Exhibit 99.1

www.globalmedicalreit.com Capital Partners to Health Care Providers INVESTOR PRESENTATION January 2017

www.globalmedicalreit.com DISCLAIMER 2 This presentation is for informational purposes only and does not constitute an offer to sell, or a solicitation of offers to purchase, the Company’s securities . The information contained in this presentation does not purport to be complete and should not be relied upon as a basis for making an investment decision in the Company’s securities . This presentation also contains statements that, to the extent they are not recitations of historical fact, constitute “forward - looking statements . ” Forward - looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology . The forward - looking statements included herein are based upon the Company’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control . Although the Company believes that the expectations reflected in such forward - looking statements are based on reasonable assumptions, the Company’s actual results and performance could differ materially from those set forth in the forward - looking statements due to the impact of many factors including, but not limited to, those discussed under “Risk Factors” in the Company’s Annual Report on Form 10 - K and any prospectus or prospectus supplement filed with the Securities and Exchange Commission . The Company undertakes no obligation to update or revise any such information for any reason after the date of this presentation, unless required by law .

www.globalmedicalreit.com AT A GLANCE ▪ Well positioned to execute on pipeline acquisitions using recently - announced credit facility ▪ Efficient balance of leveraged properties with additional properties that can be mortgaged STOCK INFORMATION * 3 BALANCE SHEET HIGHLIGHTS • GMRE (NYSE) STOCK PRICE: $8.92 • Market Capitalization: $157 million • Common shares outstanding: 17.6 million * Data is as of December 30, 2016 KEY BUSINESS POINTS • Healthcare REIT focused on the acquisition and leasing of state - of - the - art, purpose built healthcare facilities • Substantial pipeline of high quality assets • Experienced management • Attractive industry tailwinds

www.globalmedicalreit.com LEADERSHIP 4 ▪ Over 25 years of experience in medical and hospital real estate ▪ Vice President – Acquisitions at Windrose Medical Properties Trust (NYSE: WRS), which was acquired by Welltower (NYSE: HCN) ▪ Executive responsible for business development for Healthcare Property Investors (NYSE: HCP) and helped it grow from AUM of $ 300 million to over $3.5 billion ▪ Developed specialized real estate financing of hospitals and medical clinics as part of GE financial services ▪ Over 20 years of experience in accounting and extensive experience in operational business development, creating policy and p roc edures specific to REIT compliance ▪ Prior role as accounting manager of Washington Real Estate Investment Trust (NYSE: WRE) ▪ Previously CFO of Quantum Real Estate Management ▪ Over 15 years of experience in real estate finance and has completed $ 3 billion of transactions ▪ Prior experience as principal at investment advisor to pension funds and investment banker representing healthcare systems, developers and REITs ▪ Healthcare real estate investment banker for Cain Brothers DAVID YOUNG , Chief Executive Officer DON McCLURE , Chief Financial Officer and Treasurer ALFONZO LEON , Chief Investment Officer Key team members average over 20 years healthcare and real estate experience ▪ Over 20 years of experience in healthcare, real estate development, management and investment ▪ Former assistant to the U.S. Secretary of Housing & Urban Development ▪ United States Special Representative to United Nations in Geneva ▪ Developed large - scale residential, commercial, hospitality and retail properties JEFFREY BUSCH , Chairman and President

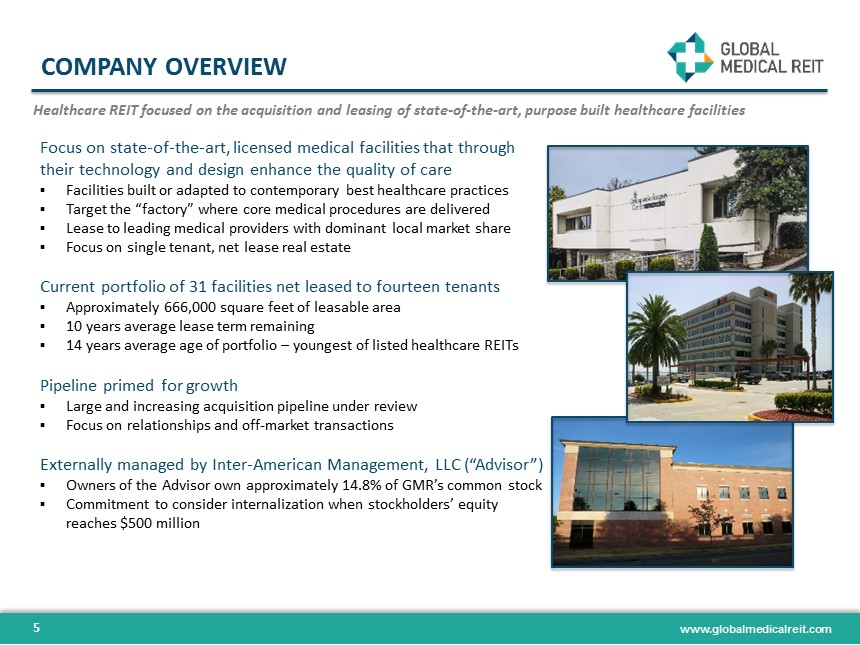

www.globalmedicalreit.com COMPANY OVERVIEW 5 Healthcare REIT focused on the acquisition and leasing of state - of - the - art, purpose built healthcare facilities Focus on state - of - the - art, licensed medical facilities that through their technology and design enhance the quality of care ▪ Facilities built or adapted to contemporary best healthcare practices ▪ Target the “factory” where core medical procedures are delivered ▪ Lease to leading medical providers with dominant local market share ▪ Focus on single tenant, net lease real estate Current portfolio of 31 facilities net leased to fourteen tenants ▪ Approximately 666,000 square feet of leasable area ▪ 10 years average lease term remaining ▪ 14 years average age of portfolio – youngest of listed healthcare REITs Pipeline primed for growth ▪ Large and increasing acquisition pipeline under review ▪ Focus on relationships and off - market transactions Externally managed by Inter - American Management, LLC (“Advisor”) ▪ Owners of the Advisor own approximately 14.8% of GMR’s common stock ▪ Commitment to consider internalization when stockholders’ equity reaches $500 million

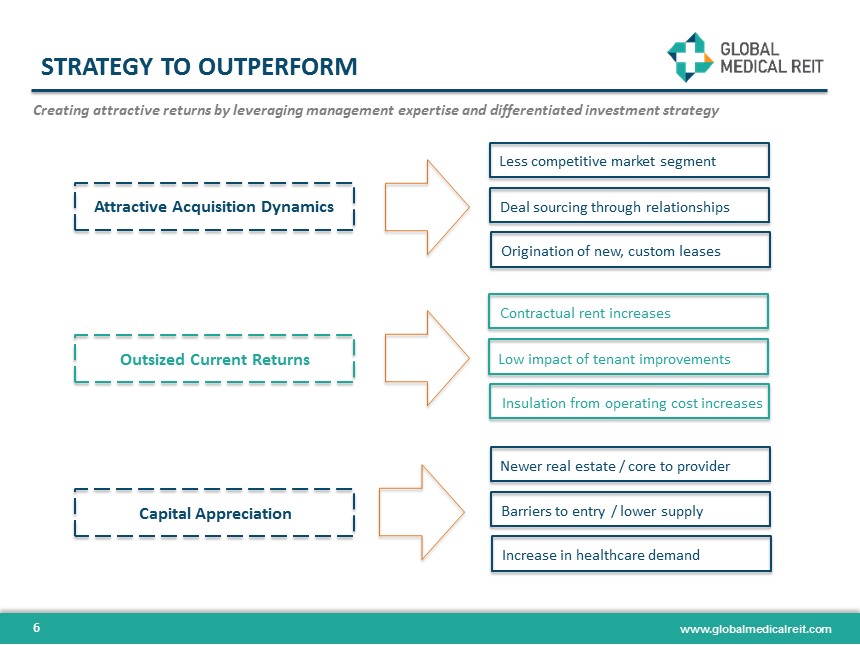

www.globalmedicalreit.com STRATEGY TO OUTPERFORM 6 Creating attractive returns by leveraging management expertise and differentiated investment strategy Attractive Acquisition Dynamics Outsized Current Returns Capital Appreciation Less competitive market segment Deal sourcing through relationships Origination of new, custom leases Contractual rent increases Low impact of tenant improvements Insulation from operating cost increases Newer real estate / core to provider Barriers to entry / lower supply Increase in healthcare demand

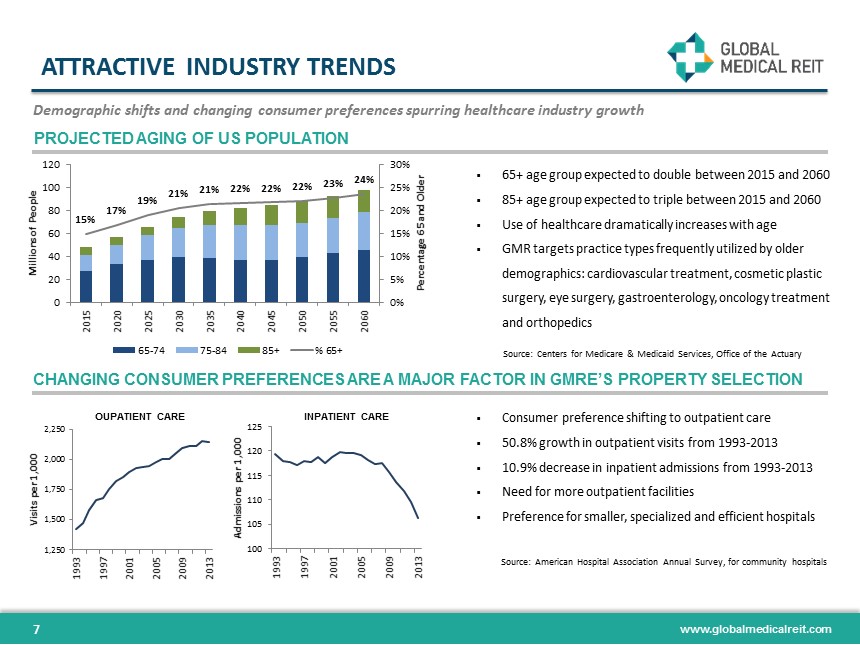

www.globalmedicalreit.com ATTRACTIVE INDUSTRY TRENDS 7 PROJECTED AGING OF US POPULATION CHANGING CONSUMER PREFERENCES ARE A MAJOR FACTOR IN GMRE’S PROPERTY SELECTION 15% 17% 19% 21% 21% 22% 22% 22% 23% 24% 0% 5% 10% 15% 20% 25% 30% 0 20 40 60 80 100 120 2015 2020 2025 2030 2035 2040 2045 2050 2055 2060 Percentage 65 and Older Millions of People 65-74 75-84 85+ % 65+ ▪ 65+ age group expected to double between 2015 and 2060 ▪ 85+ age group expected to triple between 2015 and 2060 ▪ Use of healthcare dramatically increases with age ▪ GMR targets practice types frequently utilized by older demographics: cardiovascular treatment, cosmetic plastic surgery, eye surgery, gastroenterology, oncology treatment and orthopedics Source: Centers for Medicare & Medicaid Services, Office of the Actuary 1,250 1,500 1,750 2,000 2,250 1993 1997 2001 2005 2009 2013 Visits per 1,000 100 105 110 115 120 125 1993 1997 2001 2005 2009 2013 Admissions per 1,000 OUPATIENT CARE INPATIENT CARE Demographic shifts and changing consumer preferences spurring healthcare industry growth ▪ Consumer preference shifting to outpatient care ▪ 50.8% growth in outpatient visits from 1993 - 2013 ▪ 10.9% decrease in inpatient admissions from 1993 - 2013 ▪ Need for more outpatient facilities ▪ Preference for smaller, specialized and efficient hospitals Source: American Hospital Association Annual Survey, for community hospitals

www.globalmedicalreit.com EVIDENCE - BASED DESIGN 8 As EBD research becomes more widely recognized and reproduced, facilities with these features expect to outperform STATE - OF - THE - ART MEDICAL TECHNOLOGY ADVANCED BUILDING ENGINEERING EFFICIENT TREATMENT AND PROCESSING DESIGN AMENITIZED PATIENT ENVIRONMENT ▪ EBD research demonstrates an interrelatedness between the design of a healthcare facility and patient outcomes ▪ Certain design elements have an important impact on productivity, safety, health and morale for both physicians and patients ▪ Facilities with these features can attract and retain strong tenants and will outperform over time BETTER PATIENT OUTCOMES

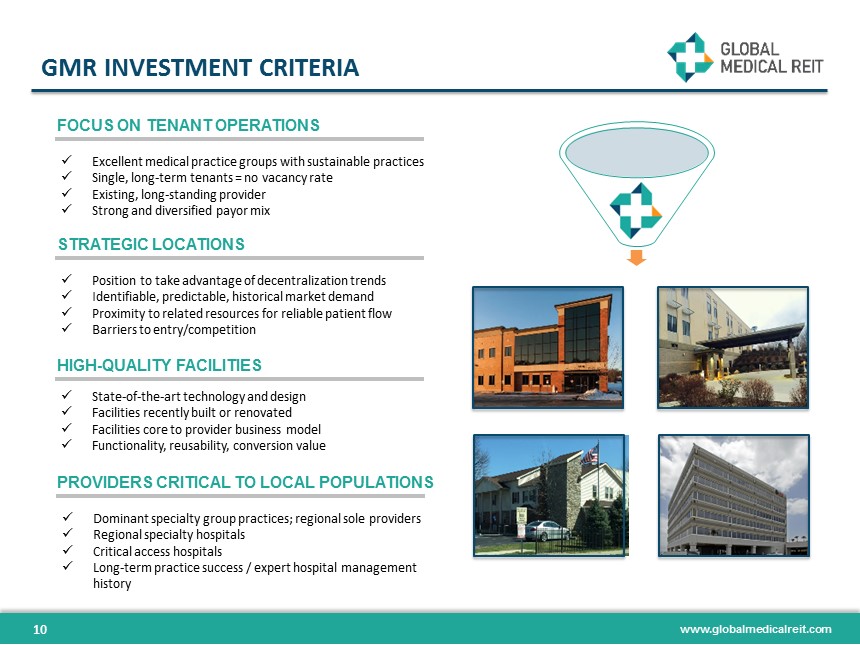

www.globalmedicalreit.com GMR INVESTMENT CRITERIA HIGH - QUALITY FACILITIES x State - of - the - art technology and design x Facilities recently built or renovated x Facilities core to provider business model x Functionality, reusability, conversion value FOCUS ON TENANT OPERATIONS x Excellent medical practice groups with sustainable practices x Single, long - term tenants = no vacancy rate x Existing, long - standing provider x Strong and diversified payor mix STRATEGIC LOCATIONS x Position to take advantage of decentralization trends x Identifiable, predictable, historical market demand x Proximity to related resources for reliable patient flow x Barriers to entry/competition x Dominant specialty group practices; regional sole providers x Regional specialty hospitals x Critical access hospitals x Long - term practice success / expert hospital management history PROVIDERS CRITICAL TO LOCAL POPULATIONS 10

www.globalmedicalreit.com OFF - MARKET DEAL SOURCING GMR executives have robust relationships with healthcare providers, allowing for direct negotiation and generation of new long term leases without broker intermediaries 11 RELATIONSHIP – BASED REAL ESTATE SOLUTIONS PHYSICIAN GROUPS HOSPITAL CHAINS OUTPATIENT TREATMENT COMPANIES BUILDERS & DEVELOPERS

www.globalmedicalreit.com MARKET DOMINANT TENANTS ESTABLISHED PROVIDER CLINICAL EXPERTISE STRONG CREDIT 12 What we seek to acquire: ▪ Demonstrated clinical leaders ▪ Going concern history ▪ High market share ▪ Stable and competent management ▪ Robust and durable payor contracts Competitive advantages: ▪ Predictable, stable rents ▪ Strong and diversified payor mix ▪ Higher barrier to entry for competitors ▪ Supports long term lease terms What we seek to acquire: ▪ Prominent local physicians ▪ Board credentials ▪ Strong peer reviews ▪ Academic identity ▪ Age - related procedure expertise Competitive advantages: ▪ Require newer, purpose - built real estate ▪ Creates patient loyalty and stronger market share ▪ Focused on the future of healthcare What we seek to acquire: ▪ Strong EBITDARM / rent coverage ▪ Guarantors with strong credit ▪ Subordination of profits to rent ▪ Operators with regional or national footprint Competitive advantages: ▪ Rent coverage in excess of peers ▪ Implicit credit stronger than peers

www.globalmedicalreit.com Target annual base rent of 7% - 9% of projected total investment cost Typically 2% - 3% annual rent escalations ▪ Attractive and sustainable base return for REIT and shareholders ▪ Built - in inflation protection Absolute NNN lease, 10 - 20 year initial lease terms ▪ No operating expense risk to GMRE ▪ Minimal recurring capital expenditure exposure ▪ Minimal asset management expense Credit enhancements mitigate risk ▪ Subordination of tenant physician salaries and medical practice profit distributions to timely payment of rent ▪ Licenses, CONs (Certificates of Need) stay with the real estate in the event of change in occupancy ▪ Personal, corporate, sponsor guarantees and/or third party letters of credit ▪ High rent coverage ratios (EBITDARM) required of tenant for security ▪ GMRE has right to evict and replace management of medical provider tenant ▪ Cross - collateralization for portfolio investments by GMRE with same operator ▪ Comprehensive tenant reporting requirements and annual audits PROPRIETARY DEAL STRUCTURES When possible, originating new leases as opposed to acquiring leased fee returns creates value 13

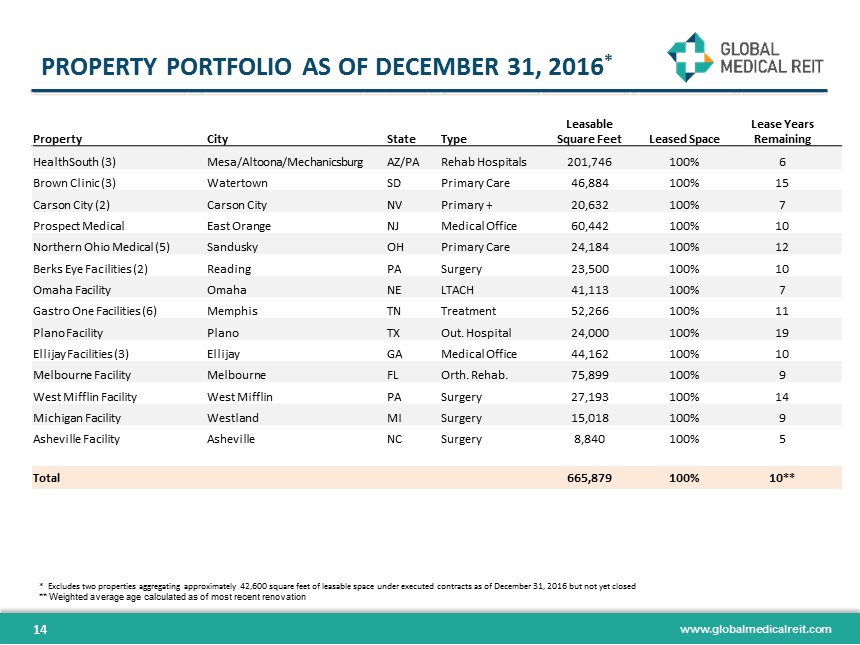

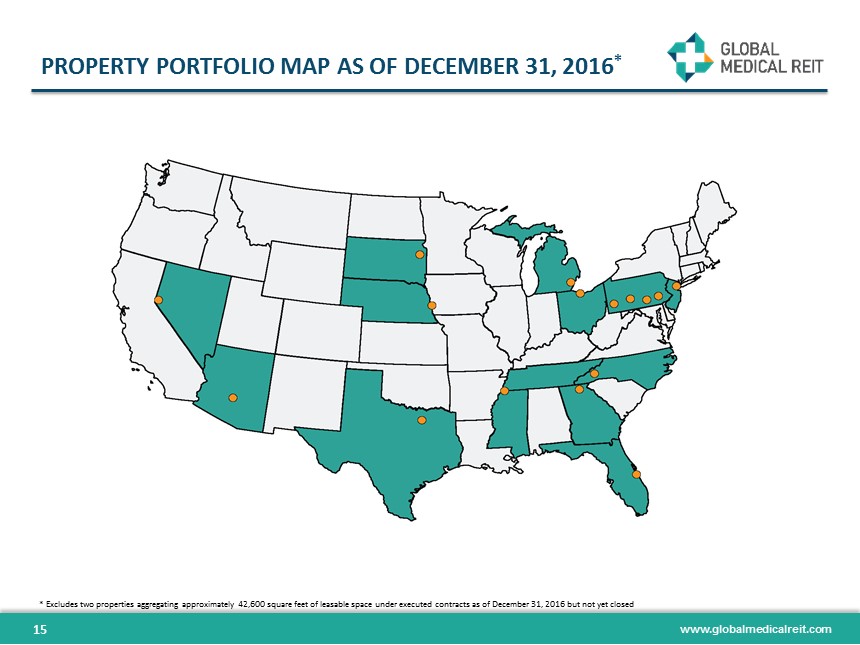

www.globalmedicalreit.com PROPERTY PORTFOLIO AS OF DECEMBER 31, 2016 * 14 * Excludes two properties aggregating approximately 42,600 square feet of leasable space under executed contracts as of Dece mbe r 31, 2016 but not yet closed ** Weighted average age calculated as of most recent renovation Property City State Type Leasable Square Feet Leased Space Lease Years Remaining HealthSouth (3) Mesa/Altoona/Mechanicsburg AZ/PA Rehab Hospitals 201,746 100% 6 Brown Clinic (3) Watertown SD Primary Care 46,884 100% 15 Carson City (2) Carson City NV Primary + 20,632 100% 7 Prospect Medical East Orange NJ Medical Office 60,442 100% 10 Northern Ohio Medical (5) Sandusky OH Primary Care 24,184 100% 12 Berks Eye Facilities (2) Reading PA Surgery 23,500 100% 10 Omaha Facility Omaha NE LTACH 41,113 100% 7 Gastro One Facilities (6) Memphis TN Treatment 52,266 100% 11 Plano Facility Plano TX Out. Hospital 24,000 100% 19 Ellijay Facilities (3) Ellijay GA Medical Office 44,162 100% 10 Melbourne Facility Melbourne FL Orth. Rehab. 75,899 100% 9 West Mifflin Facility West Mifflin PA Surgery 27,193 100% 14 Michigan Facility Westland MI Surgery 15,018 100% 9 Asheville Facility Asheville NC Surgery 8,840 100% 5 Total 665,879 100% 10**

www.globalmedicalreit.com PROPERTY PORTFOLIO MAP AS OF DECEMBER 31, 2016 * 15 * Excludes two properties aggregating approximately 42,600 square feet of leasable space under executed contracts as of Decem ber 31, 2016 but not yet closed

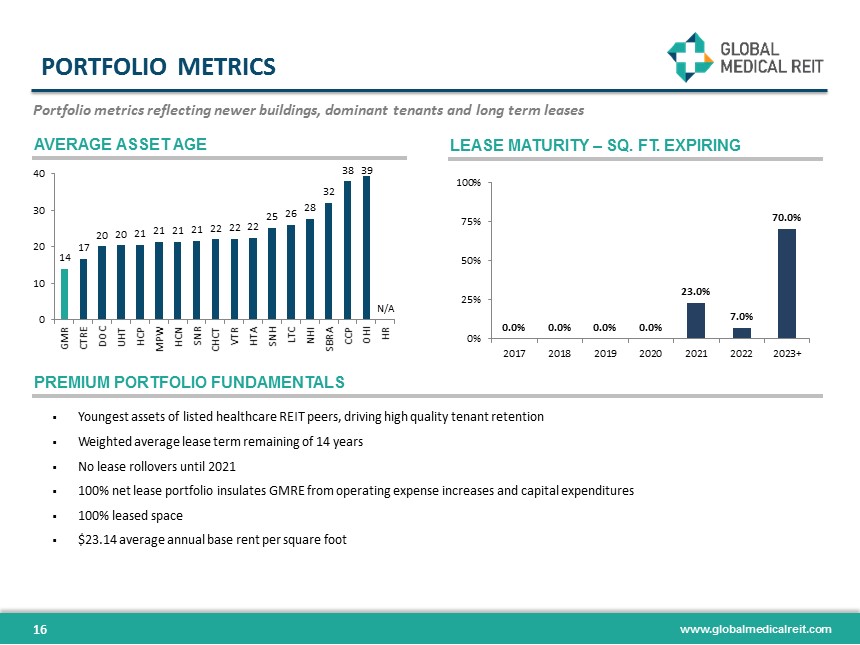

www.globalmedicalreit.com PORTFOLIO METRICS AVERAGE ASSET AGE LEASE MATURITY – SQ. FT. EXPIRING PREMIUM PORTFOLIO FUNDAMENTALS Portfolio metrics reflecting newer buildings, dominant tenants and long term leases 14 17 20 20 21 21 21 21 22 22 22 25 26 28 32 38 39 N/A 0 10 20 30 40 GMR CTRE DOC UHT HCP MPW HCN SNR CHCT VTR HTA SNH LTC NHI SBRA CCP OHI HR 0.0% 0.0% 0.0% 0.0% 23.0% 7.0% 70.0% 0% 25% 50% 75% 100% 2017 2018 2019 2020 2021 2022 2023+ 16 ▪ Youngest assets of listed healthcare REIT peers, driving high quality tenant retention ▪ Weighted average lease term remaining of 14 years ▪ No lease rollovers until 2021 ▪ 100% net lease portfolio insulates GMRE from operating expense increases and capital expenditures ▪ 100% leased space ▪ $23.14 average annual base rent per square foot

www.globalmedicalreit.com GASTRO ONE MEMPHIS, TN KEY STATISTICS SIX BUILDING PORTFOLIO TOP FACILITIES AND CREATIVE LEASE LOCALLY DOMINANT TENANT ▪ Fully operational ambulatory centers that have all scored 100% on their periodic survey inspections by the AAAHC ▪ Highly desirable office park locations ▪ Profitable operator provides high, 10.5x rent coverage ▪ GMR originated a new, long term lease with 1.75% annual rent escalators ▪ Optional future expansion of existing facilities and possible substitution of any current portfolio location with a GMR - approved new location, if needed ▪ Sourced through a trade association relationship ▪ Gastro One annually serves approximately 90% of the total caseload for gastroscopic, colonoscopic and liver scan procedures in the Memphis, TN MSA ▪ 34 doctor practice provides highest quality care ▪ Flexible lease terms allow Gastro One to expand or shift footprint with GMRE’s consent 17 Asset Type Treatment Facilities Gross Leasable Area 52,266 square feet Average Age 10 years EBITDARM / Rent 10.5x at lease inception Leased Occupancy 100% Lease Expiration 12/31/2027 Transaction Value $20.0 million

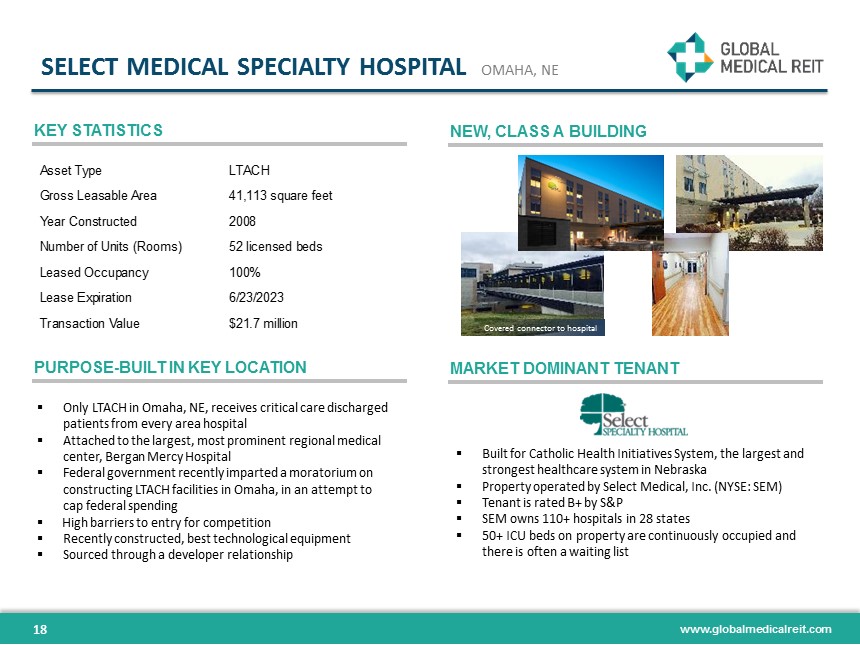

www.globalmedicalreit.com ▪ Only LTACH in Omaha, NE, receives critical care discharged patients from every area hospital ▪ Attached to the largest, most prominent regional medical center, Bergan Mercy Hospital ▪ Federal government recently imparted a moratorium on constructing LTACH facilities in Omaha, in an attempt to cap federal spending ▪ High barriers to entry for competition ▪ Recently constructed, best technological equipment ▪ Sourced through a developer relationship SELECT MEDICAL SPECIALTY HOSPITAL OMAHA, NE KEY STATISTICS NEW, CLASS A BUILDING PURPOSE - BUILT IN KEY LOCATION MARKET DOMINANT TENANT ▪ Built for Catholic Health Initiatives System, the largest and strongest healthcare system in Nebraska ▪ Property operated by Select Medical, Inc. (NYSE: SEM) ▪ Tenant is rated B+ by S&P ▪ SEM owns 110+ hospitals in 28 states ▪ 50+ ICU beds on property are continuously occupied and there is often a waiting list Covered connector to hospital 18 Asset Type LTACH Gross Leasable Area 41,113 square feet Year Constructed 2008 Number of Units (Rooms) 52 licensed beds Leased Occupancy 100% Lease Expiration 6/23/2023 Transaction Value $21.7 million

www.globalmedicalreit.com PIPELINE OVERVIEW MOVING TO DEPLOY CAPITAL ▪ July 2016 IPO proceeds fully deployed as of December 31, 2016 ▪ Year - end 2016 portfolio exceeds $200 million with leasable square feet of approximately 666,000 ▪ Multiple facilities under executed contracts or letters of intent ▪ Significant and growing pipeline of assets actively engaged PIPELINE CHARACTERISTICS ▪ Customized long - term leases ▪ Market dominant tenants ▪ Facilities core to provider business model ▪ Class A, recently built assets ▪ Current emphasis on assets within dominant health system portfolios ▪ Originating deals directly from owners of multiple properties ▪ Focus on relationships and off - market transactions SOURCING Recently - announced credit facility provides ample liquidity to continue property acquisitions 19 East Orange, NJ*

www.globalmedicalreit.com INVESTMENT HIGHLIGHTS Management Team with Public REIT Experience State - of - the - Art Healthcare Facilities Attractive Industry Trends Market Dominant Tenants High Quality Initial Portfolio Substantial Pipeline of High Quality Assets 19

www.globalmedicalreit.com APPENDIX 20

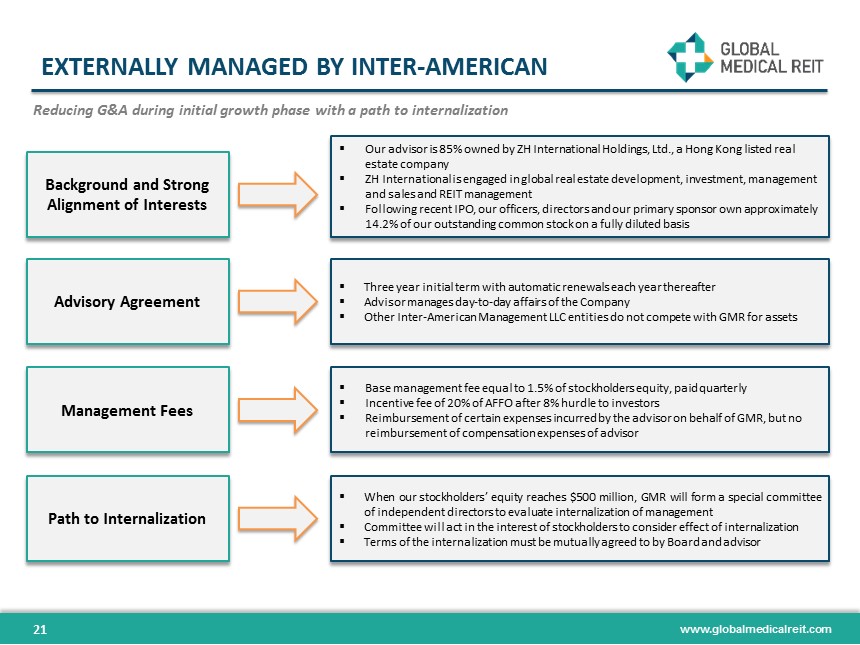

www.globalmedicalreit.com EXTERNALLY MANAGED BY INTER - AMERICAN 21 Background and Strong Alignment of Interests Advisory Agreement Management Fees Path to Internalization ▪ Our advisor is 85% owned by ZH International Holdings, Ltd., a Hong Kong listed real estate company ▪ ZH International is engaged in global real estate development, investment, management and sales and REIT management ▪ Following recent IPO, our officers, directors and our primary sponsor own approximately 14.2% of our outstanding common stock on a fully diluted basis ▪ Base management fee equal to 1.5% of stockholders equity, paid quarterly ▪ Incentive fee of 20% of AFFO after 8% hurdle to investors ▪ Reimbursement of certain expenses incurred by the advisor on behalf of GMR, but no reimbursement of compensation expenses of advisor ▪ When our stockholders’ equity reaches $ 500 million, GMR will form a special committee of independent directors to evaluate internalization of management ▪ Committee will act in the interest of stockholders to consider effect of internalization ▪ Terms of the internalization must be mutually agreed to by Board and advisor ▪ Three year initial term with automatic renewals each year thereafter ▪ Advisor manages day - to - day affairs of the Company ▪ Other Inter - American Management LLC entities do not compete with GMR for assets Reducing G&A during initial growth phase with a path to internalization

www.globalmedicalreit.com INDEPENDENT DIRECTORS 23 ▪ President of Global Development International, providing development support and oversight for initiatives in medical and hea lth care programs (e.g. Instant Labs Medical Diagnostics, MedPharm & MPRC Group) ▪ Former President and Founder of international programs at The Futures Group International, a healthcare consulting firm ▪ Director of International Health and Population Programs for GE’s Center for Advanced Studies ▪ Yale (B.S.); Johns Hopkins (MA) ▪ Professor at Georgetown University’s McDonough School of Business as the director of the Real Estate Finance Initiative ▪ Former director at Invesco Real Estate (NYSE: IVR) where he was responsible for oversight of the Underwriting Group, which ac qui red $10.2 billion worth of institutional real estate ▪ Underwrote $1.5 billion of acquisitions and oversaw the Valuations group, which marked to market Invesco’s more than $13 bil lio n North American portfolio ▪ Penn State University (B.S.); Texas A&M University (M.S. and Ph.D.) ▪ Over 40 years experience in managing financial functions for large and small publicly traded companies ▪ Previously CFO of three public companies, Arlington Asset Investment Corp . (NYSE : AI), FBR Capital Markets and Jupiter National, Inc . ▪ Director of Wheeler Real Estate Investment Trust (NASDAQ : WHLR) and trustee and treasurer of Nichols College ▪ Nichols College (B . S . ) ; CPA ▪ Founder and CEO of Health Care Corporation of America (HCCA) Management Company, originally a subsidiary of Hospital Corporation of America (HCA) ▪ 30 + years in international healthcare focused on healthcare systems with prior experience developing the Twelfth Evacuation Hospital in Vietnam ▪ Tennessee Technological University (B . S . ) ; California Western University (Ph . D . ) HENRY COLE , Independent Director MATTHEW CYPHER, Ph. D , Independent Director KURT HARRINGTON , Independent Director RONALD MARSTON , Independent Director ▪ Rear Admiral (Retired) and Chief Veterinary Medical Officer of United States Public Health Service ▪ Former Assistant United States Surgeon General, point person for global development support with a focus on less developed countries ▪ Epidemic Intelligence Service Officer with the U . S . Centers for Disease Control and Prevention (CDC) ▪ Chief epidemiologist with the Centers of Devices and Radiological Health in the US Food and Drug Administration (FDA) ▪ Tuskegee University (B . S . & DVM) ; University in Michigan (M . P . H . ) ; Johns Hopkins University (Ph . D . ) DR. ROSCOE MOORE , Independent Director Majority independent Board with strong backgrounds in healthcare, real estate and capital markets

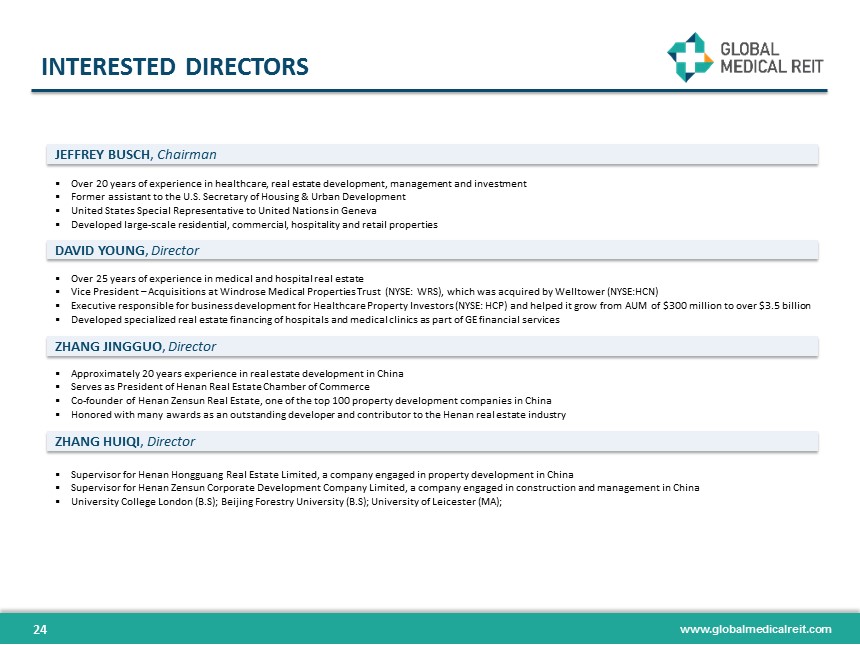

www.globalmedicalreit.com INTERESTED DIRECTORS 24 ▪ Over 20 years of experience in healthcare, real estate development, management and investment ▪ Former assistant to the U.S. Secretary of Housing & Urban Development ▪ United States Special Representative to United Nations in Geneva ▪ Developed large - scale residential, commercial, hospitality and retail properties ▪ Over 25 years of experience in medical and hospital real estate ▪ Vice President – Acquisitions at Windrose Medical Properties Trust (NYSE: WRS), which was acquired by Welltower (NYSE:HCN) ▪ Executive responsible for business development for Healthcare Property Investors (NYSE: HCP) and helped it grow from AUM of $ 300 million to over $3.5 billion ▪ Developed specialized real estate financing of hospitals and medical clinics as part of GE financial services ▪ Approximately 20 years experience in real estate development in China ▪ Serves as President of Henan Real Estate Chamber of Commerce ▪ Co - founder of Henan Zensun Real Estate, one of the top 100 property development companies in China ▪ Honored with many awards as an outstanding developer and contributor to the Henan real estate industry ▪ Supervisor for Henan Hongguang Real Estate Limited, a company engaged in property development in China ▪ Supervisor for Henan Zensun Corporate Development Company Limited, a company engaged in construction and management in China ▪ University College London (B . S) ; Beijing Forestry University (B . S) ; University of Leicester (MA) ; JEFFREY BUSCH , Chairman DAVID YOUNG , Director ZHANG JINGGUO , Director ZHANG HUIQI , Director