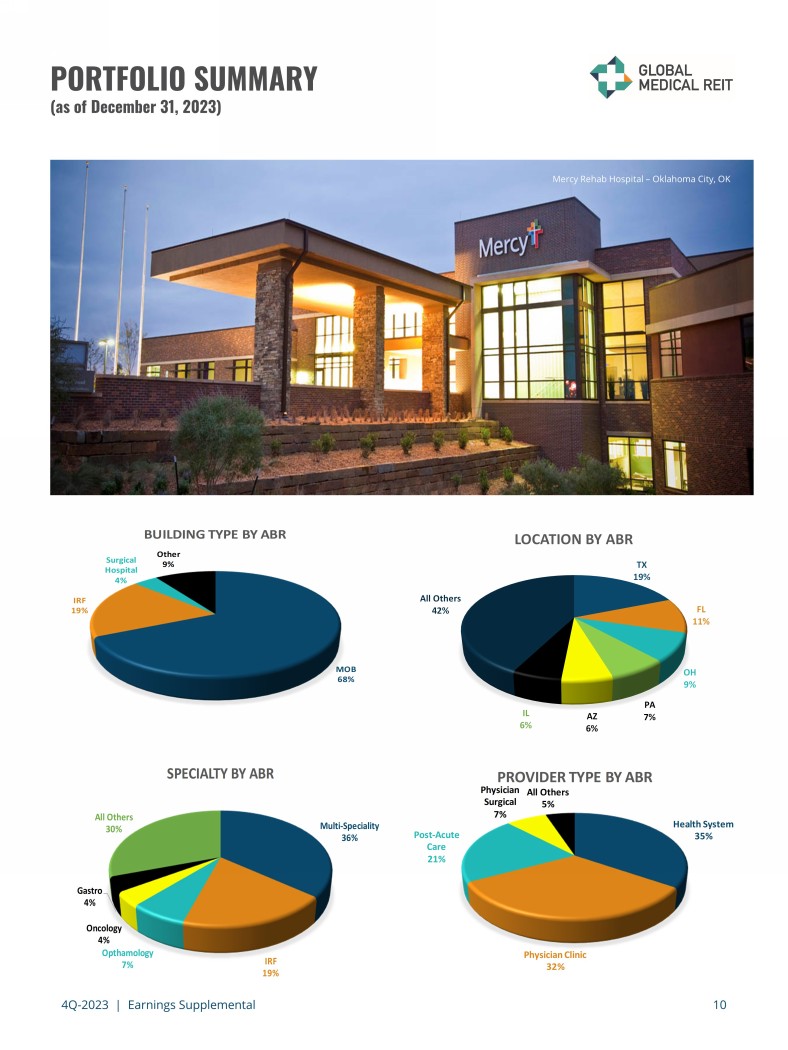

4Q - 2023 | Earnings Supplemental 10 PORTFOLIO SUMMARY (as of December 31, 2023) Mercy Rehab Hospital – Oklahoma City, OK Multi - Speciality 36% IRF 19% Opthamology 7% Oncology 4% Gastro 4% All Others 30% SPECIALTY BY ABR Health System 35% Physician Clinic 32% Post - Acute Care 21% Physician Surgical 7% All Others 5% PROVIDER TYPE BY ABR MOB 68% IRF 19% Surgical Hospital 4% Other 9% BUILDING TYPE BY ABR TX 19% FL 11% OH 9% PA 7% AZ 6% IL 6% All Others 42% LOCATION BY ABR

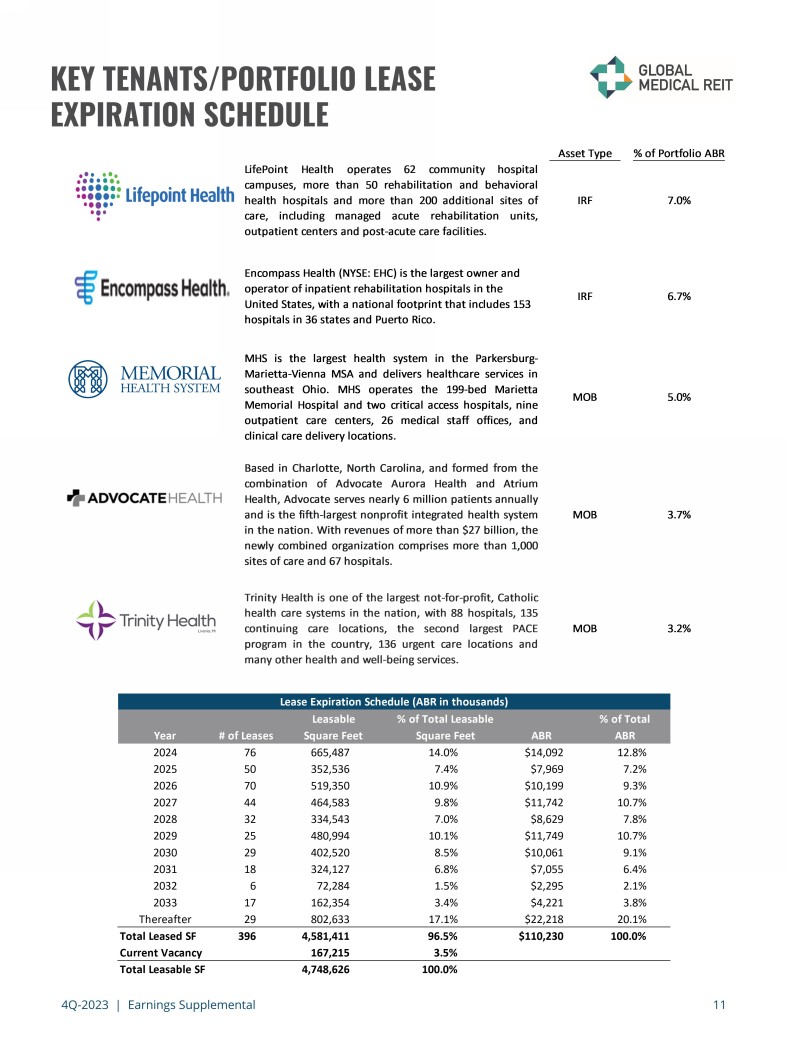

4Q - 2023 | Earnings Supplemental 11 KEY TENANTS/PORTFOLIO LEASE EXPIRATION SCHEDULE Leasable % of Total Leasable % of Total Year # of Leases Square Feet Square Feet ABR ABR 2024 76 665,487 14.0% $14,092 12.8% 2025 50 352,536 7.4% $7,969 7.2% 2026 70 519,350 10.9% $10,199 9.3% 2027 44 464,583 9.8% $11,742 10.7% 2028 32 334,543 7.0% $8,629 7.8% 2029 25 480,994 10.1% $11,749 10.7% 2030 29 402,520 8.5% $10,061 9.1% 2031 18 324,127 6.8% $7,055 6.4% 2032 6 72,284 1.5% $2,295 2.1% 2033 17 162,354 3.4% $4,221 3.8% Thereafter 29 802,633 17.1% $22,218 20.1% Total Leased SF 396 4,581,411 96.5% $110,230 100.0% Current Vacancy 167,215 3.5% Total Leasable SF 4,748,626 100.0% Lease Expiration Schedule (ABR in thousands) Asset Type % of Portfolio ABR LifePoint Health operates 62 community hospital campuses, more than 50 rehabilitation and behavioral healthhospitalsandmorethan200additionalsitesof care, including managed acute rehabilitation units, outpatient centers and post-acute care facilities. IRF 7.0% Encompass Health (NYSE: EHC) is the largest owner and operator of inpatient rehabilitation hospitals in the United States, with a national footprint that includes 153 hospitals in 36 states and Puerto Rico. IRF 6.7% MHS is the largest health system in the Parkersburg- Marietta-ViennaMSAanddelivershealthcareservicesin southeast Ohio. MHS operates the 199-bed Marietta MemorialHospitalandtwocriticalaccesshospitals,nine outpatient care centers, 26 medical staff offices, and clinical care delivery locations. MOB 5.0% BasedinCharlotte,NorthCarolina,andformedfromthe combination of Advocate Aurora Health and Atrium Health,Advocateservesnearly6millionpatientsannually andisthefifth-largestnonprofitintegratedhealthsystem inthenation.Withrevenuesofmorethan$27billion,the newlycombinedorganizationcomprisesmorethan1,000 sites of care and 67 hospitals. MOB 3.7% TrinityHealthisoneofthelargestnot-for-profit,Catholic healthcaresystemsinthenation,with88hospitals,135 continuing care locations, the second largest PACE programinthecountry,136urgentcarelocationsand many other health and well-being services. MOB 3.2%

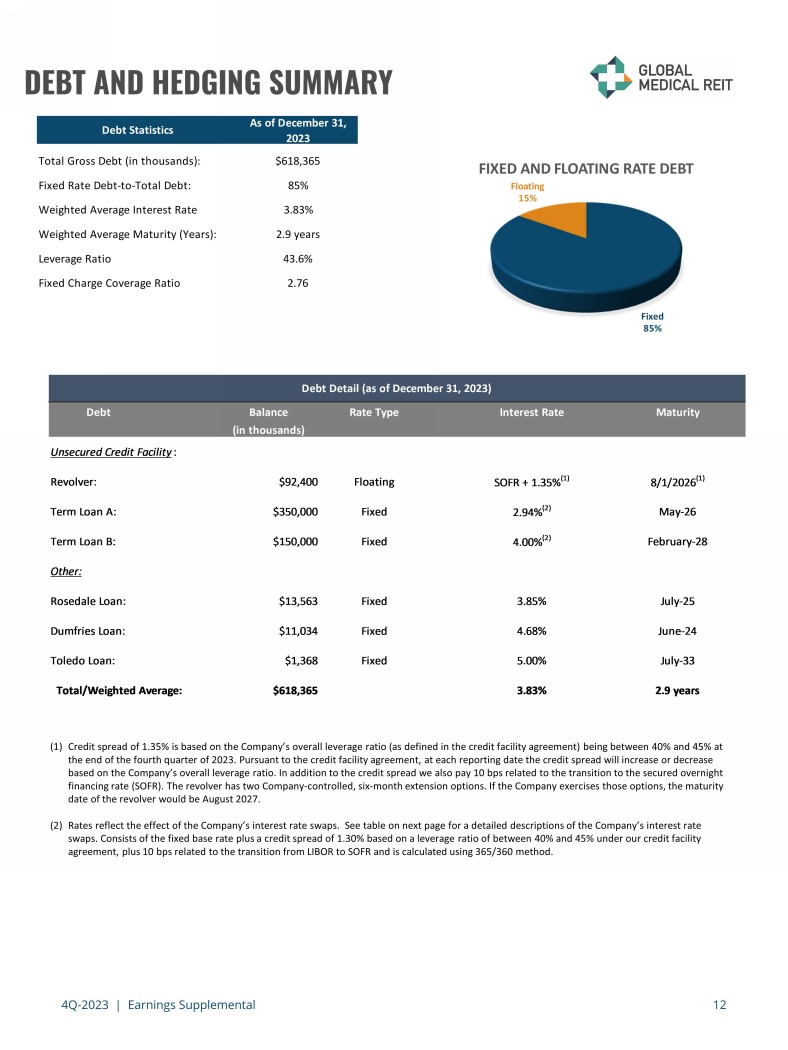

4Q - 2023 | Earnings Supplemental 12 DEBT AND HEDGING SUMMARY (1) Credit spread of 1.35% is based on the Company’s overall leverage ratio (as defined in the credit facility agreement) being b etw een 40% and 45% at the end of the fourth quarter of 2023. Pursuant to the credit facility agreement, at each reporting date the credit spread wi ll increase or decrease based on the Company’s overall leverage ratio. In addition to the credit spread we also pay 10 bps related to the transition to the secured overnight financing rate (SOFR). The revolver has two Company - controlled, six - month extension options. If the Company exercises those opti ons, the maturity date of the revolver would be August 2027. (2) Rates reflect the effect of the Company’s interest rate swaps. See table on next page for a detailed descriptions of the Com pan y’s interest rate swaps. Consists of the fixed base rate plus a credit spread of 1.30% based on a leverage ratio of between 40% and 45 % under our credit facility agreement, plus 10 bps related to the transition from LIBOR to SOFR and is calculated using 365/360 method. Debt Statistics As of December 31, 2023 Total Gross Debt (in thousands): $618,365 Fixed Rate Debt-to-Total Debt: 85% Weighted Average Interest Rate 3.83% Weighted Average Maturity (Years): 2.9 years Leverage Ratio 43.6% Fixed Charge Coverage Ratio 2.76 Fixed 85% Floating 15% FIXED AND FLOATING RATE DEBT Debt Balance Rate Type Interest Rate Maturity (in thousands) Unsecured Credit Facility: Revolver: $92,400 Floating SOFR + 1.35% (1) 8/1/2026 (1) Term Loan A: $350,000 Fixed 2.94% (2) May-26 Term Loan B: $150,000 Fixed 4.00% (2) February-28 Other: Rosedale Loan: $13,563 Fixed 3.85% July-25 Dumfries Loan: $11,034 Fixed 4.68% June-24 Toledo Loan: $1,368 Fixed 5.00% July-33 Total/Weighted Average: $618,365 3.83% 2.9 years Debt Detail (as of December 31, 2023)

4Q - 2023 | Earnings Supplemental 13 DEBT AND HEDGING SUMMARY (1) Consists of a total of ten current interest rates swaps and three forward starting interest rate swaps whereby we pay (or wil l p ay) the fixed base rate listed in the table above and receive the one - month SOFR, which is the reference rate for the outstanding loans in our credit fa cility. (2) Consists of the fixed base rate plus a credit spread of 1.30% based on a leverage ratio of between 40% and 45% under our cred it facility agreement, plus 10 bps related to the transition from LIBOR to SOFR and is calculated using 365/360 method. Citrus Valley Medical Associates – Corona, CA Notional Term Term Loan A - $350,000 current – 8/2024 Fixed base rate: 1.50% Effective interest rate: 2.94% (2) 8/2024 – 4/2026 Fixed base rate: 1.36% Effective interest rate: 2.80% (2) Term Loan B - $150,000 current – 2/2028 Fixed base rate: 2.54% Effective interest rate: 4.00% (2) Interest Rate Swap Detail (as of December 31, 2023) (1) Weighted Average Interest Rates

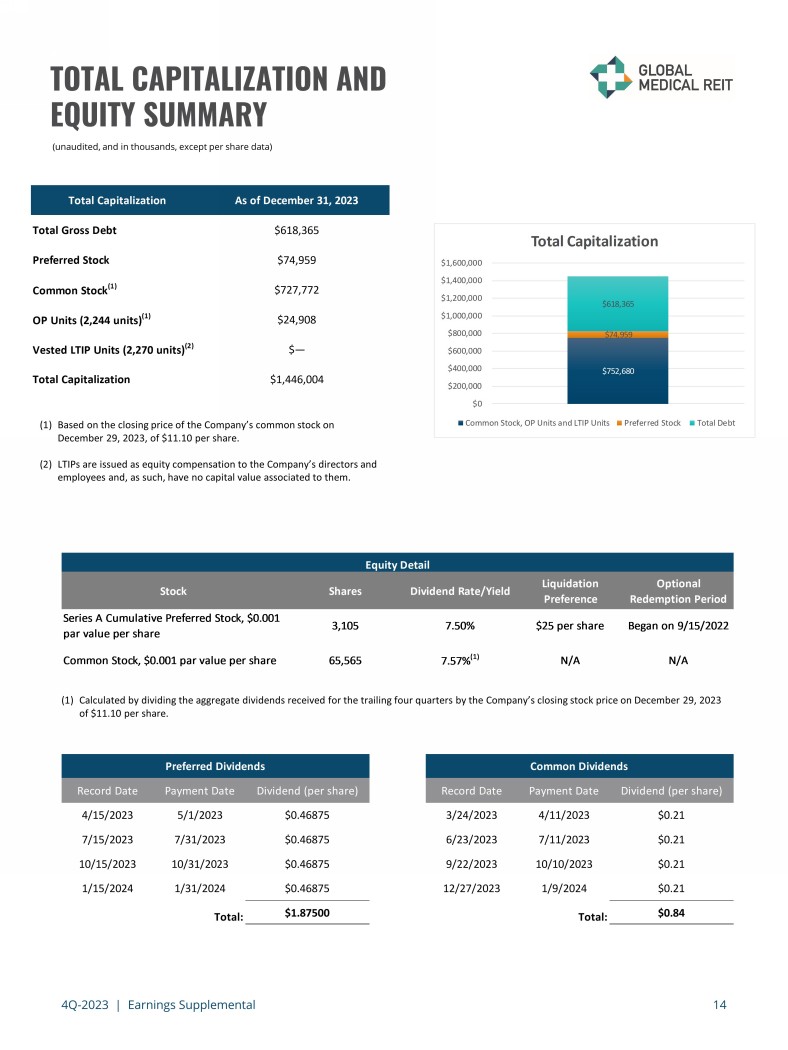

4Q - 2023 | Earnings Supplemental 14 TOTAL CAPITALIZATION AND EQUITY SUMMARY (unaudited, and in thousands, except per share data) (1) Based on the closing price of the Company’s common stock on December 29, 2023, of $11.10 per share. (2) LTIPs are issued as equity compensation to the Company’s directors and employees and, as such, have no capital value associated to them. (1) Calculated by dividing the aggregate dividends received for the trailing four quarters by the Company’s closing stock price o n D ecember 29, 2023 of $11.10 per share. Total Capitalization As of December 31, 2023 Total Gross Debt $618,365 Preferred Stock $74,959 Common Stock (1) $727,772 OP Units (2,244 units) (1) $24,908 Vested LTIP Units (2,270 units) (2) $— Total Capitalization $1,446,004 $752,680 $74,959 $618,365 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 Total Capitalization Common Stock, OP Units and LTIP Units Preferred Stock Total Debt Stock Shares Dividend Rate/Yield Liquidation Preference Optional Redemption Period Series A Cumulative Preferred Stock, $0.001 par value per share 3,105 7.50% $25 per share Began on 9/15/2022 Common Stock, $0.001 par value per share 65,565 7.57% (1) N/A N/A Equity Detail Record Date Payment Date Dividend (per share) 4/15/2023 5/1/2023 $0.46875 7/15/2023 7/31/2023 $0.46875 10/15/2023 10/31/2023 $0.46875 1/15/2024 1/31/2024 $0.46875 Total: $1.87500 Preferred Dividends Record Date Payment Date Dividend (per share) 3/24/2023 4/11/2023 $0.21 6/23/2023 7/11/2023 $0.21 9/22/2023 10/10/2023 $0.21 12/27/2023 1/9/2024 $0.21 Total: $0.84 Common Dividends

4Q - 2023 | Earnings Supplemental 15 ESG SUMMARY We take climate change and the risks associated with climate change seriously — both physical and transitional . We utilized Moody’s 427 Risk Management platform to help us identify and measure the potential climate risk exposure for our properties . The analysis summarizes the climate change - related risks, groups them by onset potential, and identifies opportunities for risk mitigation . We utilize the ENERGY STAR platform to collect and track our energy consumption data and have identified properties that are strong candidates for the ENERGY STAR certificate program . In 2022 , we earned an ENERGY STAR certification for our Select Medical facility in Omaha, Nebraska, which scored 99 , and for our Brown Clinic facility in Watertown, South Dakota, which attained a score of 84 . In addition, in 2023 , our facilities located in Dumfries, Virginia, Hialeah, Florida, and Dallas, Texas joined those in Omaha and Watertown as ENERGY STAR certificate recipients . . We prioritize energy efficiency and sustainability when evaluating investment opportunities . We utilize utility and energy audits that are performed by third - party engineering consultants during the due diligence phase of our acquisitions . The energy consumption data that we collect is used to assess our facilities’ carbon emission levels . We improved our overall GRESB score from 46 in 2022 to 54 for 2023 . The scores reflect activity for the previous year . Since we began receiving a GRESB Assessment score in 2021 , we have improved our score by 12 points . In the 2023 GRESB public disclosure assessment, GMRE ranked 4 th of 10 in peer group . Fostering a resilient posture is essential to our business and we continue to explore methods to assess our climate - related risks and mitigate the impacts . For example, according to the 2023 GRESB assessment report for the risk management sector, GMRE received a score of 4 . 25 / 5 while the benchmark score was 3 . 97 / 5 . In the performance sector of the Risk Assessment, GMRE received a score of 6 . 46 / 9 while the benchmark average was 5 . 66 / 9 . In the second quarter we published our 2022 corporate sustainability report, which can be found at https : //www . globalmedicalreit . com/about/corporate - responsibility/ . ENVIRONMENTAL SOCIAL Our Board continues to lead our social and governance efforts . With its diverse composition, our Board is a strong example of inclusive leadership with a composition of 43 % women and individuals from underrepresented groups . • Our Board has been recognized by “Women on Boards” and our executive team reflects our demographically diverse staff . • Our commitment to employee engagement remains a high - priority, as we continue to make accommodations for health, safety, and work - life balance . With this commitment in mind, and with the compensation committee of the Board’s leadership, we conducted an employee survey that covered a comprehensive range of subjects related to our employees’ attitudes about our work culture, compensation components, as well as demographic and identification data . GOVERNANCE • The Board formed a standing ESG committee that oversees the Company’s environmental, social, governance and resilience efforts . • GMRE is a member of the National Association of Corporate Directors .

4Q - 2023 | Earnings Supplemental 16 CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited, and in thousands, except per share amounts) 2023 2022 2023 2022 Revenue Rental revenue $32,931 $36,290 $140,934 $137,167 Other income 31 16 115 116 Total revenue 32,962 36,306 141,049 137,283 Expenses General and administrative 4,220 4,051 16,853 16,545 Operating expenses 6,094 7,138 28,082 25,188 Depreciation expense 10,204 10,580 41,266 40,008 Amortization expense 4,041 4,513 16,869 16,715 Interest expense 6,984 8,064 30,893 25,230 Preacquisition expense — 112 44 354 Total expenses 31,543 34,458 134,007 124,040 Income before gain on sale of investment properties and loss on extinguishment of debt 1,419 1,848 7,042 13,243 Gain on sale of investment properties — — 15,560 6,753 Loss on extinguishment of debt (868) — (868) — Net income $551 $1,848 $21,734 $19,996 Less: Preferred stock dividends (1,455) (1,455) (5,822) (5,822) Less: Net loss (income) attributable to noncontrolling interest 64 (24) (1,122) (854) Net (loss) income attributable to common stockholders ($840) $369 $14,790 $13,320 Net (loss) income attributable to common stockholders per share - basic and diluted ($0.01) $0.01 $0.23 $0.20 Weighted average shares outstanding – basic and diluted 65,565 65,518 65,550 65,462 Three Months Ended December 31, Twelve Months Ended December 31,

4Q - 2023 | Earnings Supplemental 17 CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited, and in thousands) December 31, 2023 December 31, 2022 Assets Investment in real estate: June 30, 2023+B5:B22 Land $164,315 $168,308 Building 1,035,705 1,079,781 Site improvements 21,974 22,024 Tenant improvements 66,358 65,987 Acquired lease intangible assets 138,617 148,077 1,426,969 1,484,177 Less: accumulated depreciation and amortization (247,503) (198,218) Investment in real estate, net 1,179,466 1,285,959 Cash and cash equivalents 1,278 4,016 Restricted cash 5,446 10,439 Tenant receivables, net 6,762 8,040 Due from related parties 193 200 Escrow deposits 673 7,833 Deferred assets 27,132 29,616 Derivative asset 25,125 34,705 Goodwill 5,903 5,903 Other assets 15,722 6,550 Total assets $1,267,700 $1,393,261 Liabilities and Equity Liabilities: Credit Facility, net $585,333 $636,447 Notes payable, net 25,899 57,672 Accounts payable and accrued expenses 12,781 13,819 Dividends payable 16,134 15,821 Security deposits 3,688 5,461 Other liabilities 12,770 7,363 Acquired lease intangible liability, net 5,281 7,613 Total liabilities 661,886 744,196 Equity: Preferred stock ($77,625 liquidation preference) 74,959 74,959 Common stock 66 66 Additional paid-in capital 722,418 721,991 Accumulated deficit (238,984) (198,706) Accumulated other comprehensive income 25,125 34,674 Total Global Medical REIT Inc. stockholders' equity 583,584 632,984 Noncontrolling interest 22,230 16,081 Total equity 605,814 649,065 Total liabilities and equity $1,267,700 $1,393,261 As of

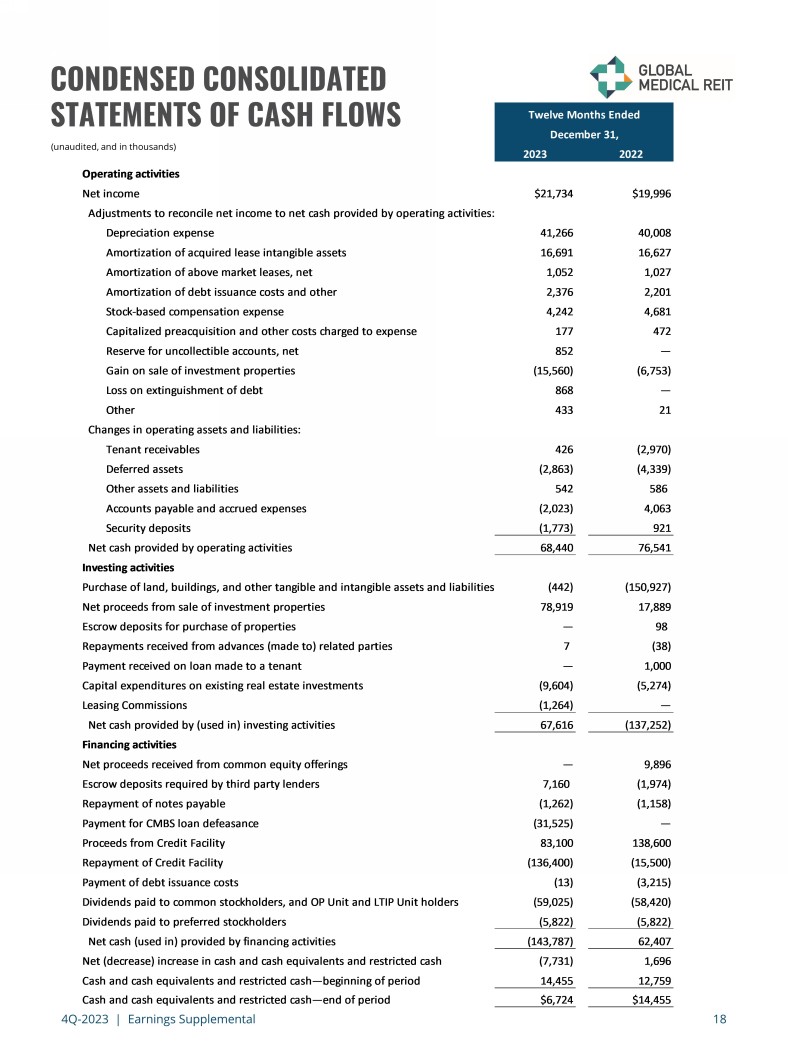

4Q - 2023 | Earnings Supplemental 18 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited, and in thousands) 2023 2022 Operating activities Net income $21,734 $19,996 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense 41,266 40,008 Amortization of acquired lease intangible assets 16,691 16,627 Amortization of above market leases, net 1,052 1,027 Amortization of debt issuance costs and other 2,376 2,201 Stock-based compensation expense 4,242 4,681 Capitalized preacquisition and other costs charged to expense 177 472 Reserve for uncollectible accounts, net 852 — Gain on sale of investment properties (15,560) (6,753) Loss on extinguishment of debt 868 — Other 433 21 Changes in operating assets and liabilities: Tenant receivables 426 (2,970) Deferred assets (2,863) (4,339) Other assets and liabilities 542 586 Accounts payable and accrued expenses (2,023) 4,063 Security deposits (1,773) 921 Net cash provided by operating activities 68,440 76,541 Investing activities Purchase of land, buildings, and other tangible and intangible assets and liabilities (442) (150,927) Net proceeds from sale of investment properties 78,919 17,889 Escrow deposits for purchase of properties — 98 Repayments received from advances (made to) related parties 7 (38) Payment received on loan made to a tenant — 1,000 Capital expenditures on existing real estate investments (9,604) (5,274) Leasing Commissions (1,264) — Net cash provided by (used in) investing activities 67,616 (137,252) Financing activities Net proceeds received from common equity offerings — 9,896 Escrow deposits required by third party lenders 7,160 (1,974) Repayment of notes payable (1,262) (1,158) Payment for CMBS loan defeasance (31,525) — Proceeds from Credit Facility 83,100 138,600 Repayment of Credit Facility (136,400) (15,500) Payment of debt issuance costs (13) (3,215) Dividends paid to common stockholders, and OP Unit and LTIP Unit holders (59,025) (58,420) Dividends paid to preferred stockholders (5,822) (5,822) Net cash (used in) provided by financing activities (143,787) 62,407 Net (decrease) increase in cash and cash equivalents and restricted cash (7,731) 1,696 Cash and cash equivalents and restricted cash—beginning of period 14,455 12,759 Cash and cash equivalents and restricted cash—end of period $6,724 $14,455 Twelve Months Ended December 31,

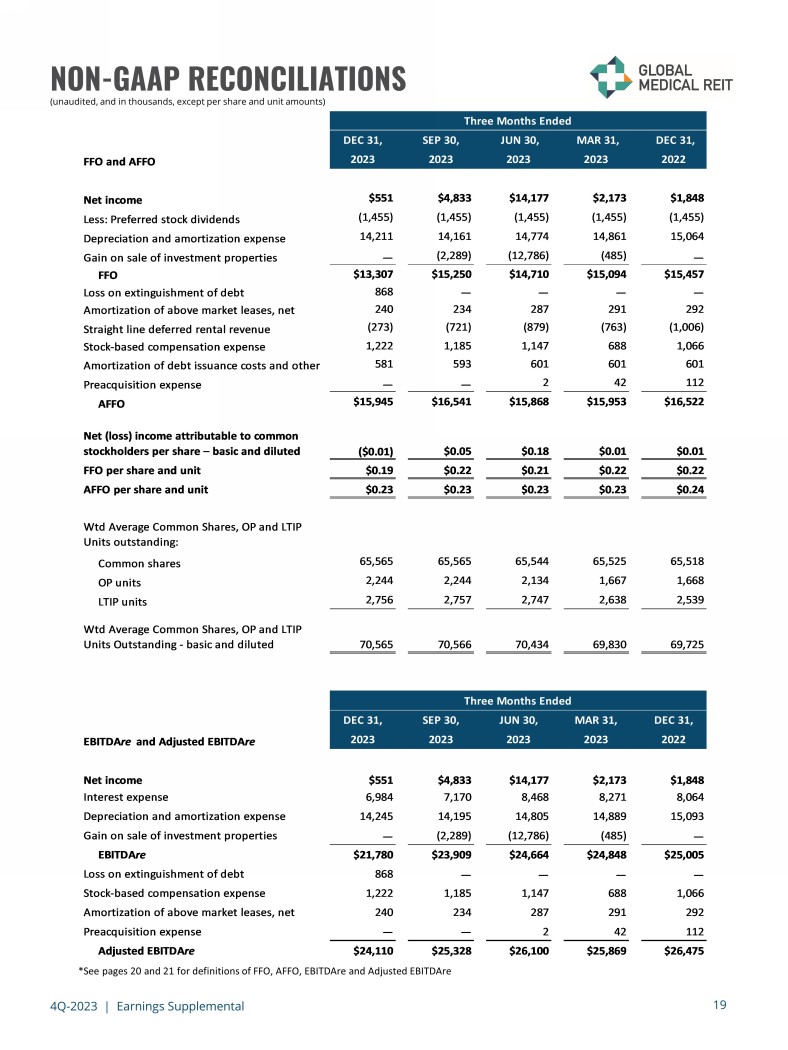

4Q - 2023 | Earnings Supplemental 19 NON - GAAP RECONCILIATIONS (unaudited, and in thousands, except per share and unit amounts) *See pages 20 and 21 for definitions of FFO, AFFO, EBITDAre and Adjusted EBITDAre DEC 31, SEP 30, JUN 30, MAR 31, DEC 31, FFO and AFFO 2023 2023 2023 2023 2022 Net income $551 $4,833 $14,177 $2,173 $1,848 Less: Preferred stock dividends (1,455) (1,455) (1,455) (1,455) (1,455) Depreciation and amortization expense 14,211 14,161 14,774 14,861 15,064 Gain on sale of investment properties — (2,289) (12,786) (485) — FFO $13,307 $15,250 $14,710 $15,094 $15,457 Loss on extinguishment of debt 868 — — — — Amortization of above market leases, net 240 234 287 291 292 Straight line deferred rental revenue (273) (721) (879) (763) (1,006) Stock-based compensation expense 1,222 1,185 1,147 688 1,066 Amortization of debt issuance costs and other 581 593 601 601 601 Preacquisition expense — — 2 42 112 AFFO $15,945 $16,541 $15,868 $15,953 $16,522 Net (loss) income attributable to common stockholders per share – basic and diluted ($0.01) $0.05 $0.18 $0.01 $0.01 FFO per share and unit $0.19 $0.22 $0.21 $0.22 $0.22 AFFO per share and unit $0.23 $0.23 $0.23 $0.23 $0.24 Wtd Average Common Shares, OP and LTIP Units outstanding: Common shares 65,565 65,565 65,544 65,525 65,518 OP units 2,244 2,244 2,134 1,667 1,668 LTIP units 2,756 2,757 2,747 2,638 2,539 Wtd Average Common Shares, OP and LTIP Units Outstanding - basic and diluted 70,565 70,566 70,434 69,830 69,725 DEC 31, SEP 30, JUN 30, MAR 31, DEC 31, EBITDAre and Adjusted EBITDAre 2023 2023 2023 2023 2022 Net income $551 $4,833 $14,177 $2,173 $1,848 Interest expense 6,984 7,170 8,468 8,271 8,064 Depreciation and amortization expense 14,245 14,195 14,805 14,889 15,093 Gain on sale of investment properties — (2,289) (12,786) (485) — EBITDAre $21,780 $23,909 $24,664 $24,848 $25,005 Loss on extinguishment of debt 868 — — — — Stock-based compensation expense 1,222 1,185 1,147 688 1,066 Amortization of above market leases, net 240 234 287 291 292 Preacquisition expense — — 2 42 112 Adjusted EBITDAre $24,110 $25,328 $26,100 $25,869 $26,475 Three Months Ended Three Months Ended

4Q - 2023 | Earnings Supplemental 20 REPORTING DEFINITIONS AND OTHER DISCLOSURES Annualized Base Rent Annualized base rent represents monthly base rent for December 2023, multiplied by 12 (or base rent net of annualized expenses for properties with gross leases). Accordingly, this methodology produces an annualized amount as of a point in time but does not take into account future ( i ) contractual rental rate increases, (ii) leasing activity or (iii) lease expirations. Additionally, leases that are accounted for on a cash - collected basis are not included in annualized base rent. Capitalization Rate The capitalization rate (“Cap Rate”) for an acquisition is calculated by dividing current Annualized Base Rent by contractual purchase price. For the portfolio capitalization rate, certain adjustments, including for subsequent capital invested, are made to the contractual purchase price. Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“ EBITDAre ” and “Adjusted EBITDAre ”) We calculate EBITDAre in accordance with standards established by NAREIT and define EBITDAre as net income or loss computed in accordance with GAAP plus depreciation and amortization, interest expense, gain or loss on the sale of investment properties, and impairment loss, as applicable. We define Adjusted EBITDAre as EBITDAre plus loss on the extinguishment of debt, non - cash stock compensation expense, non - cash intangible amortization related to above and below market leases, preacquisition expense and other normalizing items. Management considers EBITDAre and Adjusted EBITDAre important measures because they provide additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Funds from Operations and Adjusted Funds from Operations Funds from operations (“FFO”) and adjusted funds from operations (“AFFO”) are non - GAAP financial measures within the meaning of the rules of the SEC. The Company considers FFO and AFFO to be important supplemental measures of its operating performance and believes FFO is frequently used by securities analysts, investors, and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. In accordance with the National Association of Real Estate Investment Trusts’ (“NAREIT”) definition, FFO means net income or loss computed in accordance with GAAP before noncontrolling interests of holders of OP units and LTIP units, excluding gains (or losses) from sales of property and extraordinary items, less preferred stock dividends, plus real estate - related depreciation and amortization (excluding amortization of debt issuance costs and the amortization of above and below market leases), and after adjustments for unconsolidated partnerships and joint ventures. Because FFO excludes real estate - related depreciation and amortization (other than amortization of debt issuance costs and above and below market lease amortization expense), the Company believes that FFO provides a performance measure that, when compared period - over - period, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from the closest GAAP measurement, net income or loss. AFFO is a non - GAAP measure used by many investors and analysts to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations. Management calculates AFFO by modifying the NAREIT computation of FFO by adjusting it for certain cash and non - cash items and certain recurring and non - recurring items. For the Company these items include recurring acquisition and disposition costs, loss on the extinguishment of debt, recurring straight line deferred rental revenue, recurring stock - based compensation expense, recurring amortization of above and below market leases, recurring amortization of debt issuance costs, and other items. Management believes that reporting AFFO in addition to FFO is a useful supplemental measure for the investment community to use when evaluating the operating performance of the Company on a comparative basis.

4Q - 2023 | Earnings Supplemental 21 REPORTING DEFINITIONS AND OTHER DISCLOSURES Rent Coverage Ratio For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded credit - rated tenants or their subsidiaries for which financial statements were either not available or not sufficiently detailed. These ratios are based on the latest available information only. Most tenant financial statements are unaudited and we have not independently verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information is accurate or complete. Certain other tenants (approximately 17% of our portfolio) are excluded from the calculation due to (i) lack of available financial information or (ii) small tenant size. Additionally, included within 17% of non - reporting tenants is Pipeline Healthcare, LLC, which was sold to Heights Healthcare in October 2023 and is being operated under new management. Additionally, our Rent Coverage Ratio adds back physician distributions and compensation. Management believes all adjustments are reasonable and necessary. Other Disclosures Non - GAAP Financial Measures Management considers certain non - GAAP financial measures to be useful supplemental measures of the Company's operating performance. For the Company, non - GAAP measures consist of EBITDAre , Adjusted EBITDAre , FFO and AFFO. A non - GAAP financial measure is generally defined as one that purports to measure financial performance, financial position or cash flows, but excludes or includes amounts that would not be so adjusted in the most comparable measure determined in accordance with GAAP. The Company reports non - GAAP financial measures because these measures are observed by management to also be among the most predominant measures used by the REIT industry and by industry analysts to evaluate REITs. For these reasons, management deems it appropriate to disclose and discuss these non - GAAP financial measures. The non - GAAP financial measures presented herein are not necessarily identical to those presented by other real estate companies due to the fact that not all real estate companies use the same definitions. These measures should not be considered as alternatives to net income, as indicators of the Company's financial performance, or as alternatives to cash flow from operating activities as measures of the Company's liquidity, nor are these measures necessarily indicative of sufficient cash flow to fund all of the Company's needs. Management believes that in order to facilitate a clear understanding of the Company's historical consolidated operating results, these measures should be examined in conjunction with net income and cash flows from operations as presented elsewhere herein. Additional Information The information in this document should be read in conjunction with the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K, and other information filed with, or furnished to, the SEC. You can access the Company’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.globalmedicalreit.com) under “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into, this Earnings Supplemental. You also can review these SEC filings and other information by accessing the SEC’s website at http://www.sec.gov . Certain information contained in this package, including, but not limited to, information contained in our Top 10 tenant profiles is derived from publicly - available third - party sources. The Company has not independently verified this information and there can be no assurance that such information is accurate or complete.

INVESTOR RELATIONS globalmedicalreit.com NYSE: GMRE Stephen Swett 203.682.8377 stephen.swett@icrinc.com