Exhibit 99.1

Investor Presentation May 2025

Our primary mission is to attain earnings growth with a well covered dividend by maximizing the investment spread in our healthcare real estate assets. Our strategies to achieve this mission are as follows: • Asset Type - primarily invest in off - campus, out - patient medical facilities, and post - acute, in - patient medical facilities; • Asset Yield - acquire properties with attractive capitalization rates; • Tenants – acquire properties that are tenanted by profitable national or regional healthcare systems or physician groups; and • Management – utilize our experienced management team to operate our company and portfolio to maximize returns to investors. 2 MISSION STATEMENT AND STRATEGY

On May 28, 2025 the Board of Directors reduced the Company’s quarterly common stock dividend from $0.21 per share to $0.15 per share. We believe the reduction to the dividend best positions the Company for future growth, strengthens the balance sheet, and provides investors with an attractively yielding, well - covered dividend. • Positions for Future Growth – The reduction of the dividend provides balance sheet flexibility to optimize growth opportunities, both internal and external. • Strengthens Balance Sheet – Reduction to dividend generates additional free cash flow that allows for organic reduction of leverage and improved cost of capital. • Over $17 million annually of estimated retained cash flow*. • Well Covered Dividend – Common dividend and estimated future capital expenditures are projected to be fully funded through expected operating cash flows. 3 DIVIDEND OVERVIEW *Assumes a $0.60 annual dividend rate per share on approximately 72.5 million shares of common stock and operating partnershi p u nits outstanding as of March 31, 2025.

• YTD 2025 Investment Activity: • $69.6 million of total acquisitions, consisting of 5 properties with 486,598 leasable square feet, at a 9.0% weighted average capitalization rate. • Sold two medical facilities, receiving aggregate gross proceeds of $8.2 million, resulting in an aggregate gain of $1.4 million. • 2024 Investment Activity: • $80.3 million of total acquisitions, consisting of 15 properties with 254,220 leasable square feet, at an 8.0% weighted average capitalization rate. • Completed seven dispositions, including two properties sold to the Company’s joint venture with Heitman, generating aggregate gross proceeds of $60.7 million, resulting in an aggregate gain on sale of $4.2 million. • Beaumont, TX Facility: • Rent commenced on a new, 15 - year, triple - net lease with an affiliate of CHRISTUS Health with $2.9 million of annual base rent for the first lease year and 2.5% annual rent increases thereafter, replacing Steward Health Care who filed for bankruptcy in May 2024 and rejected its lease at this facility. 4 BUSINESS UPDATE* *As of May 27, 2025, unless otherwise stated.

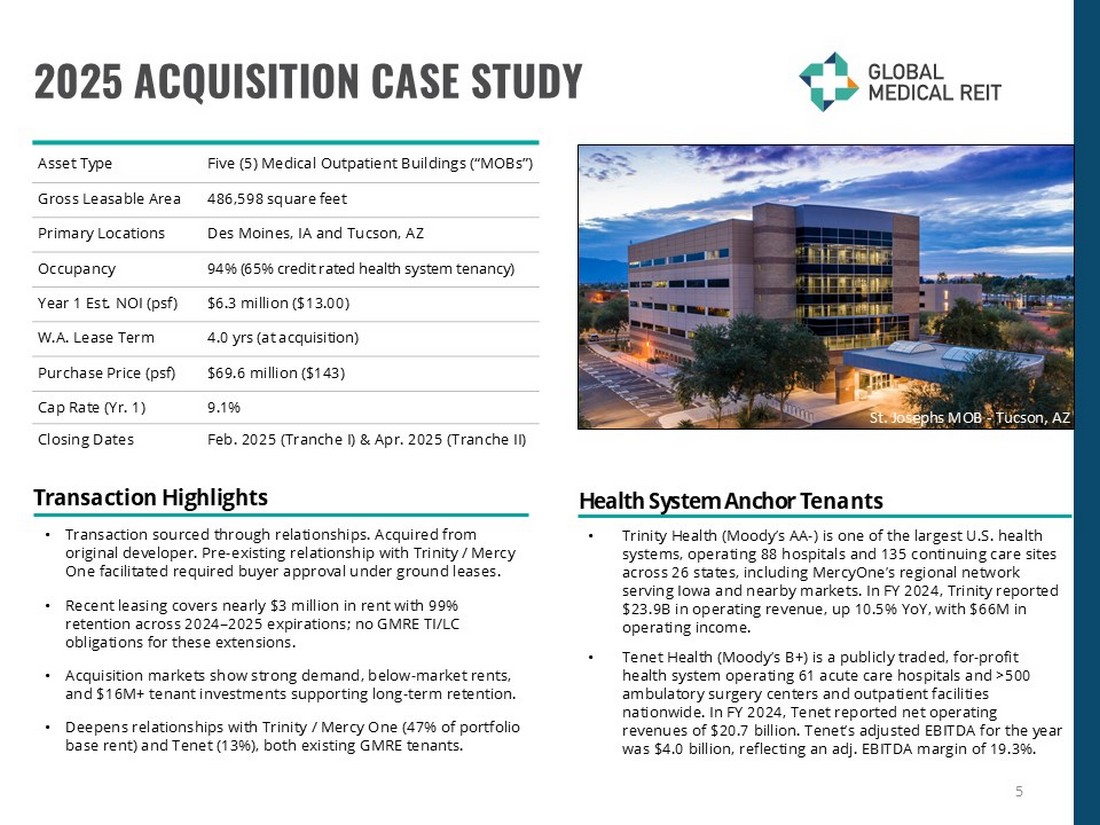

5 2025 ACQUISITION CASE STUDY Five (5) Medical Outpatient Buildings (“MOBs”) Asset Type 486,598 square feet Gross Leasable Area Des Moines, IA and Tucson, AZ Primary Locations 94% (65% credit rated health system tenancy) Occupancy $ 6.3 million ($ 13.00) Year 1 Est. NOI ( psf) 4.0 yrs (at acquisition) W.A. Lease Term $ 69.6 million ($ 143 ) Purchase Price (psf) 9.1 % Cap Rate (Yr. 1 ) Feb. 2025 (Tranche I) & Apr. 2025 (Tranche II) Closing Dates Transaction Highlights • Transaction sourced through relationships. Acquired from original developer. Pre - existing relationship with Trinity / Mercy One facilitated required buyer approval under ground leases. • Recent leasing covers nearly $3 million in rent with 99% retention across 2024 – 2025 expirations; no GMRE TI/LC obligations for these extensions. • Acquisition markets show strong demand, below - market rents, and $16M+ tenant investments supporting long - term retention. • Deepens relationships with Trinity / Mercy One (47% of portfolio base rent) and Tenet (13%), both existing GMRE tenants. Health System Anchor Tenants • Trinity Health (Moody’s AA - ) is one of the largest U.S. health systems, operating 88 hospitals and 135 continuing care sites across 26 states, including MercyOne’s regional network serving Iowa and nearby markets. In FY 2024, Trinity reported $23.9B in operating revenue, up 10.5% YoY, with $66M in operating income. • Tenet Health (Moody’s B+) is a publicly traded, for - profit health system operating 61 acute care hospitals and >500 ambulatory surgery centers and outpatient facilities nationwide. In FY 2024, Tenet reported net operating revenues of $20.7 billion. Tenet’s adjusted EBITDA for the year was $4.0 billion, reflecting an adj. EBITDA margin of 19.3%. St. Josephs MOB - Tucson, AZ

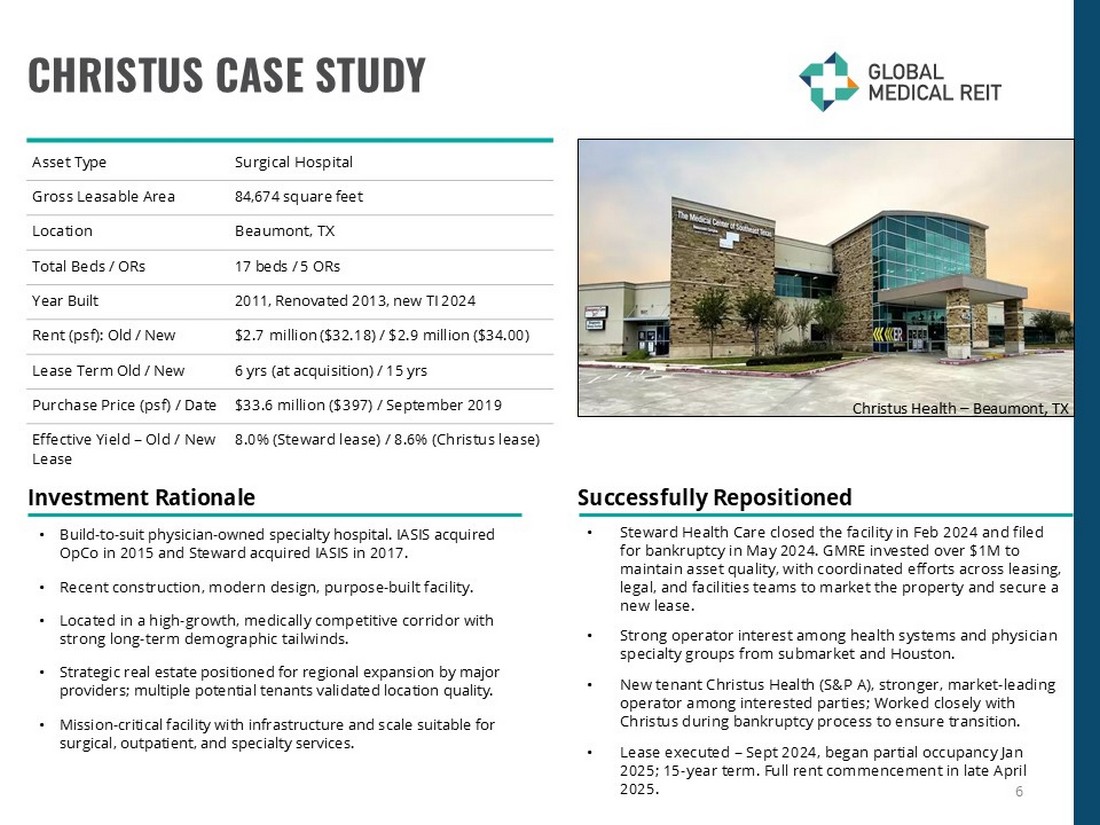

6 CHRISTUS CASE STUDY Surgical Hospital Asset Type 84,674 square feet Gross Leasable Area Beaumont, TX Location 1 7 beds / 5 ORs Total Beds / ORs 2011 , Renovated 2013, new TI 2024 Year Built $ 2.7 million ($32. 18) / $2.9 million ($34.00) Rent (psf): Old / New 6 y r s (at acquisition) / 15 yrs Lease Term Old / New $ 33 . 6 million ($ 397 ) / September 2019 Purchase Price (psf) / Date 8.0 % (Steward lease) / 8.6 % (Christus lease) Effective Yield – Old / New Lease Investment Rationale • Build - to - suit physician - owned specialty hospital. IASIS acquired OpCo in 2015 and Steward acquired IASIS in 2017. • Recent construction, modern design, purpose - built facility. • Located in a high - growth, medically competitive corridor with strong long - term demographic tailwinds. • Strategic real estate positioned for regional expansion by major providers; multiple potential tenants validated location quality. • Mission - critical facility with infrastructure and scale suitable for surgical, outpatient, and specialty services. Successfully Repositioned • Steward Health Care closed the facility in Feb 2024 and filed for bankruptcy in May 2024. GMRE invested over $1M to maintain asset quality, with coordinated efforts across leasing, legal, and facilities teams to market the property and secure a new lease. • Strong operator interest among health systems and physician specialty groups from submarket and Houston. • New tenant Christus Health (S&P A), stronger, market - leading operator among interested parties; Worked closely with Christus during bankruptcy process to ensure transition. • Lease executed – Sept 2024, began partial occupancy Jan 2025; 15 - year term. Full rent commencement in late April 2025. Christus Health – Beaumont, TX

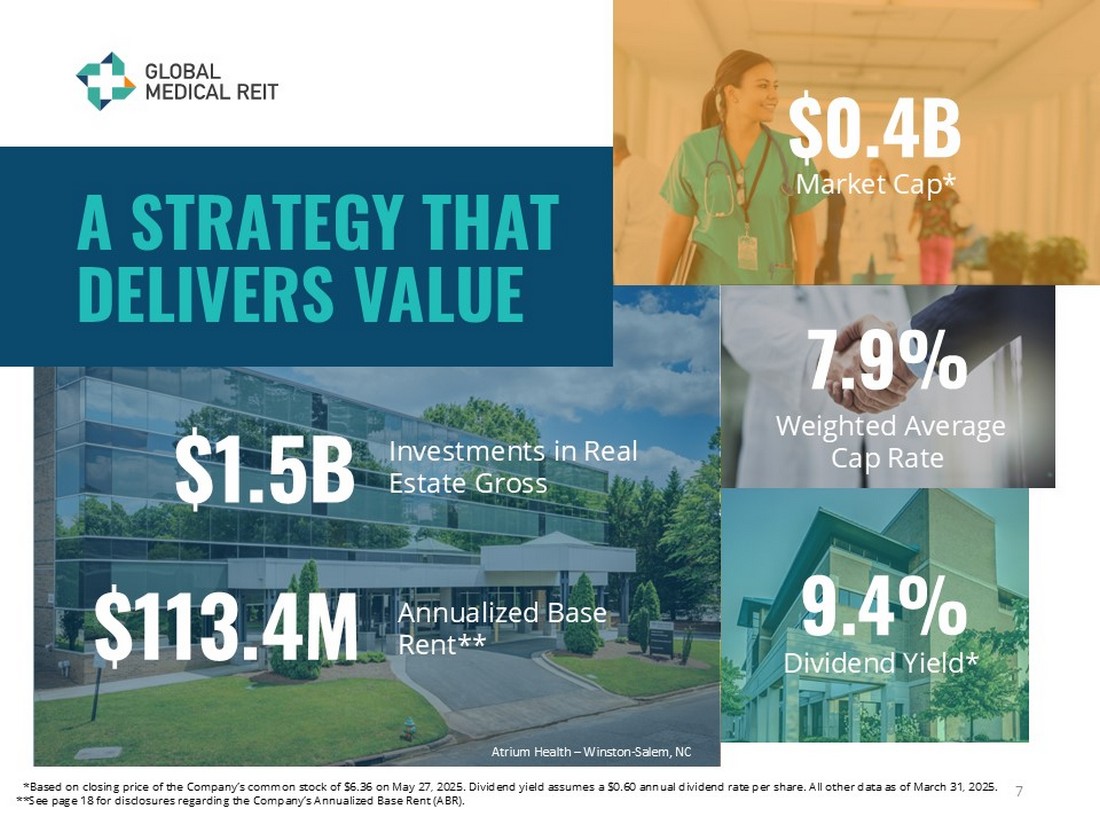

7 A STRATEGY THAT DELIVERS VALUE $1.5B Investments in Real Estate Gross $0.4B Market Cap* 7.9% Weighted Average Cap Rate 9.4% Dividend Yield* *Based on closing price of the Company’s common stock of $6.36 on May 27, 2025. Dividend yield assumes a $0.60 annual dividen d rate per share. All other data as of March 31, 2025. **See page 18 for disclosures regarding the Company’s Annualized Base Rent (ABR). Atrium Health – Winston - Salem, NC Annualized Base Rent** $113.4M

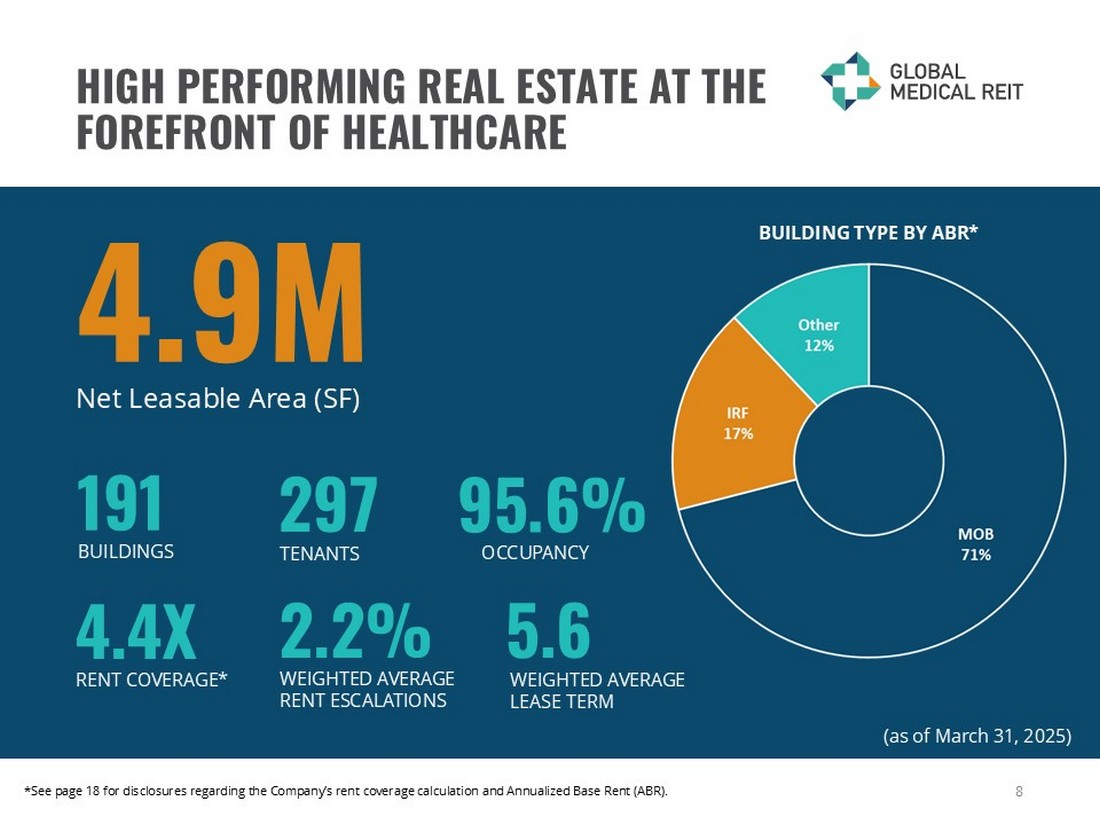

HIGH PERFORMING REAL ESTATE AT THE FOREFRONT OF HEALTHCARE 8 4.4X RENT COVERAGE* 2.2% WEIGHTED AVERAGE RENT ESCALATIONS 5.6 WEIGHTED AVERAGE LEASE TERM 191 BUILDINGS 297 TENANTS 95.6% OCCUPANCY 4.9M Net Leasable Area (SF) *See page 18 for disclosures regarding the Company’s rent coverage calculation and Annualized Base Rent (ABR). BUILDING TYPE BY ABR* (as of March 31, 2025)

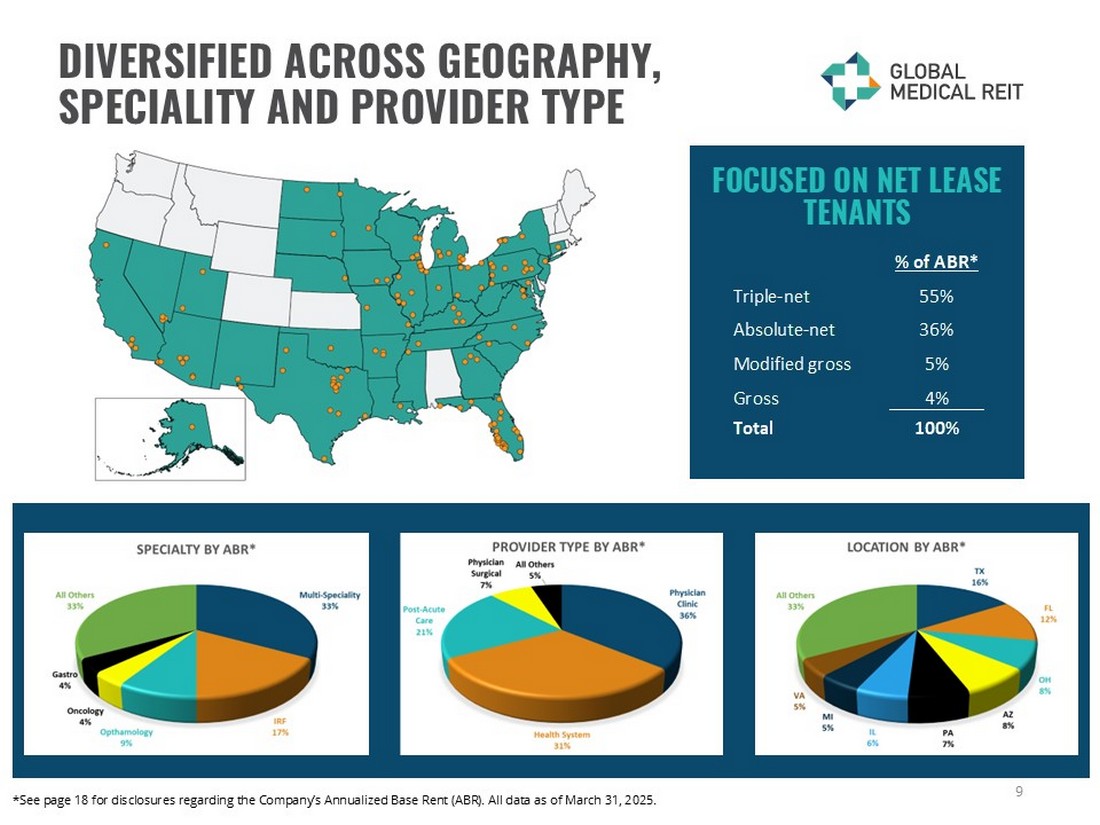

DIVERSIFIED ACROSS GEOGRAPHY, SPECIALITY AND PROVIDER TYPE 9 FOCUSED ON NET LEASE TENANTS % of ABR* Triple-net 55% Absolute-net 36% Modified gross 5% Gross 4% Total 100% *See page 18 for disclosures regarding the Company’s Annualized Base Rent (ABR). All data as of March 31, 2025.

10 DOMINANT LOCAL PHYSICIAN GROUPS POST - ACUTE CARE PROVIDERS, SURGICAL OPERATOR PARNERSHIPS, AND HEALTHCARE CORPORATES STRONG, DIVERSE HEALTHCARE TENANT BASE NOT - FOR - PROFIT HEALTH SYSTEMS AFFILIATIONS DOMINANT LOCAL PHYSICIAN GROUPS

11 INVESTING IN THE FUTURE OF HEALTHCARE Encompass – Mesa, AZ Southlake Heart & Vascular Institute – Clermont, FL Mission Health – Livonia, MI Legent Hospital for Special Surgery – Plano, TX

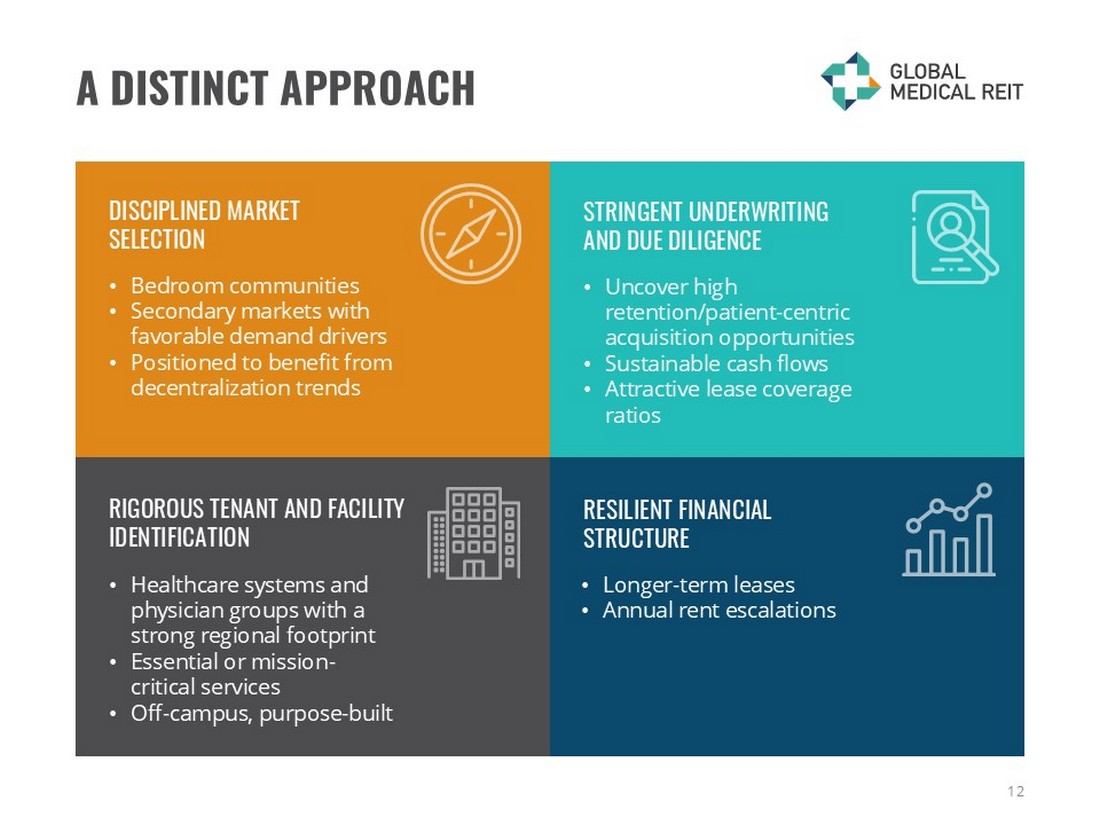

A DISTINCT APPROACH 12 • Longer - term leases • Annual rent escalations • Bedroom communities • Secondary markets with favorable demand drivers • Positioned to benefit from decentralization trends • Uncover high retention/patient - centric acquisition opportunities • Sustainable cash flows • Attractive lease coverage ratios • Healthcare systems and physician groups with a strong regional footprint • Essential or mission - critical services • Off - campus, purpose - built DISCIPLINED MARKET SELECTION STRINGENT UNDERWRITING AND DUE DILIGENCE RIGOROUS TENANT AND FACILITY IDENTIFICATION RESILIENT FINANCIAL STRUCTURE

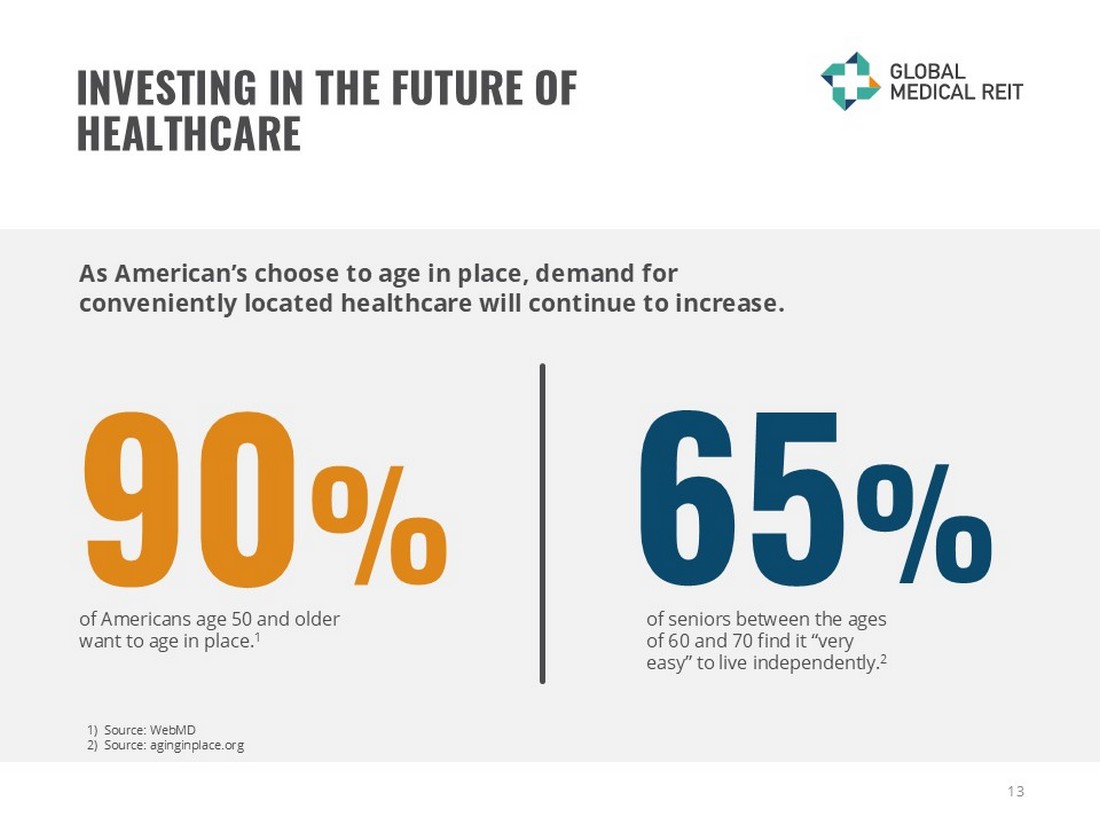

INVESTING IN THE FUTURE OF HEALTHCARE 13 90 % of Americans age 50 and older want to age in place. 1 65 % of seniors between the ages of 60 and 70 find it “very easy” to live independently. 2 As American’s choose to age in place, demand for conveniently located healthcare will continue to increase. 1) Source: WebMD 2) Source: aginginplace.org

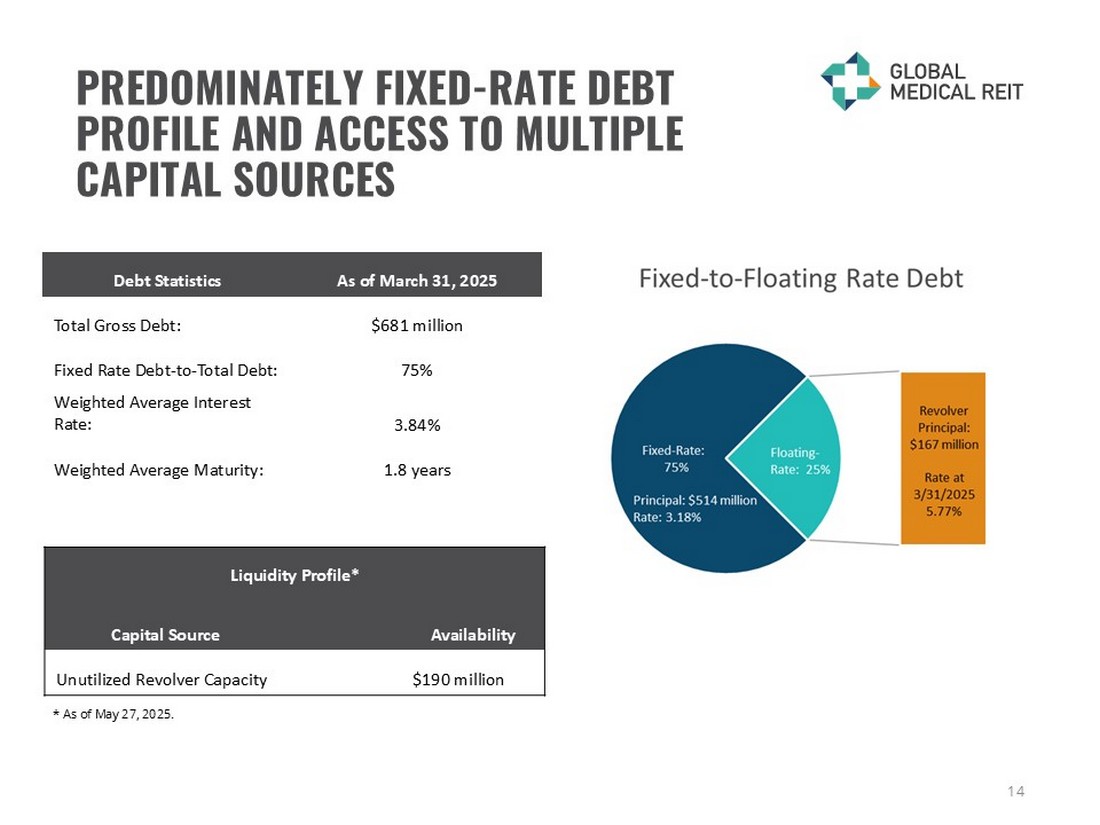

PREDOMINATELY FIXED - RATE DEBT PROFILE AND ACCESS TO MULTIPLE CAPITAL SOURCES 14 Liquidity Profile* Availability Capital Source $190 million Unutilized Revolver Capacity * As of May 27, 2025. As of March 31, 2025 Debt Statistics $681 million Total Gross Debt: 75% Fixed Rate Debt - to - Total Debt: 3.84% Weighted Average Interest Rate: 1.8 years Weighted Average Maturity:

INSTITUTIONAL KNOWLEDGE, HANDS - ON APPROACH Jeffrey Busch — Chairman, Chief Executive Officer and President 20+ years of experience in healthcare, real estate development, management and investment Robert Kiernan — Chief Financial Officer and Treasurer 30+ years of experience in financial accounting, reporting and management, with extensive experience in SEC reporting and SOX compliance Alfonzo Leon — Chief Investment Officer 20+ years of experience in real estate finance and has completed $3 billion of transactions Danica Holley — Chief Operating Officer 20+ years of management and business development experience Jamie Barber — General Counsel and Corporate Secretary 20+ years of experience with SEC compliance and reporting matters, corporate governance, investment banking and REIT - related capital markets 15

HIGHLY SKILLED AND DIVERSE BOARD 16 Jeffrey Busch — Chairman, Chief Executive Officer and President 20+ years of experience in healthcare, real estate development, management and investment. Lori Wittman — Lead Independent Director, Audit Committee Chair, ESG Committee Member Decades of experience in senior finance and capital market positions at leading REITs and healthcare real estate development companies. Matthew Cypher, PH.D — Nominating and Corporate Governance Committee Chair, ESG Committee Member, Audit Committee Member Professor at Georgetown University’s Steers Center for Global Real Estate and previously was a director at Invesco Real Estate. Henry Cole — ESG Committee Chair, Compensation Committee Member, Audit Committee Member, Nominating and Corporate Governance Committee Member 40+ years of successful executive management and implementation of health and medical programs involving innovations in technology, market development and service delivery. Paula Crowley — Compensation Committee Chair, Audit Committee Member, Nominating and Corporate Governance Committee Member 40+ years of real estate experience including co - founding Anchor Health Properties in 1987. Ronald Marston — Nominating and Corporate Governance Committee Member, Compensation Committee Member 40+ years of experience in healthcare and is known as an international authority on healthcare systems and trends. Zhang Huiqi — Director Serves as non - Executive Director of Xingye Wulian Service Group Co. Ltd, and the supervisor for Henan Hongguang Real Estate Limited and Henan Zensun Corporate Development Group Company Limited.

FORWARD LOOKING STATEMENTS Certain statements contained herein may be considered “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and it is the Company’s intent that any such statements be protected by the safe harbor create d thereby. These forward - looking statements are identified by their use of terms and phrases such as "anticipate," "believe," "cou ld," "estimate," "expect," "intend," "may," "should," "plan," "predict," "project," "will," "continue" and other similar terms and ph rases, including references to assumptions and forecasts of future results. Except for historical information, the statements set fo rth herein including, but not limited to, any statements regarding our earnings, our liquidity, our tenants’ ability to pay rent to us, exp ected financial performance (including future cash flows associated with new tenants or the expansion of current properties), futur e dividends (including future dividend coverage and payout ratios) or other financial items; any other statements concerning ou r p lans, strategies, objectives and expectations for future operations and future portfolio occupancy rates, our pipeline of acquisiti on opportunities and expected acquisition activity, including the timing and/or successful completion of any acquisitions and ex pec ted rent receipts on these properties, our expected disposition activity, including the timing and/or successful completion of an y dispositions and the expected use of proceeds therefrom, and any statements regarding future economic conditions or performan ce are forward - looking statements. These forward - looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties. Although the Company believes that the expectations, estimate s a nd assumptions reflected in its forward - looking statements are reasonable, actual results could differ materially from those projec ted or assumed in any of the Company’s forward - looking statements. Additional information concerning us and our business, including additional factors that could materially and adversely affect our financial results, include, without limitation, the risks d esc ribed under Part I, Item 1A - Risk Factors, in our Annual Report on Form 10 - K, our Quarterly Reports on Form 10 - Q, and in our other filings with the SEC. You are cautioned not to place undue reliance on forward - looking statements. The Company does not intend, and undertakes no obligation, to update any forward - looking statement. This presentation includes information regarding certain of our tenants, which are not subject to SEC reporting requirements. Th e information related to our tenants contained in this report was provided to us by such tenants or was derived from publicly a vai lable information. We have not independently investigated or verified this information. We have no reason to believe that this info rma tion is inaccurate in any material respect, but we cannot provide any assurance of its accuracy. We are providing this data for informational purposes only. 17

DISCLOSURES Rent Coverage Ratio and Other Matters For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded credit - rated tenants or their subsidiaries for which financial statements were either not available or not sufficiently detailed. Th ese ratios are based on the latest available information only. Most tenant financial statements are unaudited and we have not independen tly verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information i s accurate or complete. Certain other tenants (approximately 21% of our portfolio) are excluded from the calculation due to ( i ) lack of available financial information or (ii) small tenant size. Additionally, included within 21 % of non - reporting tenants is Pipeline Healthcare, LLC, which ( i ) was sold to Heights Healthcare in October 2023 and is being operated under new management and (ii) occupies our only acute care hospital asset, which is not one of our core asset classes. Additionally, our Rent Coverage Rati o a dds back physician distributions and compensation. Management believes all adjustments are reasonable and necessary. Annualized Base Rent Annualized base rent represents monthly base rent for March 2025 (or, for recent acquisitions, monthly base rent for the mont h o f acquisition), multiplied by 12 (or base rent net of annualized expenses for properties with gross leases). Accordingly, this methodology produces an annualized amount as of a point in time but does not take into account future ( i ) contractual rental rate increases, (ii) leasing activity or (iii) lease expirations. Additionally, leases that are accounted for on a cash - collected bas is, or that are in a free rent period, are not included in annualized base rent. Additional Information The information in this document should be read in conjunction with the Company’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K, and other information filed with, or furnished to, the SEC. You can access the Compan y’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.globalmedicalreit.com) under “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not , and shall not be deemed to be, a part of, or incorporated into, this Earnings Supplemental. You also can review these SEC filings an d other information by accessing the SEC’s website at http://www.sec.gov. Certain information contained in this package, including, but not limited to, information contained in our Top 10 tenant prof ile s is derived from publicly - available third - party sources. The Company has not independently verified this information and there can b e no assurance that such information is accurate or complete. 18