Exhibit 99.1

www.globalmedicalreit.com NYSE: GMRE Investor Presentation June 2019

Forward - Looking Statements 1 This presentation is for informational purposes only and does not constitute an offer to sell, or a solicitation of offers to purchase, Global Medical REIT Inc . ’s (the “Company”, or “GMRE”) securities . The information contained in this presentation does not purport to be complete and should not be relied upon as a basis for making an investment decision in the Company’s securities . This presentation also contains statements that, to the extent they are not recitations of historical fact, constitute “forward - looking statements . ” Forward - looking statements are typically identified by the use of terms such as “may,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology . The forward - looking statements included herein are based upon the Company’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control . Although the Company believes that the expectations reflected in such forward - looking statements are based on reasonable assumptions, the Company’s actual results and performance could differ materially from those set forth in the forward - looking statements due to the impact of many factors including, but not limited to, those discussed under “Risk Factors” in the Company’s Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q and any prospectus or prospectus supplement filed with the Securities and Exchange Commission . The Company undertakes no obligation to update or revise any such information for any reason after the date of this presentation, unless required by law . This presentation includes information regarding certain of our tenants, which are not subject to SEC reporting requirements . The information related to our tenants contained in this report was provided to us by such tenants or was derived from publicly available information . We have not independently investigated or verified this information . We have no reason to believe that this information is inaccurate in any material respect, but we cannot provide any assurance of its accuracy . We are providing this data for informational purposes only .

ABOUT GMRE

GMRE Value Proposition Net lease operating platform, which tends to be more resilient during economic fluctuations Healthcare facilities providing mission critical services with leading operators Proven investment strategy resulting in operational flexibility for tenants and improved asset value D IFFERENTIATED S TRATEGY Primary focus on physician and real estate tenants with triple - net lease structures Meticulous underwriting with multiple layers of review and approvals for acquisitions Investments are structured with favorable credit support and attractive lease coverage ratios Long - term demographic tailwinds – increasing specialization and localization of healthcare delivery Robust investment pipeline with network that facilitates referral - based transactions with attractive pricing Deep market of high - quality assets with attractive cap rates in non - gateway markets Extensive expertise in healthcare real estate acquisitions, finance, development and administration Decades of experience with deep relationships in the space Board with decades of public company and real estate experience D ISCIPLINED EXECUTION L ARGE M ARKET O PPORTUNITY S EASONED M ANAGEMENT T EAM AND B OARD OF D IRECTORS 3

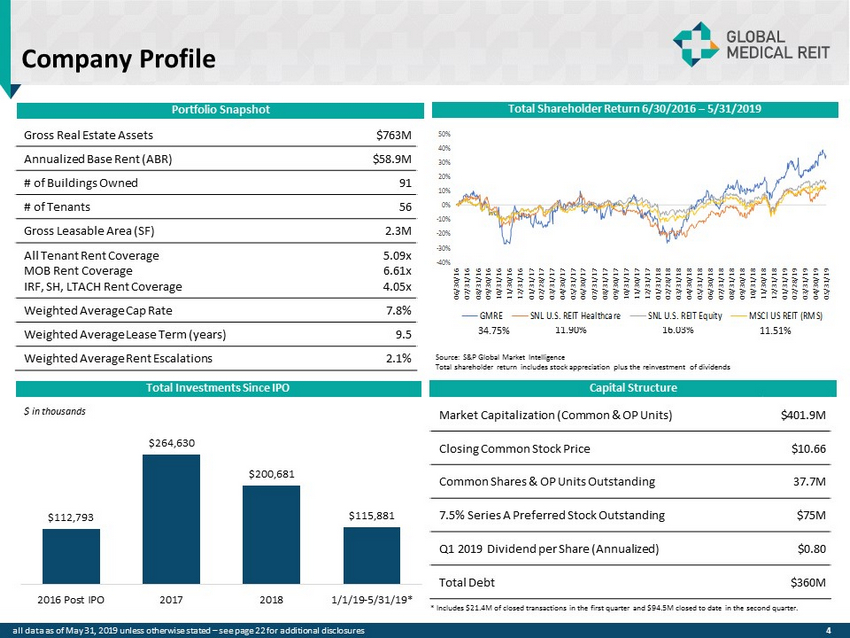

Capital Structure Company Profile Gross Real Estate Assets $763M Annualized Base Rent (ABR) $58.9M # of Buildings Owned 91 # of Tenants 56 Gross Leasable Area (SF) 2.3M All Tenant Rent Coverage MOB Rent Coverage IRF, SH, LTACH Rent Coverage 5.09x 6.61x 4.05x Weighted Average Cap Rate 7.8% Weighted Average Lease Term (years) 9.5 Weighted Average Rent Escalations 2.1% Market Capitalization (Common & OP Units) $401.9M Closing Common Stock Price $10.66 Common Shares & OP Units Outstanding 37.7M 7.5% Series A Preferred Stock Outstanding $75M Q1 2019 Dividend per Share (Annualized) $0.80 Total Debt $360M Portfolio Snapshot Total Investments Since IPO 4 Total Shareholder Return 6/30/2016 – 5/31/2019 Source: S&P Global Market Intelligence Total shareholder return includes stock appreciation plus the reinvestment of dividends all data as of May 31, 2019 unless otherwise stated – see page 22 for additional disclosures 34.75% 11.90% 16.03% 11.51% $112,793 $264,630 $200,681 $115,881 2016 Post IPO 2017 2018 1/1/19-5/31/19* $ in thousands * Includes $21.4M of closed transactions in the first quarter and $94.5M closed to date in the second quarter. -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% 06/30/16 07/31/16 08/31/16 09/30/16 10/31/16 11/30/16 12/31/16 01/31/17 02/28/17 03/31/17 04/30/17 05/31/17 06/30/17 07/31/17 08/31/17 09/30/17 10/31/17 11/30/17 12/31/17 01/31/18 02/28/18 03/31/18 04/30/18 05/31/18 06/30/18 07/31/18 08/31/18 09/30/18 10/31/18 11/30/18 12/31/18 01/31/19 02/28/19 03/31/19 04/30/19 05/31/19 GMRE SNL U.S. REIT Healthcare SNL U.S. REIT Equity MSCI US REIT (RMS)

GMRE STRATEGY

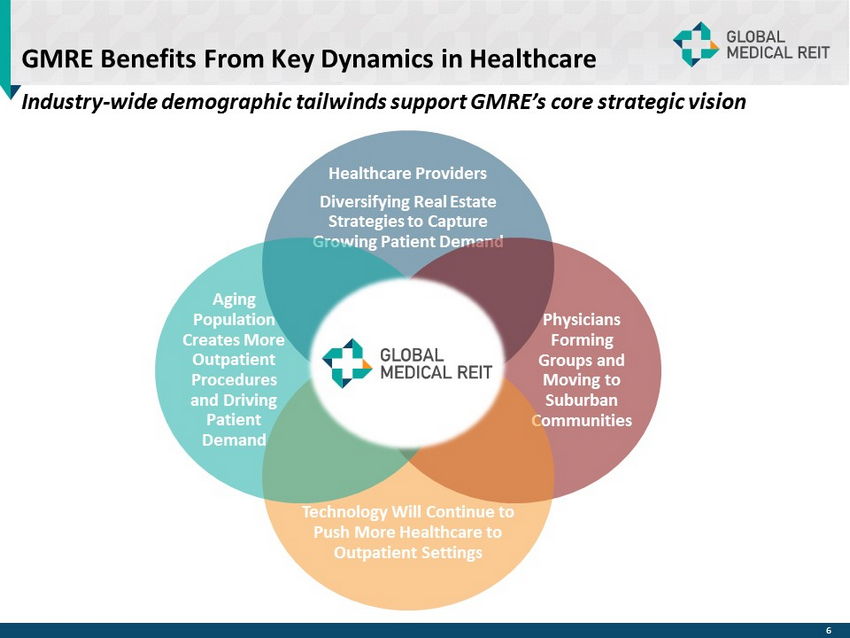

GMRE Benefits From Key Dynamics in Healthcare Industry - wide demographic tailwinds support GMRE’s core strategic vision Healthcare Providers Diversifying Real Estate Strategies to Capture Growing Patient Demand Physicians Forming Groups and Moving to Suburban Communities Technology Will Continue to Push More Healthcare to Outpatient Settings Aging Population Creates More Outpatient Procedures and Driving Patient Demand 6

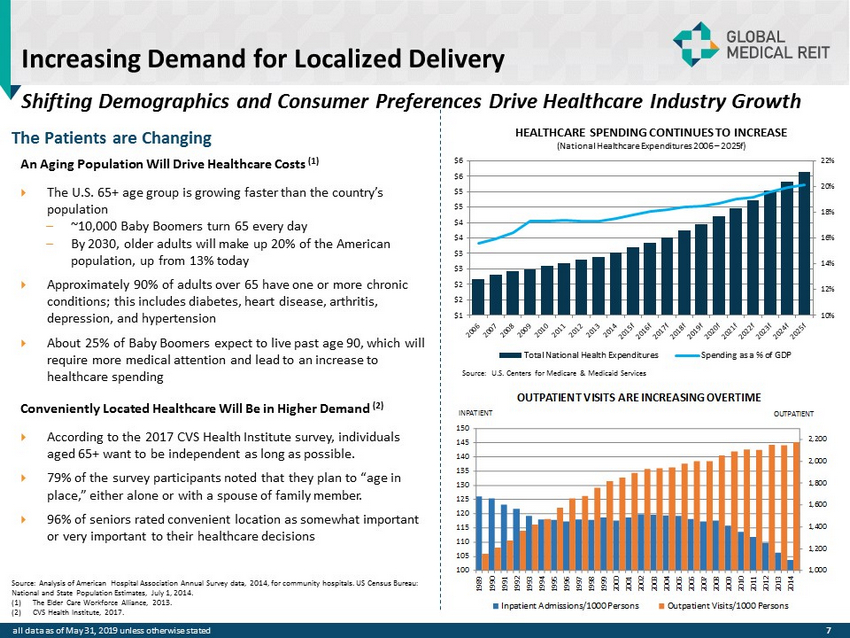

Increasing Demand for Localized Delivery An Aging Population Will Drive Healthcare Costs (1) The U.S. 65+ age group is growing faster than the country’s population – ~10,000 Baby Boomers turn 65 every day – By 2030, older adults will make up 20% of the American population, up from 13% today Approximately 90% of adults over 65 have one or more chronic conditions; this includes diabetes, heart disease, arthritis, depression, and hypertension About 25% of Baby Boomers expect to live past age 90, which will require more medical attention and lead to an increase to healthcare spending The Patients are Changing Source: Analysis of American Hospital Association Annual Survey data, 2014, for community hospitals. US Census Bureau: National and State Population Estimates, July 1, 2014. (1) The Elder Care Workforce Alliance, 2013. (2) CVS Health Institute, 2017. Conveniently Located Healthcare Will Be in Higher Demand (2) According to the 2017 CVS Health Institute survey, individuals aged 65+ want to be independent as long as possible. 79% of the survey participants noted that they plan to “age in place,” either alone or with a spouse of family member. 96% of seniors rated convenient location as somewhat important or very important to their healthcare decisions 7 1,000 1,200 1,400 1,600 1,800 2,000 2,200 100 105 110 115 120 125 130 135 140 145 150 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 OUTPATIENT VISITS ARE INCREASING OVERTIME Inpatient Admissions/1000 Persons Outpatient Visits/1000 Persons INPATIENT OUTPATIENT 10% 12% 14% 16% 18% 20% 22% $1 $2 $2 $3 $3 $4 $4 $5 $5 $6 $6 Total National Health Expenditures Spending as a % of GDP Source: U.S. Centers for Medicare & Medicaid Services HEALTHCARE SPENDING CONTINUES TO INCREASE (National Healthcare Expenditures 2006 – 2025f) Shifting Demographics and Consumer Preferences Drive Healthcare Industry Growth all data as of May 31, 2019 unless otherwise stated

Disciplined Yet Opportunistic Acquisition Strategy We aim to create a property portfolio comprised substantially of off - campus, purpose - built, licensed medical facilities such as MOBs, specialty hospitals, IRFs and ASCs, that are geographically situated to take advantage of the aging U.S. population and the decentralization of healthcare. TENANTS MARKETS / LOCATIONS FACILITIES x Strong providers with leading market share x Rent guarantees and other credit protection x Specialization in age - related procedures x Operators with regional footprints x Strong and diversified payor mix and history x Institutional quality x Purpose - built real estate x Single tenant focus with selective multi - tenant acquisitions x Class A / Recent construction or renovation x Amenitized patient areas x Convenient access / location x Long - term leases with annual rent escalations x Healthcare market with clear and quantifiable competitive dynamics x Positioned to benefit from ongoing decentralization trends in healthcare x Proximity to related resources x Long - term positive demand drivers (population growth and demographics) x Barriers to competition 8

Future Growth Strategies GMRE consistently maintains a large pipeline of actionable acquisition opportunities to sustain growth as a result of being an attractive deal partner Ability to navigate complex transactions through an adaptable approach to negotiations and deal structuring, creating a favorable reputation within the market A large, broad network of investment sales brokers, coupled with a solid reputation of being able to execute, has driven direct referrals to prospective sellers With a variety of capital sources, GMRE is well - positioned to pursue investment transactions with a competitive advantage among other bidders who have limited capital sources Use of OP Units provides efficient use of equity currency while providing sellers with an attractive, tax - advantage form of consideration and providing us with attractive pricing as evidenced by ~ $28 million in acquisition related transactions between 2018 - 2019 9 Flexible Partner Strong Broker Relationships Certainty of Closing Use of OP Units

GMRE PORTFOLIO

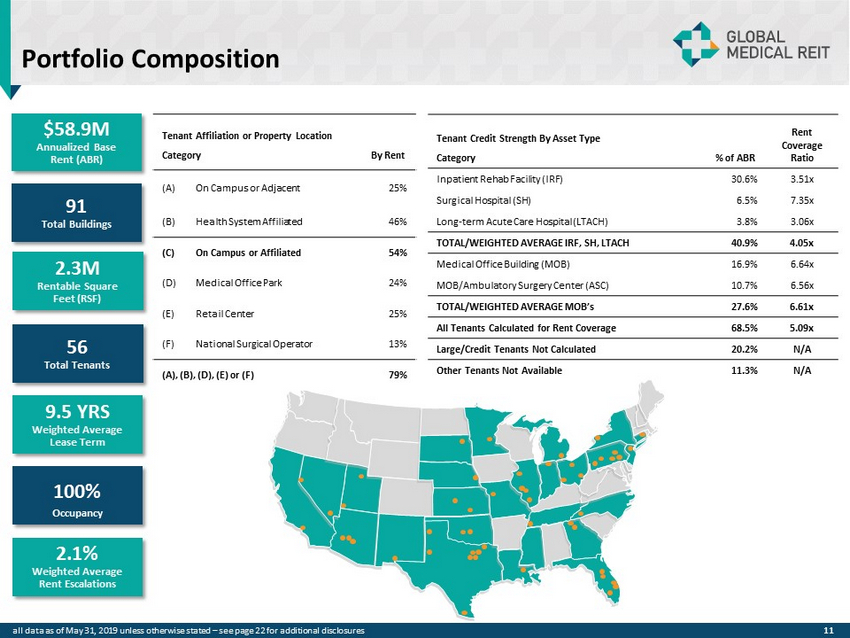

Portfolio Composition 2.1% Weighted Average Rent Escalations 91 Total Buildings 9.5 YRS Weighted Average Lease Term 100% Occupancy 2.3M Rentable Square Feet (RSF) 56 Total Tenants 11 Lease Expiration Schedule (% of Portfolio) (1) and Associated ABR ($ millions) 10.4 year weighted average remaining lease term Tenant Affiliation or Property Location Category By Rent (A) On Campus or Adjacent 25% (B) Health System Affiliated 46% (C) On Campus or Affiliated 54% (D) Medical Office Park 24% (E) Retail Center 25% (F) National Surgical Operator 13% (A), (B), (D), (E) or (F) 79% Tenant Credit Strength By Asset Type Category % of ABR Rent Coverage Ratio Inpatient Rehab Facility (IRF) 30.6% 3.51x Surgical Hospital (SH) 6.5% 7.35x Long - term Acute Care Hospital (LTACH) 3.8% 3.06x TOTAL/WEIGHTED AVERAGE IRF, SH, LTACH 40.9% 4.05x Medical Office Building (MOB) 16.9% 6.64x MOB/Ambulatory Surgery Center (ASC) 10.7% 6.56x TOTAL/WEIGHTED AVERAGE MOB’s 27.6% 6.61x All Tenants Calculated for Rent Coverage 68.5% 5.09x Large/Credit Tenants Not Calculated 20.2% N/A Other Tenants Not Available 11.3% N/A $58.9M Annualized Base Rent (ABR) all data as of May 31, 2019 unless otherwise stated – see page 22 for additional disclosures

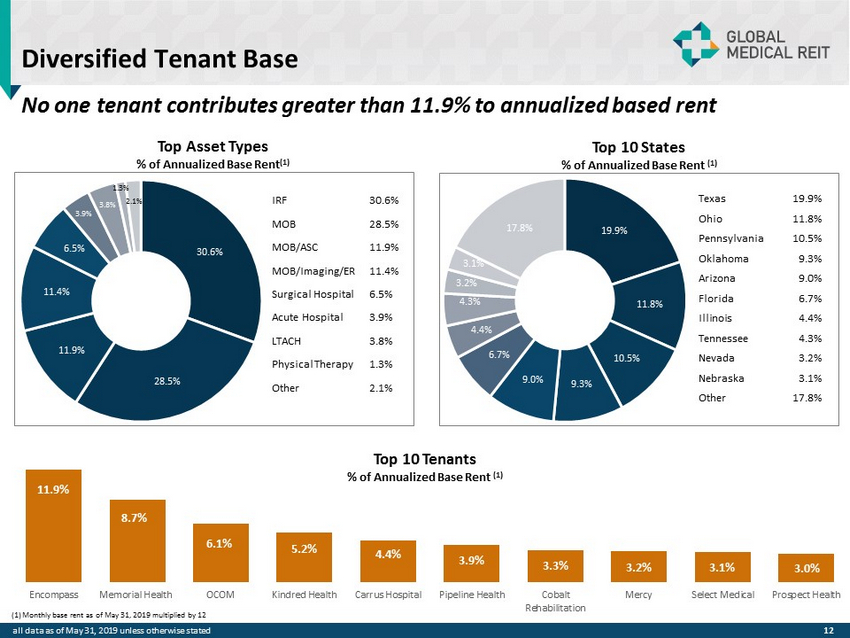

Diversified Tenant Base No one tenant contributes greater than 11.9% to annualized based rent 12 19.9% 11.8% 10.5% 9.3% 9.0% 6.7% 4.4% 4.3% 3.2% 3.1% 17.8% Top 10 States % of Annualized Base Rent (1) 30.6% 28.5% 11.9% 11.4% 6.5% 3.9% 3.8% 1.3% 2.1% IRF 30.6% MOB 28.5% MOB/ASC 11.9% MOB/Imaging/ER 11.4% Surgical Hospital 6.5% Acute Hospital 3.9% LTACH 3.8% Physical Therapy 1.3% Other 2.1% Texas 19.9% Ohio 11.8% Pennsylvania 10.5% Oklahoma 9.3% Arizona 9.0% Florida 6.7% Illinois 4.4% Tennessee 4.3% Nevada 3.2% Nebraska 3.1% Other 17.8% 11.9% 8.7% 6.1% 5.2% 4.4% 3.9% 3.3% 3.2% 3.1% 3.0% Encompass Memorial Health OCOM Kindred Health Carrus Hospital Pipeline Health Cobalt Rehabilitation Mercy Select Medical Prospect Health (1) Monthly base rent as of May 31, 2019 multiplied by 12 Top 10 Tenants % of Annualized Base Rent (1) all data as of May 31, 2019 unless otherwise stated Top Asset Types % of Annualized Base Rent (1)

Established Strong Healthcare Operators as Tenants Not - For - Profit Health System Affiliations For - Profit Systems Affiliations and Surgical Operator Partnerships Dominant Local Physician Groups 13

IRF PORTFOLIO CASE STUDIES

IRF Portfolio Summary Key Highlights Premier Facilities Transaction Highlights Large National Tenants Portfolio comprised of four IRFs located in Nevada, Arizona, Oklahoma and Indiana being sold by CNL Healthcare Properties Attractive population growth – particularly within the Southwestern markets Large operator tenants with national scale Estimated 2.4% compound annual growth of triple net (“NNN”) rents over the first five years Encompass – Nation’s largest owner and operator of IRFs, including 130 IRFs and 278 home health and hospice locations Cobalt/Tenet – Cobalt is a leader in healthcare real estate development and rehab hospital operations with 80+ years of industry expertise amongst its leadership team. Tenet operates 68 hospitals, 23 surgical hospitals, and 475 outpatient centers Saint Joseph Health System – Part of Trinity Health, one of the nation’s largest multi - institutional Catholic healthcare systems with 94 hospitals and 109 continuing care locations in 22 states Mercy Health/Kindred Healthcare – Mercy Health operates 40+ acute care and specialty hospitals. Kindred provides healthcare services in 1,800+ locations in 45 states Asset Type Four Inpatient Rehabilitation Facilities (“IRFs”) Gross Leasable Area 207,204 square feet Total Beds 180 Average Year Built 2011 Year 1 Rent ( psf ) $6.8 million ($32.87) W.A. Lease Term 8.2 years Purchase Price ( psf ) $94.0 million ($454) Cap Rate (Yr. 1 / Yr. 2) 7.3% / 7.6% (1) Mercy/Kindred Oklahoma City Facility all data as of May 31, 2019 unless otherwise stated 15 (1) See additional information on page 22

Las Vegas, NV - Key Highlights Surprise, AZ - Key Highlights Gross Leasable Area 53,260 square feet Total Beds 50 Year Built 2007 Year 1 Rent ( psf ) $1.5 million ($28.24) Lease Term 6.0 years Purchase Price ( psf ) $21.5 million ($404) Cap Rate 7.0% Tenant Encompass (Ba3) (1) Largest owner and operator of IRFs in the U.S. Gross Leasable Area 54,575 square feet Total Beds 40 Year Built 2015 Year 1 Rent ( psf ) $2.0 million ($36.12) Lease Term 11.6 years Purchase Price ( psf ) $28.5 million ($522) Cap Rate 6.9% Tenant Cobalt / Tenet (NR / Ba3) (1) Cobalt has 80+ years combined experience in healthcare real estate development Tenet operates 68 hospitals, 23 surgical hospitals, and 475 outpatient centers (1) Moody’s credit rating. all data as of May 31, 2019 unless otherwise stated 16 IRF Portfolio – Nevada / Arizona Encompass Nevada Facility Cobalt - Tenet Arizona Facility

all data as of May 31, 2019 unless otherwise stated 17 Oklahoma City, OK - Key Highlights Mishawaka, IN - Key Highlights Gross Leasable Area 53,449 square feet Total Beds 50 Year Built 2012 Year 1 Rent ( psf ) $1.9 million ($35.02) Lease Term 8.3 years Purchase Price ( psf ) $28.0 million ($524) Cap Rate 6.7% Tenant Mercy / Kindred (Aa3 / B2) (1) Mercy Health operates more than 40 acute care and specialty hospitals Kindred provides healthcare services in 1,800+ locations in 45 states Gross Leasable Area 45,920 square feet Total Beds 40 Year Built 2009 Year 1 Rent ( psf ) $1.5 million ($31.89) Lease Term 5.6 years Purchase Price ( psf ) $16.0 million ($348) Cap Rate 9.2% Tenant St. Joseph Health System Member of Trinity Health (Aa3) (1) healthcare network - nation’s 4 th largest Catholic health system (1) Moody’s credit rating. IRF Portfolio – Oklahoma / Indiana Mercy/Kindred Oklahoma City Facility St. Joseph Mishawaka Facility

APPENDIX

Leadership JEFFREY BUSCH , Chairman, Chief Executive Officer and President ROBERT KIERNAN , Chief Financial Officer and Treasurer ALFONZO LEON , Chief Investment Officer ▪ 17 + years of experience in real estate finance and has completed $ 3 billion of transactions ▪ Prior experience as principal at investment advisor to pension funds and investment banker representing healthcare systems, d eve lopers and REITs ▪ Healthcare real estate investment banker for Cain Brothers ▪ Acquired $ 800 million in multi - family, office, medical office, and industrial property on behalf of institutional investors while at LaSalle Investment DANICA HOLLEY, Chief Operating Officer ▪ 18 + years of management and business development experience ▪ More than a decade of experience managing multinational teams for complex service delivery across disciplines ▪ More than 8 years in healthcare programs and infrastructure as Executive Director of Safe Blood International ▪ 10+ years of experience with SEC compliance and reporting matters, corporate governance, investment banking and REIT - related ca pital markets ▪ Served as Associate General Counsel of FBR ▪ Prior role as Senior Associate – REIT Capital Markets at Hunton & Williams LLP, where he represented public REITs in conjunction with their SEC compliance requirements, corporate governance matters, offerings of equity and debt securities and merger and acquisition tra nsa ctions ▪ Previously with Sullivan & Cromwell LLP and KPMG JAMIE BARBER, General Counsel and Corporate Secretary ▪ 20+ years of experience in healthcare, real estate development, management and investment ▪ Former assistant to the U.S. Secretary of Housing & Urban Development ▪ United States Special Representative to United Nations in Geneva ▪ Developed a multitude of institutional quality real estate assets spanning several sectors including residential, commercial, ho spitality and retail ▪ 30+ years of experience in financial accounting, reporting and management, with extensive experience in SEC reporting and SOX co mpliance ▪ Served as the Senior Vice President, Controller and Chief Accounting Officer of FBR & Co. (“FBR”)(NASDAQ: FBRC) beginning in Oct ober 2007 ▪ Prior role as Senior Vice President, Controller and Chief Accounting Officer of Arlington Asset Investment Corp. (NYSE: AI) ▪ Previously Senior Manager in the assurance practice at Ernst & Young 19 all data as of May 31, 2019 unless otherwise stated

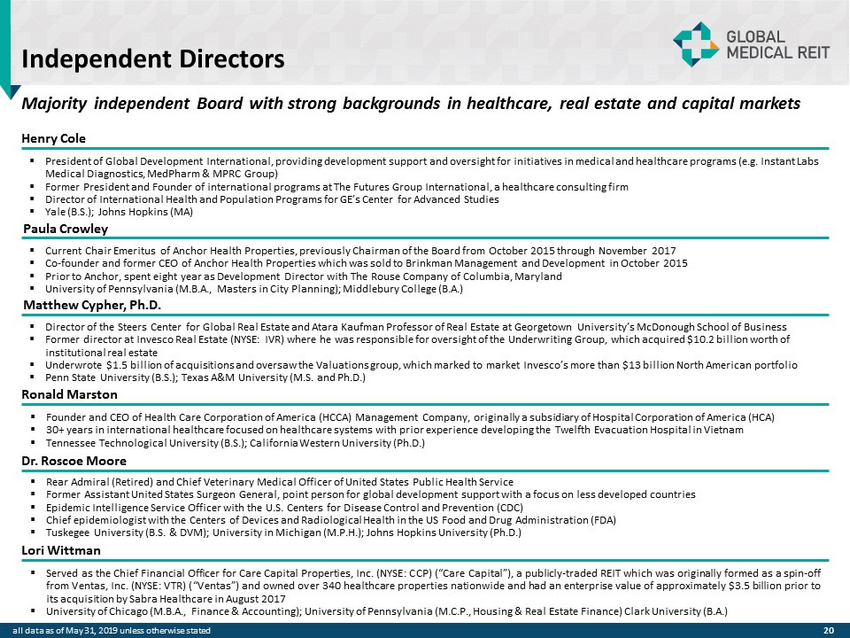

Independent Directors Majority independent Board with strong backgrounds in healthcare, real estate and capital markets Henry Cole ▪ President of Global Development International, providing development support and oversight for initiatives in medical and hea lth care programs (e.g. Instant Labs Medical Diagnostics, MedPharm & MPRC Group) ▪ Former President and Founder of international programs at The Futures Group International, a healthcare consulting firm ▪ Director of International Health and Population Programs for GE’s Center for Advanced Studies ▪ Yale (B.S.); Johns Hopkins (MA) Matthew Cypher, Ph.D. ▪ Director of the Steers Center for Global Real Estate and Atara Kaufman Professor of Real Estate at Georgetown University’s McDonough School of Business ▪ Former director at Invesco Real Estate (NYSE: IVR) where he was responsible for oversight of the Underwriting Group, which ac qui red $10.2 billion worth of institutional real estate ▪ Underwrote $1.5 billion of acquisitions and oversaw the Valuations group, which marked to market Invesco’s more than $13 bill ion North American portfolio ▪ Penn State University (B.S.); Texas A&M University (M.S. and Ph.D.) Lori Wittman ▪ Served as the Chief Financial Officer for Care Capital Properties, Inc . (NYSE : CCP) (“Care Capital”), a publicly - traded REIT which was originally formed as a spin - off from Ventas, Inc . (NYSE : VTR) (“Ventas”) and owned over 340 healthcare properties nationwide and had an enterprise value of approximately $ 3 . 5 billion prior to its acquisition by Sabra Healthcare in August 2017 ▪ University of Chicago (M . B . A . , Finance & Accounting) ; University of Pennsylvania (M . C . P . , Housing & Real Estate Finance) Clark University (B . A . ) Ronald Marston ▪ Founder and CEO of Health Care Corporation of America (HCCA) Management Company, originally a subsidiary of Hospital Corporation of America (HCA) ▪ 30 + years in international healthcare focused on healthcare systems with prior experience developing the Twelfth Evacuation Hospital in Vietnam ▪ Tennessee Technological University (B . S . ) ; California Western University (Ph . D . ) ▪ Rear Admiral (Retired) and Chief Veterinary Medical Officer of United States Public Health Service ▪ Former Assistant United States Surgeon General, point person for global development support with a focus on less developed countries ▪ Epidemic Intelligence Service Officer with the U . S . Centers for Disease Control and Prevention (CDC) ▪ Chief epidemiologist with the Centers of Devices and Radiological Health in the US Food and Drug Administration (FDA) ▪ Tuskegee University (B . S . & DVM) ; University in Michigan (M . P . H . ) ; Johns Hopkins University (Ph . D . ) Dr. Roscoe Moore Paula Crowley ▪ Current Chair Emeritus of Anchor Health Properties, previously Chairman of the Board from October 2015 through November 2017 ▪ Co - founder and former CEO of Anchor Health Properties which was sold to Brinkman Management and Development in October 2015 ▪ Prior to Anchor, spent eight year as Development Director with The Rouse Company of Columbia, Maryland ▪ University of Pennsylvania (M.B.A., Masters in City Planning); Middlebury College (B.A.) 20 all data as of May 31, 2019 unless otherwise stated

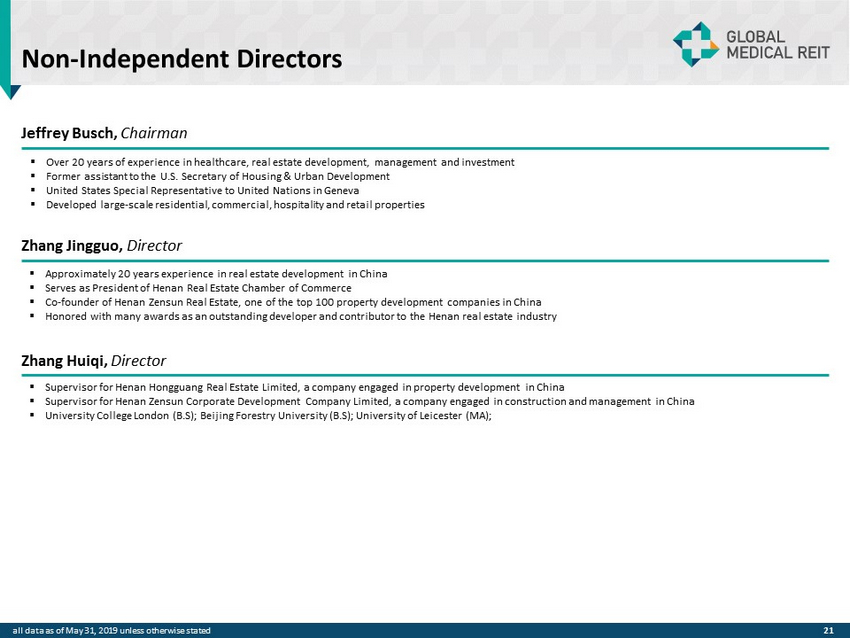

Non - Independent Directors Jeffrey Busch, Chairman ▪ Over 20 years of experience in healthcare, real estate development, management and investment ▪ Former assistant to the U.S. Secretary of Housing & Urban Development ▪ United States Special Representative to United Nations in Geneva ▪ Developed large - scale residential, commercial, hospitality and retail properties Zhang Jingguo , Director ▪ Approximately 20 years experience in real estate development in China ▪ Serves as President of Henan Real Estate Chamber of Commerce ▪ Co - founder of Henan Zensun Real Estate, one of the top 100 property development companies in China ▪ Honored with many awards as an outstanding developer and contributor to the Henan real estate industry ▪ Supervisor for Henan Hongguang Real Estate Limited, a company engaged in property development in China ▪ Supervisor for Henan Zensun Corporate Development Company Limited, a company engaged in construction and management in China ▪ University College London (B . S) ; Beijing Forestry University (B . S) ; University of Leicester (MA) ; Zhang Huiqi , Director 21 all data as of May 31, 2019 unless otherwise stated

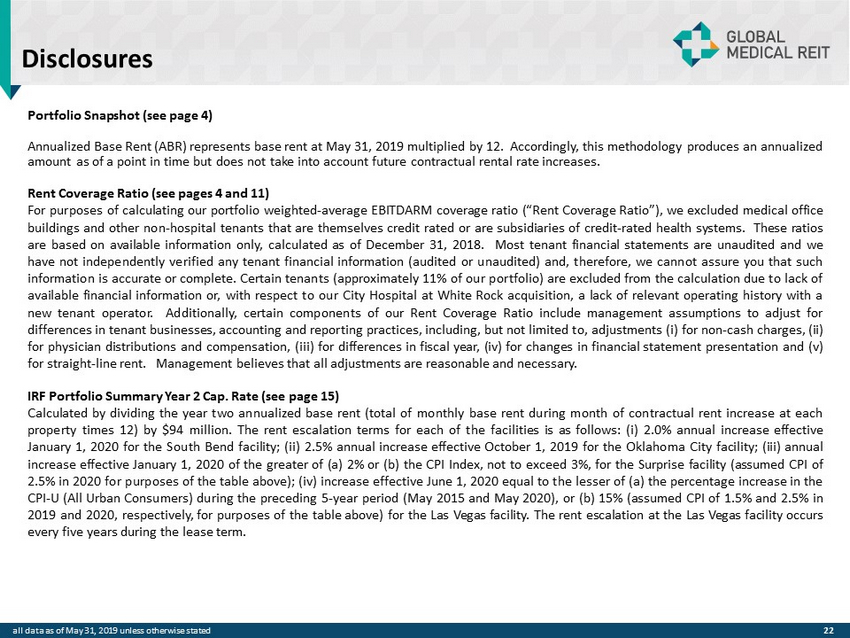

Disclosures 22 Portfolio Snapshot (see page 4 ) Annualized Base Rent (ABR) represents base rent at May 31, 2019 multiplied by 12 . Accordingly, this methodology produces an annualized amount as of a point in time but does not take into account future contractual rental rate increases. Rent Coverage Ratio (see pages 4 and 11 ) For purposes of calculating our portfolio weighted - average EBITDARM coverage ratio (“Rent Coverage Ratio”), we excluded medical office buildings and other non - hospital tenants that are themselves credit rated or are subsidiaries of credit - rated health systems . These ratios are based on available information only, calculated as of December 31 , 2018 . Most tenant financial statements are unaudited and we have not independently verified any tenant financial information (audited or unaudited) and, therefore, we cannot assure you that such information is accurate or complete . Certain tenants (approximately 11 % of our portfolio) are excluded from the calculation due to lack of available financial information or , with respect to our City Hospital at White Rock acquisition, a lack of relevant operating history with a new tenant operator . Additionally, certain components of our Rent Coverage Ratio include management assumptions to adjust for differences in tenant businesses, accounting and reporting practices, including, but not limited to, adjustments ( i ) for non - cash charges, (ii) for physician distributions and compensation, (iii) for differences in fiscal year, (iv) for changes in financial statement presentation and (v) for straight - line rent . Management believes that all adjustments are reasonable and necessary . IRF Portfolio Summary Year 2 Cap . Rate (see page 15 ) Calculated by dividing the year two annualized base rent (total of monthly base rent during month of contractual rent increase at each property times 12 ) by $ 94 million . The rent escalation terms for each of the facilities is as follows : ( i ) 2 . 0 % annual increase effective January 1 , 2020 for the South Bend facility ; (ii) 2 . 5 % annual increase effective October 1 , 2019 for the Oklahoma City facility ; (iii) annual increase effective January 1 , 2020 of the greater of (a) 2 % or (b) the CPI Index, not to exceed 3 % , for the Surprise facility (assumed CPI of 2 . 5 % in 2020 for purposes of the table above) ; (iv) increase effective June 1 , 2020 equal to the lesser of (a) the percentage increase in the CPI - U (All Urban Consumers) during the preceding 5 - year period (May 2015 and May 2020 ), or (b) 15 % (assumed CPI of 1 . 5 % and 2 . 5 % in 2019 and 2020 , respectively, for purposes of the table above) for the Las Vegas facility . The rent escalation at the Las Vegas facility occurs every five years during the lease term . all data as of May 31, 2019 unless otherwise stated

www.globalmedicalreit.com NYSE: GMRE INVESTOR RELATIONS Mary Jensen maryj@globalmedicalreit.com 202.524.6869 – Office 310.526.1707 – Cell