Exhibit 99.1

Investor Presentation January 2018 1

Disclaimer This presentation is for informational purposes only and does not constitute an offer to sell, or a solicitation of offers to pu rchase, the Company’s securities. The information contained in this presentation does not purport to be complete and should not be relie d u pon as a basis for making an investment decision in the Company’s securities. This presentation also contains statements that, to the extent they are not recitations of historical fact, constitute “forward - looking statements.” Forward - looking statements are typically identifie d by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict ,” “potential” or the negative of such terms and other comparable terminology. The forward - looking statements included herein are based upon the Comp any’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions re lat ing to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and futur e b usiness decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control. Al though the Company believes that the expectations reflected in such forward - looking statements are based on reasonable assumptions, the Com pany’s actual results and performance could differ materially from those set forth in the forward - looking statements due to the impact of many factors including, but not limited to, those discussed under “Risk Factors” in the Company’s Annual Report on Form 10 - K and Quar terly Reports on Form 10 - Q and any prospectus or prospectus supplement filed with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any such information for any reason after the date of this presentation, unless req uired by law. 2

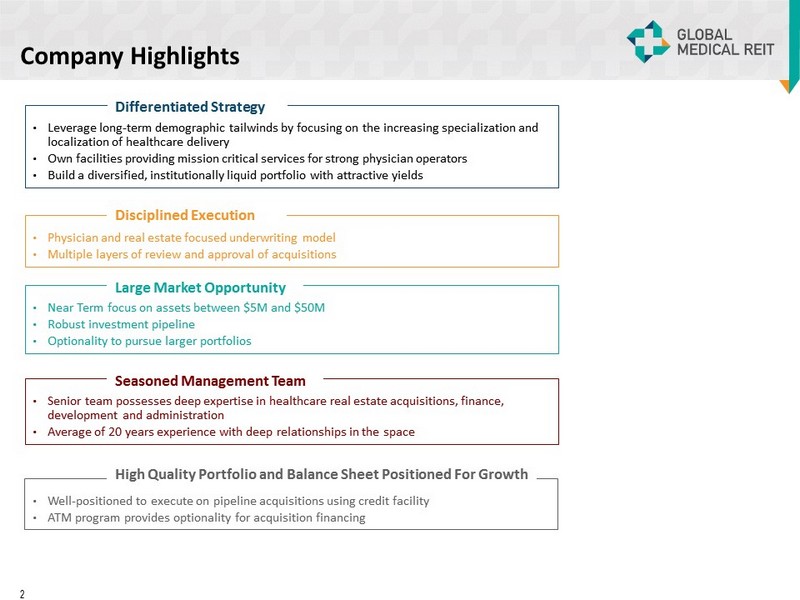

Company Highlights • Leverage long - term demographic tailwinds by focusing on the increasing specialization and localization of healthcare delivery • Own facilities providing mission critical services for strong physician operators • Build a diversified, institutionally liquid portfolio with attractive yields Differentiated Strategy • Physician and real estate focused underwriting model • Multiple layers of review and approval of acquisitions Disciplined Execution • Near Term focus on assets between $5M and $50M • Robust investment pipeline • Optionality to pursue larger portfolios Large Market Opportunity • Senior team possesses deep expertise in healthcare real estate acquisitions, finance, development and administration • Average of 20 years experience with deep relationships in the space Seasoned Management Team • Well - positioned to execute on pipeline acquisitions using credit facility • ATM program provides optionality for acquisition financing High Quality Portfolio and Balance Sheet Positioned For Growth 2

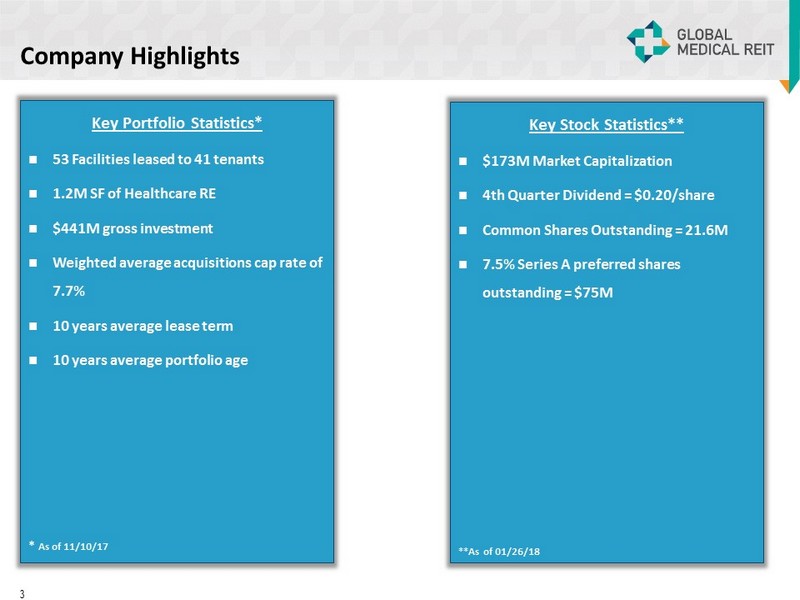

Key Portfolio Statistics* 53 Facilities leased to 41 tenants 1.2M SF of Healthcare RE $441M gross investment Weighted average acquisitions cap rate of 7.7% 10 years average lease term 10 years average portfolio age * As of 11/10/17 Company Highlights 3 Key Stock Statistics** $173M Market Capitalization 4th Quarter Dividend = $0.20/share Common Shares Outstanding = 21.6M 7.5% Series A preferred shares outstanding = $75M **As of 01/26/18

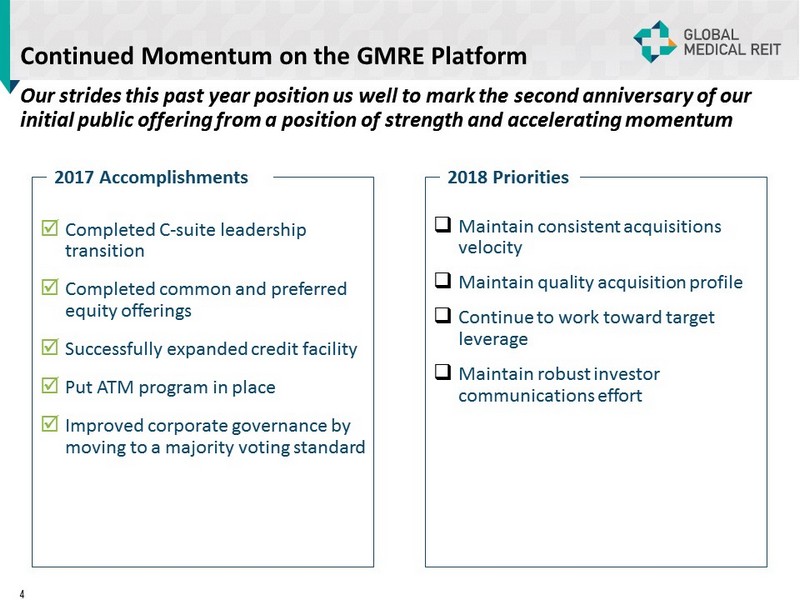

Continued Momentum on the GMRE Platform Our strides this past year position us well to mark the second anniversary of our initial public offering from a position of strength and accelerating momentum Completed C - suite leadership transition Completed common and preferred equity offerings Successfully expanded credit facility Put ATM program in place Improved corporate governance by moving to a majority voting standard 2017 Accomplishments □ Maintain consistent acquisitions velocity □ Maintain quality acquisition profile □ Continue to work toward target leverage □ Maintain robust investor communications effort 2018 Priorities 4

Strategy Leverages Key Dynamics in Healthcare Today Healthcare Industry’s “Path of Growth” Favors Localization and Specialization Strong Providers in our Markets Require Real Estate Solutions The biggest risks to healthcare real estate are driven by operator quality Pricing for “One - off” Acquisitions and Smaller Portfolios is Highly Inefficient Industry - wide demographic tailwinds support GMRE’s core strategic vision 5

GMR Austin Austin, Texas 6

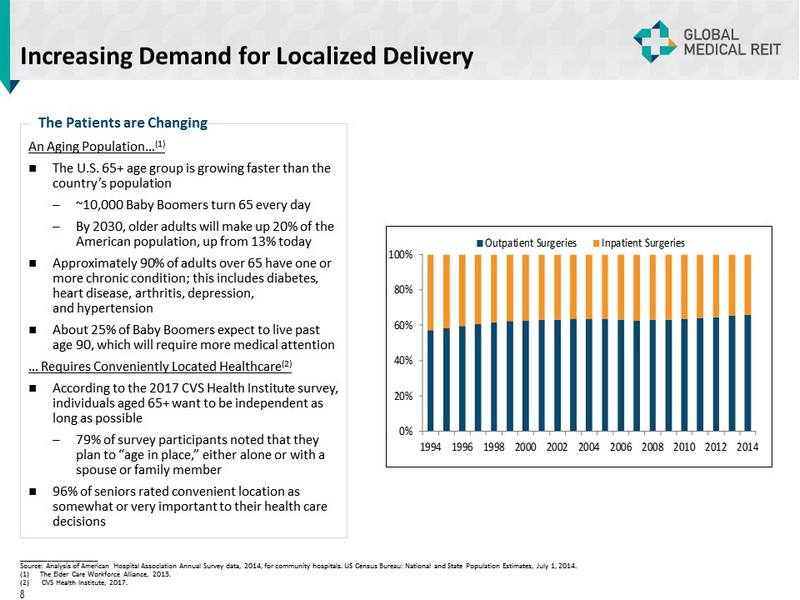

Increasing Demand for Localized Delivery 0% 20% 40% 60% 80% 100% 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Outpatient Surgeries Inpatient Surgeries An Aging Population… (1) The U.S. 65+ age group is growing faster than the country’s population – ~10,000 Baby Boomers turn 65 every day – By 2030, older adults will make up 20% of the American population, up from 13% today Approximately 90% of adults over 65 have one or more chronic condition; this includes diabetes, heart disease, arthritis, depression, and hypertension About 25% of Baby Boomers expect to live past age 90, which will require more medical attention … Requires Conveniently Located Healthcare (2) According to the 2017 CVS Health Institute survey, individuals aged 65+ want to be independent as long as possible – 79% of survey participants noted that they plan to “age in place,” either alone or with a spouse or family member 96% of seniors rated convenient location as somewhat or very important to their health care decisions The Patients are Changing _____________________ Source: Analysis of American Hospital Association Annual Survey data, 2014, for community hospitals. US Census Bureau: Nation al and State Population Estimates, July 1, 2014. (1) The Elder Care Workforce Alliance, 2013. (2) CVS Health Institute, 2017. 8

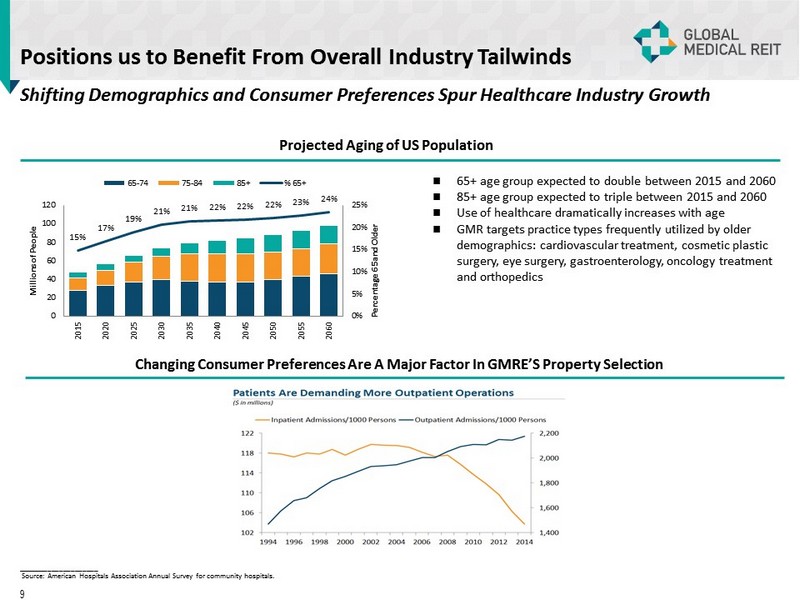

Shifting Demographics and Consumer Preferences Spur Healthcare Industry Growth Positions us to Benefit From Overall Industry Tailwinds Projected Aging of US Population 65+ age group expected to double between 2015 and 2060 85+ age group expected to triple between 2015 and 2060 Use of healthcare dramatically increases with age GMR targets practice types frequently utilized by older demographics: cardiovascular treatment, cosmetic plastic surgery, eye surgery, gastroenterology, oncology treatment and orthopedics Changing Consumer Preferences Are A Major Factor In GMRE’S Property Selection 15% 17% 19% 21% 21% 22% 22% 22% 23% 24% 0% 5% 10% 15% 20% 25% 0 20 40 60 80 100 120 2015 2020 2025 2030 2035 2040 2045 2050 2055 2060 Percentage 65 and Older Millions of People 65-74 75-84 85+ % 65+ _____________________ Source: American Hospitals Association Annual Survey for community hospitals. 9

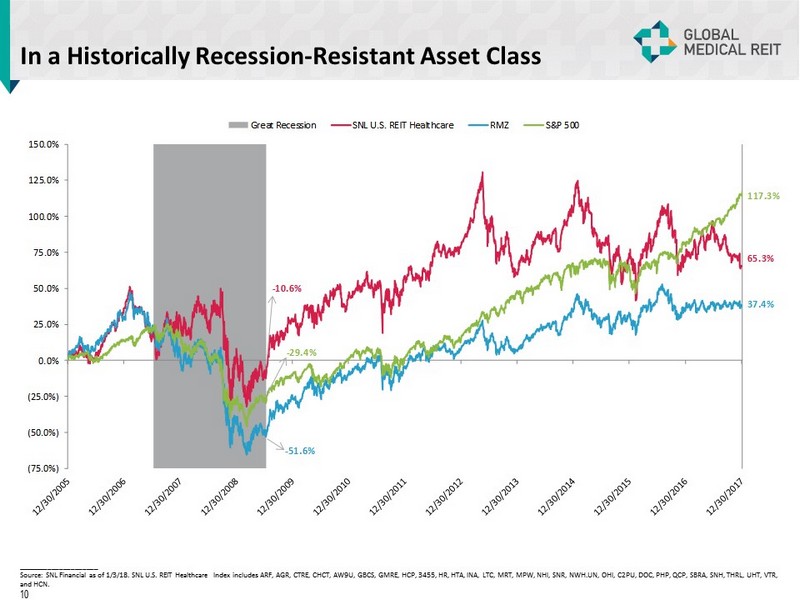

- 10.6% 65.3% - 51.6% 37.4% - 29.4% 117.3% (75.0%) (50.0%) (25.0%) 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% Great Recession SNL U.S. REIT Healthcare RMZ S&P 500 In a Historically Recession - Resistant Asset Class _____________________ Source: SNL Financial as of 1/3/18. SNL U.S. REIT Healthcare Index includes ARF, AGR, CTRE, CHCT, AW9U, GBCS, GMRE, HCP, 3455, HR, HTA, INA, LTC, MRT, MPW, NHI, SNR, NWH.UN, OHI, C2PU, DOC, PHP, QCP, S BRA , SNH, THRL, UHT, VTR, and HCN. 10

GMR Flower Mound Flower Mound, Texas 11

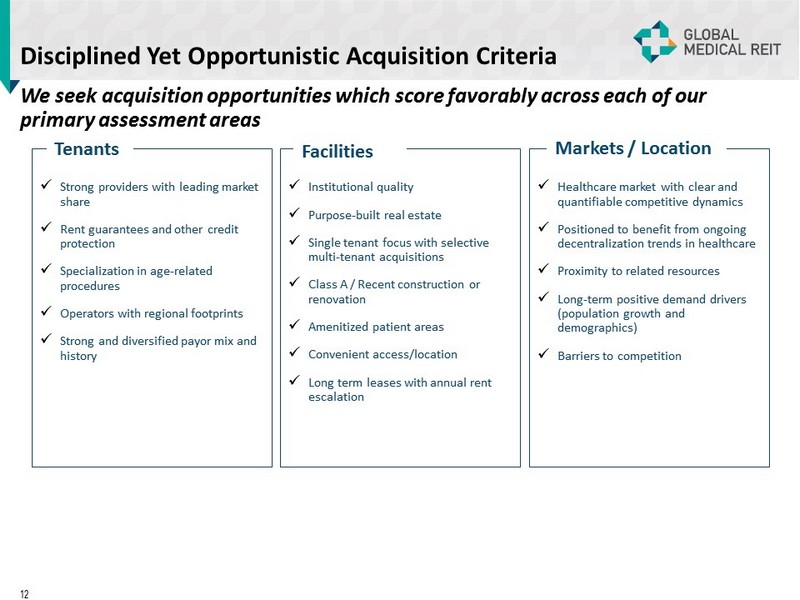

Disciplined Yet Opportunistic Acquisition Criteria x Strong providers with leading market share x Rent guarantees and other credit protection x Specialization in age - related procedures x Operators with regional footprints x Strong and diversified payor mix and history x Institutional quality x Purpose - built real estate x Single tenant focus with selective multi - tenant acquisitions x Class A / Recent construction or renovation x Amenitized patient areas x Convenient access/location x Long term leases with annual rent escalation x Healthcare market with clear and quantifiable competitive dynamics x Positioned to benefit from ongoing decentralization trends in healthcare x Proximity to related resources x Long - term positive demand drivers (population growth and demographics) x Barriers to competition Tenants Facilities Markets / Location We seek acquisition opportunities which score favorably across each of our primary assessment areas 12

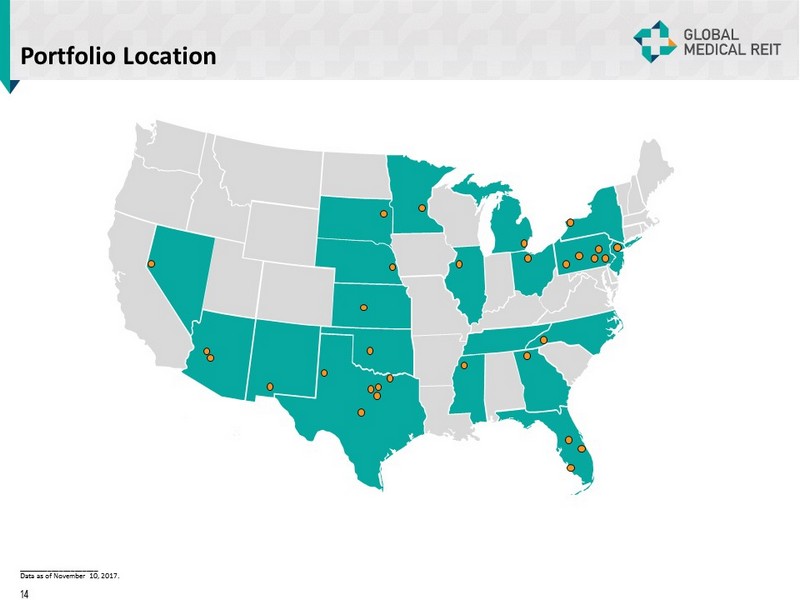

Portfolio Location _____________________ Data as of November 10, 2017. 14

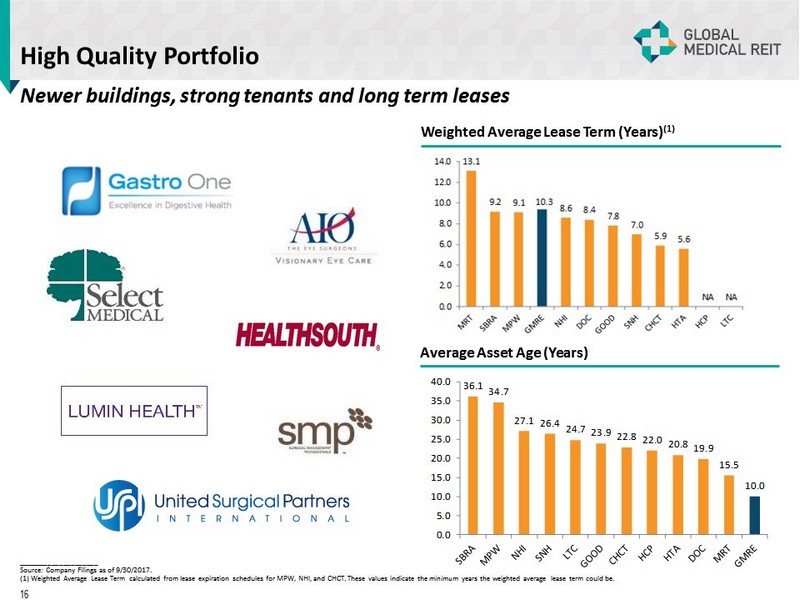

36.1 34.7 27.1 26.4 24.7 23.9 22.8 22.0 20.8 19.9 15.5 10.0 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 High Quality Portfolio Newer buildings, strong tenants and long term leases Weighted Average Lease Term (Years) (1) Average Asset Age (Years) _____________________ Source: Company Filings as of 9/30/2017. (1) Weighted Average Lease Term calculated from lease expiration schedules for MPW, NHI, and CHCT. These values indicate the minimum years the weighted average lease term could be. 16

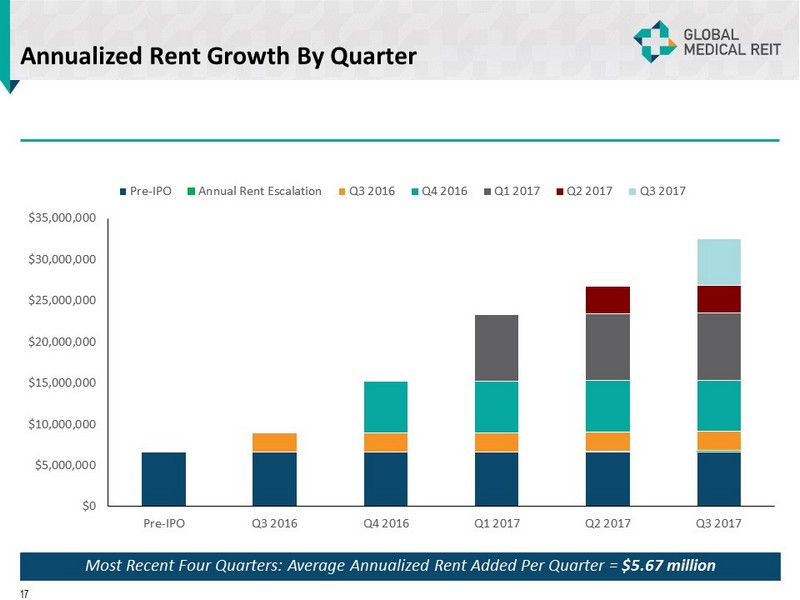

Annualized Rent Growth By Quarter $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 Pre-IPO Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Pre-IPO Annual Rent Escalation Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Most Recent Four Quarters: Average Annualized Rent Added Per Quarter = $5.67 million 17

Case Study: Associates In Ophthalmology Key Statistics State of the Art Facility Top Facilities and Creative Lease Locally Dominant Tenant The building contains state of are equipment used diagnosis and treatment of cataracts, glaucoma, diabetic eye care and macular degeneration The building is accredited by the Accreditation Association for Ambulatory Health Care (AAAHC) Profitable operator provides high, 7x rent coverage Longterm NNN Leases with annual rent increases of 2% Lease is protected by a strong corporate guarantor Associates in Ophthalmology (AIO) subordinates profits before distributions to physicians, to rent payments The facility is operated by Associates in Ophthalmology (AIO) and Associates Surgery Centers (ASC) respectively via two separate lease agreements that expire in 2030 Located in the Pittsburgh market, the facility can draw from a population of 764,000 within a 10 - mile radius of the property. 32% of the regional population is over the age of 55, a key demographic for AIO services 34 doctor practice provides highest quality care Market - leading ophthalmology practice with 11+ physicians and 7 locations 19 Asset Type Surgery Center and Medical Office Building Gross Leasable Area 27,193 Year Built 2006 EBITDARM / Rent 7x at lease inception Leased Occupancy 100% Lease Expiration 9/25/2030 Transaction Value $11.4m

Case Study: HealthSouth Portfolio AZ (1) and PA (2) Key Statistics State of the Art Facility Serving Contemporary Trends Market Dominant Tenant Although each facility has a different overall layout, the buildings are purpose built to provide a complete compliment of care Sustainable Design Elements such as the use of sunshade devices on windows Centrally Located Nursing Stations Comforts amenities such as ample Lounge areas and parking for family visits Care enhancement services like on - site Pharmacies to properly obtain and administer prescriptions to patients. HealthSouth is the leading U.S. provider of post - acute healthcare services, offering both facility - based and home - based post - acute services. Operates in 30 plus states and Puerto Rico through network home health agencies, and hospice agencies. HealthSouth had $3.1 billion in revenue in 2015 and $4.6 billion in total assets as of the end of 2015. The inpatient rehabilitation (IRF) industry is highly fragmented, and HealthSouth has no single, large competitor Altoona , PA Mechanicsburg, PA Mesa, AZ Asset Type Inpatient Rehab Hospitals Gross Leasable Area 200,746 Year Built Class A-/B+ Assets EBITDARM / Rent 6x average at purchase Leased Occupancy 100% Lease Expiration 5/2021 (PA) & 11/2024 (AZ) Transaction Value $68.1m 20

Leadership JEFFREY BUSCH , Chairman, Chief Executive Officer and President ▪ Over 20 years of experience in healthcare, real estate development, management and investment ▪ Former assistant to the U.S. Secretary of Housing & Urban Development ▪ United States Special Representative to United Nations in Geneva ▪ Developed large - scale residential, commercial, hospitality and retail properties ROBERT KIERNAN , Chief Financial Officer and Treasurer ▪ Over 30 years of experience in financial accounting, reporting and management, including extensive experience in SEC reportin g and Sarbanes - Oxley compliance ▪ Served as the Senior Vice President, Controller and Chief Accounting Officer of FBR & Co. (“FBR” NASDAQ: FBRC) beginning in O cto ber 2007 ▪ Prior role as Senior Vice President, Controller and Chief Accounting Officer of Arlington Asset Investment Corp. (NYSE: AI) ▪ Previously Senior Manager in the assurance practice at Ernst & Young ALFONZO LEON , Chief Investment Officer ▪ Over 17 years of experience in real estate finance and has completed $ 3 billion of transactions ▪ Prior experience as principal at investment advisor to pension funds and investment banker representing healthcare systems, dev elopers and REITs ▪ Healthcare real estate investment banker for Cain Brothers ▪ Acquired $ 800 million in multi - family, office, medical office, and industrial property on behalf of institutional investors while at LaSalle Investment DANICA HOLLEY, Chief Operating Officer ▪ Management and business development experience spans more than 18 years ▪ More than a decade of experience managing multinational teams for complex service delivery across disciplines ▪ More than 8 years in healthcare programs and infrastructure as Executive Director of Safe Blood International ▪ More than a decade of experience with SEC compliance and reporting matters, corporate governance, investment banking and REIT - related capital markets ▪ Served as Associate General Counsel of FBR (NASDAQ: FBRC) beginning in July 2012 ▪ Prior role as Senior Associate – REIT Capital Markets at Hunton & Williams LLP, where he represented public REITs in conjunction with their SEC compliance requirements, corporate governance matters, offerings of equity and debt securities and merger and acquisition transactions ▪ Previously with Sullivan & Cromwell LLP and KPMG JAMIE BARBER, General Counsel and Corporate Secretary 21

Independent Directors Majority independent Board with strong backgrounds in healthcare, real estate and capital markets Henry Cole, Independent Director ▪ President of Global Development International, providing development support and oversight for initiatives in medical and hea lth care programs (e.g. Instant Labs Medical Diagnostics, MedPharm & MPRC Group) ▪ Former President and Founder of international programs at The Futures Group International, a healthcare consulting firm ▪ Director of International Health and Population Programs for GE’s Center for Advanced Studies ▪ Yale (B.S.); Johns Hopkins (MA) Matthew Cypher, Ph.D., Independent Director ▪ Professor at Georgetown University’s McDonough School of Business as the director of the Steers Center for Global Real Estate ▪ Former director at Invesco Real Estate (NYSE: IVR) where he was responsible for oversight of the Underwriting Group, which ac qui red $10.2 billion worth of institutional real estate ▪ Underwrote $1.5 billion of acquisitions and oversaw the Valuations group, which marked to market Invesco’s more than $13 bil lio n North American portfolio ▪ Penn State University (B.S.); Texas A&M University (M.S. and Ph.D.) Kurt Harrington , Independent Director ▪ Over 40 years experience in managing financial functions for large and small publicly traded companies ▪ Previously CFO of three public companies, Arlington Asset Investment Corp . , FBR Capital Markets and Jupiter National, Inc . ▪ Director of Wheeler Real Estate Investment Trust (NASDAQ : WHLR) and trustee and treasurer of Nichols College ▪ Nichols College (B . S . ) ; CPA (inactive) Ronald Marston, Independent Director ▪ Founder and CEO of Health Care Corporation of America (HCCA) Management Company, originally a subsidiary of Hospital Corporation of America (HCA) ▪ 30 + years in international healthcare focused on healthcare systems with prior experience developing the Twelfth Evacuation Hospital in Vietnam ▪ Tennessee Technological University (B . S . ) ; California Western University (Ph . D . ) ▪ Rear Admiral (Retired) and Chief Veterinary Medical Officer of United States Public Health Service ▪ Former Assistant United States Surgeon General, point person for global development support with a focus on less developed countries ▪ Epidemic Intelligence Service Officer with the U . S . Centers for Disease Control and Prevention (CDC) ▪ Chief epidemiologist with the Centers of Devices and Radiological Health in the US Food and Drug Administration (FDA) ▪ Tuskegee University (B . S . & DVM) ; University in Michigan (M . P . H . ) ; Johns Hopkins University (Ph . D . ) Dr. Roscoe Moore, Independent Director 22

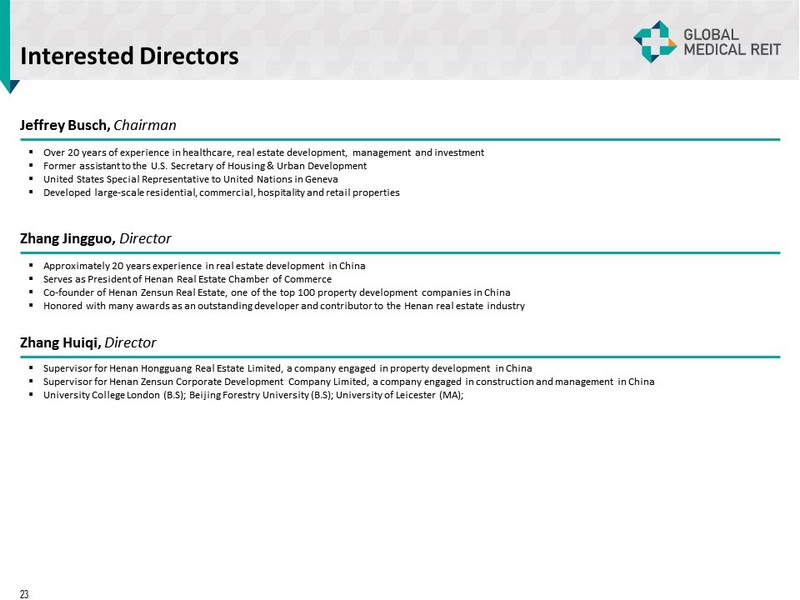

Interested Directors Jeffrey Busch, Chairman ▪ Over 20 years of experience in healthcare, real estate development, management and investment ▪ Former assistant to the U.S. Secretary of Housing & Urban Development ▪ United States Special Representative to United Nations in Geneva ▪ Developed large - scale residential, commercial, hospitality and retail properties Zhang Jingguo , Director ▪ Approximately 20 years experience in real estate development in China ▪ Serves as President of Henan Real Estate Chamber of Commerce ▪ Co - founder of Henan Zensun Real Estate, one of the top 100 property development companies in China ▪ Honored with many awards as an outstanding developer and contributor to the Henan real estate industry ▪ Supervisor for Henan Hongguang Real Estate Limited, a company engaged in property development in China ▪ Supervisor for Henan Zensun Corporate Development Company Limited, a company engaged in construction and management in China ▪ University College London (B . S) ; Beijing Forestry University (B . S) ; University of Leicester (MA) ; Zhang Huiqi , Director 23

APPENDIX 24

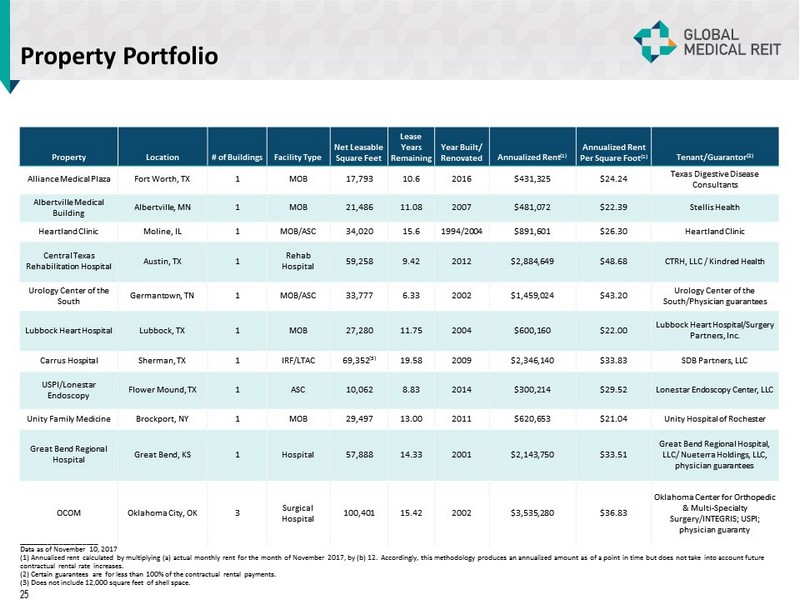

Property Portfolio Property Location # of Buildings Facility Type Net Leasable Square Feet Lease Years Remaining Year Built/ Renovated Annualized Rent (1) Annualized Rent Per Square Foot (1) Tenant/Guarantor (2) Alliance Medical Plaza Fort Worth, TX 1 MOB 17,793 10.6 2016 $431,325 $24.24 Texas Digestive Disease Consultants Albertville Medical Building Albertville, MN 1 MOB 21,486 11.08 2007 $481,072 $22.39 Stellis Health Heartland Clinic Moline, IL 1 MOB/ASC 34,020 15.6 1994/2004 $891,601 $26.30 Heartland Clinic Central Texas Rehabilitation Hospital Austin, TX 1 Rehab Hospital 59,258 9.42 2012 $2,884,649 $48.68 CTRH, LLC / Kindred Health Urology Center of the South Germantown, TN 1 MOB/ASC 33,777 6.33 2002 $1,459,024 $43.20 Urology Center of the South/Physician guarantees Lubbock Heart Hospital Lubbock, TX 1 MOB 27,280 11.75 2004 $600,160 $22.00 Lubbock Heart Hospital/Surgery Partners, Inc. Carrus Hospital Sherman, TX 1 IRF/LTAC 69,352 (3) 19.58 2009 $2,346,140 $33.83 SDB Partners, LLC USPI/ Lonestar Endoscopy Flower Mound, TX 1 ASC 10,062 8.83 2014 $300,214 $29.52 Lonestar Endoscopy Center, LLC Unity Family Medicine Brockport, NY 1 MOB 29,497 13.00 2011 $620,653 $21.04 Unity Hospital of Rochester Great Bend Regional Hospital Great Bend, KS 1 Hospital 57,888 14.33 2001 $2,143,750 $33.51 Great Bend Regional Hospital, LLC/ Nueterra Holdings, LLC, physician guarantees OCOM Oklahoma City, OK 3 Surgical Hospital 100,401 15.42 2002 $3,535,280 $36.83 Oklahoma Center for Orthopedic & Multi - Specialty Surgery/INTEGRIS; USPI; physician guaranty _____________________ Data as of November 10, 2017 (1) Annualized rent calculated by multiplying (a) actual monthly rent for the month of November 2017, by (b) 12. Accordingly, t his methodology produces an annualized amount as of a point in time but does not take into account future contractual rental rate increases. (2) Certain guarantees are for less than 100% of the contractual rental payments. (3) Does not include 12,000 square feet of shell space. 25

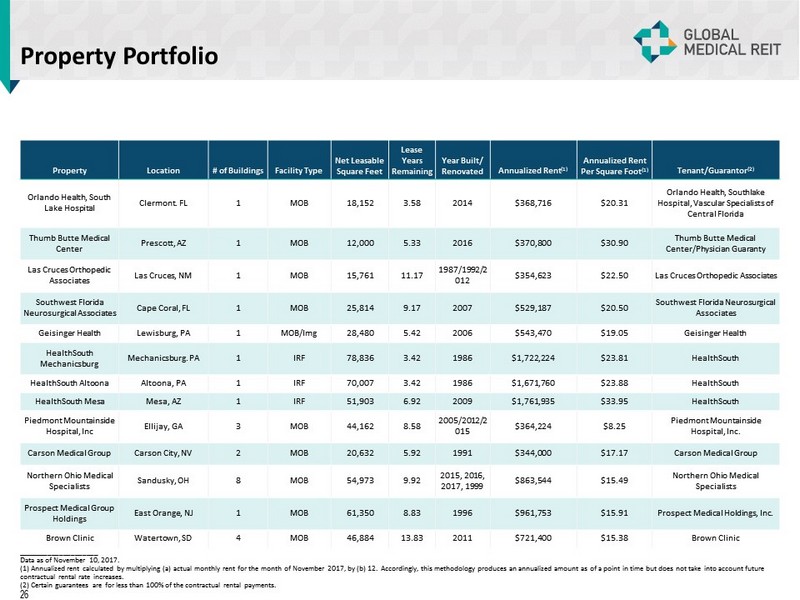

Property Portfolio Property Location # of Buildings Facility Type Net Leasable Square Feet Lease Years Remaining Year Built/ Renovated Annualized Rent (1) Annualized Rent Per Square Foot (1) Tenant/Guarantor (2) Orlando Health, South Lake Hospital Clermont. FL 1 MOB 18,152 3.58 2014 $368,716 $20.31 Orlando Health, Southlake Hospital, Vascular Specialists of Central Florida Thumb Butte Medical Center Prescott, AZ 1 MOB 12,000 5.33 2016 $370,800 $30.90 Thumb Butte Medical Center /Physician Guaranty Las Cruces Orthopedic Associates Las Cruces, NM 1 MOB 15,761 11.17 1987/1992/2 012 $354,623 $22.50 Las Cruces Orthopedic Associates Southwest Florida Neurosurgical Associates Cape Coral, FL 1 MOB 25,814 9.17 2007 $529,187 $20.50 Southwest Florida Neurosurgical Associates Geisinger Health Lewisburg, PA 1 MOB/Img 28,480 5.42 2006 $543,470 $19.05 Geisinger Health HealthSouth Mechanicsburg Mechanicsburg. PA 1 IRF 78,836 3.42 1986 $1,722,224 $23.81 HealthSouth HealthSouth Altoona Altoona, PA 1 IRF 70,007 3.42 1986 $1,671,760 $23.88 HealthSouth HealthSouth Mesa Mesa, AZ 1 IRF 51,903 6.92 2009 $1,761,935 $33.95 HealthSouth Piedmont Mountainside Hospital, Inc Ellijay, GA 3 MOB 44,162 8.58 2005/2012/2 015 $364,224 $8.25 Piedmont Mountainside Hospital, Inc. Carson Medical Group Carson City, NV 2 MOB 20,632 5.92 1991 $344,000 $17.17 Carson Medical Group Northern Ohio Medical Specialists Sandusky, OH 8 MOB 54,973 9.92 2015, 2016, 2017, 1999 $863,544 $15.49 Northern Ohio Medical Specialists Prospect Medical Group Holdings East Orange, NJ 1 MOB 61,350 8.83 1996 $961,753 $15.91 Prospect Medical Holdings, Inc. Brown Clinic Watertown, SD 4 MOB 46,884 13.83 2011 $721,400 $15.38 Brown Clinic _____________________ Data as of November 10, 2017. (1) Annualized rent calculated by multiplying (a) actual monthly rent for the month of November 2017, by (b) 12. Accordingly, t his methodology produces an annualized amount as of a point in time but does not take into account future contractual rental rate increases. (2) Certain guarantees are for less than 100% of the contractual rental payments. 26

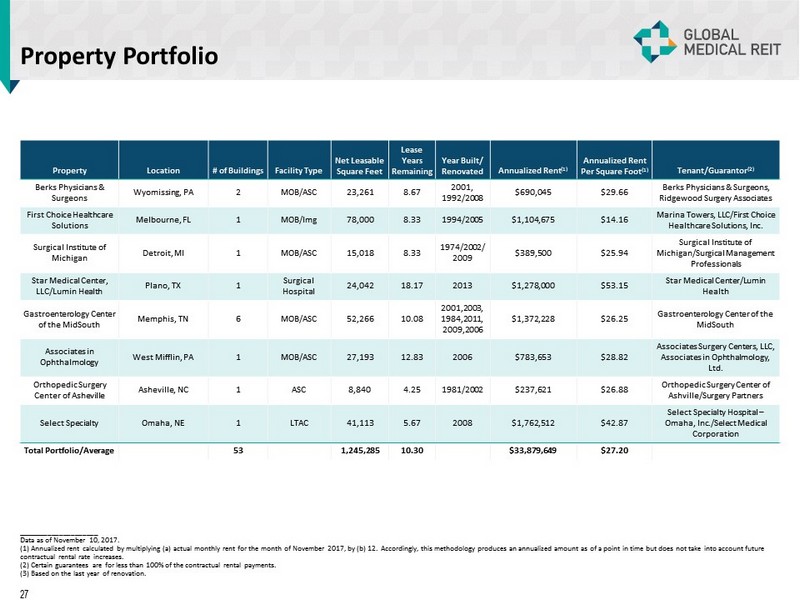

Property Portfolio Property Location # of Buildings Facility Type Net Leasable Square Feet Lease Years Remaining Year Built/ Renovated Annualized Rent (1) Annualized Rent Per Square Foot (1) Tenant/Guarantor (2) Berks Physicians & Surgeons Wyomissing, PA 2 MOB/ASC 23,261 8.67 2001, 1992/2008 $690,045 $29.66 Berks Physicians & Surgeons, Ridgewood Surgery Associates First Choice Healthcare Solutions Melbourne, FL 1 MOB/ Img 78,000 8.33 1994/2005 $1,104,675 $14.16 Marina Towers, LLC/First Choice Healthcare Solutions, Inc. Surgical Institute of Michigan Detroit, MI 1 MOB/ASC 15,018 8.33 1974/2002/ 2009 $389,500 $25.94 Surgical Institute of Michigan/Surgical Management Professionals Star Medical Center , LLC/ Lumin Health Plano, TX 1 Surgical Hospital 24,042 18.17 2013 $1,278,000 $53.15 Star Medical Center/ Lumin Health Gastroenterology Center of the MidSouth Memphis, TN 6 MOB/ASC 52,266 10.08 2001,2003, 1984,2011, 2009,2006 $1,372,228 $26.25 Gastroenterology Center of the MidSouth Associates in Ophthalmology West Mifflin, PA 1 MOB/ASC 27,193 12.83 2006 $783,653 $28.82 Associates Surgery Centers , LLC, Associates in Ophthalmology, Ltd. Orthopedic Surgery Center of Asheville Asheville, NC 1 ASC 8,840 4.25 1981/2002 $237,621 $26.88 Orthopedic Surgery Center of Ashville/Surgery Partners Select Specialty Omaha, NE 1 LTAC 41,113 5.67 2008 $1,762,512 $42.87 Select Specialty Hospital – Omaha, Inc./Select Medical Corporation Total Portfolio/Average 53 1,245,285 10.30 $33,879,649 $27.20 _____________________ Data as of November 10, 2017. (1) Annualized rent calculated by multiplying (a) actual monthly rent for the month of November 2017, by (b) 12. Accordingly, t his methodology produces an annualized amount as of a point in time but does not take into account future contractual rental rate increases. (2) Certain guarantees are for less than 100% of the contractual rental payments. (3) Based on the last year of renovation. 27

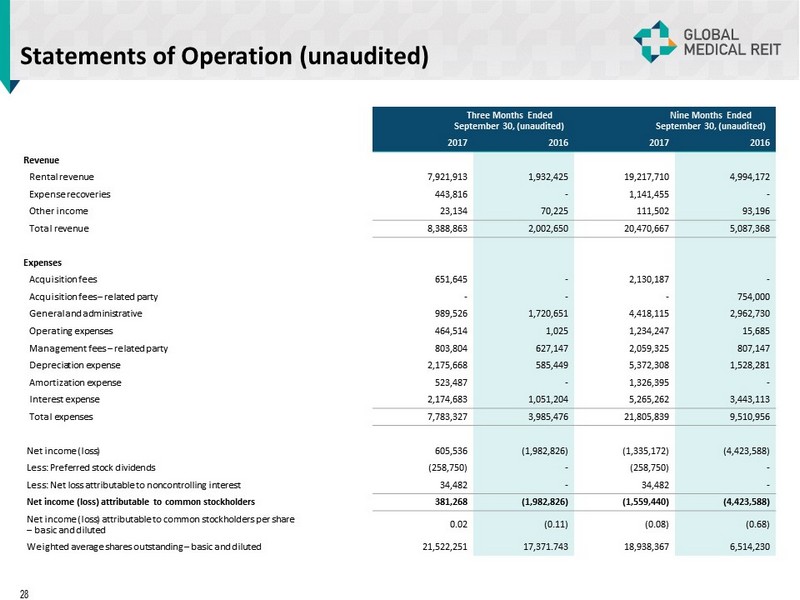

Statements of Operation (unaudited) Three Months Ended September 30, (unaudited) Nine Months Ended September 30, (unaudited) 2017 2016 2017 2016 Revenue Rental revenue 7,921,913 1,932,425 19,217,710 4,994,172 Expense recoveries 443,816 - 1,141,455 - Other income 23,134 70,225 111,502 93,196 Total revenue 8,388,863 2,002,650 20,470,667 5,087,368 Expenses Acquisition fees 651,645 - 2,130,187 - Acquisition fees – related party - - - 754,000 General and administrative 989,526 1,720,651 4,418,115 2,962,730 Operating expenses 464,514 1,025 1,234,247 15,685 Management fees – related party 803,804 627,147 2,059,325 807,147 Depreciation expense 2,175,668 585,449 5,372,308 1,528,281 Amortization expense 523,487 - 1,326,395 - Interest expense 2,174,683 1,051,204 5,265,262 3,443,113 Total expenses 7,783,327 3,985,476 21,805,839 9,510,956 Net income (loss) 605,536 (1,982,826) (1,335,172) (4,423,588) Less: Preferred stock dividends (258,750) - (258,750) - Less: Net loss attributable to noncontrolling interest 34,482 - 34,482 - Net income (loss) attributable to common stockholders 381,268 (1,982,826) (1,559,440) (4,423,588) Net income (loss) attributable to common stockholders per share – basic and diluted 0.02 (0.11) (0.08) (0.68) Weighted average shares outstanding – basic and diluted 21,522,251 17,371.743 18,938,367 6,514,230 28

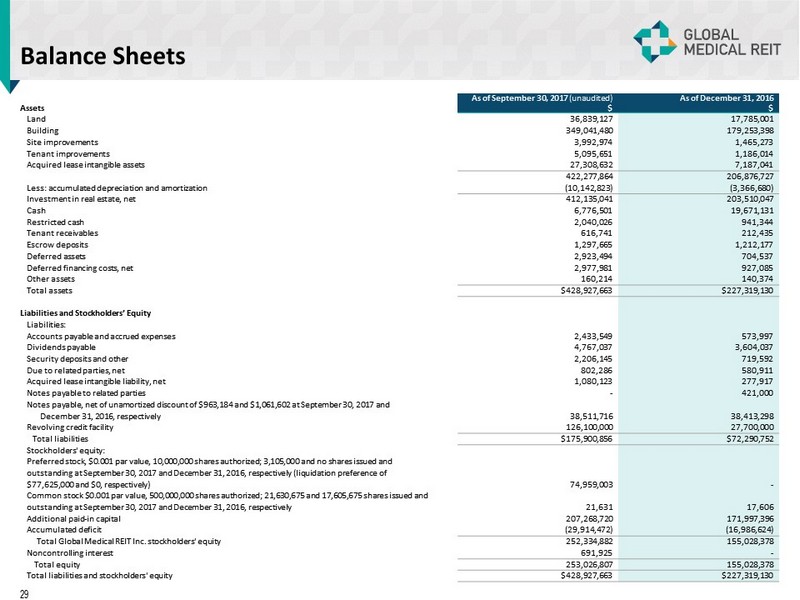

Balance Sheets As of September 30, 2017 (unaudited) As of December 31, 2016 Assets $ $ Land 36,839,127 17,785,001 Building 349,041,480 179,253,398 Site improvements 3,992,974 1,465,273 Tenant improvements 5,095,651 1,186,014 Acquired lease intangible assets 27,308,632 7,187,041 422,277,864 206,876,727 Less: accumulated depreciation and amortization (10,142,823) (3,366,680) Investment in real estate, net 412,135,041 203,510,047 Cash 6,776,501 19,671,131 Restricted cash 2,040,026 941,344 Tenant receivables 616,741 212,435 Escrow deposits 1,297,665 1,212,177 Deferred assets 2,923,494 704,537 Deferred financing costs, net 2,977,981 927,085 Other assets 160,214 140,374 Total assets $428,927,663 $227,319,130 Liabilities and Stockholders’ Equity Liabilities: Accounts payable and accrued expenses 2,433,549 573,997 Dividends payable 4,767,037 3,604,037 Security deposits and other 2,206,145 719,592 Due to related parties, net 802,286 580,911 Acquired lease intangible liability, net 1,080,123 277,917 Notes payable to related parties - 421,000 Notes payable, net of unamortized discount of $963,184 and $1,061,602 at September 30, 2017 and December 31, 2016, respectively 38,511,716 38,413,298 Revolving credit facility 126,100,000 27,700,000 Total liabilities $175,900,856 $72,290,752 Stockholders' equity: Preferred stock, $0.001 par value, 10,000,000 shares authorized; 3,105,000 and no shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively (liquidation preference of $77,625,000 and $0, respectively) 74,959,003 - Common stock $0.001 par value, 500,000,000 shares authorized; 21,630,675 and 17,605,675 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively 21,631 17,606 Additional paid - in capital 207,268,720 171,997,396 Accumulated deficit (29,914,472) (16,986,624) Total Global Medical REIT Inc. stockholders' equity 252,334,882 155,028,378 Noncontrolling interest 691,925 - Total equity 253,026,807 155,028,378 Total liabilities and stockholders' equity $428,927,663 $227,319,130 29

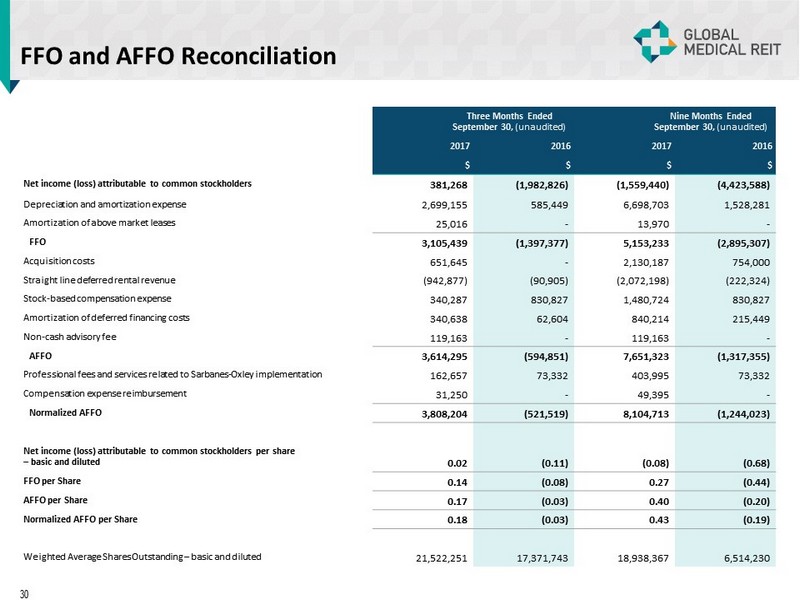

FFO and AFFO Reconciliation Three Months Ended September 30, (unaudited) Nine Months Ended September 30, (unaudited) 2017 2016 2017 2016 $ $ $ $ Net income (loss) attributable to common stockholders 381,268 (1,982,826) (1,559,440) (4,423,588) Depreciation and amortization expense 2,699,155 585,449 6,698,703 1,528,281 Amortization of above market leases 25,016 - 13,970 - FFO 3,105,439 (1,397,377) 5,153,233 (2,895,307) Acquisition costs 651,645 - 2,130,187 754,000 Straight line deferred rental revenue (942,877) (90,905) (2,072,198) (222,324) Stock - based compensation expense 340,287 830,827 1,480,724 830,827 Amortization of deferred financing costs 340,638 62,604 840,214 215,449 Non - cash advisory fee 119,163 - 119,163 - AFFO 3,614,295 (594,851) 7,651,323 (1,317,355) Professional fees and services related to Sarbanes - Oxley implementation 162,657 73,332 403,995 73,332 Compensation expense reimbursement 31,250 - 49,395 - Normalized AFFO 3,808,204 (521,519) 8,104,713 (1,244,023) Net income (loss) attributable to common stockholders per share – basic and diluted 0.02 (0.11) (0.08) (0.68) FFO per Share 0.14 (0.08) 0.27 (0.44) AFFO per Share 0.17 (0.03) 0.40 (0.20) Normalized AFFO per Share 0.18 (0.03) 0.43 (0.19) Weighted Average Shares Outstanding – basic and diluted 21,522,251 17,371,743 18,938,367 6,514,230 30