UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

Or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File Number: 333-177592

Global Medical REIT Inc.

(Exact name of registrant as specified in its charter)

| Maryland | 46-4757266 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

4800 Montgomery Lane #450, Bethesda, MD |

20814 | |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: 202-524-6851

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by a check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one).

| ¨ Large accelerated filer | ¨ Accelerated flier | ¨ Non-accelerated flier | x Smaller reporting company |

|

(do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of the last business day of the registrant’s most recently completed third fiscal quarter, there was no active public trading market for the registrant’s common stock.

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold as of the last business day of the registrant’s most recently completed second fiscal quarter: $0 on June 30, 2016.

As of March 27, 2017 there were 17,605,675 shares of the registrant’s common stock, par value of $0.001 per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains forward-looking statements within the meaning of the federal securities laws. In particular, statements pertaining to our capital resources, healthcare facility performance and results of operations, among others, contain forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology including, but not limited to, “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

| · | general economic conditions; |

| · | adverse economic or real estate developments, either nationally or in the markets in which our healthcare facilities are located; |

| · | our failure to generate sufficient cash flows to service our outstanding indebtedness; |

| · | fluctuations in interest rates and increased operating costs; |

| · | our ability to deploy the debt and equity capital we raise; |

| · | our ability to raise additional equity and debt capital on terms that are attractive or at all; |

| · | our ability to make distributions on shares of our common stock; |

| · | general volatility of the market price of our common stock; |

| · | our lack of significant operating history; |

| · | changes in our business or strategy; |

| · | our dependence upon key personnel whose continued service is not guaranteed; |

| · | our ability to identify, hire and retain highly qualified personnel in the future; |

| · | the degree and nature of our competition; |

| · | changes in governmental regulations, tax rates and similar matters; |

| · | defaults on or non-renewal of leases by tenant-operators; |

| · | decreased rental rates or increased vacancy rates; |

| · | difficulties in identifying healthcare facilities to acquire and completing such acquisitions; |

| · | competition for investment opportunities; |

| · | our failure to successfully develop, integrate and operate acquired healthcare facilities and operations; |

| · | the financial condition and liquidity of, or disputes with, joint venture and development partners with whom we may make co-investments in the future; |

| · | changes in accounting policies generally accepted in the United States of America (“GAAP”); |

| · | lack of or insufficient amounts of insurance; |

| · | other factors affecting the real estate industry generally; |

| · | our failure to qualify and maintain our qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes; |

| · | limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for U.S. federal income tax purposes; and |

| · | changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs. |

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this Report, except as required by applicable law. You should not place undue reliance on any forward-looking statements that are based on information currently available to us or the third parties making the forward-looking statements.

| 3 |

CERTAIN TERMS USED IN THIS REPORT

When this Report uses the words “we,” “us,” “our,” and the “Company,” they refer to Global Medical REIT Inc., unless otherwise indicated.

“Inter-American Management, LLC,” our advisor, refers to Inter-American Management, LLC, a Delaware limited liability company. Our advisor is 85% owned by ZH International Holdings Limited (formerly known as Heng Fai Enterprises, Ltd.), a Hong Kong limited company.

“ZH USA, LLC” is a Delaware limited liability company owned by ZH International Holdings Limited. ZH USA, LLC is a related party and was our majority stockholder prior to the completion of our initial public offering.

“SEC” and “the Commission” refer to the United States Securities and Exchange Commission.

“Common stock” refers to the common shares in our capital stock.

Our consolidated financial statements are prepared in accordance with GAAP.

| 4 |

| ITEM 1. | BUSINESS |

Organization

Global Medical REIT Inc. (the “Company”) is a Maryland corporation engaged primarily in the acquisition of licensed, state-of-the-art, purpose-built healthcare facilities and the leasing of these facilities to leading clinical operators with dominant market share. The Company is externally managed and advised by Inter-American Management, LLC (the “Advisor”).

The Company holds its facilities and conducts its operations through a Delaware limited partnership subsidiary called Global Medical REIT L.P. (the “Operating Partnership”). The Company serves as the sole general partner of the Operating Partnership through a wholly-owned subsidiary of the Company called Global Medical REIT GP LLC (the “GP”), a Delaware limited liability company. As of December 31, 2016, the Company was the 97.7% limited partner of the Operating Partnership, with the remaining 2.3% owned by the holders of long term incentive plan (“LTIP”) units issued by the Operating Partnership as incentive equity awards. The Company intends to conduct all future acquisition activity and operations through the Operating Partnership. The Operating Partnership has separate wholly-owned Delaware limited liability company subsidiaries that were formed for each healthcare facility acquisition.

Completed Initial Public Offering

On July 1, 2016, the Company closed its initial public offering and issued 13,043,479 shares of its common stock at a price of $10.00 per share resulting in gross proceeds of $130,434,790. After deducting underwriting discounts and commissions, advisory fees, and other offering expenses, the Company received net proceeds from the offering of $120,773,630. Additionally, on July 11, 2016, the underwriters exercised their over-allotment option in full, resulting in the issuance by the Company of an additional 1,956,521 shares of the Company’s common stock at a price of $10.00 per share for gross proceeds of $19,565,210. After deducting underwriting discounts and commissions, advisory fees, and other offering expenses, the Company received net proceeds from the over-allotment option shares of $18,195,645. Total shares issued by the Company in the initial public offering, including over-allotment option shares, were 15,000,000 shares and the total net proceeds received were $137,288,016, which represented gross proceeds received of $138,969,275 net of $1,681,259 in costs directly attributable to the initial public offering that were deferred and paid.

Use of Proceeds:

The Company designated the following uses for the net proceeds of the initial public offering:

| · | approximately $14.9 million ($14.6 million in principal outstanding as of July 1, 2016 and an early termination fee of $0.3 million) to repay the outstanding loan from Capital One encumbering the Company’s Omaha Facility on July 11, 2016 (see Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility”); |

| · | $10.0 million to repay a portion of the Company’s outstanding 8.0% convertible debentures held by ZH USA, LLC on July 8, 2016 (see Note 6 – “Related Party Transactions”); |

| · | $9.38 million in aggregate to acquire the Reading Facilities on July 20, 2016 (see Note 3 – “Property Portfolio”); |

| · | $1.5 million to repay the outstanding interest free loan from ZH USA, LLC on July 8, 2016 (see Note 6 – “Related Party Transactions”); and |

| · | the remaining approximately $101.6 million for the acquisition of properties in the Company’s investment pipeline, properties under letter of intent and other potential acquisitions, capital improvements to the Company’s properties and general corporate and working capital purposes. See Note 3 – “Property Portfolio” for proceeds used to acquire properties during the year. |

The Company invested the unexpended net proceeds of the offering in interest-bearing accounts, money market accounts, and interest-bearing securities in a manner that is consistent with its intention to qualify for taxation as a real estate investment trust (“REIT”).

In connection with the Company’s initial public offering, the Company’s common stock was listed on the New York Stock Exchange under the ticker symbol “GMRE.”

Business Overview

As disclosed in the “Organization” section, we are a Maryland corporation engaged primarily in the acquisition of licensed, state-of-the-art, purpose-built healthcare facilities in select markets and the leasing of these facilities to leading clinical operators with dominant market share. Our management team has significant healthcare, real estate and public REIT experience and has long-established relationships with a wide range of healthcare providers, which we believe will provide us a competitive advantage in sourcing growth opportunities that produce attractive risk-adjusted returns.

| 5 |

We believe that the aging of America is increasing the need for specialized healthcare facilities leased to premier practice groups, healthcare systems and corporate providers that will capture the growth in age-related procedures. These leading medical operators require state-of-the-art facilities that through their technology and design enhance the quality of care provided and improve clinical outcomes for patients. We seek to invest in these purpose-built, specialized facilities, such as surgery centers, specialty hospitals and outpatient treatment centers, in order to align with contemporary trends in the delivery of best healthcare practices. Our healthcare facilities are leased to established providers that, through clinical expertise and strong management, operate sustainable and dominant practices. We target markets with high demand for premium healthcare services, and within those markets, assets that are strategically located to take advantage of the decentralization of healthcare. We believe that our investment in the confluence of state-of-the-art medical facilities, market dominant tenant-operators and strategic sub-markets enhances clinical outcomes and provides attractive risk-adjusted returns to our stockholders.

Our healthcare facilities are typically fully leased under long-term triple-net leases. We may acquire existing healthcare facilities under sale-leaseback or similar arrangements, or we may contract to purchase facilities under development that are being built to an operator’s specifications. Most of our tenant-operators are physician group tenant-operators, community hospital tenant-operators and corporate medical treatment chain operators that are leading clinical operators in the markets they serve.

For details about the portfolio of properties that we owned as of December 31, 2016, refer to Item 2. – “Properties” herein.

Our Objectives and Growth Strategy

Our principal business objective is to provide attractive risk-adjusted returns to our stockholders through a combination of (i) sustainable and increasing rental income that allows us to pay reliable, increasing dividends, and (ii) potential long-term appreciation in the value of our healthcare facilities and common stock. Our primary strategies to achieve our business objective are to:

| · | acquire state-of-the-art, licensed medical facilities that through their technology and design enhance the quality of care provided and improve clinical outcomes for patients; |

| · | target facilities that are built and adapted to contemporary best healthcare practices; |

| · | lease each facility to a single, local market leading medical provider with a track record of successfully managing excellent clinical and profitable practices; |

| · | focus on practice types that are highly dependent on their purpose-built real estate to deliver core medical procedures, such as cardiovascular treatment, cosmetic plastic surgery, eye surgery, gastroenterology, oncology treatment and orthopedics; |

| · | originate the majority of our investments by working directly with the operating medical providers in our target markets; |

| · | create value by negotiating new leases rather than acquiring leased fee returns via acquisition of already rented healthcare facilities; |

| · | lease the facilities under long-term triple-net leases with contractual rent escalations; and |

| · | efficiently and rapidly grow our portfolio to drive economies of scale and diversification. |

We believe that healthcare facilities with the following technological and design characteristics, which are generally consistent with our current portfolio, will enable us to achieve strong risk-adjusted returns:

| · | state-of-the-art intensive care and operating room equipment and imaging technology; |

| · | efficient and contiguous patient treatment space for imaging, pre-operation, surgery, post-surgery and recovery phases of care; |

| · | state-of-the-art infection control materials in patient treatment room surfaces; |

| · | specialized sub-micron filtration HVAC in operating rooms; |

| · | high capacity and modern back-up emergency power generation; |

| · | highly durable and energy efficient internal and external construction materials, including membrane roofing; and |

| · | fiber optic cabling incorporated in initial construction. |

Financing Strategy:

The primary objective of our financing strategy is to maintain financial flexibility with a prudent capital structure using retained cash flows, long-term debt and the issuance of common and preferred stock to finance our growth. We seek to manage our balance sheet by maintaining prudent financial ratios and leverage levels. As disclosed in Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility” on December 2, 2016 we secured a revolving credit facility to finance acquisitions in concert with other debt instruments. We intend to (i) achieve opportunistic and reasonable debt service with leverage that initially approaches approximately 60% of the fair market value of our healthcare facilities, and lower ratios as we grow our equity capital base, (ii) create staggered debt maturities that are aligned to our expected average lease term, positioning us to re-price parts of our capital structure as our rental rates change with market conditions, (iii) achieve easier and faster access to the equity capital markets using a shelf registration statement once we are eligible to use Form S-3, which we expect to occur in the second quarter of 2017, and (iv) access international capital to avoid market cycle shortages and enhance acquisition expediency. We are not subject to any limitations on the amount of leverage we may use, and accordingly, the amount of leverage we use may be significantly less or greater than we currently anticipate.

| 6 |

Healthcare Industry and Healthcare Real Estate Market Opportunity

We believe the U.S. healthcare industry is continuing its rapid pace of growth due to increasing healthcare expenditures, favorable demographic trends, evolving patient preferences and recently enacted government initiatives. Furthermore, we believe these factors are contributing to the increasing need for healthcare providers to enhance the delivery of healthcare by, among other things, integrating real estate solutions that focus on higher quality, more efficient and conveniently located patient care.

U.S. Healthcare Spending Expected to Increase 5.8% per Year over Next Decade

According to the United States Department of Health and Human Services, or HHS, healthcare spending was approximately 17.5% of U.S. gross domestic product, or GDP, in 2014, the first year that the Affordable Care Act’s coverage provisions were in effect. The anticipated continuing increase in demand for healthcare services, together with an evolving complex and costly regulatory environment, changes in medical technology and reductions in government reimbursements are expected to pressure capital-constrained healthcare providers to find cost effective solutions for their real estate needs. We believe the demand of healthcare providers for healthcare facilities will increase as health spending in the United States continues to increase.

Aging U.S. Population Driving Increase in Demand for Healthcare Services

The general aging of the population, driven by the baby boomer generation and advances in medical technology and services which increase life expectancy, is a key driver of the growth in healthcare expenditures. We believe that demographic trends in the United States, including in particular an aging population, will result in continued growth in the demand for healthcare services, which in turn will lead to an increasing need for a greater supply of modern, well-located healthcare facilities.

Clinical Care Continues to Shift to Outpatient Facilities

We believe the continued shift in the delivery of healthcare services to outpatient facilities will increase the need for smaller, more specialized and efficient hospitals and outpatient facilities that more effectively accommodate those services. Procedures traditionally performed in hospitals, such as certain types of surgery, are increasingly moving to outpatient facilities driven by advances in clinical science, shifting consumer preferences, limited or inefficient space in existing hospitals and lower costs in the outpatient environment. This shift in delivery of healthcare services to an outpatient environment increases the need for additional outpatient facilities and smaller, more specialized and efficient hospitals.

We believe that healthcare is delivered more cost effectively and with higher patient satisfaction when it is provided on an outpatient basis. We believe the Affordable Care Act, and healthcare market trends toward outpatient care will continue to push healthcare services out of larger, older, inefficient hospitals and into newer, more efficient and conveniently located outpatient facilities and smaller specialized hospitals. Increased specialization within the medical field is also driving demand for medical facilities that are purpose-built for particular specialties.

Evidence-Based Design Influencing Healthcare Real Estate

Evidence-based design, or EBD, is an increasingly recognized component of healthcare real estate. EBD demonstrates that there is an interrelatedness between the design of a healthcare facility and patient outcomes. EBD research indicates that certain design elements, such as efficient layouts, placement of sinks and bathrooms, orientation of furniture, size of hallways and uniformity of surgical rooms, have an important impact on productivity, safety, health and morale for both physicians and patients.

We believe that as EBD research becomes more widely recognized and reproduced, healthcare facilities without these design principles will be disadvantaged. We believe that leading medical providers will increasingly desire and require modern, purpose-built facilities with state of the art technology and efficient layouts, such as those that we own in our current portfolio. We believe that this positions us to outperform other healthcare facility owners over time.

Qualification as a REIT

Our business strategy is conducive to a more favorable tax structure whereby we may qualify and elect to be treated as a REIT for U.S. federal income tax purposes. We plan to elect to be taxed as REIT under U.S. federal income tax laws commencing with our contemplated taxable year ending December 31, 2016. We believe that, commencing with 2016, we have organized and have operated in such a manner as to qualify for taxation as a REIT under all of the U.S. federal income tax laws, and we intend to continue to operate in such a manner. However, we cannot provide assurances that we will operate in a manner so as to qualify or remain qualified as a REIT.

| 7 |

In order to qualify as a REIT, a substantial percentage of our assets must be qualifying real estate assets and a substantial percentage of our income must be rental revenue from real property or interest on mortgage loans. We must elect under the U.S. Internal Revenue Code (the “Code”) to be treated as a REIT. Subject to a number of significant exceptions, a corporation that qualifies as a REIT generally is not subject to U.S. federal corporate income taxes on income and gains that it distributes to its stockholders, thereby reducing its corporate level taxes.

Competition

Our healthcare facilities often face competition from nearby hospitals and other healthcare facilities that provide comparable services. Similarly, our tenant-operators face competition from other medical practices and service providers at nearby hospitals and other healthcare facilities. From time to time and for reasons beyond our control, managed-care organizations may change their lists of preferred hospitals or in-network physicians. Physicians also may change hospital affiliations. If competitors of our tenant-operators or competitors of the associated healthcare delivery systems with which our healthcare facilities are strategically aligned have greater geographic coverage, improve access and convenience to physicians and patients, provide or are perceived to provide higher quality services, recruit physicians to provide competing services at their facilities, expand or improve their services or obtain more favorable managed-care contracts, our tenant-operators may not be able to successfully compete. Any reduction in rental revenues resulting from the inability of our tenant-operators or the associated healthcare delivery systems with which our healthcare facilities are strategically aligned to compete in providing medical services and/or receiving sufficient rates of reimbursement for healthcare services rendered may have a material adverse effect on our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock.

Government Regulation

The healthcare industry is heavily regulated by U.S. federal, state and local governmental authorities. Our tenant-operators generally will be subject to laws and regulations covering, among other things, licensure, and certification for participation in government programs, billing for services, privacy and security of health information and relationships with physicians and other referral sources. In addition, new laws and regulations, changes in existing laws and regulations or changes in the interpretation of such laws or regulations could negatively affect our financial condition and the financial condition of our tenant-operators. These changes, in some cases, could apply retroactively. The enactment, timing or effect of legislative or regulatory changes cannot be predicted.

Many states regulate the construction of healthcare facilities, the expansion of healthcare facilities, the construction or expansion of certain services, including by way of example specific bed types and medical equipment, as well as certain capital expenditures through certificate of need, or CON, laws. Under such laws, the applicable state regulatory body must determine a need exists for a project before the project can be undertaken. If one of our tenant-operators seeks to undertake a CON-regulated project, but is not authorized by the applicable regulatory body to proceed with the project, the tenant-operator would be prevented from operating in its intended manner.

Failure to comply with these laws and regulations could adversely affect us directly and our tenant-operators’ ability to make rent payments to us, which may have an adverse effect on our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock.

Healthcare Legislation

Health Reform Laws

On March 23, 2010, President Obama signed into law Affordable Care Act and the Health Care and Education Reconciliation Act of 2010, which amends the Affordable Care Act (collectively with other subsequently enacted federal health care laws and regulations, the “Health Reform Laws”). The Health Reform Laws contain various provisions that may directly impact us or our tenant-operators. Some provisions of the Health Reform Laws may have a positive impact on our tenant-operators’ revenues, by, for example, increasing coverage of uninsured individuals, while others may have a negative impact on the reimbursement of our tenant-operators by, for example, altering the market basket adjustments for certain types of health care facilities. The Health Reform Laws also enhance certain fraud and abuse penalty provisions that could apply to our tenant-operators, in the event of one or more violations of the federal health care regulatory laws. In addition, there are provisions that impact the health coverage that we and our tenant-operators provide to our respective employees. The Health Reform Laws also provide additional Medicaid funding to allow states to carry out the expansion of Medicaid coverage to certain financially-eligible individuals beginning in 2014, and have also permitted states to expand their Medicaid coverage to these individuals since April 1, 2010, if certain conditions are met. On June 28, 2012, the United States Supreme Court upheld the individual mandate of the Health Reform Laws but partially invalidated the expansion of Medicaid. The ruling on Medicaid expansion will allow states not to participate in the expansion—and to forego funding for the Medicaid expansion—without losing their existing Medicaid funding. Given that the federal government substantially funds the Medicaid expansion, it is unclear how many states will ultimately pursue this option. The participation by states in the Medicaid expansion could have the dual effect of increasing our tenants’ revenues, through new patients, but could also further strain state budgets. While the federal government paid for approximately 100% of those additional costs from 2014 to 2016, states now are expected to pay for part of those additional costs.

Challenges to the Health Reform Laws and Potential Repeal and/or Further Reforms under Trump Administration.

Since the enactment of the Health Care Laws, there have been multiple attempts through legislative action and legal challenge to repeal or amend the Health Reform Laws, including the case that was before the U.S. Supreme Court, King v. Burwell. Although the Supreme Court in Burwell upheld the use of subsidies to individuals in federally-facilitated health care exchanges on June 25, 2015, which ultimately did not disrupt significantly the implementation of the Health Reform Laws, we cannot predict whether other current or future efforts to repeal, amend or challenge the validity of all or part of the Health Reform Laws will be successful, nor can we predict the impact that such a repeal, amendment or challenge would have on our operators or tenants and their ability to meet their obligations to us.

On January 20, 2017, newly-sworn-in President Trump issued an executive order aimed at seeking the prompt repeal of the Affordable Care Act, and directed the heads of all executive departments and agencies to minimize the economic and regulatory burdens of the Affordable Care Act to the maximum extent permitted by law. In addition, there have been and continue to be numerous Congressional attempts to amend and repeal the Affordable Care Act. We cannot predict whether any of these attempts to amend or repeal the Affordable Care Act will be successful. The future of the Affordable Care Act is uncertain and any changes to existing laws and regulations, including the Affordable Care Act’s repeal, modification or replacement, could have a long-term financial impact on the delivery of and payment for healthcare. We and our tenants may be adversely affected by the law or its repeal, modification or replacement.

Fraud and Abuse Laws

There are various federal and state laws prohibiting fraudulent and abusive business practices by healthcare providers who participate in, receive payments from or are in a position to make referrals in connection with government-sponsored healthcare programs, including the Medicare and Medicaid programs. Our lease arrangements with certain tenant-operators may also be subject to these fraud and abuse laws.

| 8 |

These laws include without limitation:

| · | the Federal Anti-Kickback Statute, which prohibits, among other things, the offer, payment, solicitation or receipt of any form of remuneration in return for, or to induce, the referral of any U.S. federal or state healthcare program patients; |

| · | the Federal Physician Self-Referral Prohibition (commonly called the “Stark Law”), which, subject to specific exceptions, restricts physicians who have financial relationships with healthcare providers from making referrals for designated health services for which payment may be made under Medicare or Medicaid programs to an entity with which the physician, or an immediate family member, has a financial relationship; |

| · | the False Claims Act, which prohibits any person from knowingly presenting false or fraudulent claims for payment to the federal government, including under the Medicare and Medicaid programs; |

| · | the Civil Monetary Penalties Law, which authorizes the Department of Health and Human Services to impose monetary penalties for certain fraudulent acts; and |

| · | state anti-kickback, anti-inducement, anti-referral and insurance fraud laws which may be generally similar to, and potentially more expansive than, the federal laws set forth above. |

Violations of these laws may result in criminal and/or civil penalties that range from punitive sanctions, damage assessments, penalties, imprisonment, denial of Medicare and Medicaid payments and/or exclusion from the Medicare and Medicaid programs. In addition, the Affordable Care Act clarifies that the submission of claims for items or services generated in violation of the Anti-Kickback Statute constitutes a false or fraudulent claim under the False Claims Act. The federal government has taken the position, and some courts have held, that violations of other laws, such as the Stark Law, can also be a violation of the False Claims Act. Additionally, certain laws, such as the False Claims Act, allow for individuals to bring whistleblower actions on behalf of the government for violations thereof. Imposition of any of these penalties upon one of our tenant-operators or strategic partners could jeopardize that tenant-operator’s ability to operate or to make rent payments or affect the level of occupancy in our healthcare facilities, which may have a material adverse effect on our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock. Further, we enter into leases and other financial relationships with healthcare delivery systems that are subject to or impacted by these laws. In the future we may have other investors who are healthcare providers in certain of our subsidiaries that own our healthcare facilities. If any of our relationships, including those related to the other investors in our subsidiaries, are found not to comply with these laws, we and our physician investors may be subject to civil and/or criminal penalties.

Environmental Matters

Under various U.S. federal, state and local laws, ordinances and regulations, current and prior owners and tenant-operators of real estate may be jointly and severally liable for the costs of investigating, remediating and monitoring certain hazardous substances or other regulated materials on or in such healthcare facility. In addition to these costs, the past or present owner or tenant-operator of a healthcare facility from which a release emanates could be liable for any personal injury or property damage that results from such releases, including for the unauthorized release of asbestos-containing materials and other hazardous substances into the air, as well as any damages to natural resources or the environment that arise from such releases. These environmental laws often impose such liability without regard to whether the current or prior owner or tenant-operator knew of, or was responsible for, the presence or release of such substances or materials. Moreover, the release of hazardous substances or materials, or the failure to properly remediate such substances or materials, may adversely affect the owner’s or tenant’s ability to lease, sell, develop or rent such healthcare facility or to borrow by using such healthcare facility as collateral. Persons who transport or arrange for the disposal or treatment of hazardous substances or other regulated materials may be liable for the costs of removal or remediation of such substances at a disposal or treatment facility, regardless of whether or not such facility is owned or operated by such person.

Certain environmental laws impose compliance obligations on owners and tenant-operators of real property with respect to the management of hazardous substances and other regulated materials. For example, environmental laws govern the management and removal of asbestos-containing materials and lead-based paint. Failure to comply with these laws can result in penalties or other sanctions. If we are held liable under these laws, our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock may be adversely affected.

Medicare and Medicaid Programs

Sources of revenue for our tenant-operators typically include the U.S. federal Medicare program, state Medicaid programs, private insurance payors and health maintenance organizations. Healthcare providers continue to face increased government and private payor pressure to control or reduce healthcare costs and significant reductions in healthcare reimbursement, including reduced reimbursements and changes to payment methodologies under the Affordable Care Act. The Congressional Budget Office, or CBO, estimates the reductions required by the Affordable Care Act in the future will include cuts to Medicare fee-for-service payments, the majority of which will come from hospitals, and that some hospitals will become insolvent as a result of the reductions. In some cases, private insurers rely on all or portions of the Medicare payment systems to determine payment rates which may result in decreased reimbursement from private insurers. The Affordable Care Act will likely increase enrollment in plans offered by private insurers who choose to participate in state-run exchanges, but the Affordable Care Act also imposes new requirements for the health insurance industry, including prohibitions upon excluding individuals based upon pre-existing conditions which may increase private insurer costs and, thereby, cause private insurers to reduce their payment rates to providers. At this time, it is difficult to predict the full effects of the Affordable Care Act and its impact on our business, our revenues and financial condition and those of our tenant-operators due to the law’s complexity, lack of implementing regulations or interpretive guidance, gradual implementation and possible amendment. The Affordable Care Act could adversely affect the reimbursement rates received by our tenant-operators, the financial success of our tenant-operators and strategic partners and consequently us.

| 9 |

If the United States economy enters a recession or slower growth, this could negatively affect state budgets, thereby putting pressure on states to decrease spending on state programs including Medicaid. The need to control Medicaid expenditures may be exacerbated by the potential for increased enrollment in state Medicaid programs due to unemployment and declines in family incomes. Historically, states have often attempted to reduce Medicaid spending by limiting benefits and tightening Medicaid eligibility requirements. Potential reductions to Medicaid program spending in response to state budgetary pressures could negatively impact the ability of our tenant-operators to successfully operate their businesses.

Efforts by payors to reduce healthcare costs will likely continue which may result in reductions or slower growth in reimbursement for certain services provided by some of our tenant-operators. A reduction in reimbursements to our tenant-operators from third party payors for any reason could adversely affect our tenant-operators’ ability to make rent payments to us which may have a material adverse effect on our business, financial condition and results of operations, our ability to make distributions to our stockholders and the trading price of our common stock.

Employees

As of March 27, 2017, we had no employees. The Company is externally managed by the Advisor. The Advisor provides the services of the officers and other management personnel of the Company.

| ITEM 1A. | RISK FACTORS |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this Item 1A within this Report.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Our business office is located at 4800 Montgomery Lane, Suite 450, Bethesda MD, 20814. The office space is allocated to us from the Advisor at prevailing rental rates and terms.

Facilities in Our Portfolio as of December 31, 2016

HealthSouth Facilities

HealthSouth East Valley Rehabilitation Hospital – Mesa, AZ

On December 20, 2016, the Company, through a wholly owned subsidiary of the Operating Partnership, acquired, pursuant to a purchase contract (the “Mesa PSA”) with HR ACQUISITION I CORPORATION (the “Mesa Seller”) the land and buildings known as the HealthSouth East Valley Rehabilitation Hospital (the “Mesa Property”) located in Mesa, AZ from the Mesa Seller for a purchase price of $22,350,000.

Upon the closing of the acquisition of the Mesa Property, the Company assumed from the Mesa Seller the existing triple-net lease agreement (the “Mesa Lease”) pursuant to which the Mesa Property is leased to HealthSouth Mesa Rehabilitation Hospital, LLC with a remaining initial lease term of approximately eight years, subject to four consecutive five-year renewal options by the tenant, which lease is guaranteed by HealthSouth Corporation (“HealthSouth”). The aggregate annual rent for the Mesa Property is currently $1,710,617, subject to 3% annual rent escalations. HealthSouth Mesa Rehabilitation Hospital, LLC has the option under the Mesa Lease to purchase the Mesa Property at the end of the initial lease term and at the end of each renewal term thereof, if any, upon the terms and conditions set forth in the Mesa Lease.

HealthSouth Rehabilitation Hospital of Altoona – Altoona, PA

On December 20, 2016, the Company, through a wholly owned subsidiary of the Operating Partnership, acquired, pursuant to a purchase contract (the “Altoona PSA”) with HR ACQUISITION OF PENNSYLVANIA, INC. (the “Altoona Seller”) the land and building comprising the HealthSouth Rehabilitation Hospital of Altoona (the “Altoona Property”) located in Altoona, PA from the Altoona Seller for a purchase price of $21,545,000.

| 10 |

Upon the closing of the acquisition of the Altoona Property, the Company assumed from the Altoona Seller the existing triple-net lease agreement (the “Altoona Lease”) pursuant to which the Altoona Property is leased to HealthSouth with a remaining initial lease term of approximately 4.5 years, subject to two consecutive five-year renewal options by the tenant. The annual rent for the Altoona Property is currently $1,635,773, subject to annual rent escalations based on increases in the consumer price index, or CPI, but not greater than 4% nor less than 2%.

HealthSouth Rehabilitation Hospital of Mechanicsburg – Mechanicsburg, PA

On December 20, 2016, the Company, through a wholly owned subsidiary of the Operating Partnership, pursuant to a purchase contract (the “Mechanicsburg PSA” and together with the Mesa PSA and the Altoona PSA, and the transactions contemplated thereby, the “Transactions”) with HR ACQUISITION OF PENNSYLVANIA, INC. (the “Lease Assignor” and PENNSYLVANIA HRT, INC. (“HRT”), Lease Assignor and HRT collectively referred to as “Mechanicsburg Seller”) (i) acquired the land and building comprising the HealthSouth Rehabilitation Hospital of Mechanicsburg (the “Mechanicsburg Property”) located in Mechanicsburg, PA from the Mechanicsburg Seller for a purchase price of $24,198,000; and (ii) accepted an assignment of the ground lessee’s interest (the “Assignment”) in the Ground Lease dated May 1, 1996 from the Lease Assignor, whereby HRT ground leased the Mechanicsburg Property to the Lease Assignor.

Upon the closing of the acquisition of the Mechanicsburg Property and acceptance of the Assignment, the Company assumed from the Lease Assignor the existing triple-net lease agreement (the “Mechanicsburg Lease”) pursuant to which the Mechanicsburg Property is leased to HealthSouth with a remaining initial lease term of approximately 4.5 years, subject to two consecutive five-year renewal options by the tenant. The annual rent for the Mechanicsburg Property is currently $1,836,886, subject to annual rent escalations based on increases in the CPI, but not greater than 4% nor less than 2%. HealthSouth has the option under the Mechanicsburg Lease to purchase the Mechanicsburg Property at the end of the initial lease term and at the end of each renewal term thereof, if any, upon the terms and conditions set forth in the Mechanicsburg Lease.

Ellijay Facilities

On December 16, 2016, pursuant to the terms of an asset purchase agreement between the Company, as Purchaser, and SunLink Healthcare Professional Property, LLC, a Georgia limited liability company, as seller (“SunLink”), the Company acquired three buildings, consisting of one medical office building and two ancillary healthcare related buildings (“SunLink Facilities”), encompassing an aggregate of 44,162 square feet located in Ellijay, Georgia, for a purchase price of approximately $4.9 million. The acquisitions included the SunLink Facilities, together with the real property, the improvements, and all appurtenances thereto owned by SunLink. The SunLink Facilities are operated by Piedmont Mountainside Hospital, Inc., the existing tenant of the SunLink Facilities (“Piedmont”).

Upon the closing of the transaction, the Company assumed the previous landlord’s interest in the existing 10-year triple-net lease with Piedmont, effective as of July 1, 2016 and expiring in 2026. The acquisition was funded using a portion of the proceeds from the Company’s initial public offering.

Carson City Facilities

On September 27, 2016, the Company assumed the original buyer’s interest in an asset purchase agreement between the original buyer and Carson Medical Complex, a Nevada general partnership, as seller (“Carson”). On October 31, 2016, the Company, pursuant to the asset purchase agreement, acquired two medical office buildings (the “Carson Facilities”), encompassing an aggregate of 20,632 square feet, located in Carson City, Nevada for a purchase price of approximately $3.8 million (approximately $4.0 million including legal and related fees). The acquisitions included the Carson Facilities, together with the real property, the improvements, and all appurtenances thereto owned by Carson. The Carson Facilities are operated by Carson Medical Group, a Nevada professional corporation, the existing tenant of the Carson Facilities (the “Carson Tenant”).

Upon the closing of the transaction, the Company assumed the previous landlord’s interest in the existing 7-year triple-net lease with Carson Tenant, effective as of October 31, 2016 and expiring in 2023. The lease provides for one five-year extension at the option of the Carson Tenant. The acquisition was funded using a portion of the proceeds from the Company’s initial public offering.

Sandusky Facilities

On September 29, 2016, the Company assumed the original buyer’s interest in an asset purchase agreement between the original buyer and NOMS Property, LLC and Northern Ohio Medical Specialists, LLC, both Ohio limited liability companies, as sellers (“NOMS,” and together with NOMS Property, LLC, the “NOMS Sellers”), to acquire a portfolio of seven medical properties (the “NOMS Facilities”) known as the NOMS portfolio located in Sandusky, Ohio, for a total purchase price of $10.0 million. The acquisition included the NOMS Facilities, together with the real property, the improvements, and all appurtenances thereto. The NOMS Facilities are operated by NOMS, the existing tenant of the NOMS Facilities (the “NOMS Tenant”).

| 11 |

On October 7, 2016, pursuant to the terms of the above-referenced asset purchase agreement, the Company acquired five of the seven properties comprising the NOMS Facilities (the “Five Properties”). The Five Properties encompassed an aggregate of 24,184 square feet, and the Company purchased the Five Properties for the allocated purchase price of $4.6 million (approximately $4.7 million including legal and related fees) of the total $10 million purchase price. Upon its acquisition of the Five Properties, the Company entered into a new 11-year triple-net lease with the NOMS Tenant, effective as of October 7, 2016, and expiring in 2027. The lease provides for four additional five-year renewal options. The acquisition of the Five Properties was funded using a portion of the proceeds from the Company’s initial public offering.

As discussed in Note 12 – “Subsequent Events,” the Company closed on the acquisition of one of the properties on March 10, 2017 in the amount of approximately $4.3 million using funds from the revolving credit facility. Upon the satisfaction of customary closing conditions, the Company expects to close the acquisition of the remaining property for approximately $1.1 million during the second quarter of 2017. The Company is leasing the property that closed in March 2017 to the NOMS Tenant and will lease the remaining property when acquired to the NOMS Tenant both using a triple-net lease structure with an initial term of 11 years with four additional five-year renewal options. The acquisition of the remaining building will be funded using borrowings from the Company’s revolving credit facility or other available cash.

Watertown Facilities

On September 30, 2016, the Company closed on an asset purchase agreement with Brown Investment Group, LLC, a South Dakota limited liability company, to acquire a 30,062 square foot clinic, a 3,136 square foot administration building and a 13,686 square foot facility, both located in Watertown South Dakota (collectively, the “Watertown Facilities”), for a purchase price of $9.0 million (approximately $9.1 million including legal and related fees). The acquisitions included the Watertown Facilities, together with the real property, the improvements, and all appurtenances thereto. The Watertown Facilities are operated by the Brown Clinic, P.L.L.P. (“Brown Clinic”), a South Dakota professional limited liability partnership.

Upon the closing of the transaction, the Company leased the portfolio properties to Brown Clinic via a 15-year triple-net lease that expires in 2031. The lease provides for two additional five-year extensions at the option of the tenant. The acquisition was funded using a portion of the proceeds from the Company’s initial public offering.

East Orange Facility

On September 29, 2016, the Company closed on an asset purchase agreement with Prospect EOGH, Inc. (“Prospect”), a New Jersey corporation, and wholly-owned subsidiary of Prospect Medical Holdings, Inc. (“PMH”), a Delaware corporation, to acquire a 60,442 square foot medical office building (“MOB”) located at 310 Central Avenue, East Orange, New Jersey on the campus of the East Orange General Hospital, for a purchase price of approximately $11.86 million (approximately $12.3 million including legal and related fees). The acquisitions included the MOB, together with the real property, the improvements, and all appurtenances thereto.

Upon the closing of the transaction, the Company leased the MOB to PMH via a 10-year triple-net lease that expires in 2026. The lease provides for four additional five-year extensions at the option of the tenant. The acquisition was funded using a portion of the proceeds from the Company’s initial public offering.

Reading Facilities

On July 20, 2016, the Company closed on an asset purchase agreement to acquire a 17,000 square foot eye center located at 1802 Papermill Road, Wyomissing, PA 19610 (the “Eye Center”) owned and operated by Paper Mill Partners, L.P., a Pennsylvania limited partnership, and a 6,500 square foot eye surgery center located at 2220 Ridgewood Road, Wyomissing, PA 19610 (the “Surgery Center”) owned and operated by Ridgewood Surgery Center, L.P., a Pennsylvania limited partnership, for a purchase price of approximately $9.20 million (approximately $9.38 million including legal and related fees). The acquisition included both facilities, together with the real property, the improvements, and all appurtenances thereto.

Upon the closing of the transaction, the Eye Center was leased back to Berks Eye Physicians & Surgeons, Ltd., a Pennsylvania professional corporation (the “Eye Center Tenant”) and the Surgery Center was leased back to Ridgewood Surgery Associates, LLC, a Pennsylvania limited liability company (the “Surgery Center Tenant”). Both leases are 10-year absolute triple-net lease agreements that expire in 2026 and are cross defaulted. Both leases also provide for two consecutive five-year extensions at the option of the tenants. The Eye Center lease is guaranteed by the Surgery Center Tenant and the Surgery Center lease is guaranteed by the Eye Center Tenant, each pursuant to a written guaranty. The acquisition was funded using a portion of the proceeds from the Company’s initial public offering.

| 12 |

Melbourne Facility

On March 31, 2016, the Company closed on a purchase agreement to acquire a 78,000 square-foot medical office building located on the Melbourne Bayfront for a purchase price of $15.45 million (approximately $15.5 million including legal and related fees) from Marina Towers, LLC, a Florida limited liability company. The facility is located at 709 S. Harbor City Blvd., Melbourne, FL on 1.9 acres of land. The acquisition included the site and building, an easement on the adjacent property to the north for surface parking, all tenant leases, and above and below ground parking garages. The entire facility has been leased back to Marina Towers, LLC via a 10-year absolute triple-net master lease agreement that expires in 2026. The tenant has two successive options to renew the lease for five-year periods on the same terms and conditions as the primary non-revocable lease term with the exception of rent, which will be adjusted to the prevailing fair market rent at renewal and will escalate in successive years during the extended lease period at two percent annually.

The Melbourne facility acquisition was financed in full using proceeds from the third party Cantor Loan, which is disclosed in Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility.”

Westland Facility

On March 31, 2016, the Company closed on a purchase agreement to acquire a two-story medical office building and ambulatory surgery center located in Westland, Michigan for an aggregate purchase price of $4.75 million from Cherry Hill Real Estate, LLC (“Cherry Hill”). The property contains 15,018 leasable square feet and is located on a 1.3-acre site. Under the purchase agreement, the Company acquired the site and building, including parking. Also on March 31, 2016, the Company executed a lease agreement for the entire facility with The Surgical Institute of Michigan, LLC under a triple-net master lease agreement that expires in 2026, subject to two successive ten-year renewal options for the tenant on the same terms as the initial lease, except that the rental rate will be subject to adjustment upon each renewal based on then-prevailing market rental rates. The purchase agreement contains customary covenants, representations and warranties. Commensurate with the execution of its lease with the Company, The Surgical Institute of Michigan, LLC terminated its lease agreement with Cherry Hill that was in place at the time of the sale of the facility to the Company.

The Westland facility acquisition was financed in full using proceeds from the third party Cantor Loan, which is disclosed in Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility.”

Plano Facility

On January 28, 2016, the Company closed on an asset purchase agreement with an unrelated party Star Medreal, LLC, a Texas limited liability company, to acquire a hospital facility located in Plano, Texas, along with all real property and improvements thereto for approximately $17.5 million (approximately $17.7 million including legal and related fees). Under the terms of the agreement, the Company was obligated to pay a development fee of $500,000 to Lumin, LLC at closing. The property has been leased back via an absolute triple-net lease agreement that expires in 2036. The tenant will be Star Medical Center, LLC and Lumin Health, LLC will serve as guarantor. Lumin Health, LLC is an affiliate and management company for Star Medical Center, LLC. The tenant has two successive options to renew the lease for ten-year periods on the same terms and conditions as the primary non-revocable lease term with the exception of rent, which will be computed at then prevailing fair market value as determined by an appraisal process defined in the lease. The terms of the lease also provide for a tenant allowance up to $2.75 million for a 6,400 square foot expansion to be paid by the Company.

Also on January 28, 2016, the Company entered into a Promissory Note and Deed of Trust with East West Bank to borrow a total of $9,223,500. Deferred financing costs of $53,280 were incurred and capitalized by the Company in securing this loan. The loan was scheduled to mature on January 28, 2021, five years from the closing date. At closing the Company paid the lender a non-refundable deposit of $50,000 and a non-refundable commitment fee of $46,118. The loan bears interest at a rate per annum equal to the Wall Street Journal Prime Rate (as quoted in the "Money Rates" column of The Wall Street Journal (Western Edition), rounded to two decimal places, as it may change from time to time, plus 0.50%, but not less than 4.0%. Interest expense of $64,551 was incurred on this note for the year ended December 31, 2016, prior to its repayment. As discussed in Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility,” the Company used a portion of the proceeds from another third party loan to repay the $9,223,500 principal balance of the note with East West Bank in full as of December 31, 2016. The Company also wrote off the deferred financing costs of $53,280 as of December 31, 2016 related to this note.

Additional funding for this transaction was received from ZH USA, LLC during the year ended December 31, 2015 in the amount of $9,369,310 (consisting of $9,025,000 funded directly for this transaction and $344,310 that was held in escrow from previous funding from ZH USA, LLC). The $9,369,310 was recorded by the Company as unsecured Convertible Debentures due to related party on demand, bearing interest at eight percent per annum. ZH USA, LLC may elect to convert all or a portion of the outstanding principal amount of the Convertible Debenture into shares of the Company’s common stock in an amount equal to the principal amount of the Convertible Debenture, together with accrued but unpaid interest, divided by $12.748. See Note 6 – “Related Party Transactions” for details regarding the conversion to common stock or pay-off of the Convertible Debenture balance as of December 31, 2016.

| 13 |

Tennessee Facilities

On December 31, 2015, the Company acquired a six building, 52,266 square foot medical clinic portfolio for a purchase price of $20.0 million (approximately $20.2 including legal and related fees). Five of the facilities are located in Tennessee and one facility is located in Mississippi. The portfolio will be leased back through Gastroenterology Center of the Midsouth, P.C. via an absolute triple-net lease agreement that expires in 2027. The tenant has two successive options to renew the lease for five year periods on the same terms and conditions as the primary non-revocable lease term with the exception of rent, which will be computed at the same rate of escalation used during the fixed lease term. Base rent increases by 1.75% each lease year commencing on January 1, 2018. The property is owned in fee simple. Funding for the transaction and all related costs was received in the form of a convertible debenture (“Convertible Debenture”) the Company issued to its majority stockholder in the total amount of $20,900,000. Refer to Note 6 – “Related Party Transactions” for additional details regarding the funding of this transaction.

West Mifflin Facility

On September 25, 2015, the Company acquired a surgery center and medical office building located in West Mifflin, Pennsylvania and the adjacent parking lot for approximately $11.35 million (approximately $11.6 million including legal and related fees) of approximately 27,193 square feet, combined. The facilities are operated by Associates in Ophthalmology, LTD and Associates Surgery Centers, LLC, respectively, and leased back to those entities by the Company via two separate lease agreements that expire in 2030. Each lease has two successive options by the tenants to renew for five year periods. Base rent increases by 2% each lease year commencing on October 1, 2018. The property is owned in fee simple. In connection with the acquisition of the facilities, the Company borrowed $7,377,500 from Capital One, National Association (“Capital One”) and funded the remainder of the purchase price with the proceeds from a Convertible Debenture it issued to its majority stockholder in the total amount of $4,545,838. Refer to Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility” and Note 6 – “Related Party Transactions” for additional details regarding the funding of this transaction.

Asheville Facility

On September 19, 2014, the Company acquired an approximately 8,840 square foot medical office building known as the Orthopedic Surgery Center, located in Asheville, North Carolina for approximately $2.5 million. The Asheville facility is subject to an operating lease which expires in 2017, with lease options to renew up to five years. The property is owned in fee simple. In connection with the acquisition of the Asheville facility, the Company borrowed $1.7 million from the Bank of North Carolina and funded the remainder of the purchase price with the proceeds from a Convertible Debenture it issued to its majority stockholder and with the Company’s existing cash. Refer to Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility” for additional details regarding the funding of this transaction and the prepayment in full of this note.

Omaha Facility

On June 5, 2014, the Company completed the acquisition of a 56-bed long term acute care hospital located at 1870 S 75th Street, Omaha, Nebraska for approximately $21.7 million (approximately $21.9 million including legal fees). The Omaha facility is operated by Select Specialty Hospital – Omaha, Inc. pursuant to a sublease which expires in 2023, with sub lessee options to renew up to 60 years. The real property where the Omaha facility and other improvements are located are subject to a land lease with Catholic Health Initiatives, a Colorado nonprofit corporation (the “land lease”). The land lease initially was to expire in 2023 with sub lessee options to renew up to 60 years. However, as of December 31, 2015, the Company exercised two five-year lease renewal options and therefore the land lease currently expires in 2033, subject to future renewal options by the Company. In connection with the acquisition of the Omaha facility in June 2014, the Company borrowed $15.06 million from Capital One and funded the remainder of the purchase price with funds from its majority stockholder. Refer to Note 4 – “Notes Payable Related to Acquisitions and Revolving Credit Facility” for additional details regarding the funding of this transaction and the prepayment in full of this note.

| ITEM 3. | LEGAL PROCEEDINGS |

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| 14 |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

In connection with our initial public offering, which was completed on July 1, 2016, our common stock is quoted on the New York Stock Exchange under the ticker symbol “GMRE.” Prior to that date our stock was listed on the OTC pink tier of the OTC Markets, Inc. under the symbol “GMRE” and trading of our common stock at that time was limited and sporadic.

The following table sets forth, for the periods indicated, the high and low sale prices of our common stock for the fiscal years ended December 31, 2016 and 2015, respectively, and the dividends paid by us with respect to those periods.

| 2016 | High | Low | Dividends per Share | |||||||||

| First quarter | $ | 3.58 | $ | 0.125 | $ | 0.2556 | ||||||

| Second quarter | $ | 3.58 | $ | 0.125 | $ | 0.2556 | ||||||

| Third quarter | $ | 11.38 | $ | 9.52 | $ | 0.2000 | ||||||

| Fourth quarter | $ | 9.89 | $ | 6.73 | $ | 0.2000 | ||||||

| 2015 | High | Low | Dividends per Share | |||||||||

| First quarter | $ | 3.58 | $ | 3.58 | $ | 0.2556 | ||||||

| Second quarter | $ | 3.58 | $ | 3.58 | $ | 0.2556 | ||||||

| Third quarter | $ | 3.58 | $ | 3.58 | $ | 0.2556 | ||||||

| Fourth quarter | $ | 3.58 | $ | 3.58 | $ | 0.2556 | ||||||

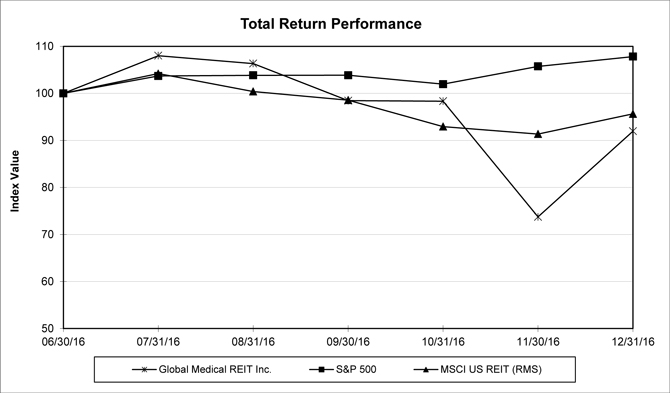

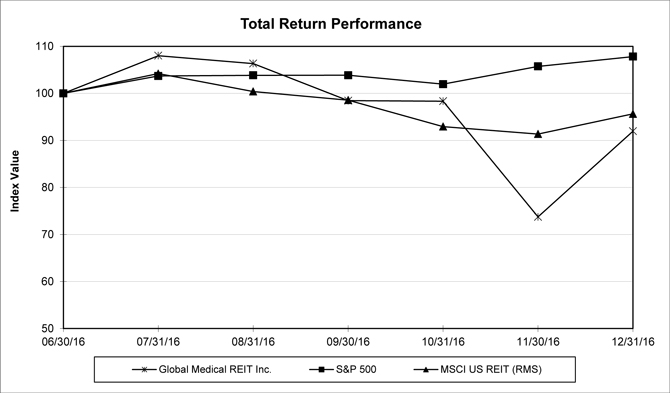

Performance Graph

This performance graph shall not be deemed “soliciting material” or to be “filed” with the SEC for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of Global Medical REIT Inc. under the Securities Act or the Exchange Act.

The graph below compares the cumulative total return of our common shares, the S&P 500 and the MSCI US REIT Index (“RMS”), from July 1, 2016 (the completion date of our IPO) through December 31, 2016. The comparison assumes $100 was invested on July 1, 2016 in our common shares and in each of the foregoing indexes and assumes reinvestment of dividends, as applicable. The MSCI US REIT Index consists of equity REITs that are included in the MSCI US Investable Market 2500 Index, except for specialty equity REITS that do not generate a majority of their revenue and income from real estate rental and leasing operations. We have included the MSCI US REIT Index because we believe that it is representative of the industry in which we compete and is relevant to an assessment of our performance.

| 15 |

| Period Ending | ||||||||||||||||||||||||||||

| Index | 06/30/16 | 07/31/16 | 08/31/16 | 09/30/16 | 10/31/16 | 11/30/16 | 12/31/16 | |||||||||||||||||||||

| Global Medical REIT Inc. | 100.00 | 108.01 | 106.33 | 98.44 | 98.34 | 73.73 | 91.96 | |||||||||||||||||||||

| S&P 500 | 100.00 | 103.69 | 103.83 | 103.85 | 101.96 | 105.73 | 107.82 | |||||||||||||||||||||

| MSCI US REIT (“RMS”) | 100.00 | 104.20 | 100.39 | 98.55 | 92.94 | 91.35 | 95.63 | |||||||||||||||||||||

As of March 27, 2017 there were approximately 34 record holders, and 17,605,675 shares of common stock issued and outstanding. As of December 31, 2016 and December 31, 2015, there were 17,605,675 and 250,000 outstanding shares of common stock, respectively.

Pursuant to a previously declared dividend approved by the Board of Directors of the Company (the “Board) and in compliance with applicable provisions of the Maryland General Corporation Law, the Company has paid a monthly dividend of $0.0852 per share each month during the four-month period from January 2016 through April 2016 in the total amount of $285,703. Additionally, on September 14, 2016, the Company announced the declaration of a cash dividend of $0.20 per share of common stock to stockholders of record as of September 27, 2016 and to the holders of the LTIP units that were granted on July 1, 2016. This dividend, in the amount of $3,592,786, was paid on October 11, 2016. On December 14, 2016, the Company announced the declaration of a cash dividend of $0.20 per share of common stock to stockholders of record as of December 27, 2016 and to the holders of the LTIP units that were granted on July 1, 2016 and December 21, 2016. This dividend, in the amount of $3,604,037, was accrued as of December 31, 2016 and subsequently paid on January 10, 2017. Total dividends paid to holders of the Company’s common stock was $3,878,489 during the year ended December 31, 2016.

Total dividends paid to holders of the Company’s common stock was $255,600 during the year ended December 31, 2015.

| ITEM 6. | SELECTED FINANCIAL DATA |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this Item 6.

| 16 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with our financial statements, including the notes to those statements, included elsewhere in this Report, and the Section entitled “Cautionary Statement Regarding Forward-Looking Statements” in this Report. As discussed in more detail in the Section entitled “Cautionary Statement Regarding Forward-Looking Statements,” this discussion contains forward-looking statements which involve risks and uncertainties. Our actual results may differ materially from the results discussed in the forward-looking statements.

Background

Global Medical REIT Inc. (the “Company,” “us,” “we,” “our”) was incorporated in the state of Nevada on March 18, 2011 and re-domiciled into a Maryland corporation, effective January 6, 2014. Our principal investment strategy is to develop and manage a portfolio of real estate assets in the healthcare industry, which includes surgery centers, specialty hospitals, and outpatient treatment centers.

We formed our Operating Partnership in March 2016 and contributed all of our then-owned healthcare facilities to the Operating Partnership in exchange for common units of limited partnership interest in the Operating Partnership. We own Global Medical REIT GP, LLC, a Delaware limited liability company, which is the sole general partner of our Operating Partnership. We intend to conduct all future acquisition activity and operations through our Operating Partnership.

Initial Public Offering

On July 1, 2016, the Company closed its initial public offering and issued 13,043,479 shares of its common stock at a price of $10.00 per share resulting in gross proceeds of $130,434,790. After deducting underwriting discounts and commissions, advisory fees, and other offering expenses, the Company received net proceeds from the offering of $120,773,630. Additionally, on July 11, 2016, the underwriters exercised their over-allotment option in full, resulting in the issuance by the Company of an additional 1,956,521 shares of the Company’s common stock at a price of $10.00 per share for gross proceeds of $19,565,210. After deducting underwriting discounts and expenses, advisory fees, and other offering expenses, the Company received net proceeds from the over-allotment option shares of $18,195,645. Total shares issued by the Company in the initial public offering, including over-allotment option shares, were 15,000,000 shares and the total net proceeds received were $137,288,016, which represented gross proceeds received of $138,969,275 net of $1,681,259 in costs directly attributable to the initial public offering that were deferred and paid.

In connection with the Company’s initial public offering, the Company’s common stock was listed on the New York Stock Exchange under the ticker symbol “GMRE.”

Amended Management Agreement

Upon completion of the Company’s initial public offering on July 1, 2016, the Company and the Advisor entered into an amended and restated management agreement, pursuant to which the Advisor manages the operations and investment activities of the Company.

2016 Equity Incentive Plan

Prior to the completion of the initial public offering on July 1, 2016, the Board approved and adopted the 2016 Equity Incentive Plan. The purposes of the 2016 Equity Incentive Plan are to attract and retain qualified persons upon whom, in large measure, our sustained progress, growth and profitability depend, to motivate the participants to achieve long-term company goals and to more closely align the participants’ interests with those of our other stockholders by providing them with a proprietary interest in our growth and performance. An aggregate of 414,504 long term incentive plan (“LTIP”) units were granted during the year ended December 31, 2016 pursuant to the 2016 Equity Incentive Plan. In addition, an aggregate of 817,893 additional shares are available for future issuance under our 2016 Equity Incentive Plan. As disclosed in Note 12 – “Subsequent Events,” on February 28, 2017, the Company’s Board approved the recommendations of the Compensation Committee of the Board with respect to the granting of 2017 Annual Performance-Based LTIP Awards and Long-Term Performance-Based Incentive LTIP Awards to the executive officers of the Company and other employees of the Advisor who perform services for the Company.

Critical Accounting Policies

The preparation of financial statements in conformity with GAAP requires our management to use judgment in the application of accounting policies, including making estimates and assumptions. We base estimates on the best information available to us at the time, our experience and on various other assumptions believed to be reasonable under the circumstances. These estimates affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. If our judgment or interpretation of the facts and circumstances relating to various transactions or other matters had been different, it is possible that different accounting would have been applied, resulting in a different presentation of our financial statements. From time to time, we re-evaluate our estimates and assumptions. In the event estimates or assumptions prove to be different from actual results, adjustments are made in subsequent periods to reflect more current estimates and assumptions about matters that are inherently uncertain. For a more detailed discussion of our significant accounting policies, see Note 2 – “Summary of Significant Accounting Policies” in the footnotes to the accompanying financial statements. Below is a discussion of accounting policies that we consider critical in that they may require complex judgment in their application or require estimates about matters that are inherently uncertain.

| 17 |

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the amounts reported in the Company’s financial statements and accompanying notes. Actual results could differ from those estimates.

Purchase of Real Estate