Exhibit 99.2

www.globalmedicalreit.com GLOBAL MEDICAL REIT SUPPLEMENTAL PORTFOLIO INFORMATION SECOND QUARTER – JUNE 30, 2017 1 1

www.globalmedicalreit.com David Young – Chief Executive Officer Jeffrey Busch – Chairman & President Don McClure – Chief Financial Officer Alfonzo Leon – Chief Investment Officer Danica Holley – Chief Operating Officer Jamie Barber – General Counsel/Corporate Secretary Allen Webb – SVP, SEC Reporting & Technical Accounting COMPANY OVERVIEW SNAPSHOT The Equity Group Jeremy Hellman Senior Associate 212 836 9626 Jhellman@equityny.com CURRENT LOCATIONS INVESTOR RELATIONS CONTACT MANAGEMENT TEAM Global Medical REIT (NYSE: GMRE) is a Maryland corporation engaged primarily in the acquisition of licensed, state - of - the - art, purpose - built healthcare facilities and the leasing of these facilities to strong clinical operators with leading market share. At June 30, 2017, the Company owned 46 buildings, encompassing approximately 1.1 million square feet of net leasable space, which was leased to 35 tenants. The Company’s portfolio consists of a variety of licensed medical facilities, including Long Term Acute Care Hospitals, Medical Office Buildings, Surgery Centers, and Primary Care offices. The Company’s acquisition strategy is focused on deal sizes ranging from $5 million to $20 million although larger acquisitions have been completed and will continue to be pursued in the future. 2

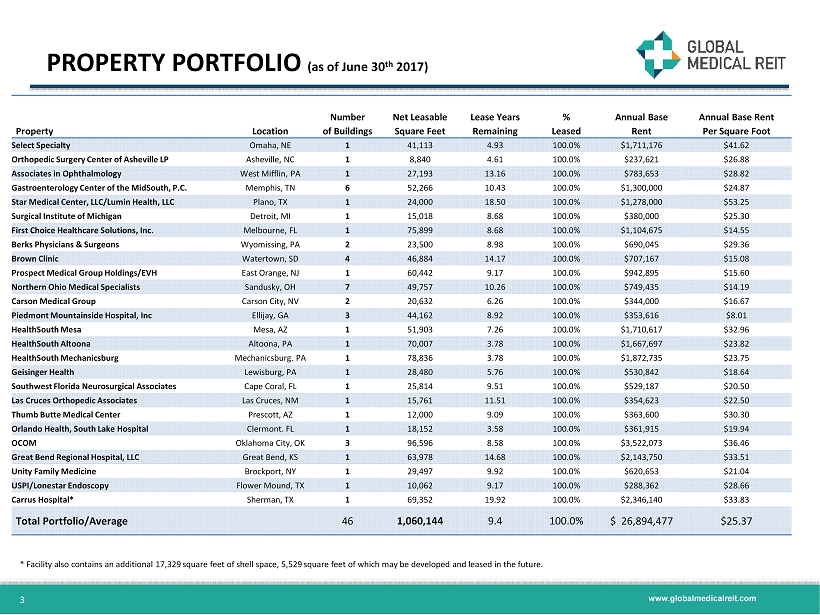

www.globalmedicalreit.com Property Location Number of Buildings Net Leasable Square Feet Lease Years Remaining % Leased Annual Base Rent Annual Base Rent Per Square Foot Select Specialty Omaha, NE 1 41,113 4.93 100.0% $1,711,176 $41.62 Orthopedic Surgery Center of Asheville LP Asheville, NC 1 8,840 4.61 100.0% $237,621 $26.88 Associates in Ophthalmology West Mifflin, PA 1 27,193 13.16 100.0% $783,653 $28.82 Gastroenterology Center of the MidSouth , P.C. Memphis, TN 6 52,266 10.43 100.0% $1,300,000 $24.87 Star Medical Center, LLC/Lumin Health, LLC Plano, TX 1 24,000 18.50 100.0% $1,278,000 $53.25 Surgical Institute of Michigan Detroit, MI 1 15,018 8.68 100.0% $380,000 $25.30 First Choice Healthcare Solutions, Inc. Melbourne, FL 1 75,899 8.68 100.0% $1,104,675 $14.55 Berks Physicians & Surgeons Wyomissing, PA 2 23,500 8.98 100.0% $690,045 $29.36 Brown Clinic Watertown, SD 4 46,884 14.17 100.0% $707,167 $15.08 Prospect Medical Group Holdings/EVH East Orange, NJ 1 60,442 9.17 100.0% $942,895 $15.60 Northern Ohio Medical Specialists Sandusky, OH 7 49,757 10.26 100.0% $749,435 $14.19 Carson Medical Group Carson City, NV 2 20,632 6.26 100.0% $344,000 $16.67 Piedmont Mountainside Hospital, Inc Ellijay, GA 3 44,162 8.92 100.0% $353,616 $8.01 HealthSouth Mesa Mesa, AZ 1 51,903 7.26 100.0% $1,710,617 $32.96 HealthSouth Altoona Altoona, PA 1 70,007 3.78 100.0% $1,667,697 $23.82 HealthSouth Mechanicsburg Mechanicsburg. PA 1 78,836 3.78 100.0% $1,872,735 $23.75 Geisinger Health Lewisburg, PA 1 28,480 5.76 100.0% $530,842 $18.64 Southwest Florida Neurosurgical Associates Cape Coral, FL 1 25,814 9.51 100.0% $529,187 $20.50 Las Cruces Orthopedic Associates Las Cruces, NM 1 15,761 11.51 100.0% $354,623 $22.50 Thumb Butte Medical Center Prescott, AZ 1 12,000 9.09 100.0% $363,600 $30.30 Orlando Health, South Lake Hospital Clermont. FL 1 18,152 3.58 100.0% $361,915 $19.94 OCOM Oklahoma City, OK 3 96,596 8.58 100.0% $3,522,073 $36.46 Great Bend Regional Hospital, LLC Great Bend, KS 1 63,978 14.68 100.0% $2,143,750 $33.51 Unity Family Medicine Brockport, NY 1 29,497 9.92 100.0% $620,653 $21.04 USPI/Lonestar Endoscopy Flower Mound, TX 1 10,062 9.17 100.0% $288,362 $28.66 Carrus Hospital* Sherman, TX 1 69,352 19.92 100.0% $2,346,140 $33.83 Total Portfolio/Average 46 1,060,144 9.4 100.0% $ 26,894,477 $25.37 PROPERTY PORTFOLIO (as of June 30 th 2017) * Facility also contains an additional 17,329 square feet of shell space, 5,529 square feet of which may be developed and lea sed in the future. 3

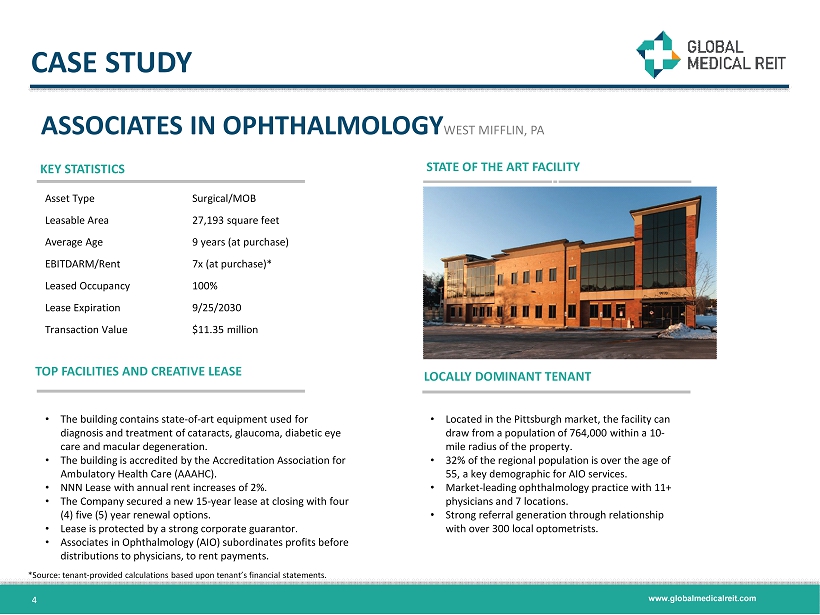

www.globalmedicalreit.com ASSOCIATES IN OPHTHALMOLOGY WEST MIFFLIN , PA KEY STATISTICS 0. STATE OF THE ART FACILITY TOP FACILITIES AND CREATIVE LEASE LOCALLY DOMINANT TENANT • The building contains state - of - art equipment used for diagnosis and treatment of cataracts, glaucoma, diabetic eye care and macular degeneration. • The building is accredited by the Accreditation Association for Ambulatory Health Care (AAAHC). • NNN Lease with annual rent increases of 2%. • The Company secured a new 15 - year lease at closing with four (4) five (5) year renewal options. • Lease is protected by a strong corporate guarantor. • Associates in Ophthalmology (AIO) subordinates profits before distributions to physicians, to rent payments. • Located in the Pittsburgh market, the facility can draw from a population of 764,000 within a 10 - mile radius of the property. • 32% of the regional population is over the age of 55, a key demographic for AIO services. • Market - leading ophthalmology practice with 11+ physicians and 7 locations. • Strong referral generation through relationship with over 300 local optometrists. CASE STUDY Asset Type Surgical/MOB Leasable Area 27,193 square feet Average Age 9 years (at purchase) EBITDARM/Rent 7x (at purchase)* Leased Occupancy 100% Lease Expiration 9/25/2030 Transaction Value $11.35 million 4 *Source: tenant - provided calculations based upon tenant’s financial statements.

www.globalmedicalreit.com Although each facility has a different overall layout, the buildings are purpose built to provide a complete compliment of care. Sustainable Design Elements such as automatic sunshade devices on windows. Centrally - located Nursing Stations. Comfort amenities such as ample lounge areas and parking for family visits. Care enhancement services like on - site pharmacies to properly obtain and administer prescriptions to patients. HEALTHSOUTH PORTFOLIO ARIZONA (1) & PENNSYLVANIA (2) KEY STATISTICS THREE LEADING HOSPITALS STATE OF THE ART FACILITIES MARKET DOMINANT TENANTS Easy access to state and interstate highways . Mesa and Altoona are the primary inpatient rehab hospitals in their respective markets. Facilities are located near acute care hospitals, a primary source of patient referrals for inpatient rehabilitation facilities (IRF). This means the facilities pull from a larger, more stable patient referral base vs a more isolated IRF. CASE STUDY Asset Type Rehabilitation Hospitals Leasable Area 200,746 square feet EBITDARM/Rent 6x (at purchase)* Leased Occupancy 100% Lease Expiration 5/2021 (PA) & 11/2024 (AZ) Transaction Value $68.1 million 5 *Source: tenant - provided calculations based upon tenant’s financial statements.

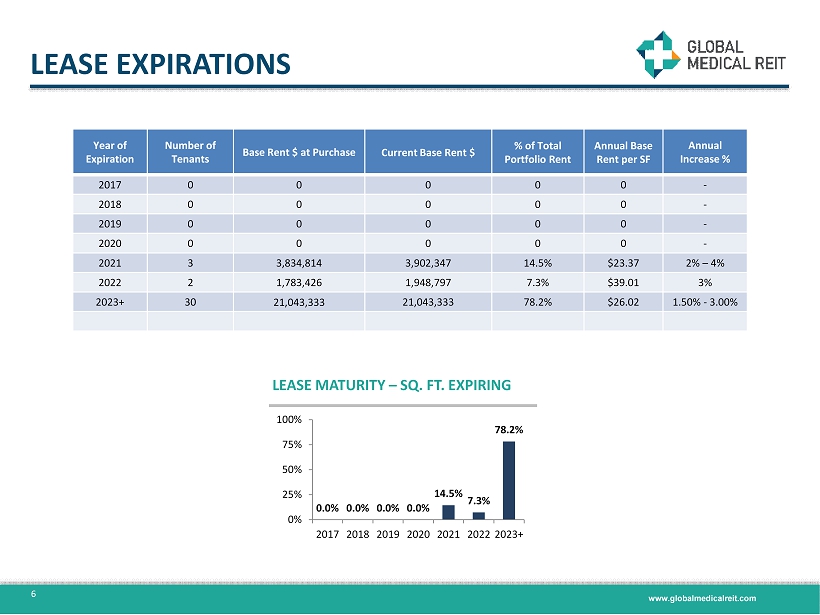

www.globalmedicalreit.com LEASE EXPIRATIONS 0.0% 0.0% 0.0% 0.0% 14.5% 7.3% 78.2% 0% 25% 50% 75% 100% 2017 2018 2019 2020 2021 2022 2023+ LEASE MATURITY – SQ. FT. EXPIRING Year of Expiration Number of Tenants Base Rent $ at Purchase Current Base Rent $ % of Total Portfolio Rent Annual Base Rent per SF Annual Increase % 2017 0 0 0 0 0 - 2018 0 0 0 0 0 - 2019 0 0 0 0 0 - 2020 0 0 0 0 0 - 2021 3 3,834,814 3,902,347 14.5% $23.37 2% – 4% 2022 2 1,783,426 1,948,797 7.3% $39.01 3% 2023+ 30 21,043,333 21,043,333 78.2% $26.02 1.50% - 3.00% 6