Exhibit 10.1

THIS LEASE, Made and entered into by and between 601 Plaza L.L.C., a West Virginia limited liability company, (hereinafter “Landlord”), and Marietta Memorial Hospital, an Ohio non profit corporation, (hereinafter “Tenant”).

WITNESSETH: That for and in consideration of the mutual terms, covenants, provisions and conditions herein set forth, Landlord does hereby lease to Tenant, and Tenant does hereby hire and rent from Landlord those certain premises, hereinafter referred to as the “Demised Premises”, as follows:

DEMISED PREMISES

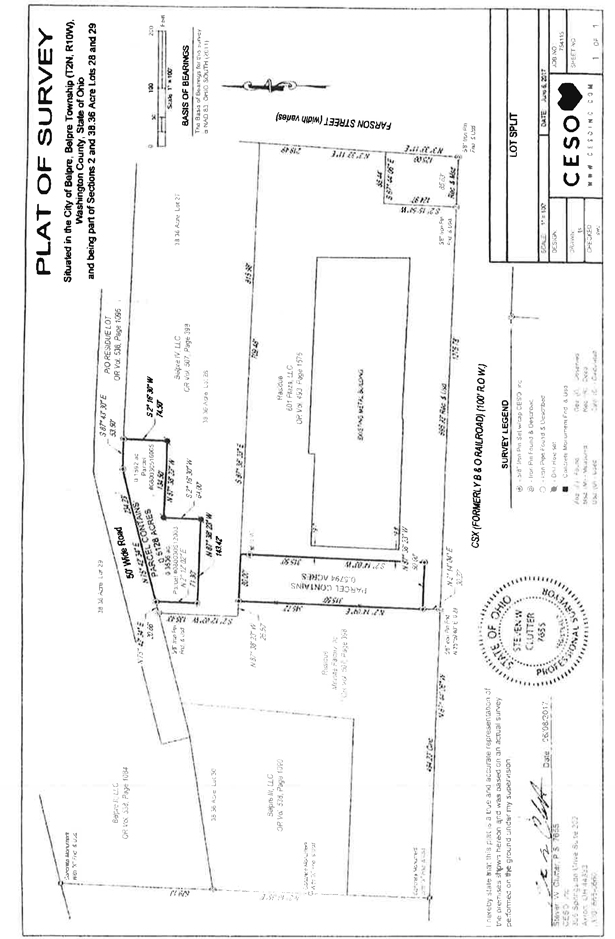

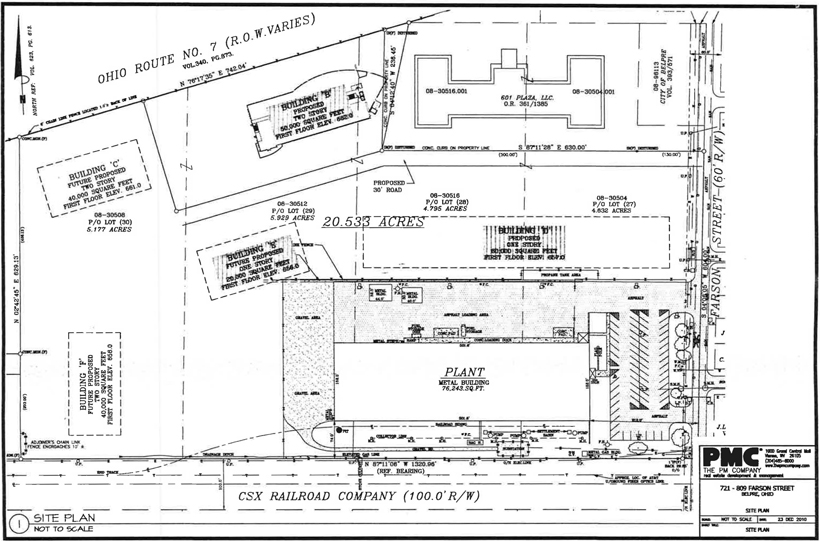

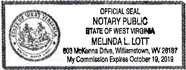

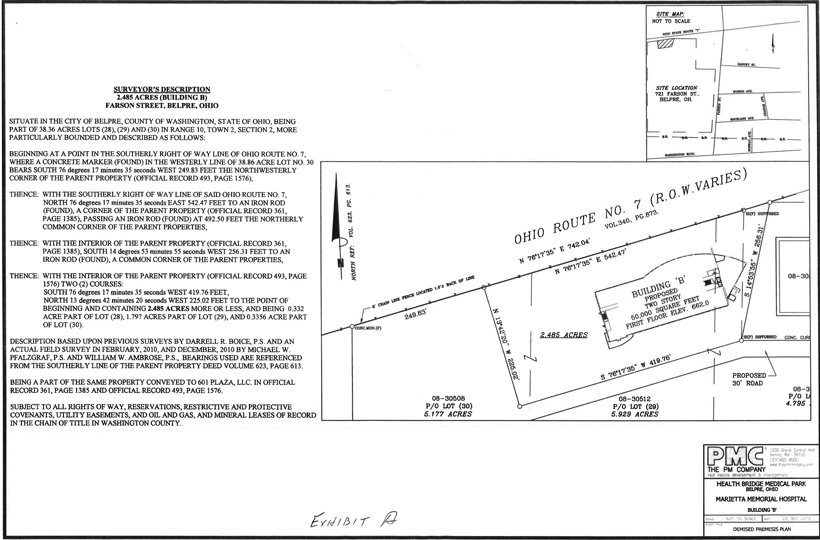

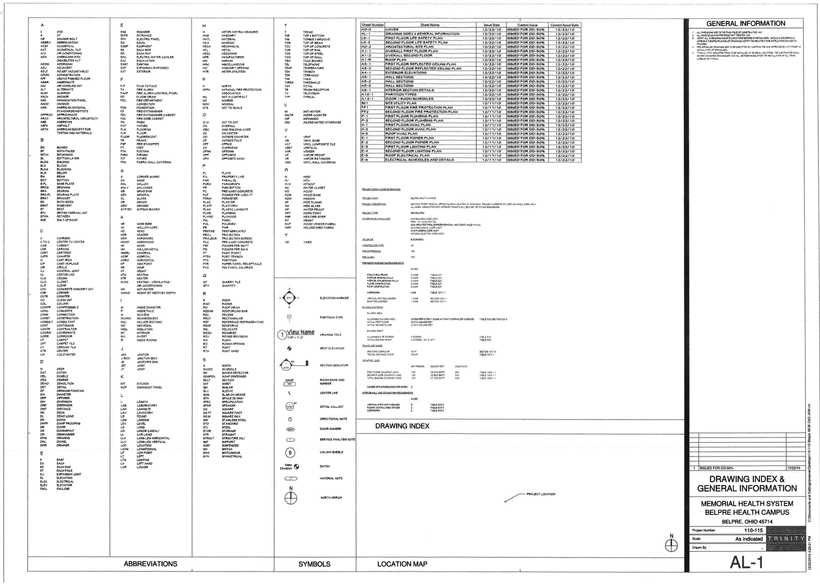

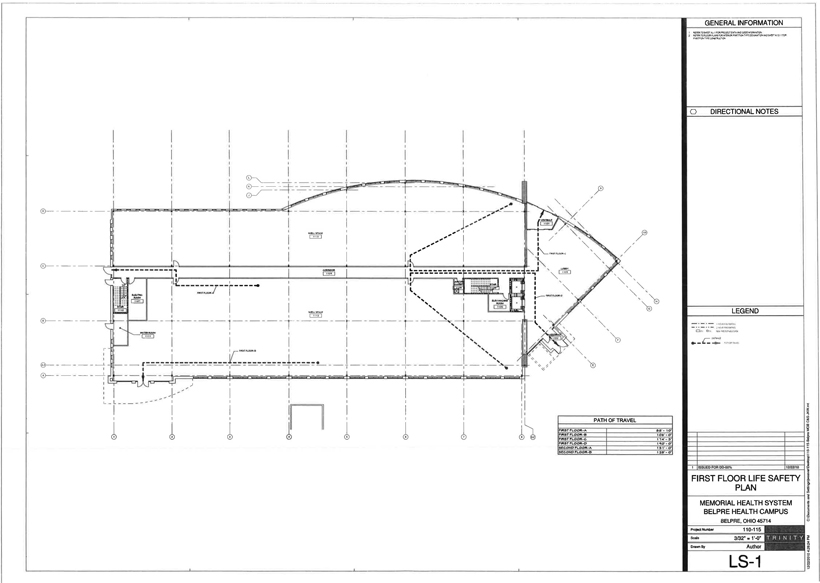

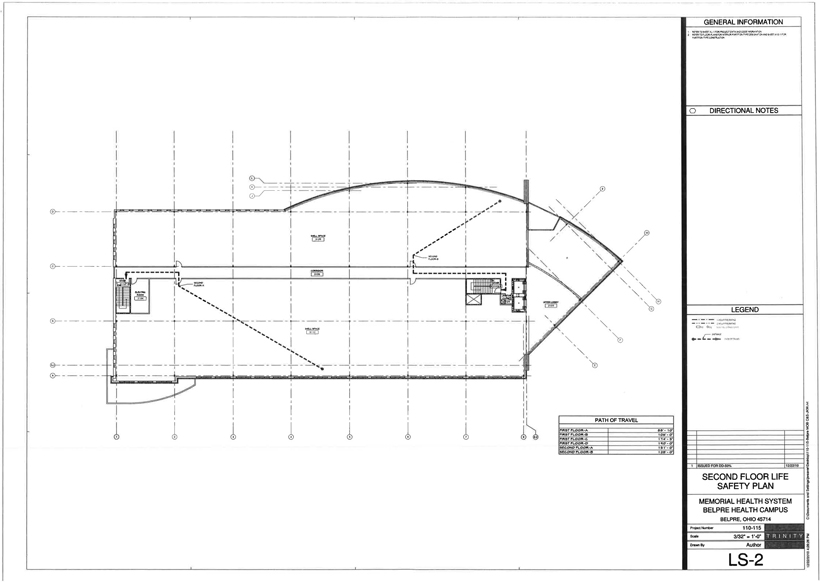

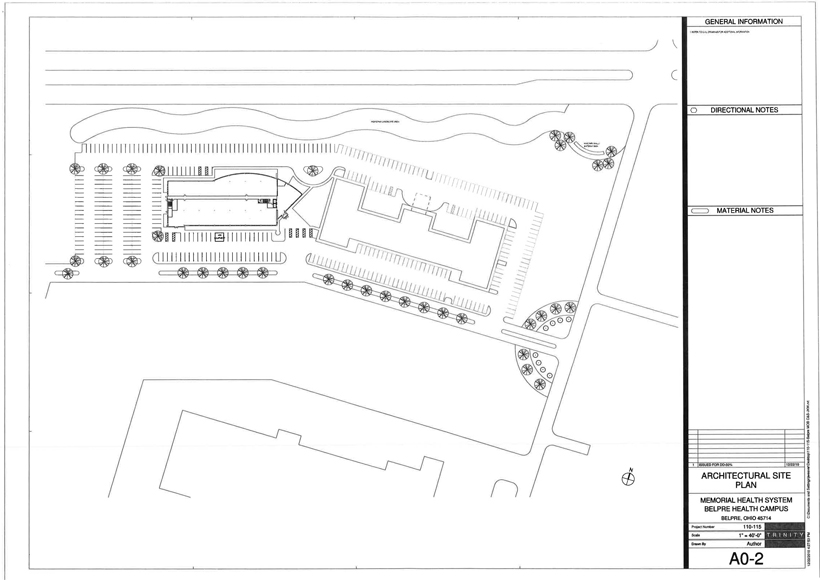

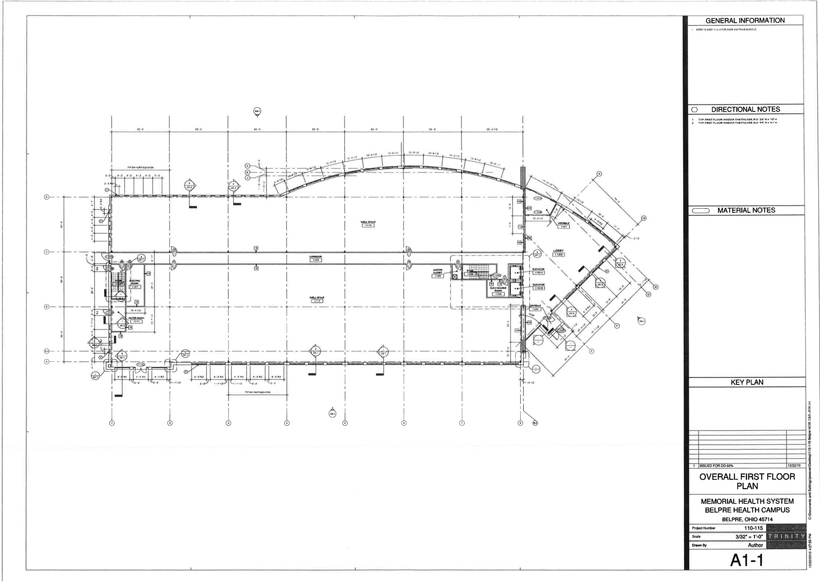

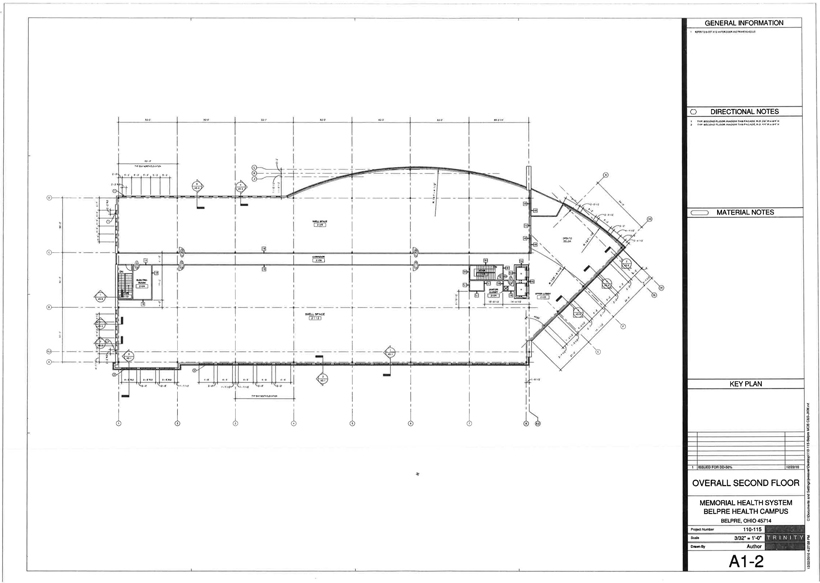

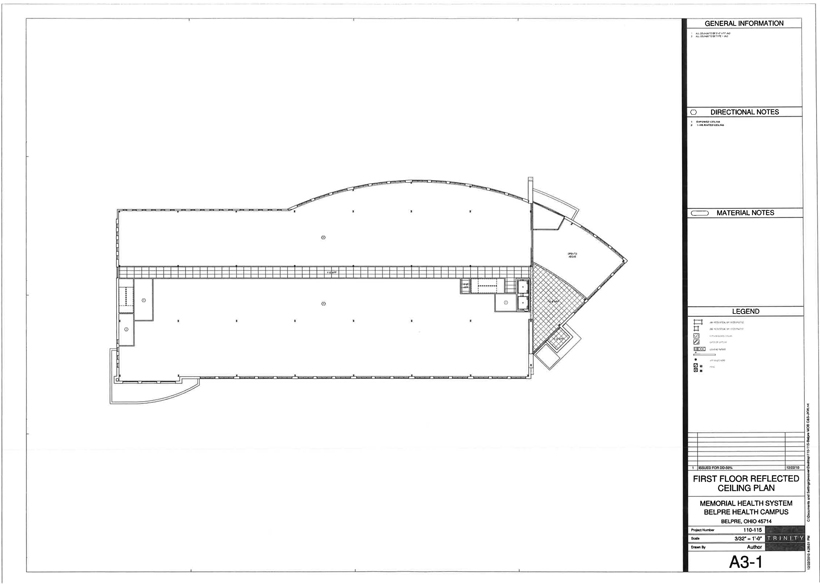

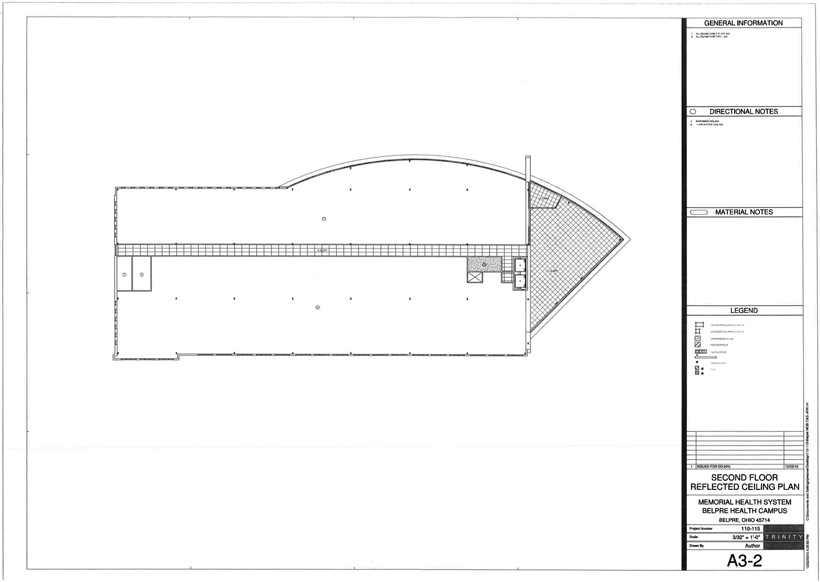

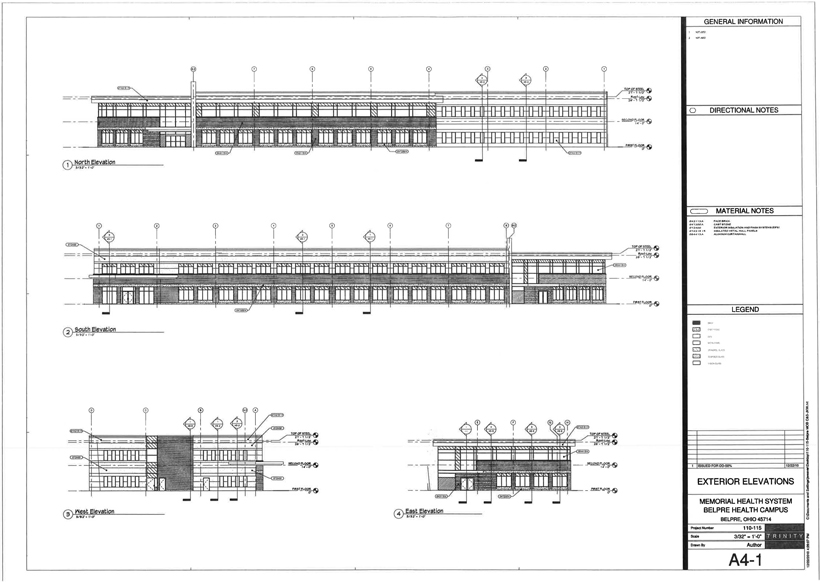

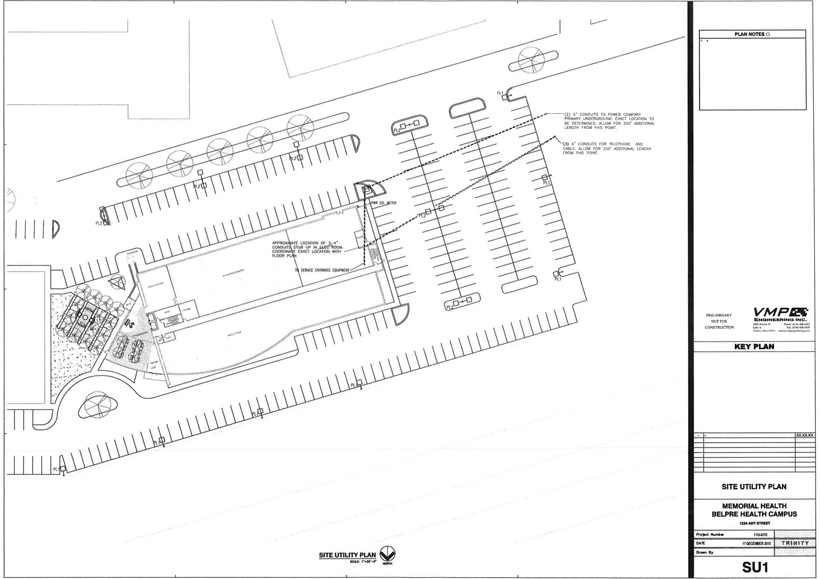

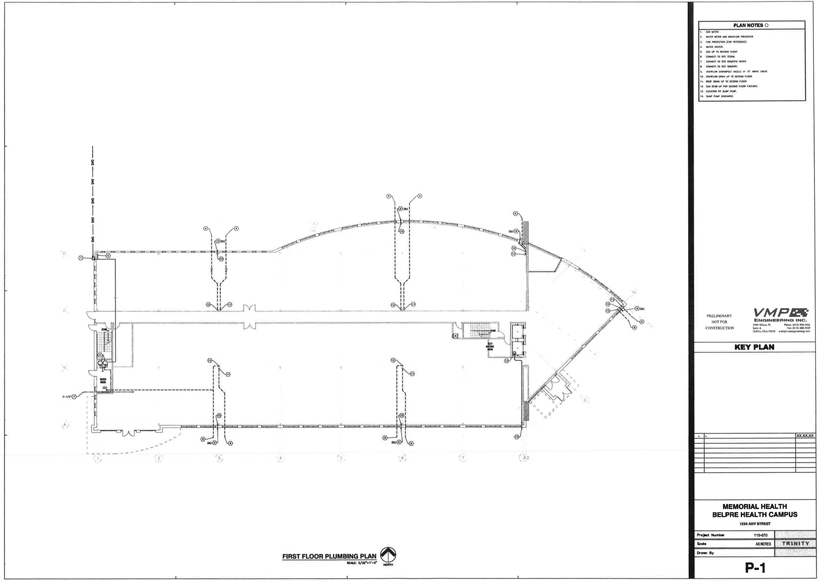

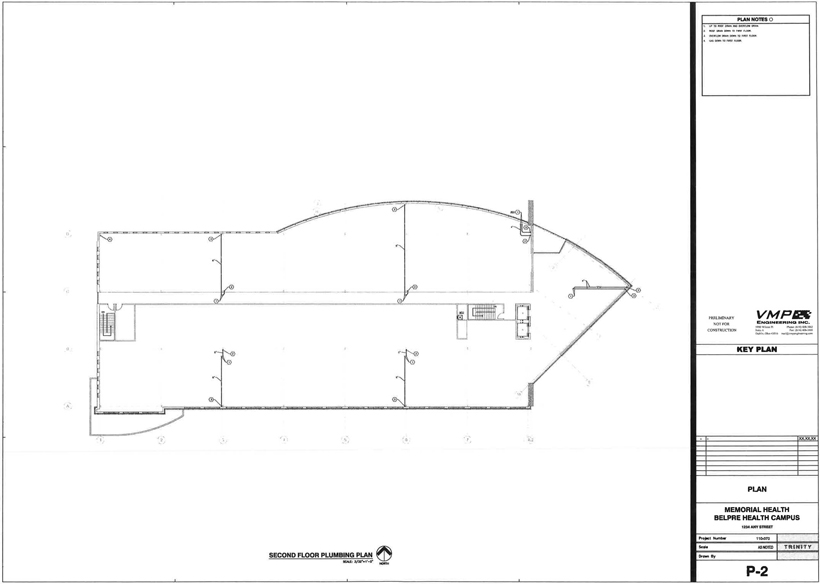

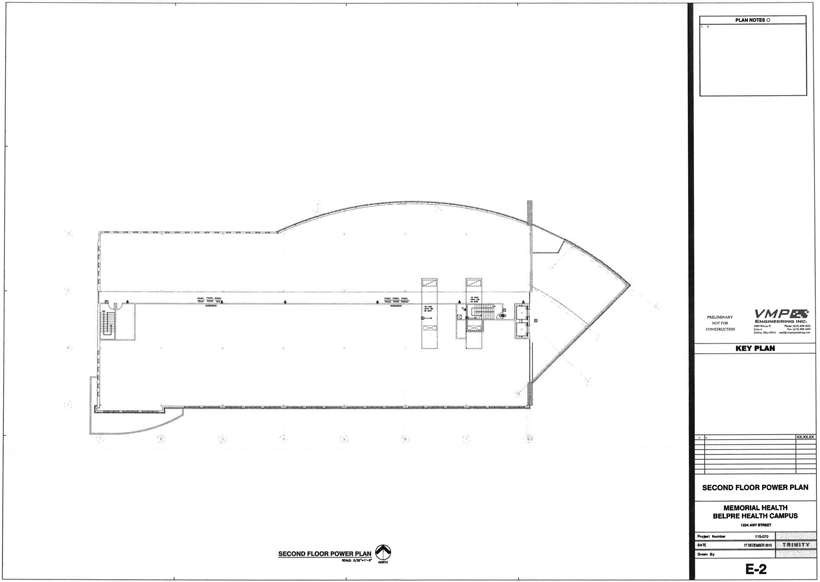

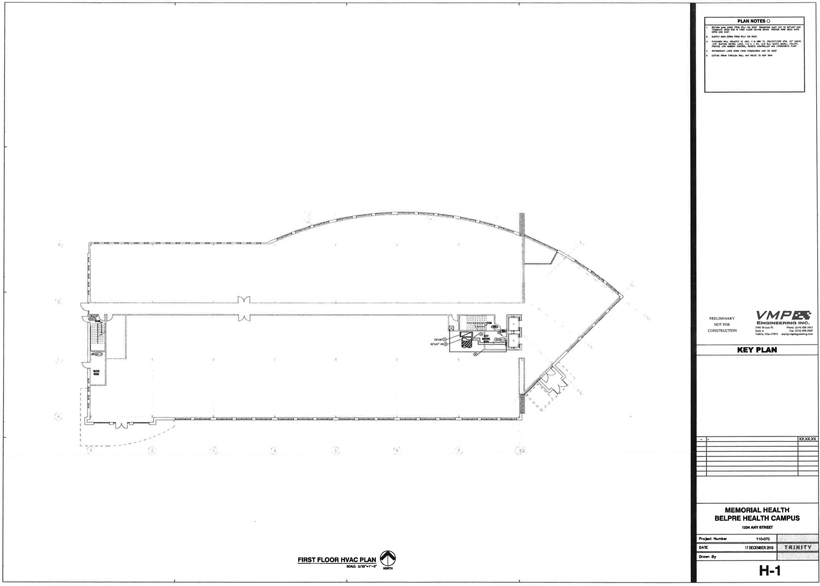

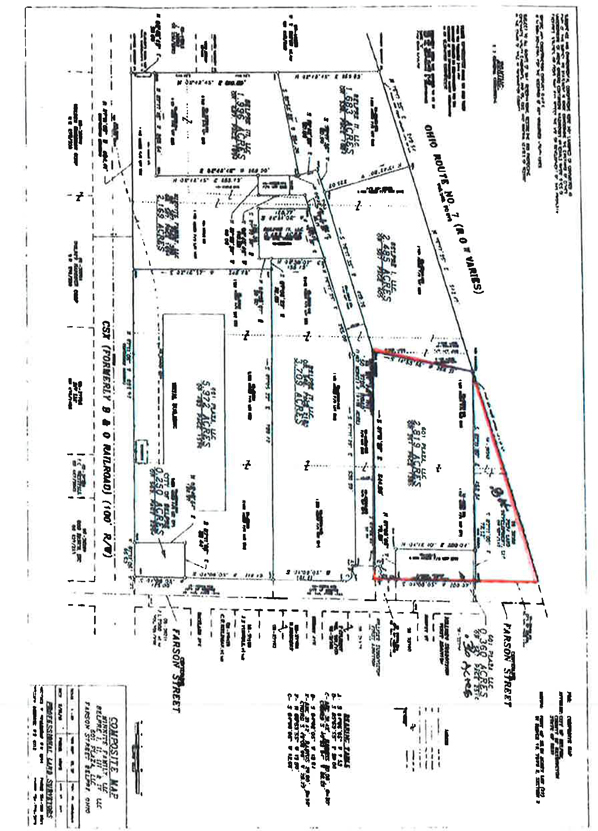

Section 1: The Demised Premises shall consist of and are described as the gross building area of 50,300 square feet, pursuant to the project design of the Trinity Health Group of the building (“Building”), to be located in the Health Bridge Medical Park, with the mailing address of 807 Farson Street, Belpre, Ohio 45714, together with the real estate upon which the Building shall be located, including parking lots and sidewalks thereon, all as shown on the plats and floor plans included in the plans and specifications hereinafter described to be attached hereto and made a part hereof as Exhibit A, being a part of the same real estate conveyed to Landlord by International Converter, LLC, a Delaware limited liability company, by Special Warranty Deed dated April 14, 2010, recorded in the Washington County, Ohio Recorder’s Office in Official Record 493, at Page 1576.

USE OF PREMISES

Section 2: The Demised Premises shall be used and occupied by Tennant during the term hereof, including any and all renewal terms, subject to the terms, conditions and limitations herein contained, as a free standing out patient health center, and for such uses reasonably related and incidental thereto.

INITIAL TERM

Section 3: The initial term of this Lease shall be for a period of Fifteen (15) years, commencing on November 1, 2011, and ending on October 31, 2026, subject, however, to the rentals, terms and conditions hereinafter set forth.

BASE RENT

Section 4: Commencing November 1, 2011, Tennant shall pay Base Rent in an annual amount of $18.50 per square foot for the portion of the gross building area of the Building which Tenant occupies November 1, 2011 or 34,000 square feet, whichever square footage is greater, plus an annual amount of $10.00 per square foot for the remainder of the gross building area of the Building (“Additional Area”). Commencing November 1, 2012 or the date upon which the Additional Area is occupied by Tennant for the purposes of this Lease, whichever first occurs, and thereafter during each year of the remainder of the first five (5) years of the initial term of this Lease, through October 31, 2016, Tenant shall pay Base Rent in an annual amount of $18.50 per square foot for the entire 50,000 square foot gross building area of the Building. During each year of the second five (5) year period of the initial term of this Lease, through October 31, 2021, Tenant shall pay Base Rent in an annual amount of $19.50 per square foot for the entire 50,000 square foot gross building area of the Building. During each year of the third five (5) year period of the initial term of this Lease, through October 31, 2026, Tenant shall pay Base Rent in an annual amount of $20.50 per square foot for the entire 50,000 square foot gross building area of the Building.

| 1 |

Such Base Rent shall be paid in equal monthly installments and shall be due and payable in advance on the 1st day of each calendar month. All required rental payments shall be made to 601 Plaza L.L.C., 1000 Grand Central Mall, Vienna, West Virginia 26105, and shall continue to be made at this address until Landlord advises of any change of address.

a. Late Fees: If the rental payment is not received within ten (10) days from the date due, a late fee equal to eight percent (8%) of the total outstanding rent and late fees shall be charged to Tenant monthly. Failure by the Landlord to enforce this provision in any one month shall not prevent Landlord from subsequently enforcing the same.

b. Returned Check Fees: In the event payment is made by check and such check is returned unpaid by the bank to Landlord, a returned check fee will be charged to Tenant in the amount of Thirty-Five and No/100ths ($35.00) Dollars.

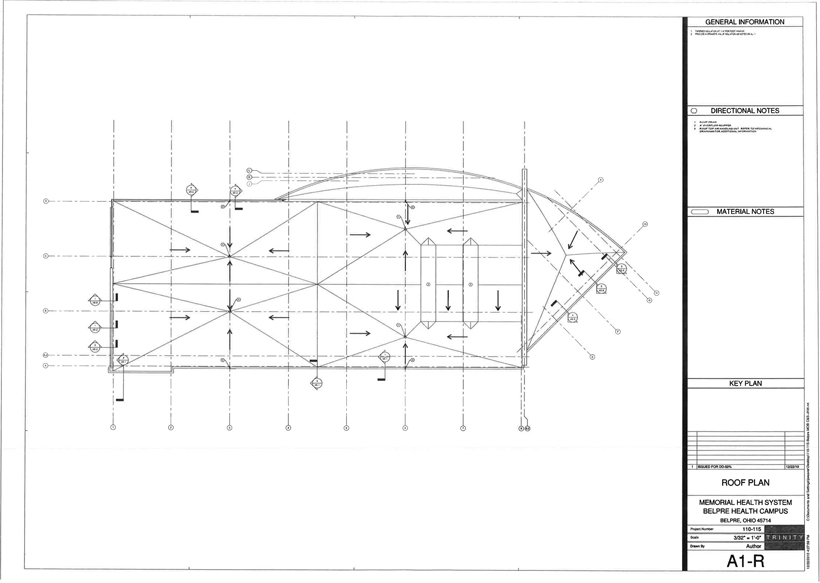

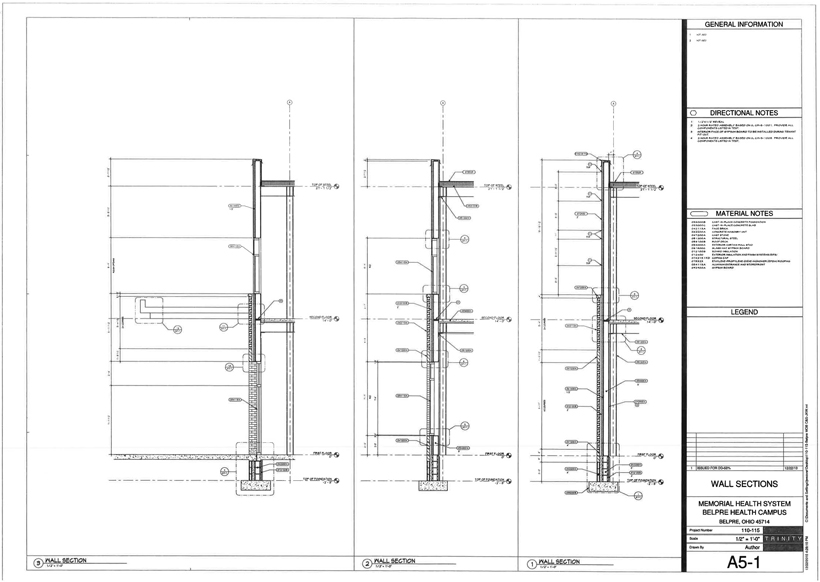

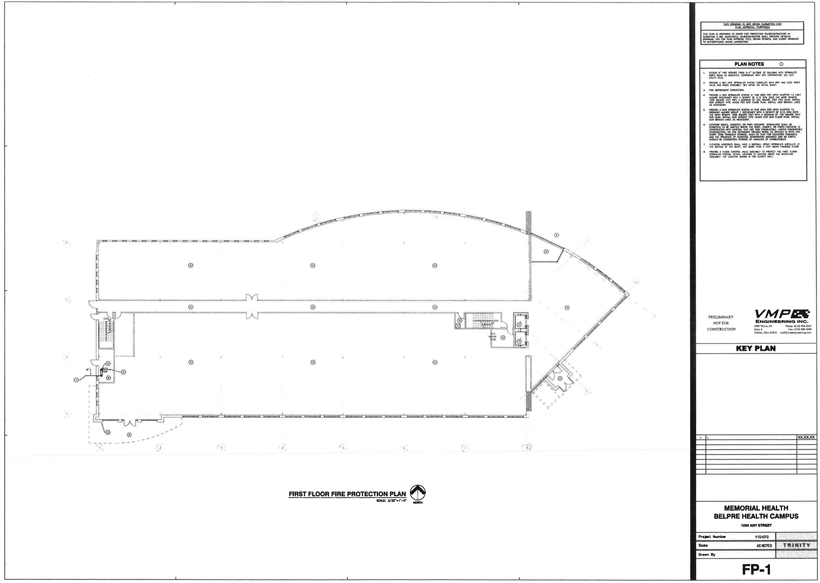

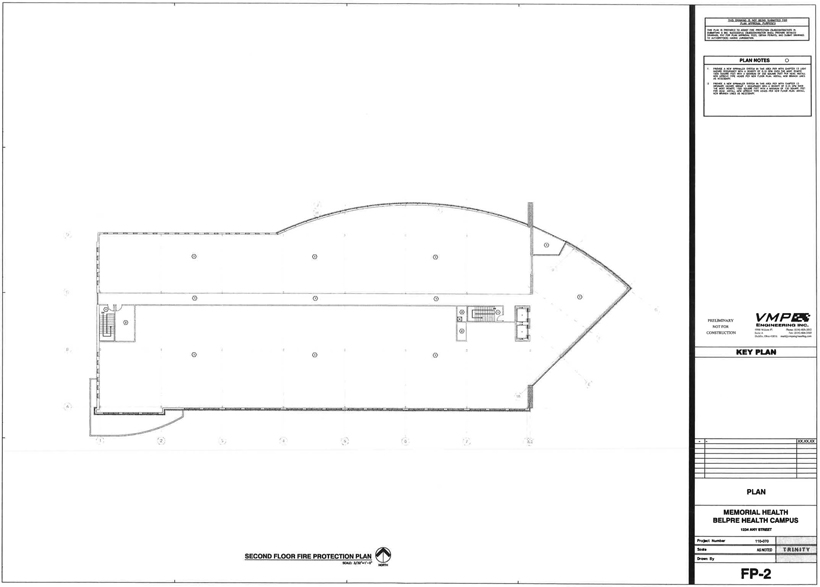

CONSTRUCTION AND TENANT BUILDOUT REQUIREMENTS

Section 5: Landlord shall construct on the Demised Premises the Building, parking lots and sidewalks for the use and occupancy of Tenant, such Building, parking lots and sidewalks to be constructed and provided to Tenant as a complete turnkey project in accordance with the project design of Trinity Health Group, in accordance with the construction budget and schedule of responsibilities of each of the parties marked as Exhibit B and attached to and made a part of this Lease and in accordance with Exhibit A. Tenant shall provide and construct at its cost the special buildout items described on Exhibit C attached to and made a part of this Lease.

The final plans and specifications for such construction shall conform to, provide for and permit construction of the Building, parking lots and sidewalks in strict accordance with the construction budget and total project cost reflected on Exhibit B and are to be approved by both Tenant and Landlord before construction begins and not more than 45 days after the signing of this Lease. Construction shall be commenced as soon as practicable after the execution of this Lease, and Landlord and Tenant shall cause construction to be completed to permit occupancy by Tenant for the purposes of this Lease on November 1, 2011, unless delayed by causes beyond the control of Landlord or Tenant. Any construction or alteration or modification resulting in any change in the construction budget and/or total project cost reflected on Exhibit B shall be approved by both Landlord and Tenant and shall be documented by written change order signed by both such parties, and any increase in costs of construction over and above those numerated in the construction budget and total project cost reflected on Exhibit B shall be paid to Landlord by Tenant upon the terms of Landlord’s invoices therefor.

| 2 |

All construction work performed by Landlord shall be guaranteed by Landlord to Tenant for a period of one (1) year from and after the completion of such construction. However, the liability of Landlord therefor shall be limited to the repair and replacement of any such work found and determined to be defective during such one (1) year period.

EXTERIOR MAINTENANCE

Section 6: Except as expressly otherwise provided herein, Tenant shall maintain and keep the exterior of the Demised Premises in good order and repair including, but not limited to, the roof, walls, gutters, downspouts, canopies, exterior doors, supply lines for gas, electric, and water, drainage and sewer lines, entrances and exits, sidewalks and parking areas, including cleaning and maintaining sidewalks and parking areas, including, but not limited to snow and ice removal, landscaping, and providing trash removal. Landlord shall make all structural repairs to the Building and all interior repairs, by reason of any exterior or structural defect, including but not limited to, leaks, broken pipes and falling plaster.

COMMON AREAS

Section 7: In connection with this Lease of the Demised Premises, Landlord further grants to Tenant, its employees, agents, customers and business invitees, the non-exclusive right to use all access ways to and from the Demised Premises and public roadways. Tenant shall reimburse Landlord its prorated share of repair and maintenance costs for such access ways based upon the percentage which the gross building area of the Building constitutes of the gross building area of all buildings on premises using the access ways, in monthly installments to be paid with Tenant’s payments of Base Rent, as budgeted, assessed and billed in advance annually by Landlord. Tenant shall reimburse Landlord a lump sum amount for the amount of any increase in the actual costs over the amount billed by Landlord therefor, and Landlord shall refund to Tenant the amount of any decrease in the actual costs below such billed amount, at the end of each fiscal year ending December 31 for which such costs were budgeted, assessed and billed, and such charges shall be subject to an annual adjustment based upon the actual costs therefor for each fiscal year ending December 31.

INTERIOR MAINTENANCE

Section 8: Except as expressly otherwise provided herein, Tenant will maintain the interior of the Building on the Demised Premises in good order and repair, reasonable and ordinary wear and tear excepted, and all interior repairs and maintenance, including, but not limited to, the HVAC system and utility fixtures, are to be the responsibility of Tenant.

| 3 |

UTILITIES AND SERVICES

Section 9: Tenant shall be responsible for the payment of all utility services rendered to the Demised Premises for the Tenant’s use including but not limited to water and sewer, gas, and electric.

TAXES

Section 10: The payment of all taxes and assessments levied or assessed against the real estate of which the Demised Premises are a part shall be the responsibility of Landlord, however, Tenant shall reimburse Landlord for its prorata share of the actual costs of the gross real estate taxes based upon the percentage which the appraised value of the real estate and improvements constituting the Demised Premises constitutes of the appraised value of all real estate and improvements assessed together with the Demised Premises. This charge shall be budgeted and billed in advance annually by Landlord, shall be payable in monthly installments to be paid with Tenant’s payments of Base Rent and shall be subject to an annual adjustment based upon the actual costs of such taxes for each fiscal year ending December 31. Additionally, Tenant shall reimburse Landlord a lump sum amount for the amount of any increase in the actual costs over the amount billed by Landlord therefor, and Landlord shall refund to Tenant the amount of any decrease in the actual costs below the amount billed by Landlord therefor, at the end of each fiscal year ending December 31 for which such costs were so budgeted and billed. Tenant shall pay any personal property taxes which may be levied against its property subject thereto.

INSURANCE; INDEMNIFICATION

Section 11: Throughout the term of this Lease Tenant will maintain in effect fire, extended coverage and special perils property insurance for the full insurable replacement value of the Demised Premises, as determined, and as determined from time to time throughout the term of this Lease, by the underwriter for Tenant’s insurer. Tenant shall name Landlord and any mortgagee as additional insureds under said policy, In case of fire, extended coverage or special perils casualty, the proceeds of such insurance shall be first applied to the repair of any damage and the surplus paid to Landlord.

Tenant shall procure and maintain during the Term of this Lease a policy of commercial general liability insurance having a combined single limit for bodily injury and property damage of not less than Three Million Dollars ($3,000,000.00), covering “occurrences” arising from or related to the use and occupancy of the Demised Premises by Tenant and its patients, employees, agents, contractors, guests and invitees, further insuring Tenant’s indemnification and obligation hereunder, and naming Landlord and any mortgagee as additional insureds. At the end of each five (5) year period or term of this Lease, as the case may be, Tenant shall increase the amounts of such coverages of such liability insurance for the ensuing five (5) year period or term of this Lease, by an amount equal to the aggregate percentage increase in the U.S. Department of Labor, Bureau of Labor Statistics Consumer Price Index for all Urban Consumer, U.S. City Average, or any successor index (“CPI”) over the immediately preceding five (5) year period. Provided, that in the event an aggregate percentage decrease occurs in the CPI during any such immediately preceding five (5) year period, no adjustment in said coverage amounts shall be made and the amounts of such coverages in effect during such immediately preceding five (5) year period shall remain in effect during the ensuing five (5) year period or term. Provided, however, that the requirement of such coverage and the limits thereof as herein provided, do not limit or define Tenant’s obligation to indemnify Landlord hereunder nor limit the extent or amount of such obligation.

| 4 |

In addition, Tenant shall maintain Professional Liability Insurance with respect to its operations on the Demised Premises, with such insurance covering Tenant for all services rendered on the Premises. Tenant’s Professional Liability Insurance shall provide for limits of not less than $1,000,000 per occurrence and $3,000,000 in the aggregate, per policy year. Tenant shall also maintain Fire Legal Liability insurance in the amount of $100,000. If and as permitted by the carriers for such coverages Tenant shall name Landlord and any mortgagee as additional insureds under said policies.

Tenant shall furnish to Landlord upon request a certificate of insurance issued by the insurance carrier of each of the aforesaid policies of insurance.

In the event Landlord obtains and carries income protection coverage pursuant to any policy or policies it maintains pertaining to the Demised Premises, Tenant shall reimburse Landlord the premium for such coverage, payable in monthly installments to be paid with Tenant’s payments of Base Rent, the charges for which shall be budgeted, assessed and billed in advance annually by Landlord and shall be subject to an annual adjustment based upon the actual costs thereof for each fiscal year ending December 31. Additionally, Tenant shall reimburse Landlord a lump sum amount for any increase in the actual costs over the amount billed by Landlord therefor, and Landlord shall refund to Tenant the amount of any decrease in the actual costs below such billed amount, at the end of each fiscal year ending December 31 for which such costs were budgeted, assessed and billed.

Tenant shall also be liable and responsible for any and all other insurance required for or by its use of and operation in and upon the Demised Premises, and Tenant may also carry insurance on the contents of the Demised Premises as it may desire.

Landlord shall indemnify, protect, defend and hold Tenant harmless from and against all liability, cost, expense, or damage (including, without limitation, attorneys fees) for bodily injury or property damage arising from: (i) the construction of the Demised Premises by Landlord, its contractors, agents or employees; or (ii) any defects in construction by Landlord, its contractors, agents or employees, or (iii) any failure by Landlord, its contractors, agents or employees to properly construct the Demised Premises in accordance with the approved project design of the Trinity Health Group. Tenant’s review and approval of any plans, specifications, or any other documents shall not relieve Landlord from Landlord’s obligations under the foregoing indemnification provision. Landlord shall procure and keep in effect from the execution date of this Lease until the completion of the Demised Premises, a Commercial General Liability insurance policy in the amount of Three Million Dollars ($3,000,000.00) per occurrence, insuring all of Landlord’s activities with respect to the Demised Premises, and a Builder’s Risk Insurance policy insuring the Demised Premises for the full replacement cost of the Demised Premises until completion. Landlord shall name Tenant as an additional insured under the Builder’s Risk Insurance policy and provide Tenant a certificate of such coverage upon request.

| 5 |

Notwithstanding the foregoing provision, Tenant shall indemnify, defend, and hold Landlord harmless from any and all claims and damages (including reasonable attorneys’ fees and costs) arising from Tenant’s occupancy and/or use of the Demised Premises or the conduct of its business or from any activity, work, or thing done, permitted, or suffered by Tenant, in or about the Demised Premises or the access ways to and from the Demised Premises. Tenant shall further indemnify, defend, and hold Landlord harmless from any and all claims and damages (including reasonable attorneys’ fees and costs) arising from any breach or default in the terms of this Lease, or arising from any act, negligence, fault, or omission of Tenant or Tenant’s agents, employees, or invitees, and from and against any and all costs, reasonable attorneys’ fees, expenses, and liabilities incurred on or about such claim or any action or proceeding brought on such claim. In case any action or proceeding shall be brought against Landlord by reason of any such claim, Tenant, on notice from Landlord, shall defend Landlord at Tenant’s expense by counsel approved in writing by Landlord, to the extent or in the event such defense is not provided by applicable insurance coverage.

Landlord shall indemnify, defend, and hold Tenant harmless from any and all claims and damages (including reasonable attorneys’ fees and costs) arising from any breach or default in the terms of this Lease, or arising from any act, negligence, fault, or omission of Landlord or Landlord’s agents, employees or contractors, and from and against any and all costs, reasonable attorneys’ fees, expenses and liabilities incurred on or about such claim or any action or proceeding brought on such claim. In case any action or proceeding shall be brought against Tenant by reason of any such claim, Landlord, on notice from Tenant, shall defend Tenant at Landlord’s expense by counsel approved in writing by Tenant, to the extent or in the event such defense is not provided by applicable insurance coverage.

DAMAGE OR DESTRUCTION OF BUILDING

Section 12: If the Demised Premises are damaged or destroyed by fire or other casualty during the term of this Lease, the rent herein reserved shall abate entirely in case the Demised Premises are, in the judgment of the Tenant, rendered untenantable, and prorata in case a part only be untenantable, until the Demised Premises are restored to tenantable condition. If such damage or destruction is covered by the insurance provided for in Paragraph 11 above, the Landlord shall with due diligence, repair and restore the Demised Premises to good and tenantable condition.

Provided however, that (a) if the destruction or damage amounts to more than 50% of the insurable replacement value of the Demised Premises determined as aforesaid, either Landlord or Tenant may cancel and terminate this Lease by giving written notice to the other party within 30 days after the date such damage or destruction occurs; (b) if the entire Demised Premises are, in the judgment of the Tenant, untenantable, the term of this Lease shall be extended for a period equal to the time required for repair and restoration of the Demised Premises unless terminated under Subparagraph (a) of this Paragraph.

EMINENT DOMAIN

Section 13: In the event that any portion or all of the Demised Premises is taken pursuant to the exercise of any power of eminent domain, the proceeds of such taking shall be divided between Landlord and Tenant as their respective interests may appear.

| 6 |

ASSIGNMENT; RIGHT OF FIRST REFUSAL

Section 14: (a) Tenant may not assign this Lease or sublet the Demised Premises to any other person, partnership or corporation without written consent of Landlord, which consent shall not be unreasonably withheld.

(b) In the event Landlord exercises its right to assign this Lease, pursuant to a conveyance of the Demised Premises, Landlord shall give Tenant the privilege of purchasing the Demised Premises at the same purchase price and on the other terms of the offer to purchase made by the proposed assignee, provided Tenant is not in default hereunder at such time. This privilege shall be given by a notice sent to Tenant at the Demised Premises by certified mail, fax transmission or hand delivery, requiring Tenant to accept the offer in writing and to sign a contract within the period of thirty (30) days after the mailing or receipt of such notice to purchase the Demised Premises upon such terms. The failure of Tenant to accept the offer to purchase or to sign a contract within the period provided shall not affect this Lease, except to nullify and void the aforesaid privilege of Tenant, and Landlord shall be at liberty to sell the Demised Premises to any such proposed assignee thereafter. Provided, that in the event that Tenant does not exercise such right, but the transaction with such proposed assignee does not thereafter occur, then Tenant’s privilege and right as herein described shall remain in effect for any and all subsequent proposed assignments in accordance with the aforesaid terms and conditions. Further provided, that the aforesaid right of Tenant shall not apply to any assignment of this Lease or conveyance of the Demised Premises to a party or parties related to Landlord, but further provided that such related party or parties shall accept such assignment and/or conveyance subject to this Lease and its terms and conditions, including this Section 14 and Tenant’s aforesaid right. Further provided that the terms of this Section 14 shall not apply to a collateral assignment of this Lease to a lender or lenders of Landlord or any such related party or parties.

DEFAULT

Section 15: (a) If proceedings are commenced against Tenant in any court under a bankruptcy act or for the appointment of a Trustee or Receiver of Tenant’s property either before or after commencement of the Lease term, or (b) if the rent or any other payments due from Tenant under this Lease, or any part thereof, shall at any time be in arrears and unpaid for a period of 30 days after agreed due date per this Lease, or (c) if there shall be default in the performance of any other covenant or condition herein contained on the part of Tenant for more than 30 days after written notice of such default by Landlord, then Tenant’s right to possession pursuant to this Lease, if Landlord so elects, shall thereupon cease, and Landlord shall have the right to reenter or repossess the premises by summary proceedings, surrender or otherwise, and to dispossess and remove therefrom the Tenant or other occupants thereof, and its effects, without being liable to prosecution therefore. In such case, Landlord may, at its option, relet the Demised Premises as the agent of Tenant, and Tenant shall pay to Landlord the difference between the rent hereby reserved and agreed to be paid by Tenant for the portion of the term remaining at the time of reentry or repossession, and the lesser amount, if any, received or to be received under such reletting for such portion of the term, together with Landlord’s fees and costs, including reasonable attorney fees, incurred by Landlord in enforcing its remedies hereunder and reletting the Demised Premises. Tenant hereby expressly waives service of notice of intention to reenter or of instituting legal proceedings to that end.

| 7 |

RENEWAL OPTION

Section 16: Provided it is not in default hereunder, Tenant shall have the option to renew this Lease for three (3) five (5) year terms by written notice to Landlord, given at least 180 days prior to the end of the existing term or renewal term, each upon the same terms and conditions herein set forth except that the Base Rent for each renewal term may be modified by Landlord, not to exceed an increase for each successive five (5) year term of 10% of the amount of Base Rent payable during the immediately preceding five (5) year period or term of this Lease. Except as expressly otherwise indicated, reference herein to the term of this Lease shall include reference to any renewal term hereof.

ALTERATION

Section 17: Tenant shall make no alteration to the Demised Premises without prior written consent of Landlord.

LIENS

Section 18: Tenant shall not permit mechanics’ liens to be filed against the fee of the Demised Premises or against Tenant’s leasehold interest in the Demised Premises by reason of work, labor, services or materials supplied or claimed to have been supplied to Tenant or anyone holding the Demised Premises through or under Tenant, whether prior or subsequent to the commencement of the term hereof. If any mechanic’s liens shall at any time be filed against the Demised Premises based on any act or failure to act on the part of Tenant and Tenant shall fail to remove the same within thirty (30) days thereafter, such failure shall constitute a default under the provisions of this Lease.

Notwithstanding the foregoing, Tenant shall have the right, at its own expense and after prior written notice to Landlord, by appropriate proceeding duly instituted and diligently prosecuted, to contest in good faith the validity or the amount of any such lien. However, if Landlord shall notify tenant that, in the reasonable opinion of counsel, by nonpayment of any such items the Demised Premises will be subject to imminent loss or forfeiture, Tenant shall promptly cause such lien to be discharged of record.

ACCESS TO PREMISES

Section 19: Landlord and its representatives shall have the right to enter the Demised Premises during Tenant’s normal business hours, upon reasonable advance notice, which notice shall not be required in the case of an emergency, in order to inspect the same, or to make repairs and to maintain the Demised Premises if required by the terms hereof.

| 8 |

LANDLORD COVENANTS

Section 20: Landlord covenants and warrants that Landlord has good title to the Demised Premises and authority to make this Lease; that Tenant, upon paying the rent and keeping and performing the covenants and conditions of this Lease on Tenant’s part to be kept and performed, shall peaceably and quietly hold, occupy and enjoy the Demised Premises during the full term of the Lease without hindrance by Landlord or by any person whatsoever.

LEASE SUBORDINATE TO ENCUMBRANCES

Section 21: This Lease is subject and subordinate to any mortgages or deeds of trust now on or hereafter placed against the Demised Premises and to advances made or that may be made on account of such encumbrances, to the full extent of the principal sums secured thereby and interest thereon; provided, however, that in the event of default by Landlord upon any note secured by such mortgage or trust deed, the holder thereof shall be required to notify the Tenant of the same forthwith or lose the benefit of this provision. In the event Landlord fails to make any payment on account of principal or interest on any mortgage or deed of trust note affecting the Demised Premises, Tenant shall, upon written notice to Landlord, have the right to pay the rent accruing under this Lease directly to the holder of such mortgage or deed of trust note and to deduct any sum so paid from subsequent installments of rent due hereunder.

NOTICE AND REASONABLE CONSENT

Section 22: All notices and statements required or permitted under this Lease shall be in writing, delivered by registered or certified mail, postage prepaid, addressed as follow:

| As to Landlord: | 601 Plaza L.L.C. | |

| 1000 Grand Central Mall | ||

| Vienna, WV 26105 | ||

| As to Tenant: | Marietta Memorial Hospital | |

| 401 Matthew Street | ||

| Marietta, OH 45750 |

Either party may at any time, in the manner set forth for giving notices to the other, designate a different address to which notices to is shall be sent. Notice shall be deemed given at the delivery time shown on the return receipt, at the time of refusal shown on said notice, or date of the first notice thereof if returned unclaimed.

SEVERABILITY

Section 23: In the event that any provision of this Lease is adjudged to be invalid or of no force or effect, all other provisions contained herein shall remain in full force and effect.

| 9 |

BINDING EFFECT

Section 24: The covenants and agreements herein contained shall extend to and be binding upon the parties hereto, their respective representatives, successors and assigns.

AMENDMENT

Section 25: No amendment, modification, or alteration of the terms hereof shall be binding unless the same is in writing, dated subsequent to the date hereof and duly executed by the parties hereto.

RESTRICTIONS ON USE

Section 26: Tenant shall not allow, permit or suffer any condition, circumstance or activity in, upon or regarding the Demised Premises which constitutes a public or private nuisance, and Tenant will observe and comply with all present and future laws, rules ordinances, and regulations of the United States of America, the State of Ohio, the County of Washington, City of Belpre, and of any other governmental or regulatory authority or agency with respect to its use and occupancy of the Demised Premises and its operations thereon, including but not limited to, environmental laws and regulations applicable thereto, and shall defend, indemnify and hold Landlord harmless from and against any and all claims, liabilities, fines, penalties, losses and expenses (including reasonable attorney fees and costs) arising in connection with Tenant’s failure to comply with the provisions of this section.

Notwithstanding any other provision of this Lease, and without limitation to the foregoing provisions of this Section 26, Tenant shall not conduct or permit to be conducted upon the Demised Premises any CT scan procedures except pursuant to the existing agreement between Tenant and Health Bridge Imaging, Limited Liability Company (“Health Bridge”), a tenant of Landlord on an adjacent tract, during the term of such agreement, and, for a period of two (2) years beginning November 1st, 2011, Tenant shall not conduct or permit to be conducted upon the Demised Premises any MRI procedures except pursuant to agreement by and between Tenant and Health Bridge, which agreement is currently the subject of negotiation between Health Bridge and Tenant. It is further agreed that upon the execution of such agreement regarding MRI procedures, the term of the aforesaid restriction regarding such procedures on the Demised Premises shall be automatically modified to the term of said agreement if different than said two (2) year period.

| 10 |

LANDLORD RESTRICTIONS; LANDLORD’S RESPONSIBILITY

Section 27: With the exception of: 1) tenants leasing at, and services already being conducted on, the Development Site on December 1st, 2010 and 2) those services specified below as Noncompetitive Health Services, Landlord agrees that during the term of this Lease, Landlord shall not without the express written consent of Tenant: a) lease to any other prospective tenant intending to provide the same or similar services as Tenant at the Development Site; or b) allow any other tenant to conduct the same or similar services as Tenant at the Development Site. Landlord shall immediately notify Tenant of any other third party attempt to initiate discussions, solicit or negotiate with Landlord concerning the same or similar activities excluded by this Section 27. Landlord acknowledges and agrees that a breach or violation of this Section 27 will have an irreparable, material and adverse effect upon Tenant and that damages arising from any such breach or violation may be difficult to ascertain. However, in the event of a breach of this Section 27, Tenant may pursue actions and damages in law or equity available to Tenant.

The Development Site shall consist of all of the property currently owned by Landlord as reflected on that certain plat attached hereto and made a part hereof as “Exhibit D.”

Noncompetitive Health Services: 1) Dentists; 2) oral surgeons; 3) ophthalmologists and/or optometrists; 4) chiropractors; 5) massage therapists; 6) mental health practitioners (including psychologists and/or psychiatrists); 7) home nursing offices; 8) dialysis clinics; 9) physical therapy providers; 10) retail pharmacy; 11) durable medical equipment providers (including prosthetic and orthotic providers) and 12) podiatrists.

Landlord represents and warrants to Tenant that Landlord has not introduced and will not do anything to introduce, onto the Demised Premises from without the Demised Premises, any toxic or hazardous materials or waste, including without limitation, material or substance having characteristics of ignitability, corrosivity, reactivity, or extraction procedure toxicity or substances or materials which are listed on any of the Environmental Protection Agency’s list of hazardous wastes, 42 U.S.C. Section 9601, et seq., 49 U.S.C. Sections 1801, et seq., 42 U.S.C. Section 6901, et seq., as the same may be amended from time to time (“Hazardous Materials”).

SIGNS

Section 28: Tenant may, at its expense, install their company’s standard sign on any existing monument sign, pole sign, or face mounted sign at the Demised Premises. Tenant shall submit to Landlord plans and specifications for such signs. All signs and installation must be approved by Landlord. Such approval shall not be unreasonably withheld. Tenant shall be responsible for all maintenance and upkeep of the signs. All additional signs (i.e. portable signs, banners, etc.) must be approved by the Landlord. Any signs permanently attached to the building are considered leasehold improvements and will remain with the Demised Premises after the end of the Lease.

| 11 |

SUBORDINATION

Section 29: Following the execution of this Lease, Landlord shall deliver to Tenant a subordination, non-disturbance and attornment agreement from Landlord’s existing lender or lenders, if any, by which such lender or lenders agree not to disturb Tenant’s possession of the Demised Premises so long as Tenant is not in material default of the terms of this Lease beyond any applicable cure period at the time if such lender or lenders foreclose on the Demised Premises. Tenant agrees to execute and deliver to Landlord any instruments that may be necessary or proper to subordinate this Lease. Additionally, both Landlord and Tenant shall execute and deliver to any lender or lenders or the other party hereto such estoppel certificates as may be reasonably requested by such lender or lenders or other party.

Section 30: Each party shall bear their own costs and fees incurred for the negotiation and preparation of this Lease, and none of the parties shall be considered to be the drafter of this Lease, or any provision hereof, for the purpose of any statute, case law or rule of interpretation or construction that would or might cause any provision to be construed against the drafter hereof.

Section 31: Except as herein otherwise provided, this Lease contains the entire agreement by and between the undersigned. No promises, representations, understandings or other warranties have been made by any party respecting the subject matter hereof, other than those expressly set forth herein. The parties further state that they have carefully read this Lease, know the contents of it, and sign the same as their own free, willing and voluntary act, both individually and on behalf of the entities they represent as set forth below.

Section 32: The execution, acknowledgment and delivery of this Lease by the parties, and the performance of the terms, covenants, conditions and obligations under this Lease, including, but not limited to, the preparation, execution and delivery of such documents as required by or pursuant to this Lease, and the doing of all things necessary to consummate the transactions herein provided, have been duly authorized or ratified, approved and confirmed, as the case may be, by all necessary action of the parties, whether by the board of directors, the shareholders, members or otherwise, and the parties each represent and warrant that each of the officers executing and delivering this Lease does so with full and complete authority to do so for and on behalf of the respective parties.

| 12 |

IN WITNESS WHEREOF, the parties hereto have executed this Lease this 27th day of December 2010.

| LANDLORD: | 601 Plaza L.L.C. | |||

| By: | /s/ Pat Minnite, Jr. | |||

| Pat Minnite, Jr. | ||||

| Its: | Managing Member | |||

| TENANT: | Marietta Memorial Hospital | |||

| By: | /s/ Scott Cantley | |||

| Scott Cantley | ||||

| Its: | CEO | |||

| 13 |

STATE OF WEST VIRGINIA

COUNTY OF WOOD, to-wit

The foregoing instrument was acknowledged before me this 27th day of December 2010, by Pat Minnite, Jr., Managing Member of 601 Plaza L.L.C., a West Virginia limited liability company, on behalf of said company.

| My commission expires | November 24, 2019 |

| Signed | /s/ Stephen Brooker | |

| Notary Public |

(Seal)

STATE OF WEST VIRGINIA

COUNTY OF WOOD, to-wit

The foregoing instrument was acknowledged before me this 27th day of December 2010, by Scott Cantley, President of Marietta Memorial Hospital, an Ohio non profit corporation, on behalf of said corporation.

| My commission expires | November 24, 2019 |

| Signed | /s/ Stephen Brooker | |

| Notary Public |

(Seal)

| 14 |

EXHIBIT B

| Phase I construction Budget | ||||||

| · | Site Development | $ | 242,000 | |||

| · | 50,000 sq. ft. building (shell and core) | $ | 4,500,000 | |||

| · | 2,600 sq. ft. public and administration | $ | 325,000 | |||

| · | 1,700 sq. ft. special clinic | $ | 145,000 | |||

| · | 7,300 sq. ft. diagnostic center | $ | 1,278,000 | |||

| · | 4,100 sq. ft. urgent care center | $ | 410,000 | |||

| · | 6,100 sq. ft. Strecker Cancer Center | $ | 1,037,000 | |||

| · | 600 sq. ft. laboratory | $ | 54,000 | |||

| · | 7,800 sq. ft. physician office | $ | 624,000 | |||

| · | Design Fees (shell and core) | $ | 450,000 | |||

| Phase I total construction budget for 50,000 sq. ft. building with 34,000 sq. ft. completely built out (occupied space) | $ | 9,050,000 | ||||

| PHASE II Construction Budget | ||||||

| · | 16,000 sq. ft. unoccupied space budget cost (physician’s offices) | $ | 1,280,000 | |||

| TOTAL PROJECT COST | $ | 10,330,000 | ||||

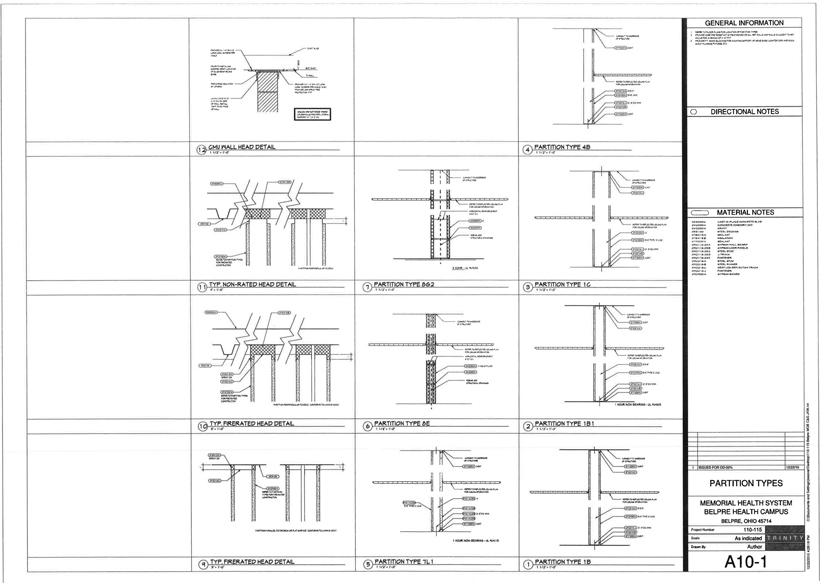

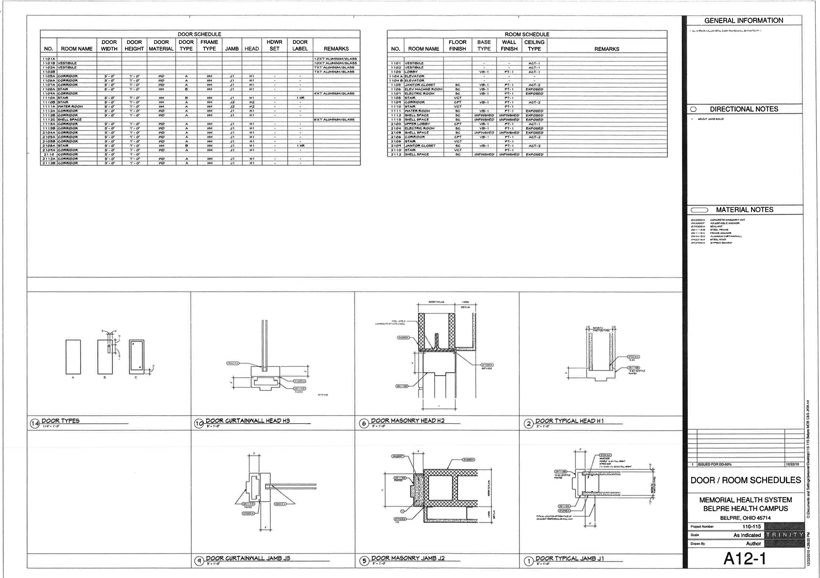

| I. | Responsibility of Tenant |

| a. | Preliminary design concept drawings and analysis |

| b. | Interior design, finishes and details, casework, equipment, interior HVAC, electric, and plumbing design |

| c. | All signage |

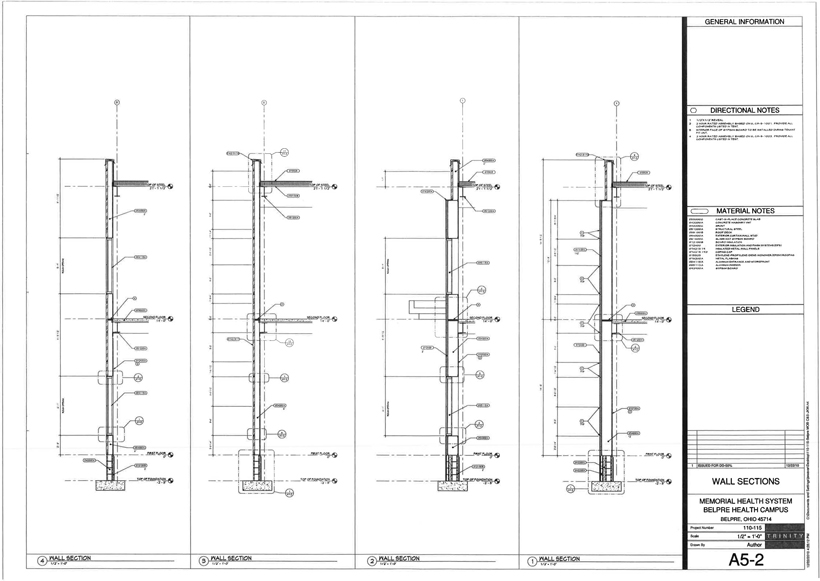

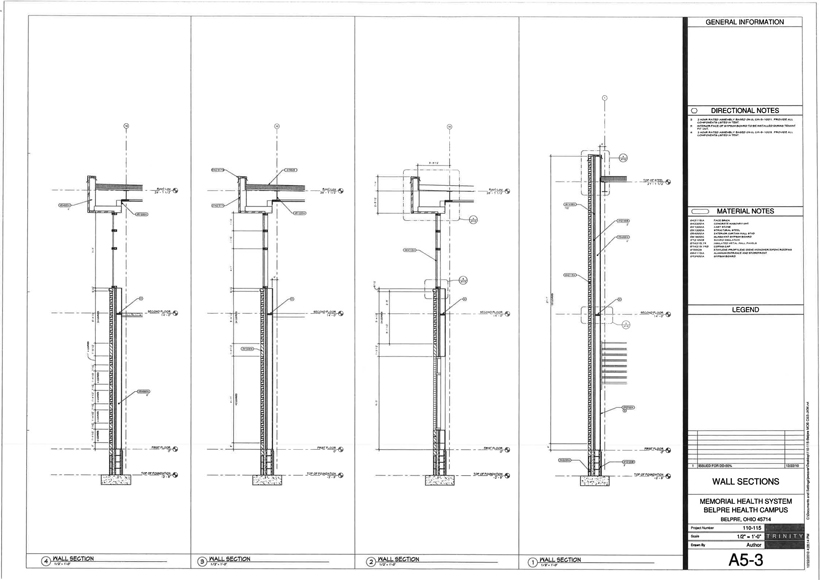

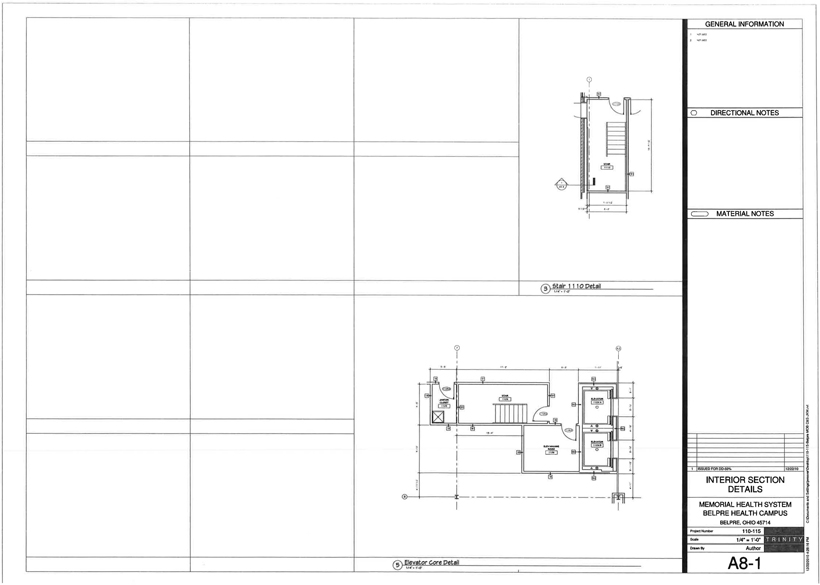

| II. | Responsibility of Landlord (design provided by Trinity Health Group) |

| a. | Shell and core (all design, construction drawings, details and specifications) |

| b. | Securing all permits |

| c. | Structural design |

| d. | Sprinkler system design |

| e. | Alarm system design |

| f. | Exterior parking, access roads, and landscaping design |

| g. | All supervision |

| h. | Site development design |

EXHIBIT C

BUILDOUT ITEMS BY TENANT, IF REQUIRED

| 1. | Appliances and equipment |

| 2. | Telephone system and wiring |

| 3. | Computer system and wiring |

| 4. | Special exhaust and HVAC systems other than standard HVAC requirements to heat and cool Tenant’s space |

| 5. | Security system |

| 6. | Special plumbing and electrical requirements for medical and diagnostic equipment |

| 7. | Purchase and proper construction, moving, location and installation of CT scan and MRI units from Health Bridge Imaging, Limited Liability Company, and any and all associated apparatus, including, but not limited to, shielding and electrical and mechanical equipment |

| 8. | Communication & Nurse Call systems and wiring |

EXHIBIT D

AMENDMENT AND ADDENDUM TO LEASE

THIS AMENDMENT AND ADDENDUM TO LEASE, Made and entered into by and between BELPRE I, LLC, a West Virginia limited liability company (hereinafter “Landlord”), and MARIETTA MEMORIAL HOSPITAL, an Ohio non profit corporation (hereinafter “Tenant”).

WHEREAS, Tenant entered into that certain Lease (“Lease”) with 601 Plaza L.L.C. (“601”) dated December 27, 2010 whereby 601 agreed to lease to Tenant and Tenant agreed to lease from 601, Demised Premises situate in Belpre, Ohio and described in the Lease, which Demised Premises includes a “Building” and other improvements to be constructed as also described in Lease, and

WHEREAS, the Lease was assigned to Landlord by Assignment dated March 3, 2011 and said Assignment was agreed to by Tenant by Subordination, Non- Disturbance and Attornment Agreement and Confirmation of Lease also dated March 3, 2011, and

WHEREAS, changes to the construction schedule and architectural design have been made, and the parties agree to, amendments of the Lease as provided hereinafter, such amendments being of benefit to the parties and constituting valuable consideration to the parties;

NOW THEREFORE WITNESSETH: That for and in consideration for the mutual benefits to the parties and the mutual terms, covenants, provisions and conditions thereof, the parties agree that the provisions of Sections 3, 4, 5, and 26 of the Lease shall be and are hereby amended to read as follows:

INITIAL TERM

Section 3: The initial term of this Lease shall be for a period of Fifteen (15) years, commencing on December 31, 2011, and ending on December 30, 2026, subject, however, to the rentals, terms and conditions hereinafter set forth.

BASE RENT

Section 4: Commencing December 31, 2011, Tennant shall pay Base Rent in an annual amount of $18.50 per square foot for the portion of the gross building area of the Building which Tenant occupies December 31, 2011 or the square footage of the area identified as ’‘First Priority” on the drawing attached as “Exhibit E” hereto, whichever square footage is greater, plus an annual amount of $10.00 per square foot for the remainder of the gross building area of the Building (“Additional Area”). Thereafter, as additional portions of the Additional Area are occupied by Tenant for the purposes of this Lease, Tenant shall pay Base Rent for such additionally occupied areas in an annual amount of $18.50 per square foot from and after the date of occupation of each such portion and thereafter during the remainder of the first five (5) years of the initial term of this Lease through December 30, 2016, and, in any event, commencing December 31, 2012, and thereafter during each year of the remainder of the first five (5) years of the initial term of this Lease, through December 30, 2016, Tenant shall pay Base Rent in an annual amount of $18.50 per square foot for the entire 50,300 square foot gross building area of the Building. During each year of the second five (5) year period of the initial term of this Lease, through December 30, 2021, Tenant shall pay Base Rent in an annual amount of $19.50 per square foot for the entire 50,300 square foot gross building area of the Building. During each year of the third five (5) year period of the initial term of this Lease, through December 30, 2026, Tenant shall pay Base Rent in an annual amount of $20.50 per square foot for the entire 50,300 square foot gross building area of the Building. Provided, that in the event the cost of construction pursuant to change orders required by Section 5 hereof exceeds the construction budget and total project cost reflected on Exhibit B hereto, such Base Rent shall be increased for each year of said fifteen (15) year initial term by an amount equal to ten (10%) per cent of the increase in such cost of construction in excess of the construction budget and total project cost. For example, in the event such increased cost of construction equals $1,000,000.00, the annual rent per square foot shall increase by $1.99 per square foot ($100,000.00% 50,300 = $1.99) for such initial term over and above the amounts provided above, resulting in a rent of $20.49 per square foot during the first five (5) years, $21.49 per square foot during the second five (5) years, and $22.49 per square foot during the third five (5) years, of said initial term. Provided, that the rent for the unoccupied portions of the Additional Area for the period or periods until such Additional Area, or portions thereof, become occupied or until December 31, 2012, whichever first occurs, shall remain an annual amount of $ 10.00 per square foot in any event.

Such Base Rent shall be paid in equal monthly installments and shall be due and payable in advance on the last day of each calendar month, being the first day of each lease month hereunder, during the term hereof. The first month’s rent is due and payable to Landlord December 31, 2011, and all required rental payments shall be made to Belpre I, LLC, 1000 Grand Central Mall, Vienna, West Virginia 26105, and shall continue to be made at this address until Landlord advises of any change of address.

| 2 |

a. Late Fees: If the rental payment is not received within ten (10) days from the date due, a late fee equal to eight percent (8%) of the total outstanding rent and late fees shall be charged to Tenant monthly. Failure by the Landlord to enforce this provision in any one month shall not prevent Landlord from subsequently enforcing the same.

b. Returned Check Fees: In the event payment is made by check and such check is returned unpaid by the bank to Landlord, a returned check fee will be charged to Tenant in the amount of Thirty-Five and No/100ths ($35.00) Dollars.

CONSTRUCTION AND TENANT BUILDOUT REQUIREMENTS

Section 5: Landlord shall construct on the Demised Premises the Building, parking lots and sidewalks for the use and occupancy of Tenant, such Building, parking lots and sidewalks to be constructed and provided to Tenant as a complete turnkey project in accordance with the project design of Trinity Health Group, in accordance with the construction budget and schedule of responsibilities of each of the parties marked as Exhibit B and attached to and made a part of this Lease and in accordance with Exhibit A. Tenant shall provide and construct at its cost the special buildout items described on Exhibit C attached to and made a part of this Lease.

The final plans and specifications for such construction shall conform to, provide for and permit construction of the Building, parking lots and sidewalks in strict accordance with the construction budget and total project cost reflected on Exhibit B and are to be approved by both Tenant and Landlord not more than thirty (30) days after receipt by both parties. Provided, that Landlord may make minor changes in material and construction detail described in such plans and specifications, provided the quality, design and appearance of the Building and building materials are not materially altered. Construction shall be commenced as soon as practicable after the execution of this Lease, and Landlord and Tenant shall cause construction to be completed to permit occupancy by Tenant for the purposes of this Lease on December 31, 2011, unless delayed by causes beyond the control of Landlord or Tenant. Any construction or alteration or modification resulting in any change in the construction budget and/or total project cost reflected on Exhibit B shall be approved by both Landlord and Tenant and shall be documented by written change order signed by both such parties, and any increase in costs of construction over and above those numerated in the construction budget and total project cost reflected on Exhibit B shall result in the increase in Base Rent as provided in Section 4 above.

All construction work performed by Landlord shall be guaranteed by Landlord to Tenant for a period of one (1) year from and after the completion of such construction. However, the liability of Landlord therefor shall be limited to the repair and replacement of any such work found and determined to be defective during such one (1) year period.

| 3 |

RESTRICTIONS ON USE

Section 26: Tenant shall not allow, permit or suffer any condition, circumstance or activity in, upon or regarding the Demised Premises which constitutes a public or private nuisance, and Tenant will observe and comply with all present and future laws, rules ordinances, and regulations of the United States of America, the State of Ohio, the County of Washington, City of Belpre, and of any other governmental or regulatory authority or agency with respect to its use and occupancy of the Demised Premises and its operations thereon, including but not limited to, environmental laws and regulations applicable thereto, and shall defend, indemnify and hold Landlord harmless from and against any and all claims, liabilities, fines, penalties, losses and expenses (including reasonable attorney fees and costs) arising in connection with Tenant’s failure to comply with the provisions of this section.

Notwithstanding any other provision of this Lease, and without limitation to the foregoing provisions of this Section 26, Tenant shall not conduct or permit to be conducted upon the Demised Premises any CT scan procedures except pursuant to the existing agreement between Tenant and Health Bridge Imaging, Limited Liability Company (“Health Bridge”), a tenant of Landlord on an adjacent tract, during the term of such agreement, and, for a period of two (2) years beginning December 31, 2011, Tenant shall not conduct or permit to be conducted upon the Demised Premises any MRI procedures except pursuant to agreement by and between Tenant and Health Bridge, which agreement is currently the subject of negotiation between Health Bridge and Tenant. It is further agreed that upon the execution of such agreement regarding MRI procedures, the term of the aforesaid restriction regarding such procedures on the Demised Premises shall be automatically modified to the term of said agreement if different than said two (2) year period.

All of the other terms, covenants, provisions and conditions of the Lease, including exhibits thereto, shall remain in full force and effect.

IN WITNESS WHEREOF, the parties hereto have executed this Amendment and Addendum to Lease this 23rd day of August 2011.

| 4 |

| LANDLORD: | BELPRE I, LLC |

| By: | Minnite Family, LLC, | |

| It’s Sole Member |

| By: | /s/ Pat Minnite, Jr. | |

| Pat Minnite, Jr. | ||

| Its: | Manager | |

| By: | /s/ Karmyn M. Conley | |

| Karmyn M. Conley | ||

| Its: | Manager | |

| By: | /s/ Pat Minnite, III | |

| Pat Minnite, III | ||

| Its: | Manager |

| By: | /s/ Jason R. Minnite | |

| Jason R. Minnite | ||

| Its: | Manager |

| TENANT: | MARIETTA MEMORIAL HOSPITAL | ||

| By: | /s/ Scott Cantley | ||

| Scott Cantley | |||

| Its: | CEO | ||

| 5 |

STATE OF WEST VIRGINIA,

COUNTY OF WOOD, TO-WIT:

The foregoing instrument was acknowledged before me this 23rd day of August 2011 by Pat Minnite, Jr., the Manager of Minnite Family, LLC, a West Virginia limited liability company, on behalf of said limited liability company acting as sole member of Belpre I, LLC, a West Virginia limited liability company, on behalf of said limited liability company.

| My commission expires: | October 19, 2019 |

|

/s/ Melinda L. Lott |

| Notary Public |

STATE OF WEST VIRGINIA,

COUNTY OF WOOD, TO-WIT:

The foregoing instrument was acknowledged before me this 23rd day of August 2011 by Karmyn M. Conley, the Manager of Minnite Family, LLC, a West Virginia limited liability company, on behalf of said limited liability company acting as sole member of Belpre I, LLC, a West Virginia limited liability company, on behalf of said limited liability company.

| My commission expires: | October 19, 2019 |

|

/s/ Melinda L. Lott |

| Notary Public |

| 6 |

STATE OF WEST VIRGINIA,

COUNTY OF WOOD, TO-WIT:

The foregoing instrument was acknowledged before me this 23rd day of August 2011 by Pat Minnite, III, the Manager of Minnite Family, LLC, a West Virginia limited liability company, on behalf of said limited liability company acting as sole member of Belpre I, LLC. a West Virginia limited liability company, on behalf of said limited liability company.

| My commission expires: | October 19, 2019 |

|

/s/ Melinda L. Lott |

| Notary Public |

STATE OF WEST VIRGINIA,

COUNTY OF WOOD, TO-WIT:

The foregoing instrument was acknowledged before me this 23rd day of August 2011 by Jason R. Minnite, the Manager of Minnite Family, LLC, a West Virginia limited liability company, on behalf of said limited liability company acting as sole member of Belpre I, LLC, a West Virginia limited liability company, on behalf of said limited liability company.

| My commission expires: | October 19, 2019 |

|

/s/ Melinda L. Lott |

| Notary Public |

STATE OF OHIO

COUNTY OF WASHINGTON, TO WIT:

The foregoing instrument was acknowledged before me this 23rd day of August 2011, by Scott Cantley, CEO/President of Marietta Memorial Hospital, an Ohio non profit corporation, on behalf of said corporation.

| My commission expires: | April 18, 2016 |

|

/s/ Deborah K Beaver |

| Notary Public |

| 7 |

ADDENDUM TO LEASE AGREEMENT

This addendum, dated November 8, 2012, shall be attached to and become part of that certain lease agreement for the 50,300 square feet medical building 807 Farson Street, Belpre, Ohio, between Belpre I LLC, Landlord, and Marietta Memorial Hospital, Tenant, as follows:

COMMON AREAS

Section 7: In connection with this Lease of the Demised Premises, Landlord further grants to Tenant, its employees, agents, customers and business invitees, the non-exclusive right to use all access ways to and from the Demised Premises and public roadways. Tenant shall reimburse Landlord its prorated share of repair and maintenance costs for such access ways based upon the percentage which the gross building area of the Building constitutes of the gross building area of all buildings on premises using the access ways, in monthly installments of Five Hundred Eighty-Three Dollars and No Cents ($583.00), to be paid with Tenant’s payments of Base Rent, as budgeted, assessed and billed in advance annually by Landlord. Tenant shall reimburse Landlord a lump sum amount for the amount of any increase in the actual costs over the amount billed by Landlord therefor, and Landlord shall refund to Tenant the amount of any decrease in the actual costs below such billed amount, at the end of each fiscal year ending December 31 for which such costs were budgeted, assessed and billed, and such charges shall be subject to an annual adjustment based upon the actual costs therefor for each fiscal year ending December 31.

All other terms and conditions of the original lease agreement will remain in full force and effect.

IN WITNESS THEREOF, the parties have caused this addendum to the lease agreement to be executed this 8th day of November, 2012, hereby binding their respective successors, assigns, executors, and administrators.

| LANDLORD: | TENANT: |

| Belpre I LLC | Marietta Memorial Hospital |

| By: | /s/ Pat Minnite, Jr. |

By: | /s/ Scott Cantley |

| Its: | Manager | Its: | CEO |

THIS AGREEMENT AND LEASE, Made and entered into by and between Minnite Family, LLC, a West Virginia limited liability company (hereinafter “Landlord”), and Marietta Memorial Hospital, an Ohio non profit corporation (hereinafter “Tenant”), Belpre I, LLC, a West Virginia limited liability company (hereinafter “Belpre I”), which executes this Agreement and Lease for the limited purposes articulated in Sections 31 and 32 hereof, and Belpre IV, LLC, a West Virginia limited liability company (hereinafter “Belpre IV”), which executes this Agreement and Lease for the limited purposes articulated in Section 31.

WITNESSETH: That for and in consideration of the mutual terms, covenants, provisions and conditions herein set forth, Landlord does hereby agree and lease to Tenant, and Tenant does hereby agree and hire and rent from Landlord, those certain premises, hereinafter referred to as the “Demised Premises,” as follows:

DEMISED PREMISES

Section 1: The Demised Premises shall consist of and are described as the gross building area of 80,000 square feet, consisting of a first story of approximately 50,000 square feet and a second story of approximately 30,000 square feet of the building (“Building”), together with the real estate upon which the Building shall be located, including parking lots and sidewalks thereon, all pursuant to and to be shown on the project design, plans and specifications hereinafter described to be attached hereto and made a part hereof as Exhibit A hereto as and when completed, said real estate being a tract of 2.819 acres located at 809 Farson Street, Belpre, Ohio 45714 formerly owned by 601 plaza L.L.C., a tract of 0.360 acres also formerly owned by 601 Plaza L.L.C. and adjoining the first mentioned tract on its eastern boundary, a tract of 0.98 acres, less 238 square feet conveyed to the City of Belpre, formerly owned by PKPJ Land Development, Limited Liability Company and adjoining the first mentioned tract along the entirety of the northern boundary of the first mentioned tract and a portion, as described in Section 31 hereof, of a tract of real estate owned by Belpre I adjoining the first mentioned tract on its western boundary, together with rights appurtenant thereto as herein described, all of said tracts being more particularly shown on Exhibit D hereto, and additionally a tract of 0,5128 acres owned by Belpre IV more particularly described on Exhibit E hereto and shown on Exhibit F hereto, and to be conveyed to Landlord by Belpre IV, as described in Section 31 hereof, to be utilized for parking purposes pursuant to the terms and conditions of this Agreement and Lease.

USE OF PREMISES

Section 2: The Demised Premises shall be used and occupied by Tennant during the initial term hereof and any and all renewal terms hereof, subject to the terms, conditions and limitations herein contained, as a free standing medical facility, and for such uses reasonably related and incidental thereto.

| 1 |

INTERIM RENT; TERMINATION OPTION

Section 3. a. Except as herein otherwise provided, Tenant shall pay Interim Rent to Landlord, in advance, in the amount of $10,000.00 per month, commencing effective December 1, 2017, and continuing on the same day of each month thereafter until the earlier of the date Tenant occupies 25% of the gross building area of the Building or December 1, 2019. Provided, that in the event that the last day prior to said date falls on a day other than the last day of the last monthly period for the payment of Interim Rent, the pro rata portion of the Interim Rent paid in advance for the remainder of said monthly period after said date shall be applied to the first month’s payment of rent as determined pursuant to Section 5. All payments of Interim Rent shall be made to Minnite Family, LLC, 1000 Grand Central Mall, Vienna, West Virginia 26105, and shall continue to be made at this address until Landlord advises of any change of address.

b. Late Fees: If the Interim Rental payment is not received within ten (10) days from the date due, a late fee equal to eight percent (8%) of the total outstanding rent and late fees shall be charged to Tenant monthly. Failure by the Landlord to enforce this provision in any one month shall not prevent Landlord from subsequently enforcing the same.

c. Returned Check Fees: In the event payment is made by check and such check is returned unpaid by the bank to Landlord, a returned check fee will be charged to Tenant in the amount of Thirty-Five and No/100ths ($35.00) Dollars.

d. Tenant’s Lease of Current Structures: Tenant agrees that its previous tenancy for the improvements currently situate on the aforesaid tract of 2.819 acres (Current Structures”) has terminated, and that it has vacated the Current Structures effective November 30, 2017, and the parties agree that they and the aforesaid real estate are and shall be free of the terms and conditions of Tenant’s previous tenancy for the Current Structures and any matter related thereto or arising therefrom.

INITIAL TERM

Section 4: The initial term of this Agreement and Lease shall be for a period of Fifteen (15) years, commencing on the earlier of either i) the first date of occupancy of the Demised Premises, or any part of the Demised Premises, for the purposes of this Agreement and Lease or ii) December 1, 2019 (“Commencement Date”), and ending on the last day of said fifteen (15) year period, subject, however, to the rentals, terms, conditions and contingencies herein set forth.

| 2 |

BASE RENT

Section 5: Commencing on the Commencement Date, Tenant shall pay Base Rent in an annual amount and rate of $49.31 per square foot (“Effective Rate”) for the amount of square footage of the gross building area of the Building that i) is occupied by Tenant from and after the date of such occupancy, and/or ii) is available for Tenant’s occupancy hereunder on December 1, 2019 and thereafter. Tenant shall also continue to pay Interim Rent in the amount of $10,000.00 per month until the earlier of the date that Tenant occupies 25% of the gross building area of the Building or December 1, 2019. Provided, that from and after December 1, 2019, Tenant shall pay an annual amount and rate of Base Rent of $27.57 per square foot (“Alternate Rate”) for the portions of the gross building area not available for Tenant’s occupancy hereunder on December 1, 2019 and thereafter (“Unavailable Additional Area”), until further adjusted as herein provided. Provided further, that as portions of the Unavailable Additional Area are thereafter constructed by Landlord and made available for Tenant’s occupancy hereunder during the one (1) year period from and after December 1, 2019, Tenant shall pay Base Rent at the Effective Rate for such additionally completed portions from and after the date or dates such additionally completed portions are made available by Landlord to Tenant for occupancy hereunder, and from and after each such date of availability the Alternative Rate of Base Rent for the portions of the Unavailable Additional Area not then completed shall continue until completed and made available for Tenant’s occupancy hereunder or until December 1, 2020, whichever first occurs. Provided further, that commencing on the date all of the Unavailable Additional Area is completed and made available for Tenant’s occupancy hereunder or December I, 2020, whichever first occurs, and thereafter, Tenant shall pay Base Rent at the Effective Rate, calculated as herein provided, for the entire 80,000 square foot gross building area of the Building. Further provided, that said Effective Rate of $49.31 for Base Rent is based and dependent upon the total budgeted project cost for the demolition and construction required hereby, exclusive of special buildout items described on Exhibit C, not exceeding $39,449,500.00 as initially calculated and budgeted by Tenant and Landlord as described on Exhibit B hereto (“initial total budgeted project cost”), and (i) in the event the total budgeted project cost, exclusive of said special buildout items, pursuant to change order or orders required by Section 6 hereof and/or other amendments and modifications to said total budgeted project cost, exceeds $39,449,500.00, or (ii) in the event Landlord constructs or provides any of the special buildout items described on Exhibit C, such Effective Rate of Base Rent shall be increased for the gross building area to which it is applicable for each year, or applicable portion thereof, by an amount per square foot equal to either (i) ten (10%) per cent of the amount by which such total budgeted project cost exceeds the initial total budgeted project cost of $39,449,500.00, or (ii) ten (10%) percent of the amount of the cost of the construction or providing of any of said special buildout items by Landlord as budgeted by Landlord from time to time, as the case may be. For example, in the event such excess total budgeted project cost, or such budgeted cost of said special buildout items, equals $800,000.00, the Effective Rate of Base Rent shall increase by $1.00 per square foot ($80,000.00 % 80,000 = $1.00) over and above the previously established Effective Rate of Base Rent, in this example, assuming the previously established Effective Rate is $49.31, resulting in an Effective Rate of Base Rent of $50.31 per square foot ($49.31 + $1.00 = $50.31) during the period from and after such adjustment. Further provided, that similar adjustments reducing the Effective Rate of Base Rent shall be made in the event the aforesaid initial total budgeted project cost, pursuant to change order or orders required by Section 6 hereof and/or other amendments and modifications to said initial total budgeted project cost, is reduced to less than $39,449,500.00, based upon deletion of material items, the budgeted cost for which is readily identifiable. Further provided, however, that if Landlord has incurred costs attributable to and in reliance upon such deleted items having been previously budgeted, Tenant shall pay such costs to Landlord pursuant to and on the terms of Landlord’s invoice to Tenant therefor. All of the aforesaid adjustments shall be made at the Commencement Date and at each date thereafter that an additional portion of the gross building area is completed and either occupied by Tenant or made available for Tenant’s occupancy hereunder as provided above, the cost of which results in an increase or decrease in the total budgeted project cost, as the case may be, and/or special buildout items are completed by Landlord and made available for Tenant’s use hereunder, as the case may be (“Adjustment Date”). Additionally provided, that for and during each of the last two (2) five (5) year periods of the initial term of this Agreement and Lease all Base Rent may be additionally modified by Landlord, not to exceed an additional increase for each such successive five (5) year period of ten (10%) per cent of the amount and rate of such Base Rent in effect upon the expiration of the immediately preceding five (5) year period.

| 3 |

All of such rent shall be paid in monthly installments and shall be due and payable in advance on the first day of each lease month hereunder, during the term hereof. The first month’s payment of such rent is due and payable to Landlord on the Commencement Date, and all required rental payments shall be made to Minnite Family, LLC, 1000 Grand Central Mall, Vienna, West Virginia 26105, and shall continue to be made at this address until Landlord advises of any change of address. Provided, that in the event of the occupancy, or availability of any portions of the Building for occupancy, occurring during a lease month based upon the Commencement Date of this Agreement and Lease, the Base Rent at the Effective Rate, for the remaining portion of such month, shall be prorated and due on such date of such occupancy or availability, and subsequent monthly installments of said Base Rent shall be due and payable in advance on the first day of each lease month during the remainder of such term, and either Interim Rent or Base Rent at the Alternative Rate, as the case may be, shall be prorated and adjusted accordingly for the remaining portion of such month.

a. Late Fees: If the rental payment is not received within ten (10) days from the date due, a late fee equal to eight percent (8%) of the total outstanding rent and late fees shall be charged to Tenant monthly. Failure by the Landlord to enforce this provision in any one month shall not prevent Landlord from subsequently enforcing the same.

| 4 |

b. Returned Check Fees: In the event payment is made by check and such check is returned unpaid by the bank to Landlord, a returned check fee will be charged to Tenant in the amount of Thirty-Five and No/100ths ($35.00) Dollars.

CONSTRUCTION AND TENANT BUILDOUT REQUIREMENTS

Section 6: Landlord shall demolish the Current Structures and construct on the Demised Premises the Building, parking lots and sidewalks for the use and occupancy of Tenant. Such Building, parking lots and sidewalks shall be constructed and provided to Tenant as a complete turnkey project in accordance with the project design, plans and specifications hereinafter described to be attached hereto and made a part hereof as Exhibit A, as and when completed, and in accordance with the total budgeted project cost prepared by Tenant and Landlord and attached to and made a part hereof as Exhibit B, and as amended and modified from time to time as herein provided. Tenant shall provide and construct at its cost the special buildout items described on Exhibit C to be provided and approved by the parties, which approval shall not be unreasonably withheld, and attached to and made a part of this Agreement and Lease as and when completed.

The project design, plans and specifications for the project shall be prepared by Tenant and provided to Landlord within a commercially reasonable time after the execution of this Agreement and Lease in order to permit Landlord to complete construction in accordance with the terms hereof, shall provide for and permit completion of construction of the Building, parking lots and sidewalks in strict accordance with the initial total budgeted project cost reflected on Exhibit B and shall be subject to approval by Landlord not more than thirty (30) days after receipt by Landlord, which approval shall not be unreasonably withheld. Provided, that Landlord may make minor changes in material and construction detail described in such project design, plans and specifications, provided the quality, design and appearance of the Building and building materials are not materially altered, and provided such changes are approved by the Project Architect, which approval shall not be unreasonably withheld and shall be provided in a timely manner. Further provided, that the nature, quality and manner of construction, upon which Tenant’s and Landlord’s initial total budgeted project cost of $39,449,500.00 is based, which also includes the cost of demolition of the Current Structures, shall be the same or similar to that of the facilities constructed and currently owned by Belpre I, LLC and Belpre IV, LLC and leased to Tenant. Demolition and construction shall be commenced as soon as practicable after the receipt and approval of the aforesaid project design, plans and specifications for the construction of the Demised Premises, and Landlord and Tenant shall cause the aforesaid demolition and construction to be completed to permit occupancy by Tenant for the purposes of this Agreement and Lease within a commercially reasonable time from and after Landlord’s receipt and approval of designs, plans and specifications provided by Tenant hereunder, unless otherwise delayed by causes beyond the control of Landlord or Tenant. Any demolition, construction or alteration or modification thereof resulting in any change in the total budgeted project cost reflected on Exhibit B from time to time and/or any construction or providing of any special buildout items described on Exhibit C, or any change therein or the budgeted cost thereof, shall be approved by both Landlord and Tenant and shall be documented by written change order or other budget amendment and modification signed by both such parties, and shall be subject to the terms of Section 5 above, as applicable.

| 5 |

All construction work performed by Landlord shall be guaranteed by Landlord to Tenant for a period of one (1) year from and after the completion of such construction. However, the liability of Landlord therefor shall be limited to the repair and replacement of any such work found and determined to be defective during such one (1) year period.

EXTERIOR MAINTENANCE

Section 7: Except as expressly otherwise provided herein, Tenant shall maintain and keep the exterior of the Demised Premises in good order and repair including, but not limited to, the roof, walls, gutters, downspouts, canopies, exterior doors, supply lines for gas, electric, and water, drainage and sewer lines, entrances and exits, sidewalks and parking areas, including cleaning and maintaining sidewalks and parking areas, including, but not limited to snow and ice removal, landscaping, and providing trash removal. Landlord shall make all structural repairs to the Building and all interior repairs, by reason of any exterior or structural defect, including but not limited to, leaks, broken pipes and falling plaster.

COMMON AREAS

Section 8: In connection with this Agreement and Lease of the Demised Premises, Landlord further grants to Tenant, its employees, agents, customers and business invitees, the non-exclusive right to use all access ways to and from the Demised Premises and public roadways. Tenant shall reimburse Landlord its prorated share of repair and maintenance costs for such access ways based upon the percentage which the gross building area of the Building constitutes of the gross building area of all buildings on premises in the Development Site, as hereinafter defined, using the access ways, in monthly installments to be paid with Tenant’s payments of Base Rent, as budgeted, assessed and billed in advance annually by Landlord. Tenant shall reimburse Landlord a lump sum amount for the amount of any increase in the actual costs over the amount billed by Landlord therefor, and Landlord shall refund to Tenant the amount of any decrease in the actual costs below such billed amount, at the end of each fiscal year ending December 31 for which such costs were budgeted, assessed and billed, and such charges shall be subject to an annual adjustment based upon the actual costs therefor for each fiscal year ending December 31.

| 6 |

INTERIOR MAINTENANCE

Section 9: Except as expressly otherwise provided herein, Tenant will maintain the interior of the Building on the Demised Premises in good order and repair, reasonable and ordinary wear and tear excepted, and all interior repairs and maintenance, including, but not limited to, the HVAC system and utility fixtures, are to be the responsibility of Tenant.

UTILITIES AND SERVICES

Section 10: Tenant shall be responsible for the payment of all utility services rendered to the Demised Premises, including but not limited to water and sewer, gas, and electric, from and after the date of Tenant’s initial occupancy of the Demised Premises, or any part thereof.

TAXES

Section 11: The payment of all taxes and assessments levied or assessed against the real estate of which the Demised Premises are a part, shall be the responsibility of Landlord and/or other owners thereof. However, Tenant shall reimburse Landlord for its prorata share of the actual costs of the gross taxes and assessments based upon the percentage which the appraised value of the real estate and improvements constituting the Demised Premises constitutes of the appraised value of all real estate and improvements assessed together with the Demised Premises. Upon the taxes and assessments being levied and assessed against the Demised Premises separately, Tenant shall reimburse Landlord the actual costs of such separately levied and assessed gross taxes and assessments. In any event, such charges shall be budgeted and billed in advance annually by Landlord, shall be payable in monthly installments to be paid with Tenant’s payments of Base Rent and shall be subject to an annual adjustment based upon the actual costs of such taxes and assessments for each fiscal year ending December 31. Additionally, Tenant shall reimburse Landlord a lump sum amount for the amount of any increase in the actual costs over the amount billed by Landlord therefor, and Landlord shall refund to Tenant the amount of any decrease in the actual costs below the amount billed by Landlord therefor, at the end of each fiscal year ending December 31 for which such costs were so budgeted and billed. Tenant shall pay any personal property taxes which may be levied against its property subject thereto.

INSURANCE; INDEMNIFICATION

Section 12: Throughout the term of this Agreement and Lease Tenant will maintain in effect fire, extended coverage and special perils property insurance for the full insurable replacement value of the Demised Premises, as determined, and as determined from time to time throughout the term of this Agreement and Lease, by the underwriter for Tenant’s insurer, provided that such insurable replacement value shall in no event be less than the final total cost of demolition and construction. Tenant shall name Landlord and any mortgagee as insureds and/or as additional insureds, as the case may be, under said policy. In case of fire, extended coverage or special perils casualty, the proceeds of such insurance shall be first applied to the repair of any damage and any surplus paid to Landlord.

| 7 |

Tenant shall procure and maintain during the Term of this Agreement and Lease a policy of commercial general liability insurance having a combined single limit for bodily injury and property damage of not less than Three Million Dollars ($3,000,000.00), covering “occurrences” arising from or related to the use and occupancy of the Demised Premises by Tenant and its patients, employees, agents, contractors, guests and invitees, further insuring Tenant’s indemnification obligation hereunder, and naming Landlord and any mortgagee as additional insureds. At the end of each five (5) year period or term of this Agreement and Lease, as the case may be, Tenant shall increase the amounts of such coverages of such liability insurance for the ensuing five (5) year period or term of this Agreement and Lease, by an amount equal to the aggregate percentage increase in the U.S. Department of Labor, Bureau of Labor Statistics Consumer Price Index for all Urban Consumer, U.S. City Average, or any successor index (“CPI”) over the immediately preceding five (5) year period. Provided, that in the event an aggregate percentage decrease occurs in the CPI during any such immediately preceding five (5) year period, no adjustment in said coverage amounts shall be made and the amounts of such coverages in effect during such immediately preceding five (5) year period shall remain in effect during the ensuing five (5) year period or term. Further provided, however, that the requirement of such coverage and the limits thereof as herein provided, do not limit or define Tenant’s obligation to indemnify Landlord hereunder nor limit the extent or amount of such obligation.