Exhibit 99.1

NIMBLE. TENACIOUS. DISCIPLINED. Investor Presentation November 2024

Our primary mission is to attain earnings growth and dividend stability by maximizing the investment spread in our healthcare real estate assets. Our strategies to achieve this mission are as follows: • Asset Type - primarily invest in off - campus, out - patient medical facilities, and post - acute, in - patient medical facilities; • Asset Yield - acquire properties with attractive capitalization rates; • Tenants – acquire properties that are tenanted by profitable national or regional healthcare systems or physician groups; and • Management – utilize our experienced management team to operate our company and portfolio to maximize returns to investors. 2 MISSION STATEMENT AND STRATEGY

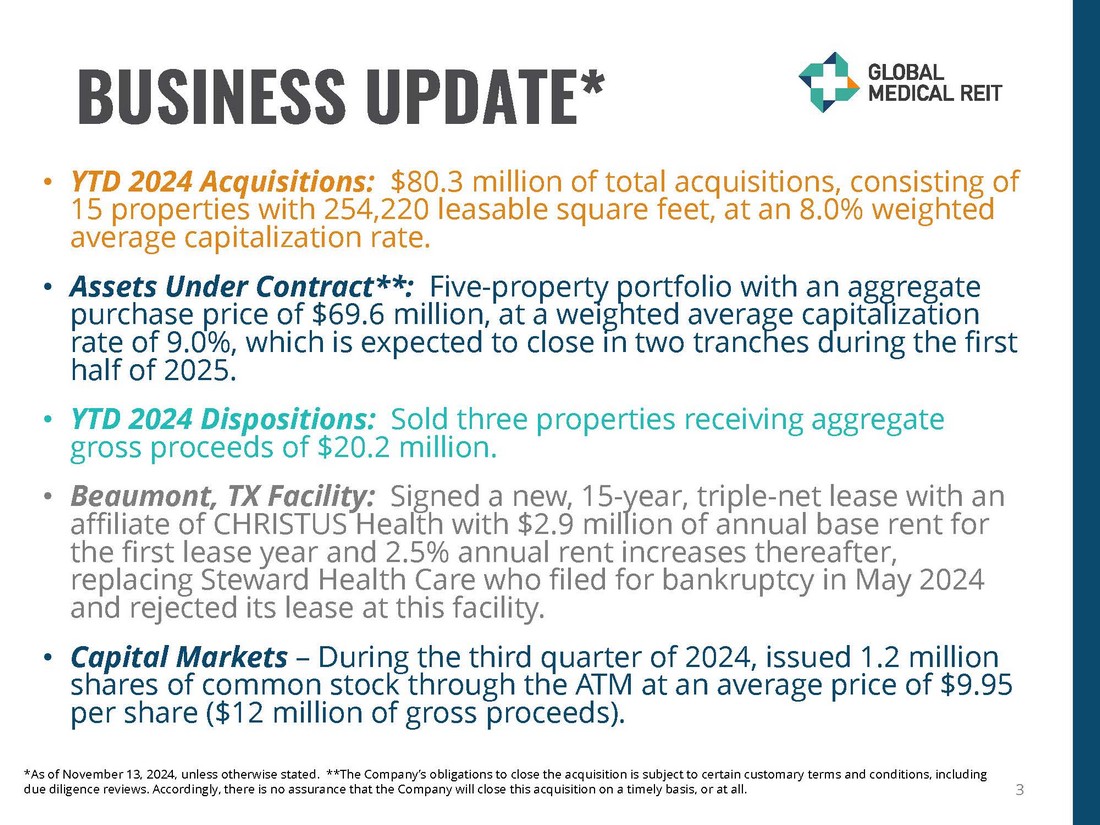

• YTD 2024 Acquisitions: $80.3 million of total acquisitions, consisting of 15 properties with 254,220 leasable square feet, at an 8.0% weighted average capitalization rate. • Assets Under Contract**: Five - property portfolio with an aggregate purchase price of $69.6 million, at a weighted average capitalization rate of 9.0%, which is expected to close in two tranches during the first half of 2025. • YTD 2024 Dispositions: Sold three properties receiving aggregate gross proceeds of $20.2 million. • Beaumont, TX Facility: Signed a new, 15 - year, triple - net lease with an affiliate of CHRISTUS Health with $2.9 million of annual base rent for the first lease year and 2.5% annual rent increases thereafter, replacing Steward Health Care who filed for bankruptcy in May 2024 and rejected its lease at this facility. • Capital Markets – During the third quarter of 2024, issued 1.2 million shares of common stock through the ATM at an average price of $9.95 per share ($12 million of gross proceeds). 3 BUSINESS UPDATE* *As of November 13, 2024, unless otherwise stated. **The Company’s obligations to close the acquisition is subject to certain customary terms and conditions, including due diligence reviews. Accordingly, there is no assurance that the Company will close this acquisition on a timely basis, or at all.

A STRATEGY THAT DELIVERS VALUE $1.4B Investments in Real Estate Gross $0.6B Market Cap* 7.7% Weighted Average Cap Rate 9.4% Dividend Yield* Atrium Health – Winston - Salem, NC 4 *Based on closing price of the Company’s common stock of $8.89 on November 13, 2024. All other data as of September 30, 2024.

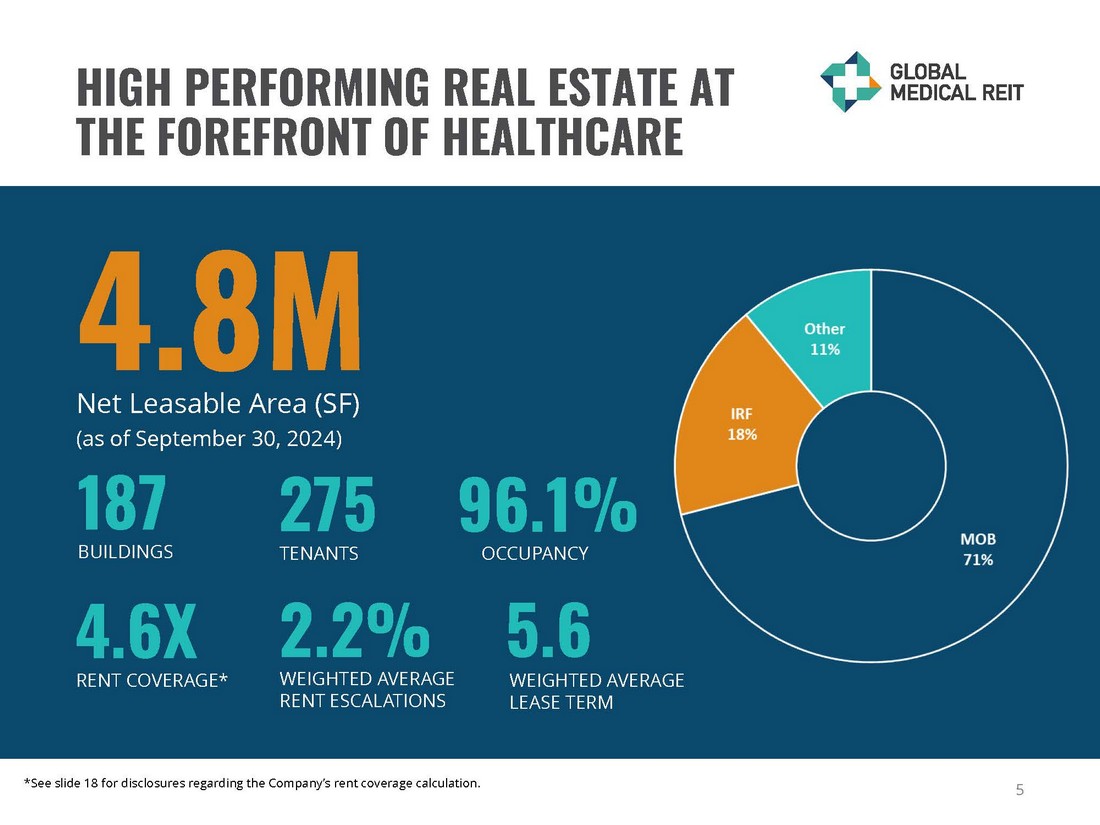

HIGH PERFORMING REAL ESTATE AT THE FOREFRONT OF HEALTHCARE 4.6X RENT COVERAGE* WEIGHTED AVERAGE RENT ESCALATIONS 2.2% 5.6 WEIGHTED AVERAGE LEASE TERM 187 BUILDINGS TENANTS 275 96.1% OCCUPANCY 4.8M Net Leasable Area (SF) (as of September 30, 2024) *See slide 18 for disclosures regarding the Company’s rent coverage calculation. 5

INVESTING IN THE FUTURE OF HEALTHCARE Encompass – Mesa, AZ 6 Southlake Heart & Vascular Institute – Clermont, FL Mission Health – Livonia, MI Legent Hospital for Special Surgery – Plano, TX

A DISTINCT APPROACH DISCIPLINED MARKET SELECTION • Bedroom communities • Secondary markets with favorable demand drivers • Positioned to benefit from decentralization trends STRINGENT UNDERWRITING AND DUE DILIGENCE • Uncover high retention/patient - centric acquisition opportunities • Sustainable cash flows • Attractive lease coverage ratios RIGOROUS TENANT AND FACILITY IDENTIFICATION • Healthcare systems and physician groups with a strong regional footprint • Essential or mission - critical services • Off - campus, purpose - built RESILIENT FINANCIAL STRUCTURE • Longer - term leases • Annual rent escalations 7

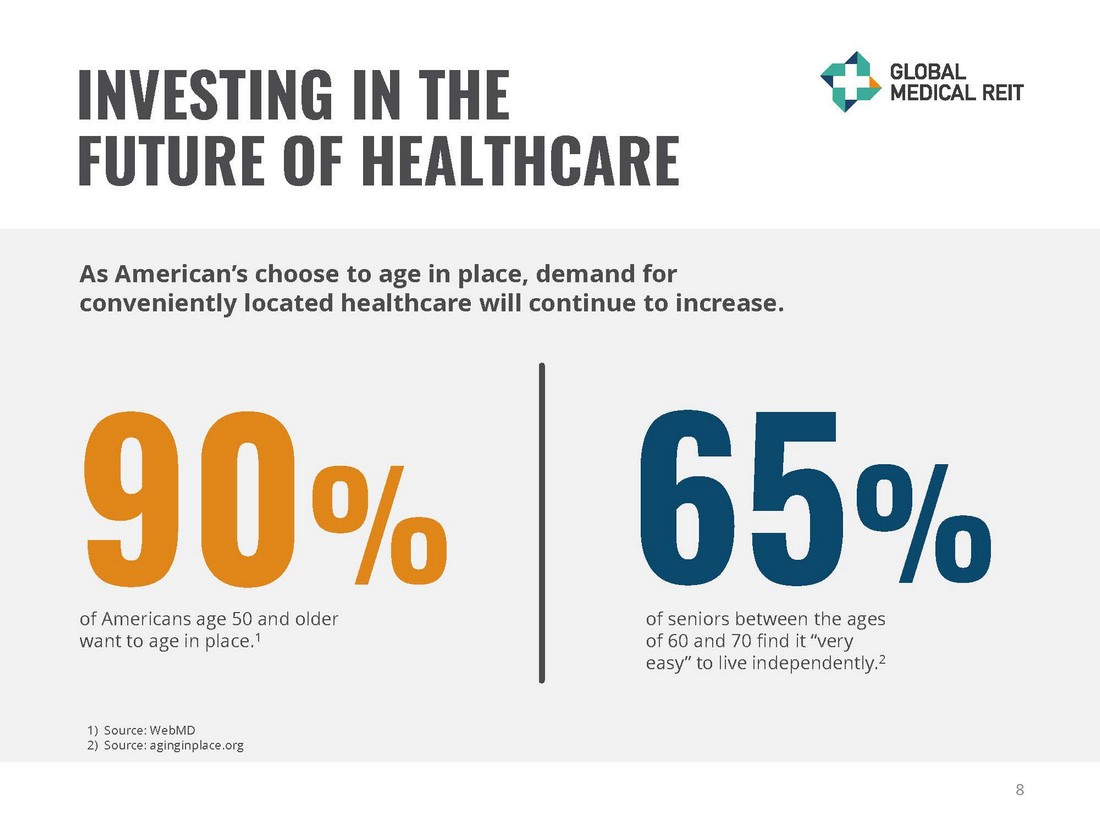

INVESTING IN THE FUTURE OF HEALTHCARE 90 % of Americans age 50 and older want to age in place. 1 65 % of seniors between the ages of 60 and 70 find it “very easy” to live independently. 2 As American’s choose to age in place, demand for conveniently located healthcare will continue to increase. 1) Source: WebMD 2) Source: aginginplace.org 8

“We don’t look at investing in real estate as a single activity to be completed but as the first step in building an enduring relationship.” Danica Holley Chief Operating Officer 9 Pediatrics Plus – Little Rock, AR

DOMINANT LOCAL PHYSICIAN GROUPS FOR - PROFIT SYSTEMS AFFILIATIONS AND SURGICAL OPERATOR PARTNERSHIPS STRONG, DIVERSE HEALTHCARE TENANT BASE NOT - FOR - PROFIT HEALTH SYSTEMS AFFILIATIONS 10

“With an attentive, flexible and creative approach, Global Medical REIT worked with us to structure a transaction that met our goals and helped propel our growth. GMRE has been a helpful partner and resource since our closing.” David Harano former CEO, Gastro One 11

“We have ample liquidity and are focused on maintaining stable leverage, which will support our accretive growth strategy . ” Robert Kiernan Chief Financial Officer and Treasurer 12 Legent Hospital for Special Surgery – Plano, TX

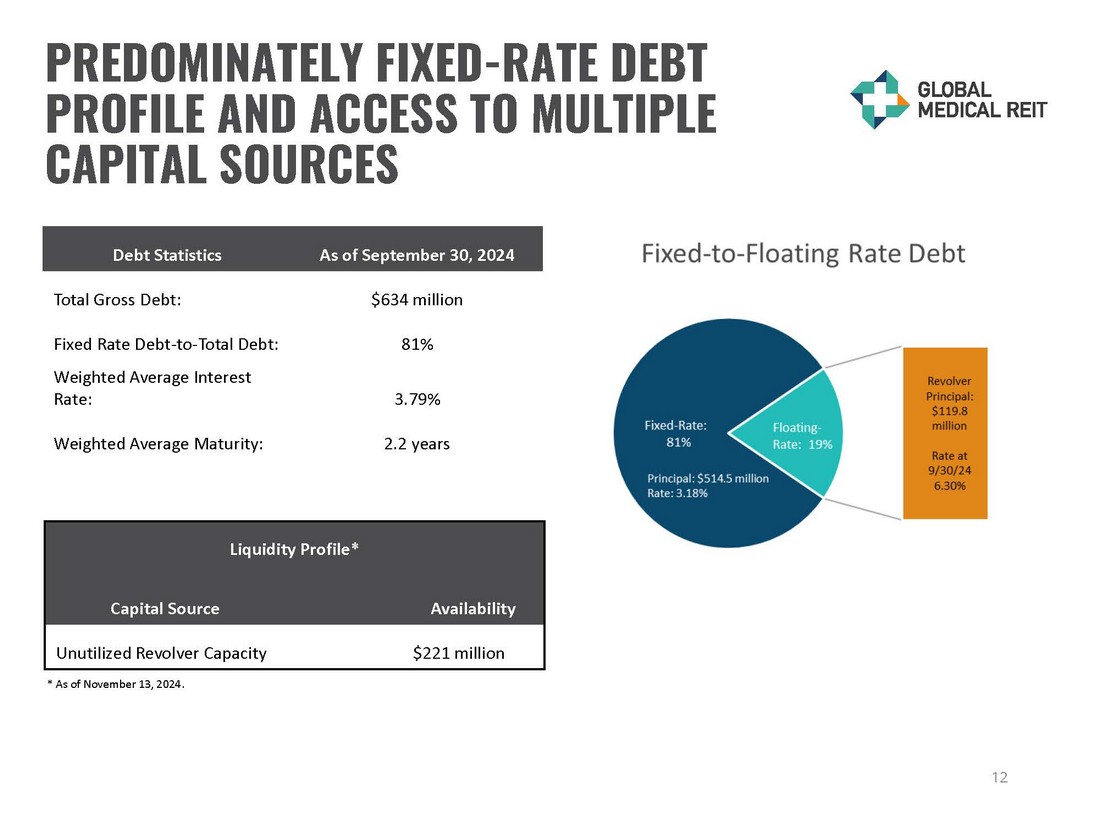

PREDOMINATELY FIXED - RATE DEBT PROFILE AND ACCESS TO MULTIPLE CAPITAL SOURCES Liquidity Profile* Availability Capital Source $221 million Unutilized Revolver Capacity * As of November 13, 2024. As of September 30, 2024 Debt Statistics $634 million Total Gross Debt: 81% Fixed Rate Debt - to - Total Debt: 3.79% Weighted Average Interest Rate: 2.2 years Weighted Average Maturity: 12

INSTITUTIONAL KNOWLEDGE, HANDS - ON APPROACH Jeffrey Busch — Chairman, Chief Executive Officer and President 20+ years of experience in healthcare, real estate development, management and investment Robert Kiernan — Chief Financial Officer and Treasurer 30+ years of experience in financial accounting, reporting and management, with extensive experience in SEC reporting and SOX compliance Alfonzo Leon — Chief Investment Officer 20+ years of experience in real estate finance and has completed $3 billion of transactions Danica Holley — Chief Operating Officer 20+ years of management and business development experience Jamie Barber — General Counsel and Corporate Secretary 20+ years of experience with SEC compliance and reporting matters, corporate governance, investment banking and REIT - related capital markets 14

HIGHLY SKILLED AND DIVERSE BOARD Jeffrey Busch — Chairman, Chief Executive Officer and President 20+ years of experience in healthcare, real estate development, management and investment. Matthew Cypher, PH.D — ESG Committee Chair, Nominating and Governance Committee Member Professor at Georgetown University’s Steers Center for Global Real Estate and previously was a director at Invesco Real Estate. Henry Cole — Lead Independent Director, Compensation Committee Chair, Audit Committee Member 40+ years of successful executive management and implementation of health and medical programs involving innovations in technology, market development and service delivery. Paula Crowley — Audit Committee Member, Compensation Committee Member, ESG Committee Member 40 + years of real estate experience including co - founding Anchor Health Properties in 1987 , now Brinkman Management and Development . 15 Ronald Marston — Nominating and Governance Committee Chair, Compensation Committee Member 40+ years of experience in healthcare and is known as an international authority on healthcare systems and trends. Lori Wittman — Audit Committee Chair, Nominating and Governance Committee Member, ESG Committee Member Decades of experience in senior finance and capital market positions at leading REITs and healthcare real estate development companies. Zhang Huiqi — Director Serves as non - Executive Director of Xingye Wulian Service Group Co. Ltd, and the supervisor for Henan Hongguang Real Estate Limited and Henan Zensun Corporate Development Group Company Limited.

• Working with tenants to improve energy consumption, carbon emissions and efficiency • Board of Directors formed a committee for oversight of corporate sustainability issues • Continue to improve Company’s GRESB score • Completed an Employee Engagement Survey to capture information on employee engagement, demographic data, and work satisfaction • Board of Directors – 71% independent and 43% women • Member of National Association of Corporate Directors COMMITTED TO CORPORATE RESPONSIBILITY 16

FORWARD LOOKING STATEMENT Certain statements contained herein may be considered “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and it is the Company’s intent that any such statements be protected by the safe harbor created thereby. These forward - looking statements are identified by their use of terms and phrases such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "should," "plan," "predict," "project," "will," "continue" and other similar terms and phrases, including references to assumptions and forecasts of future results. Except for historical information, the statements set forth herein including, but not limited to, any statements regarding our earnings, our liquidity, our tenants’ ability to pay rent to us, expected financial performance (including future cash flows associated with new tenants or the expansion of current properties), future dividends or other financial items; any other statements concerning our plans, strategies, objectives and expectations for future operations and future portfolio occupancy rates, our pipeline of acquisition opportunities and expected acquisition activity, including the timing and/or successful completion of any acquisitions and expected rent receipts on these properties, our expected disposition activity, including the timing and/or successful completion of any dispositions and the expected use of proceeds therefrom, and any statements regarding future economic conditions or performance are forward - looking statements. These forward - looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties. Although the Company believes that the expectations, estimates and assumptions reflected in its forward - looking statements are reasonable, actual results could differ materially from those projected or assumed in any of the Company’s forward - looking statements. Additional information concerning us and our business, including additional factors that could materially and adversely affect our financial results, include, without limitation, the risks described under Part I, Item 1A - Risk Factors, in our Annual Report on Form 10 - K, our Quarterly Reports on Form 10 - Q, and in our other filings with the SEC. You are cautioned not to place undue reliance on forward - looking statements. The Company does not intend, and undertakes no obligation, to update any forward - looking statement. This presentation includes information regarding certain of our tenants, which are not subject to SEC reporting requirements. The information related to our tenants contained in this report was provided to us by such tenants or was derived from publicly available information. We have not independently investigated or verified this information. We have no reason to believe that this information is inaccurate in any material respect, but we cannot provide any assurance of its accuracy. We are providing this data for informational purposes only. 17

DISCLOSURES Rent Coverage Ratio and Other Matters For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded credit - rated tenants or their subsidiaries for which financial statements were either not available or not sufficiently detailed. These ratios are based on the latest available information only. Most tenant financial statements are unaudited and we have not independently verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information is accurate or complete. Certain other tenants (approximately 19% of our portfolio) are excluded from the calculation due to (i) lack of available financial information or (ii) small tenant size. Additionally, included within 19% of non - reporting tenants is Pipeline Healthcare, LLC, which (i) was sold to Heights Healthcare in October 2023 and is being operated under new management and (ii) occupies our only acute care hospital asset, which is not one of our core asset classes. Additionally, our Rent Coverage Ratio adds back physician distributions and compensation. Management believes all adjustments are reasonable and necessary. Additional Information The information in this document should be read in conjunction with the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K, and other information filed with, or furnished to, the SEC. You can access the Company’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.globalmedicalreit.com) under “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into, this Earnings Supplemental. You also can review these SEC filings and other information by accessing the SEC’s website at http://www.sec.gov. Certain information contained in this package, including, but not limited to, information contained in our Top 10 tenant profiles is derived from publicly - available third - party sources. The Company has not independently verified this information and there can be no assurance that such information is accurate or complete. 18